Rebate Electric Car Federal Tax Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Rebate Electric Car Federal Tax

Rebate Electric Car Federal Tax

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-4.jpg

Cars That Meet Federal Rebate On Electric Cars 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-2.jpg

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/federal-tax-rebate-on-electric-cars-2022-carrebate-12.jpg

Web 7 janv 2023 nbsp 0183 32 Which vehicles are eligible for the 7 500 federal tax credit has changed dramatically compared to a previous version of the credit Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

Web Note This credit is for qualified plug in electric drive motor vehicles placed in service before 2023 qualified two wheeled plug in electric vehicles acquired before but placed in Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in

Download Rebate Electric Car Federal Tax

More picture related to Rebate Electric Car Federal Tax

Federal Tax Rebate For Electric Cars 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2023/05/federal-tax-rebate-for-electric-cars-osvehicle-3.jpg

Tax Rebates For Electric Cars Michigan 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/michigan-increases-taxes-to-fund-road-repairs-hybrids-and-electrics-1-scaled.jpg

Government Rebates Electric Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/are-there-government-rebates-for-electric-cars-2022-carrebate-3.jpg

Web 5 sept 2023 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to

Web 10 ao 251 t 2022 nbsp 0183 32 Under the Inflation Reduction Act which received Senate approval on Sunday and is expected to clear the House this week a tax credit worth up to 7 500 Web The federal tax credit for electric cars has been around for more than a decade You can get 7 500 back at tax time if you buy a new electric vehicle but not a Tesla or a

Federal Rebate On Electric Cars ElectricCarTalk

https://www.electriccartalk.net/wp-content/uploads/tesla-gets-creative-with-its-model-3-pricing-to-qualify-for-federal.png

Electric Cars Canada Rebate 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebates-for-electric-cars-kick-in-with-increased-price-limit-2.jpg

https://www.bloomberg.com/news/articles/2022-05-07/what-to-know-about...

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

https://www.irs.gov/credits-deductions/credits-for-new-electric...

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section

Washington Electric Car Tax Rebate 2023 Carrebate Californiarebates

Federal Rebate On Electric Cars ElectricCarTalk

Electric Car Available Rebates 2023 Carrebate

Tax Rebates Electric Cars 2023 Carrebate

Do Electric Cars Still Qualify For A Tax Rebate ElectricRebate

Federal Rebate Hybrid Car 2023 Carrebate

Federal Rebate Hybrid Car 2023 Carrebate

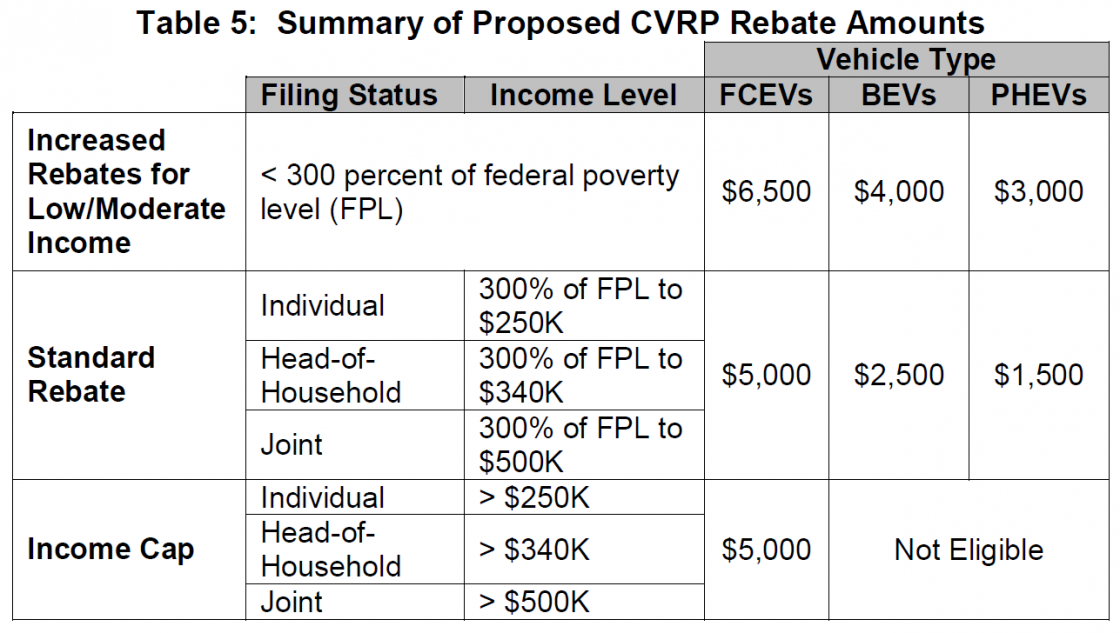

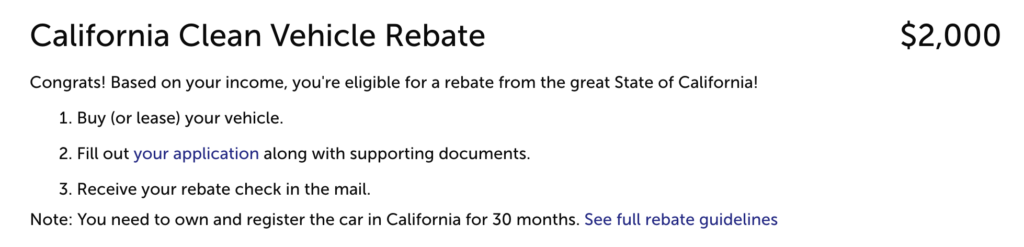

Ca Electric Car Rebate Income Limit ElectricRebate

Claiming The 7 500 Electric Vehicle Tax Credit A Step by Step Guide

Ca Electric Car Rebate Taxable 2022 Carrebate Californiarebates

Rebate Electric Car Federal Tax - Web 25 ao 251 t 2022 nbsp 0183 32 What Is the Electric Vehicle EV Tax Credit The EV tax credit is a federal incentive designed to encourage people to purchase EVs Residents who meet the