Rebate And Discount Hsn Code Discover the different types of post sale discounts and incentives offered in trade practices along with their implications and treatment for GST Learn how to differentiate between trade discounts and separate supply

Search and Find HSN Codes SAC codes GST Rates of goods and services under GST in India Under GST tax slabs have been fixed at 0 5 12 18 and 28 Products The treatment is simple the discounts given before or at the time of supply are simply deducted from the invoice value i e GST would be charges on discounted value

Rebate And Discount Hsn Code

Rebate And Discount Hsn Code

https://5065780.fs1.hubspotusercontent-na1.net/hubfs/5065780/HSN-CODE800.jpg

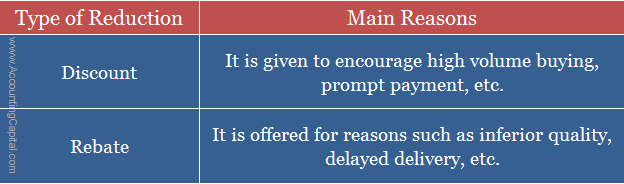

Difference Between Rebate And Discount

https://differencebetween.io/wp-content/uploads/2023/03/Rebate-and-Discount.webp

2022 Menards Rebate Forms RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/2022-menards-rebate-forms.jpg?fit=1024%2C963&ssl=1

In this article we will discuss all about incentives discounts and schemes earned by dealers and SAC code and taxability Incentives discounts and schemes are integral part of business It is Treatment of Discount under GST Discounts that are provided before supply under GST are eligible for deduction from the transaction value provided ITR Filing Deadline

Discounts are not separately classified under SAC codes If discounts like Trade discount quantity discount etc are given before or at the time of the supply GST will not be applicable No tax is required to be deducted under section 194R of the Act on sales discount cash discount and rebates allowed to customers

Download Rebate And Discount Hsn Code

More picture related to Rebate And Discount Hsn Code

Family Rapt With Cloth Nappy Rebate Strathbogie Shire

https://www.strathbogie.vic.gov.au/wp-content/uploads/2022/08/20220729ClothNappyRebate2Crop.jpg

GST HSN Code India Apps On Google Play

https://play-lh.googleusercontent.com/QTiVZ0pItKE3d5r2qmmXNxbqRh1uwvFDVOBPVzq1_LWXvmgi-ZTiiXb0n_QWpdoc01o

Discount Dance Supply Performance2023 Page 1

https://view.publitas.com/74189/1499164/pages/71ada48f-823b-4a16-94af-4450bad1abc7-at1600.jpg

In this article we will discuss how to get a discount using GST number the impact of discounts under GST and its eligibility Treatment of Discount in the Previous Example A company has a policy of allowing a cash discount of 10 if a customer makes payment of a particular invoice within 30 days In such a situation the discount will not be added to the value of taxable supply The

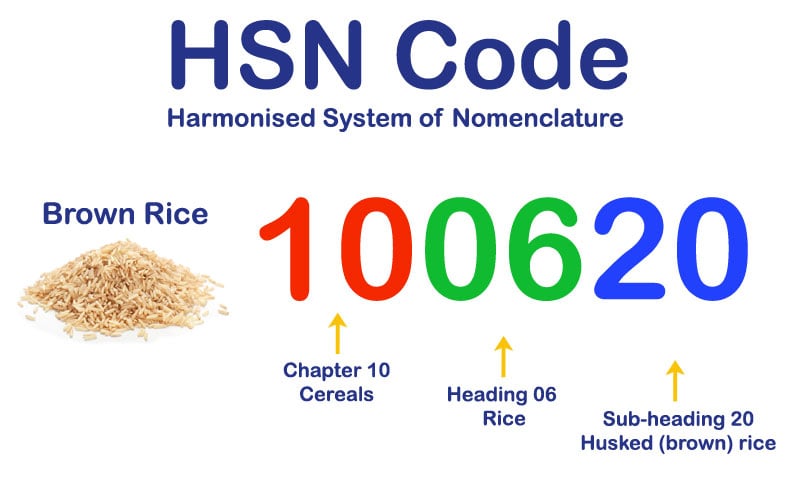

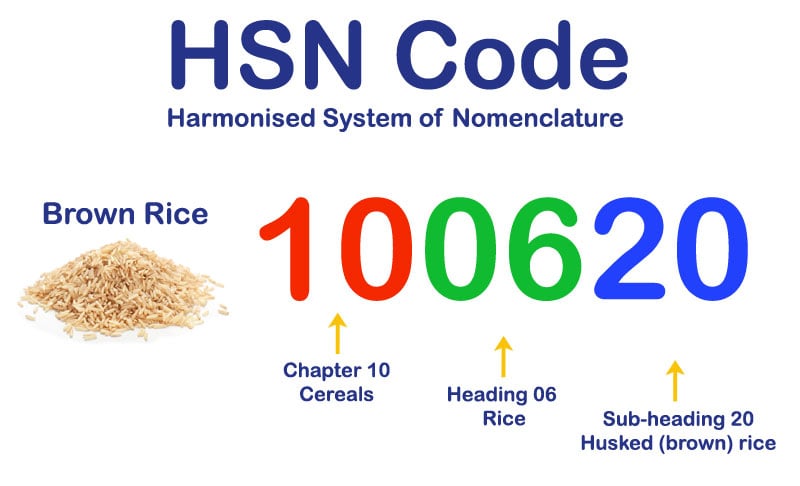

Explore the list of HSN codes for goods and services under India s GST Discover the GST rates the specifics of the HSN code its functionality and additional details All the goods and services are classified into 21 sections The supplier India Gate offers the incentive for early payment of invoices by offering a cash discount if payment is made before the due date or within certain days from

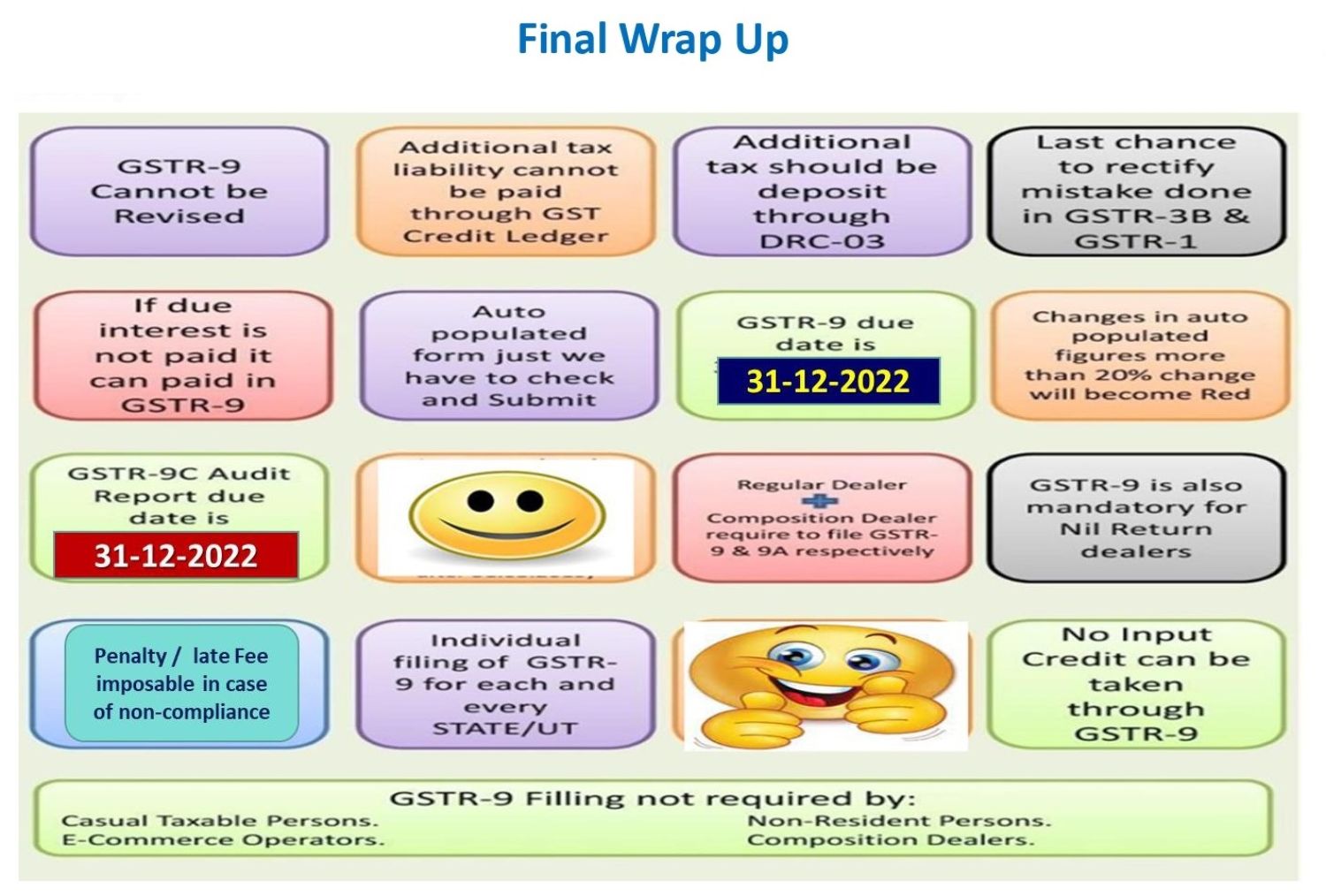

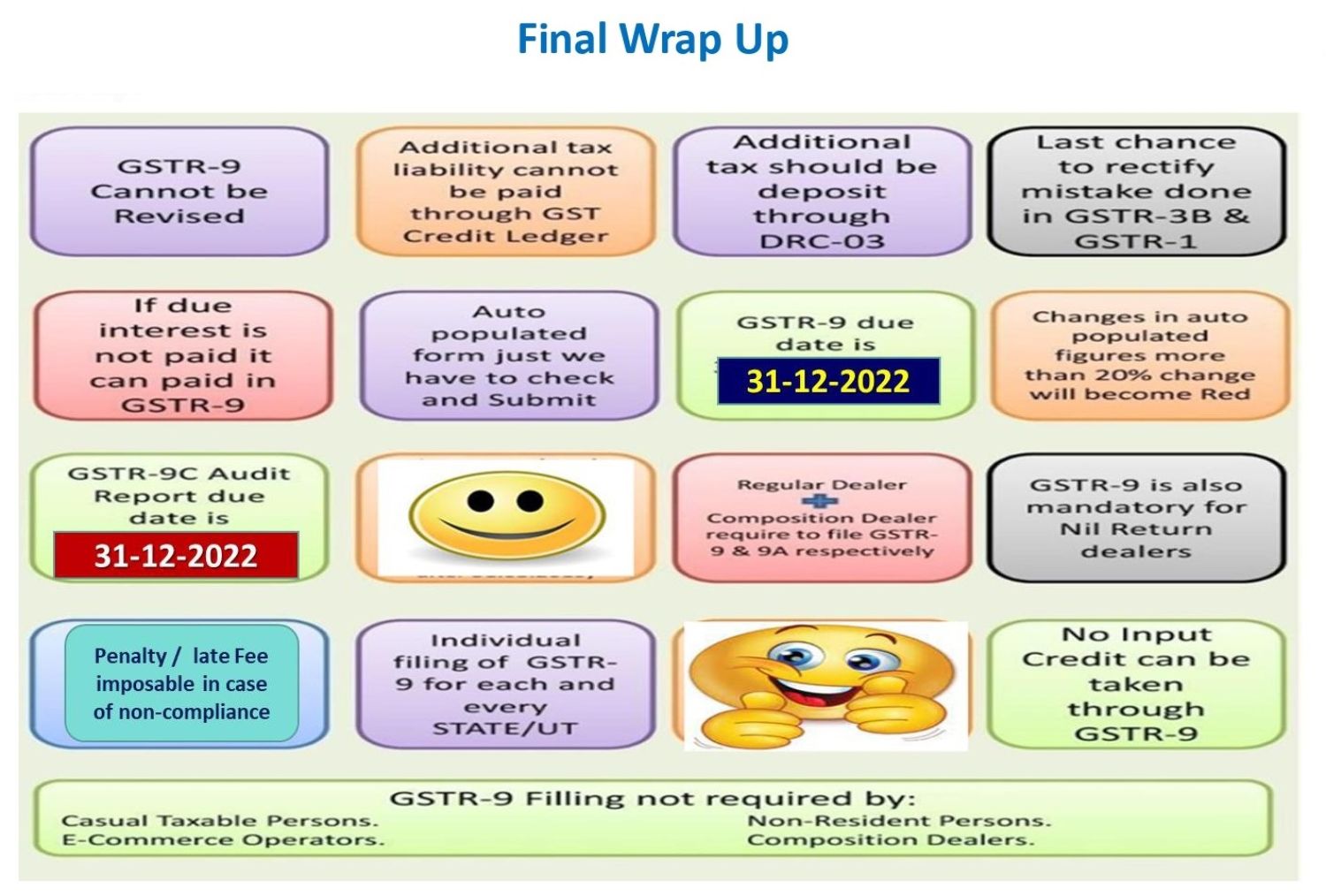

HSN Code In Annual GSTR 9 Return

https://carajput.com/art_imgs/clarification-on-hsn-code-summary-in-annual-gstr-9-return.jpg

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

https://taxguru.in/goods-and-service-tax/…

Discover the different types of post sale discounts and incentives offered in trade practices along with their implications and treatment for GST Learn how to differentiate between trade discounts and separate supply

https://cleartax.in/s/gst-hsn-lookup

Search and Find HSN Codes SAC codes GST Rates of goods and services under GST in India Under GST tax slabs have been fixed at 0 5 12 18 and 28 Products

Loan Rebate 2022 Credit Union News Loans News Harp And Crown

HSN Code In Annual GSTR 9 Return

Difference Between Discount And Rebate with Example

Battery Rebate Coordinator Zonaebt

Grab Promo Code RM5 OFF 5 FREE Rides Credit Debit Card First 5 000

Rebajas Y Descuentos Cu l Es La Diferencia Wiser Retail Strategies

Rebajas Y Descuentos Cu l Es La Diferencia Wiser Retail Strategies

Rebates Zilla

Bausch And Lomb Rebate Form 2022 Printable Rebate Form

Rebates Vs Discounts What Are The Differences Enable

Rebate And Discount Hsn Code - No tax is required to be deducted under section 194R of the Act on sales discount cash discount and rebates allowed to customers