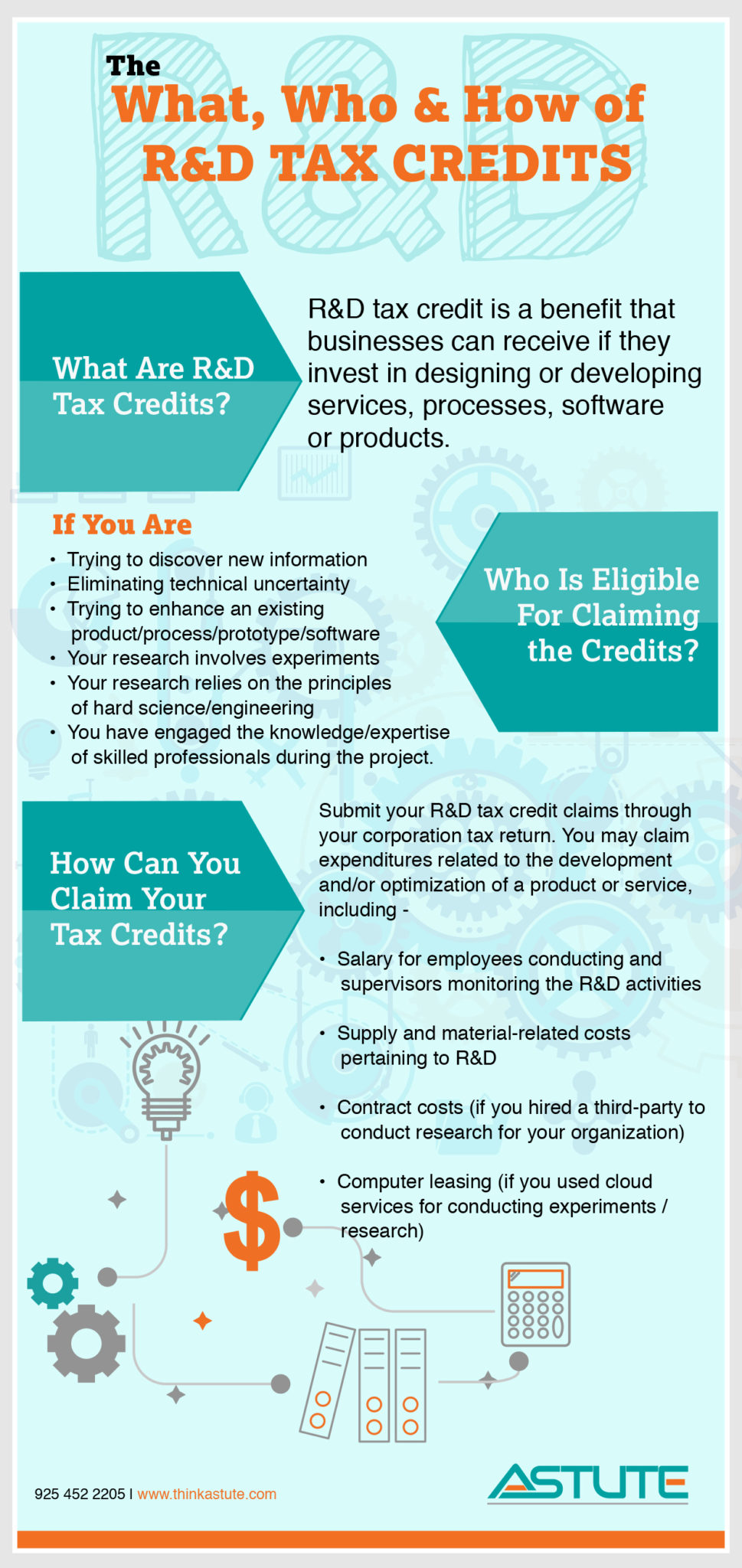

R D Tax Credit Federal and certain states tax laws permit a research and development R D tax credit to the extent that a taxpayer s current year qualified research expenses exceed a calculated base amount of research spending

R D tax credits reduce a company s tax liability for certain domestic expenses Learn if you may qualify and how to claim credits What is the R D tax credit The R D tax credit is a tax incentive in the form of a tax credit for U S companies to increase spending on research and development in the U S A tax credit generally reduces the amount of tax owed or increases a tax refund If a company s activities qualify for the R D tax credit there are two ways to calculate it

R D Tax Credit

R D Tax Credit

https://forrestbrown.co.uk/wp-content/uploads/2017/12/RD-tax-credits-calculation-for-profit-making-SMEs-1600x2647.png

Good News Regarding Tooling Expenditures The R D Tax Credit

https://www.troutcpa.com/hubfs/Research-and-Development-Tax-Credit.jpg

Are You Eligible For R D Tax Credit Find Out Using This Infographic

https://www.thinkastute.com/wp-content/uploads/2020/02/RD-Credits-Infographic-969x2048.jpg

What is the R D tax credit Created in 1981 to stimulate research and development R D in the United States the R D tax credit is a dollar for dollar offset of federal income tax liability and in certain circumstances payroll tax liability The R D tax credit regularly provides a wide range of businesses with a source of extra cash up to 10 of annual R D costs for federal purposes and much more when state credits are factored in

The tax code has supported R D primarily through two policies 1 allow for companies to elect to expense R D costs i e deduct in the first year and 2 provide for a tax credit Research and Development R D tax relief supports companies that work on innovative projects in science and technology You may be able to claim Corporation Tax relief if your project

Download R D Tax Credit

More picture related to R D Tax Credit

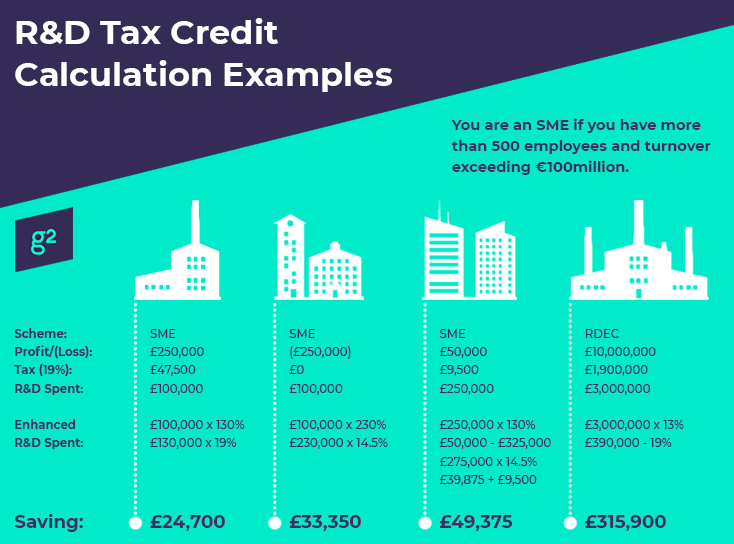

R D Tax Credits Calculation Examples G2 Innovation

https://g2innovation.co.uk/wp-content/uploads/2020/11/RD-Tax-Credit-Calculaition-Examples-Infographic-3.png

What Are R D Tax Credits YouTube

https://i.ytimg.com/vi/O5XEWHzgIuE/maxresdefault.jpg

How To Take Full Advantage Of The R D Tax Credit

https://demotix.com/wp-content/uploads/2020/07/RD-Tax-Credit-585x280.jpg

Guidance for allowance of the credit for increasing research activities under I R C 41 for taxpayers that expense research and development costs on their financial statements pursuant to ASC 730 revision September 2017 The R D tax credit was originally established in 1981 to incentivize innovative R D across the United States The 2015 Protecting Americans from Tax Hikes PATH Act made the R D tax credit permanent modified the benefit for small businesses and made the credit available to startups

[desc-10] [desc-11]

R D Tax Credits For The Healthcare Industry

https://f.hubspotusercontent40.net/hubfs/3465794/R&D.jpg

R D Tax Credit Guidance For SMEs Market Business News

https://marketbusinessnews.com/wp-content/uploads/2019/11/RD-tax-credit-image-499499.jpg

https://kpmg.com › ... › kpmg › pdf › rd-credit-rules.pdf

Federal and certain states tax laws permit a research and development R D tax credit to the extent that a taxpayer s current year qualified research expenses exceed a calculated base amount of research spending

https://www.adp.com › resources › articles-and...

R D tax credits reduce a company s tax liability for certain domestic expenses Learn if you may qualify and how to claim credits

R D Tax Credit Video YouTube

R D Tax Credits For The Healthcare Industry

Reasons To Do Business In Ireland Research And Development R D Tax

Pin By R D Tax Solutions On R D Tax Credits Explained Tax Credits

Which Industries Qualify For The R D Tax Credit Swanson Reed

How Small Businesses Can Now Qualify For The R D Tax Credit

How Small Businesses Can Now Qualify For The R D Tax Credit

R D Tax Credits For The Healthcare Industry

R D Tax Credits Explained What Are They Your FAQ s Answered

R D Tax Credit Does Your Business Qualify Our Insights Plante Moran

R D Tax Credit - [desc-14]