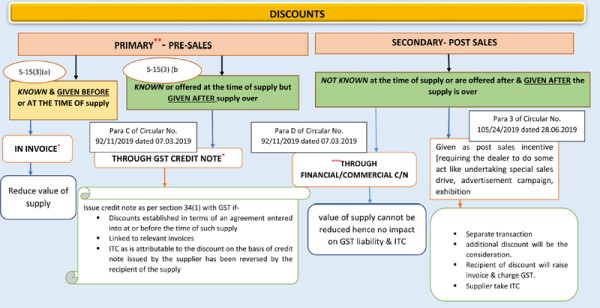

Rebate And Discount Under Gst Verkko 26 hein 228 k 2021 nbsp 0183 32 There will be no differentiation in GST between trade and cash discounts Discount allowed before or at the time of supply and it has been

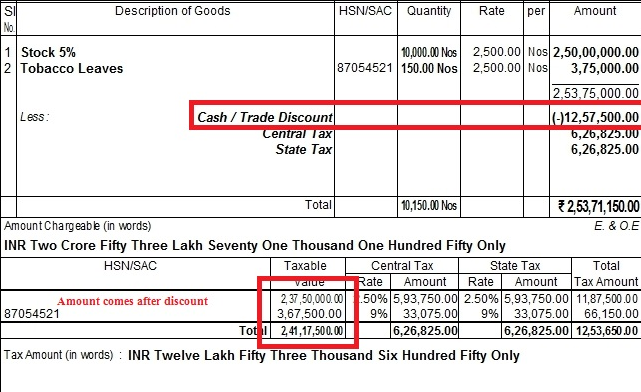

Verkko 24 marrask 2021 nbsp 0183 32 Any deduction from the actual cost of goods or services at the time of supply is called a Discount under GST Major types of discounts are Cash Verkko 30 jouluk 2019 nbsp 0183 32 The GST law provides for special provision for exclusion of such discounts subject to stipulated conditions and nature and timing of discount

Rebate And Discount Under Gst

Rebate And Discount Under Gst

https://i.ytimg.com/vi/qShsUzh0vFU/maxresdefault.jpg

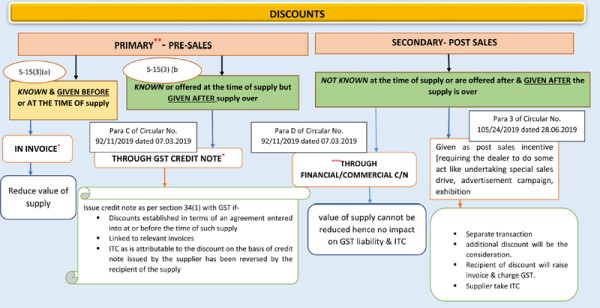

Treatment Of Discount Under GST Section 15 3 Of CGST Act 2017

https://taxguru.in/wp-content/uploads/2022/06/Treatment-of-Discount-Under-GST-Section-153-of-CGST-Act-2017.jpg

Treatment Of Discount Under GST During COVID

http://www.indialawoffices.com/UserFiles/Image/chart.png

Verkko GST on discounts and rebates Charging and accounting for GST when you provide discounts and rebates such as prompt payment discounts and volume rebates On Verkko Rebates and discounts are distinct forms of price cuts that directly or indirectly promote the overall sales of a business Both the terms may sound similar however there is

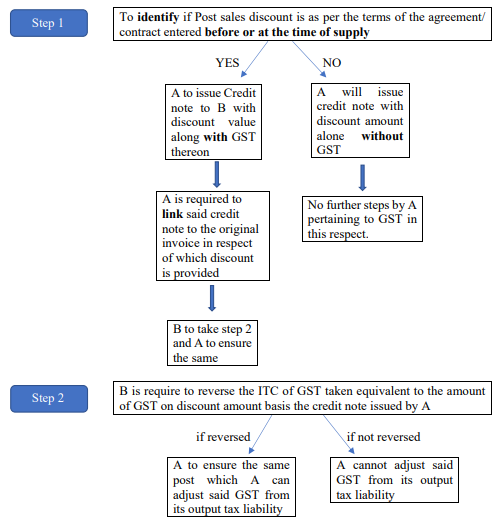

Verkko 4 elok 2019 nbsp 0183 32 Treatment of discounts under GST CA Bhupendra Choudhary Goods and Services Tax Articles Download PDF 04 Aug 2019 42 975 Views 2 comments Verkko 6 hein 228 k 2019 nbsp 0183 32 Some of discount under GST are offers upfront in invoices whereas some are offered after Sale In this article we will be discussing on post sale discount impact on GST liability and Input

Download Rebate And Discount Under Gst

More picture related to Rebate And Discount Under Gst

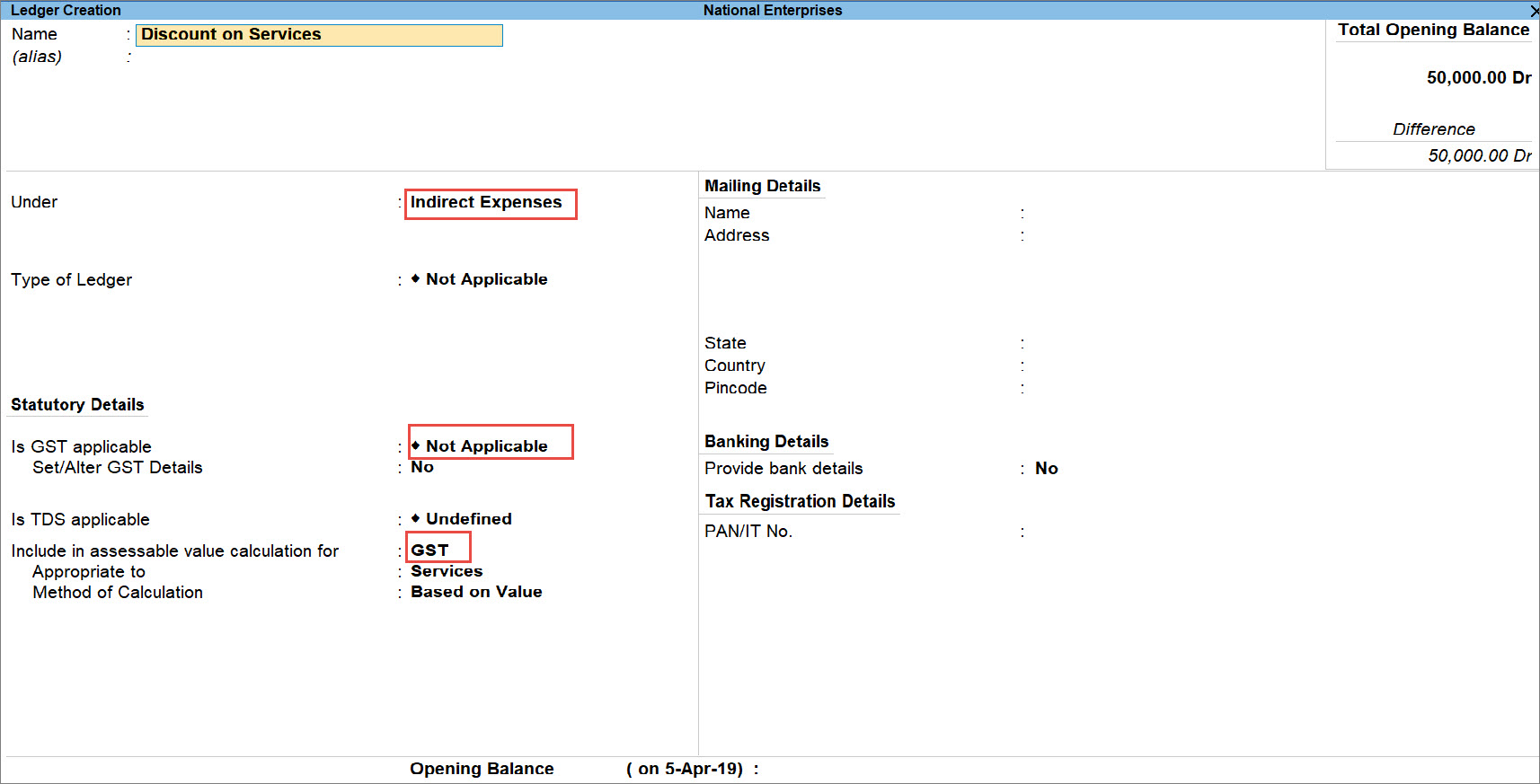

Discounts Under GST

https://www.consultease.com/wp-content/uploads/2018/08/How-to-Enter-GST-Sales-with-Cash_Trade-Discount-at-the-Item-Level-Tally-Knowledge-Google-Chrome-2018-08-29-11.41.19.png

Item Level Discount Under GST In Tally ERP 9 Learn Tally GST

https://i.ytimg.com/vi/wY5n8Br4GBw/maxresdefault.jpg

Discount Allowed Discount Received Entries With GST In Tally ERP9

https://i.ytimg.com/vi/HvBspISKKjo/maxresdefault.jpg

Verkko 2 jouluk 2019 nbsp 0183 32 1 Discounts given before or at the time of sale to understand GST on discount Discounts that are given before or at the time of sale can be deducted from Verkko 26 hein 228 k 2021 nbsp 0183 32 Discounts including Buy more save more offers Some suppliers also offer periodic year ending discounts to their stockists etc For example Get

Verkko 2 elok 2023 nbsp 0183 32 Discounts and incentives play a significant role in trade practices encouraging sales and promoting products or services This article explores various Verkko 29 helmik 2020 nbsp 0183 32 Discounts Incentives GST Implications Abhay Desai Goods and Services Tax Articles Download PDF 29 Feb 2020 94 935 Views 2 comments 1 In

All About Treatment Of Various Discounts In GST

https://www.caclubindia.com/editor_upload/1827640_20190703120813_disc1.jpg

GST Sales With Discount At The Item Level

https://help.tallysolutions.com/docs/te9rel61/Tax_India/gst/images/discount_2.gif

https://taxguru.in/goods-and-service-tax/treatment-discounts-gst-study.html

Verkko 26 hein 228 k 2021 nbsp 0183 32 There will be no differentiation in GST between trade and cash discounts Discount allowed before or at the time of supply and it has been

https://tax2win.in/guide/treatment-discounts-gst

Verkko 24 marrask 2021 nbsp 0183 32 Any deduction from the actual cost of goods or services at the time of supply is called a Discount under GST Major types of discounts are Cash

What Is A Bill Of Supply Under GST Learn By Quicko

All About Treatment Of Various Discounts In GST

Cash Discount Under GST Tally YouTube

How To Record GST Sales On Discount In TallyPrime TallyHelp

How To Record GST Sales On Discount In TallyPrime TallyHelp

How To File GST Return Step By Step Process Explained

How To File GST Return Step By Step Process Explained

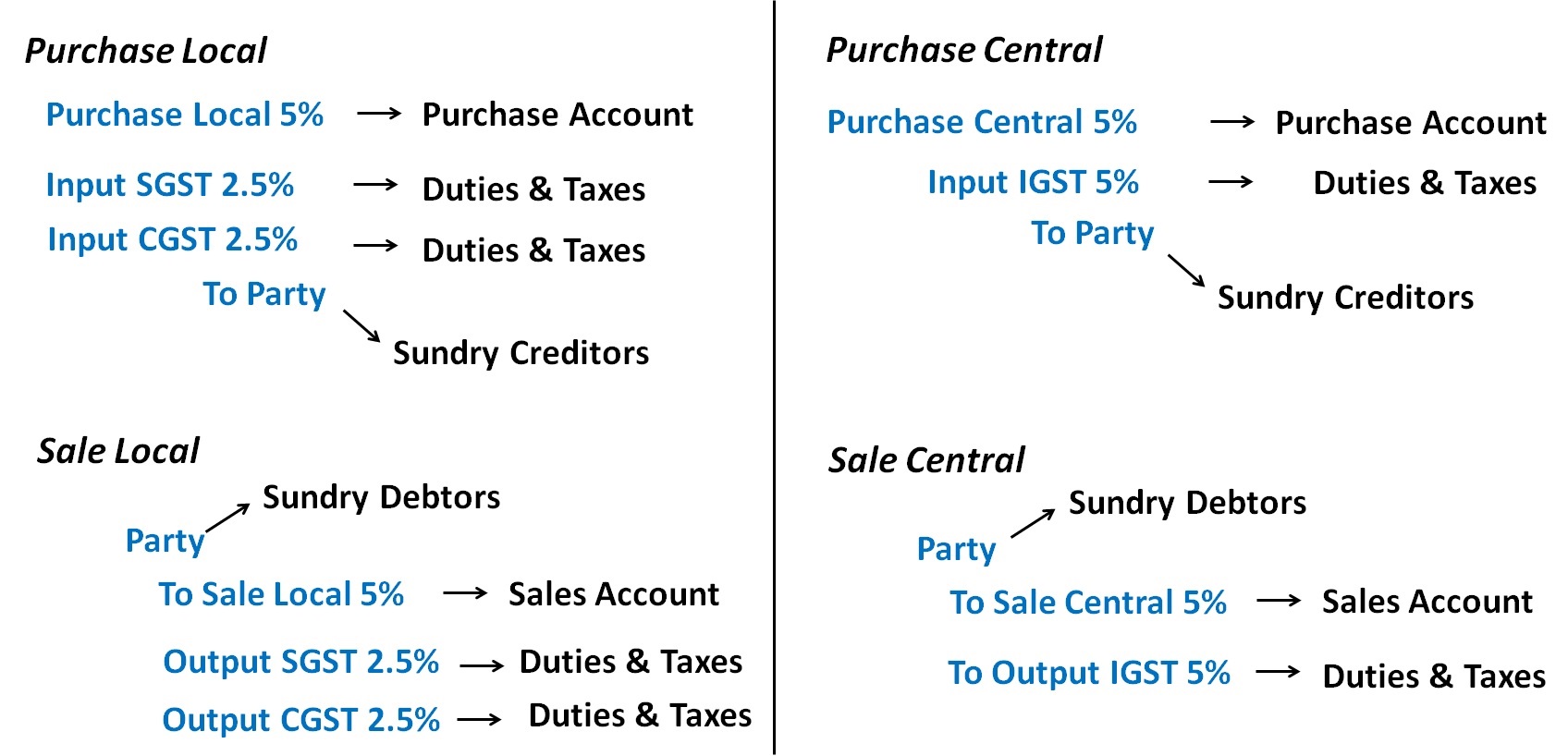

Entries For Sales And Purchase In GST Accounting Entries In GST

Post Sales Discount Under GST Returns

How To Record Purchase Invoice Under GST Tally FAQ News

Rebate And Discount Under Gst - Verkko 6 hein 228 k 2019 nbsp 0183 32 Some of discount under GST are offers upfront in invoices whereas some are offered after Sale In this article we will be discussing on post sale discount impact on GST liability and Input