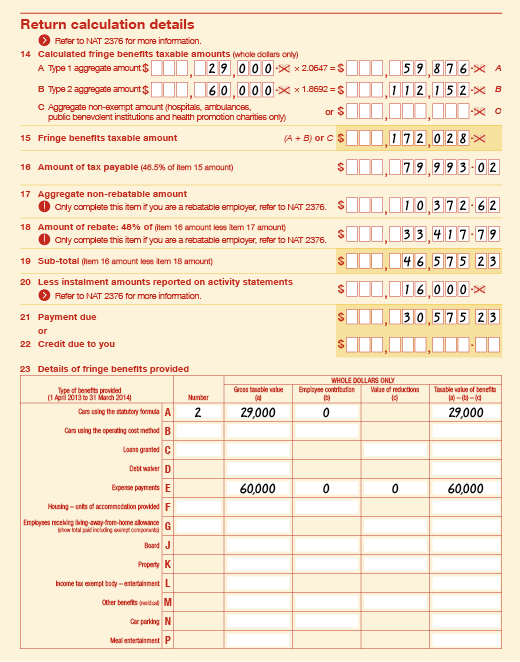

R D Tax Rebate Australia Web 30 juin 2021 nbsp 0183 32 The tax offset for eligible R amp D conducted from 1 July 2021 is now based on a premium on top of your corporate tax rate Turnover of less than 20 million For R amp D

Web The Research and Development R amp D Tax Incentive is the government s key mechanism to stimulate industry investment in R amp D in Australia R amp D drives innovation that leads to Web Australia provides R amp D tax relief through a volume based R amp D tax credit A number of changes in the design of the R amp D Tax Incentive were recently introduced with enhanced

R D Tax Rebate Australia

R D Tax Rebate Australia

https://www.ato.gov.au/uploadedImages/Content/SME/Images/39720_05.jpg?n=5095

Home RD Tax Rebate

https://rdtaxrebate.co.uk/wp-content/uploads/2021/09/RD_Image-1-1536x886.png

How Does Australia s R D Tax Incentive Compare To The Rest Of The World

https://www.swansonreed.com.au/wp-content/uploads/2016/02/RD-Incentives-Around-The-Globe-Australia-new.png

Web Check if you re eligible for the R amp D Tax Incentive Learn more about the three eligibility requirements for companies registering for the R amp D Tax Incentive Web For R amp D entities with aggregated turnover of at least 20 million the non refundable tax offset will be set at the company s tax rate plus 8 5 percentage points for R amp D expenditure between 0 and 2 R amp D

Web 18 avr 2023 nbsp 0183 32 In Australia the R amp D Tax Incentive is delivered by a tax offset which can be refundable or non refundable and the rate can differ depending on the aggregated turnover of the R amp D entity In New Web 22 mai 2023 nbsp 0183 32 For eligible R amp D activities conducted on and from 1 July 2021 there s a threshold of 150 million on R amp D Tax Incentive claims For eligible R amp D expenditure

Download R D Tax Rebate Australia

More picture related to R D Tax Rebate Australia

Cann Group To Reinvest 4 3m R D Tax Incentive Rebate Australian

https://www.australianmanufacturing.com.au/wp-content/uploads/2022/10/Cann-receives-4.348-million-RD-tax-rebate.jpg

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

https://www.researchgate.net/profile/Lex-Fullarton/publication/310952943/figure/fig2/AS:433972418224137@1480478495792/Western-Australias-average-daily-maximum-temperature-for-January-Source-Australian_Q640.jpg

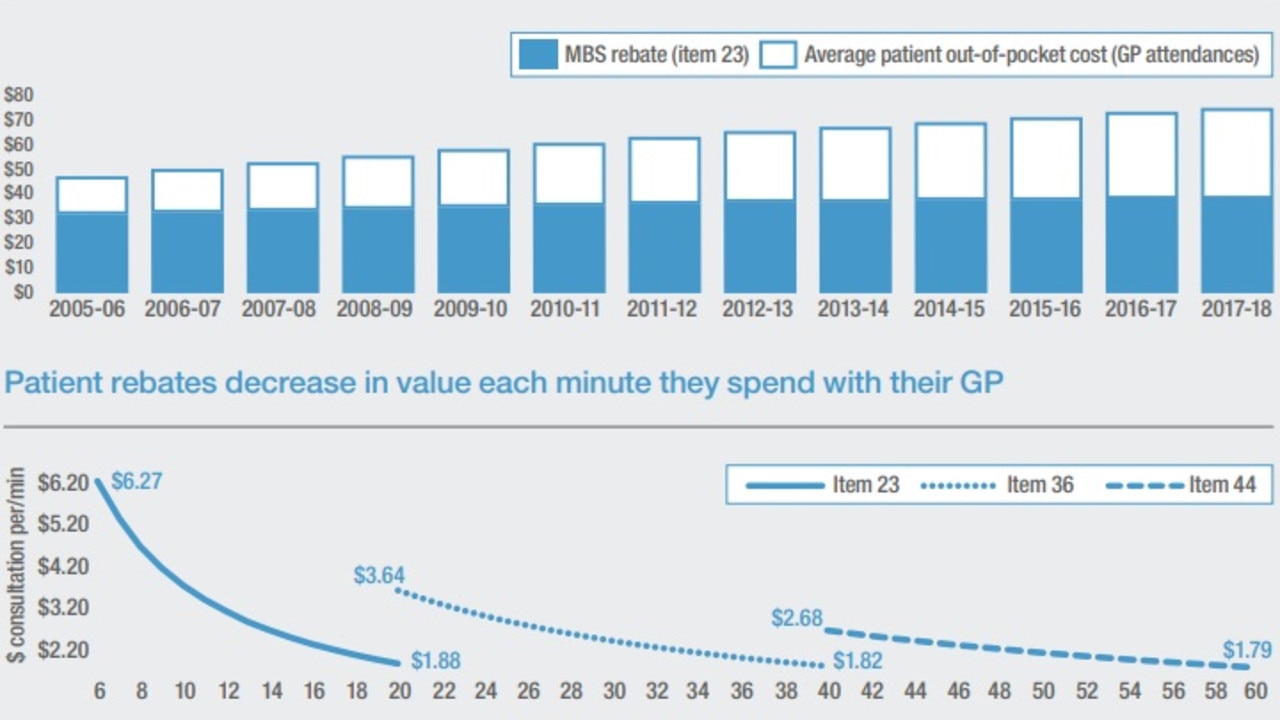

R D Tax Reliefs A Mechanism To Generate Cashflow As A Reward For

https://mooreandsmalley.co.uk/wp-content/uploads/2020/06/RD-Tax-relief-image-3-1024x536.png

Web 1 juil 2021 nbsp 0183 32 An R amp D intensity up to 2 per cent receives a tax offset equal to your company tax rate plus a 8 5 per cent premium Any expenditure which exceeds the 2 per cent Web 22 mai 2023 nbsp 0183 32 We have produced this guide to help you assess whether your R amp D is eligible for the R amp D Tax Incentive The content in this guide reflects the way we apply the

Web 29 juin 2023 nbsp 0183 32 The enhanced reforms to the R amp D Tax Incentive apply to income years beginning on or after 1 July 2021 Some administrative elements of the reforms were Web 22 mai 2023 nbsp 0183 32 1 Your overseas R amp D activity must be an R amp D activity The overseas activity must meet the R amp D Tax Incentive program s requirements for being either a core R amp D

Tax Rebate Solutions Professionalism Transparency Integrity

https://taxrebatesolutions.com/wp-content/uploads/2020/07/TRS-Logo1-Web2.png

How To Register For The Australian Government Rebate YouTube

https://i.ytimg.com/vi/Z_E2guERPNY/maxresdefault.jpg

https://business.gov.au/.../overview-of-rd-tax-incentive

Web 30 juin 2021 nbsp 0183 32 The tax offset for eligible R amp D conducted from 1 July 2021 is now based on a premium on top of your corporate tax rate Turnover of less than 20 million For R amp D

https://www.industry.gov.au/.../research-and-development-tax-incentive

Web The Research and Development R amp D Tax Incentive is the government s key mechanism to stimulate industry investment in R amp D in Australia R amp D drives innovation that leads to

Offshore Tax Rebates For Life Science R D In Australia Silicon Valley

Tax Rebate Solutions Professionalism Transparency Integrity

Home RD Tax Rebate

Australian Tax Rebate Zones In 1945 Source NATMAP NMP 84 002 24

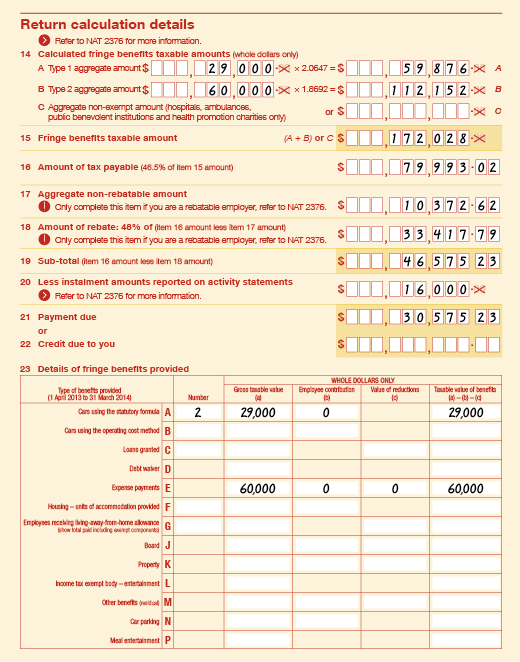

Medicare Rebate Australians Forced To Pay More To See A Doctor Or GP

R D Tax Credits Video Davis Grant

R D Tax Credits Video Davis Grant

Council Tax Rebate Single Person

Council Tax Rebate Epping Forest District Council

What Is Australian Government Rebate On Private Health Insurance

R D Tax Rebate Australia - Web 27 janv 2022 nbsp 0183 32 The R amp D Tax Incentive program provides R amp D tax offsets to encourage businesses to invest in research and development with the intention of benefitting those