Rebate In Income Tax On Education Loan Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to

If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E However the deduction is provided only for the interest part of the EMI Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is allowed as a deduction under Section 80E of the Income Tax Act 1961 This deduction is available for a maximum of 8 years or till the interest is repaid whichever is earlier

Rebate In Income Tax On Education Loan

Rebate In Income Tax On Education Loan

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

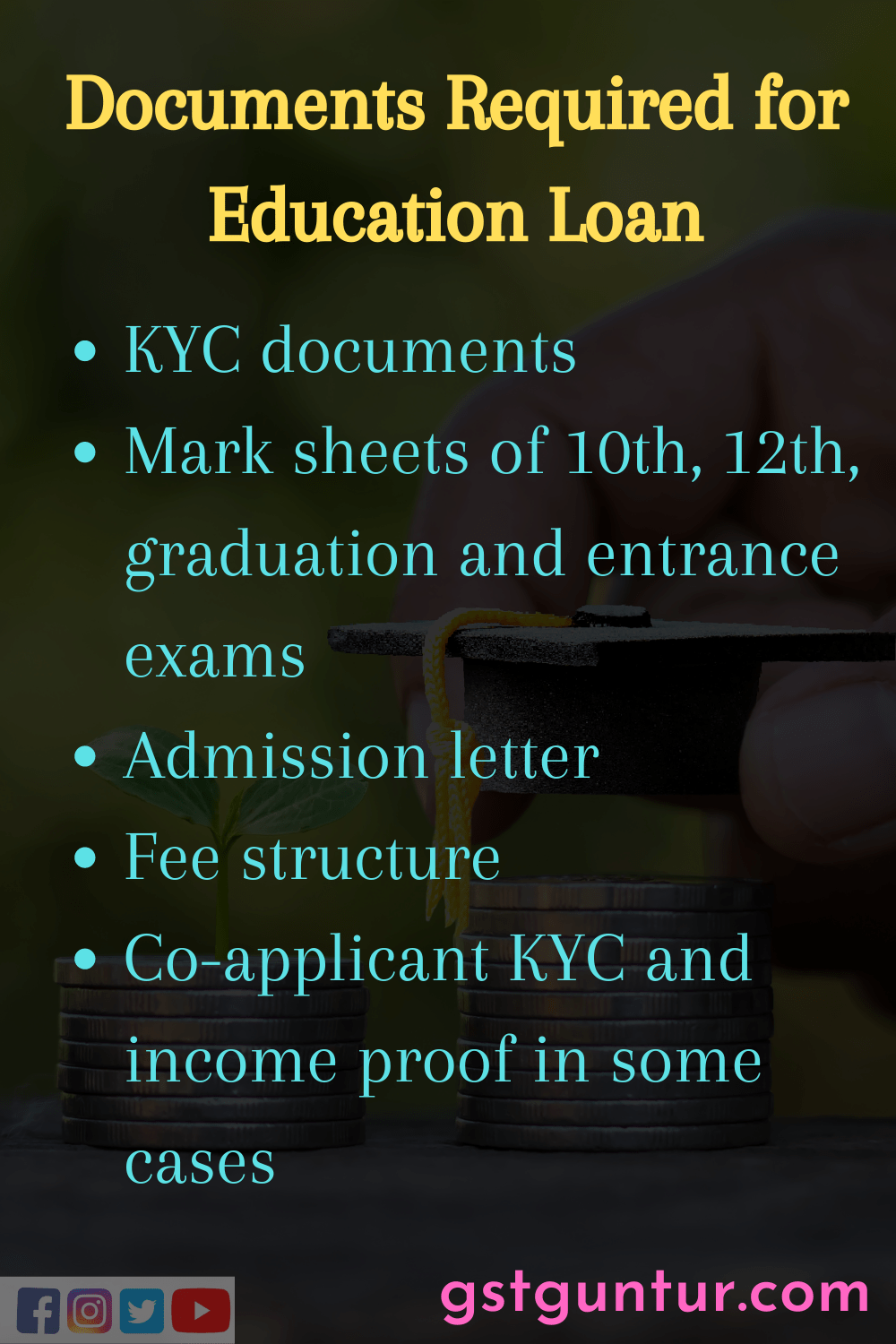

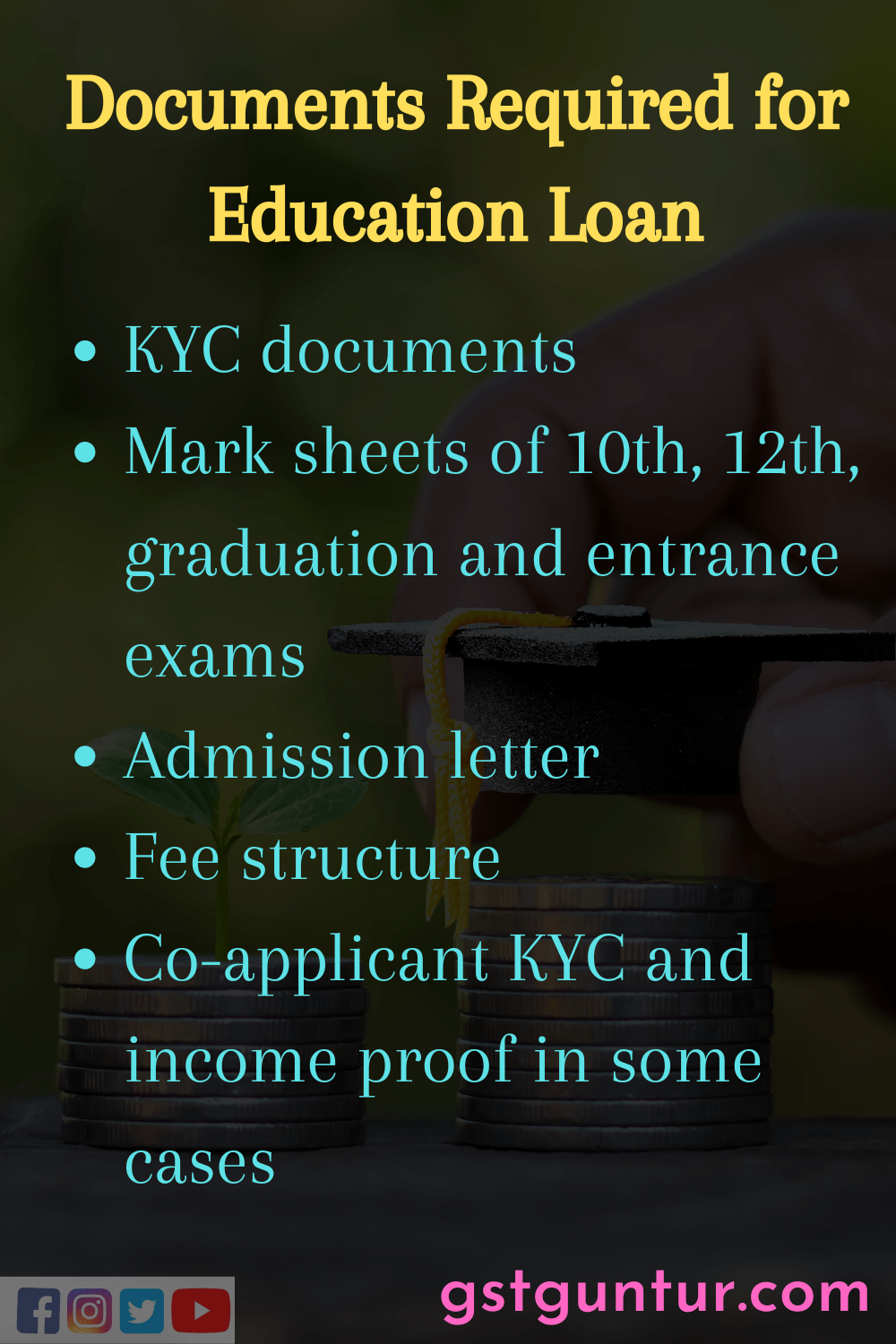

Ultimate Guide On Education Loan Eligibility Interest Rates

https://gstguntur.com/wp-content/uploads/2021/11/documents-required-for-education-loan.png

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

https://i.ytimg.com/vi/IrYTqu6Hohg/maxresdefault.jpg

Understanding education loan tax rebates can significantly reduce financial burdens Knowing about such benefits meeting eligibility criteria and strategizing repayment can lead to substantial tax savings The tax benefits on education loan are only valid once you start the repayment and moreover they are only available up to eight years For instance if your loan tenure exceeds eight years you cannot claim for deductions beyond eight years

Section 80E of the Income Tax Act allows a tax deduction on the interest paid on education loans for higher studies Section 80E deduction helps to reduce the financial burden of education loans by lowering the taxable income of the borrower Conditions on deduction Additionally the provisions of Section 80 of the Income Tax Act enable them to avail tax benefits on the repayment of their student loans However it is essential for one to decide if he or she would stretch the repayment period or pay off the amount as early as possible

Download Rebate In Income Tax On Education Loan

More picture related to Rebate In Income Tax On Education Loan

Madhya Pradesh Government Is Giving Rebate In Income Tax To Those

https://hindi.cdn.zeenews.com/hindi/sites/default/files/2020/12/02/703125-tax-rebate-in-madhya-prades.jpg

Taking An Education Loan Watch This To Save Tax On Education Loan L

https://i.ytimg.com/vi/VuftDiYC0L8/maxresdefault.jpg

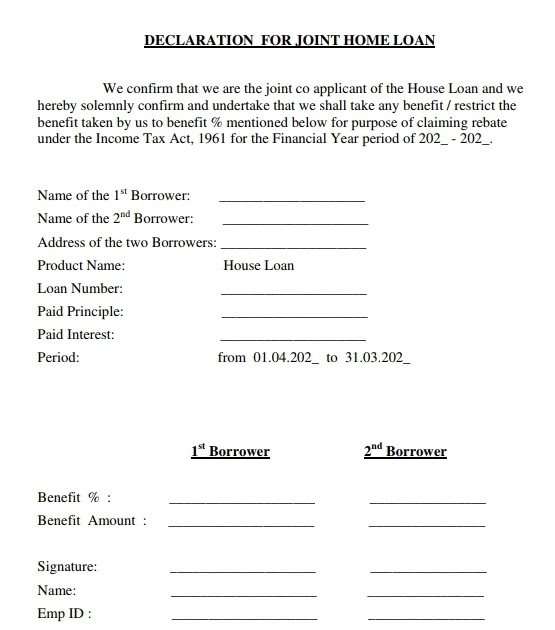

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

https://imgv2-2-f.scribdassets.com/img/document/553973286/original/542bfb7a7c/1661356692?v=1

If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is only available to Individual and not to HUF Deduction under Section 80E is allowed under Income Tax for interest paid on student loan taken for higher education The deduction is allowed to encourage users to go for higher studies Deduction is allowed even if the loan is taken for higher studies outside India

Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget Resident individual taxpayers are eligible for a tax rebate under Section 87A of the Income Tax Act when their total income does not surpass Rs 5 lakhs under the old tax regime and extends up to Rs 7 lakhs under the new tax regime Who is eligible to claim the Tax benefit

Section 87A Income Tax Rebate

https://taxguru.in/wp-content/uploads/2018/07/Tax-rebate.jpg

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

https://tax2win.in/guide/sec-80e-deduction-interest-on-education-loan

Interest on loans taken for pursuing higher education including vocational studies is eligible for deduction u s 80E Understand Section 80E of the Income Tax Act which allows tax deductions for interest paid on education loans Learn eligibility criteria benefits and how to

https://cleartax.in/s/section-80e-deduction-interest-education-loan

If you have taken an education loan and are repaying the same then the interest paid on that education loan is allowed as a deduction from the total income under Section 80E However the deduction is provided only for the interest part of the EMI

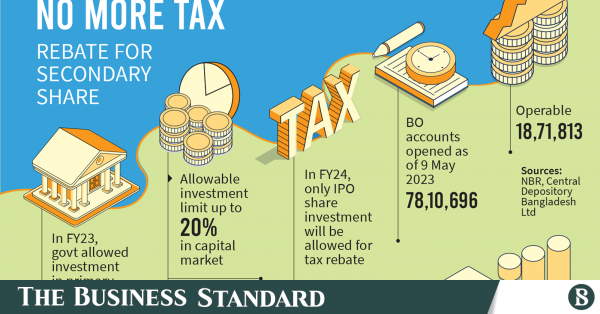

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

Section 87A Income Tax Rebate

How To Get Tax Rebate In Income Tax

Income Tax Rebate Meaning Types How To Calculate HDFC Life

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Form For Renters Rebate RentersRebate

Province Of Manitoba School Tax Rebate

Income Tax Rebate Under Section 87A

Rebate In Income Tax On Education Loan - The tax benefits on education loan are only valid once you start the repayment and moreover they are only available up to eight years For instance if your loan tenure exceeds eight years you cannot claim for deductions beyond eight years