Rebate Income Tax House Building Loan Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get

Web Les travaux 233 ligibles 224 MaPrimeR 233 nov Comme pour le cr 233 dit d imp 244 t MaPrimeR 233 nov concerne de nombreux travaux de r 233 novation 233 nerg 233 tique sous r 233 serve que les Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than

Rebate Income Tax House Building Loan

Rebate Income Tax House Building Loan

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

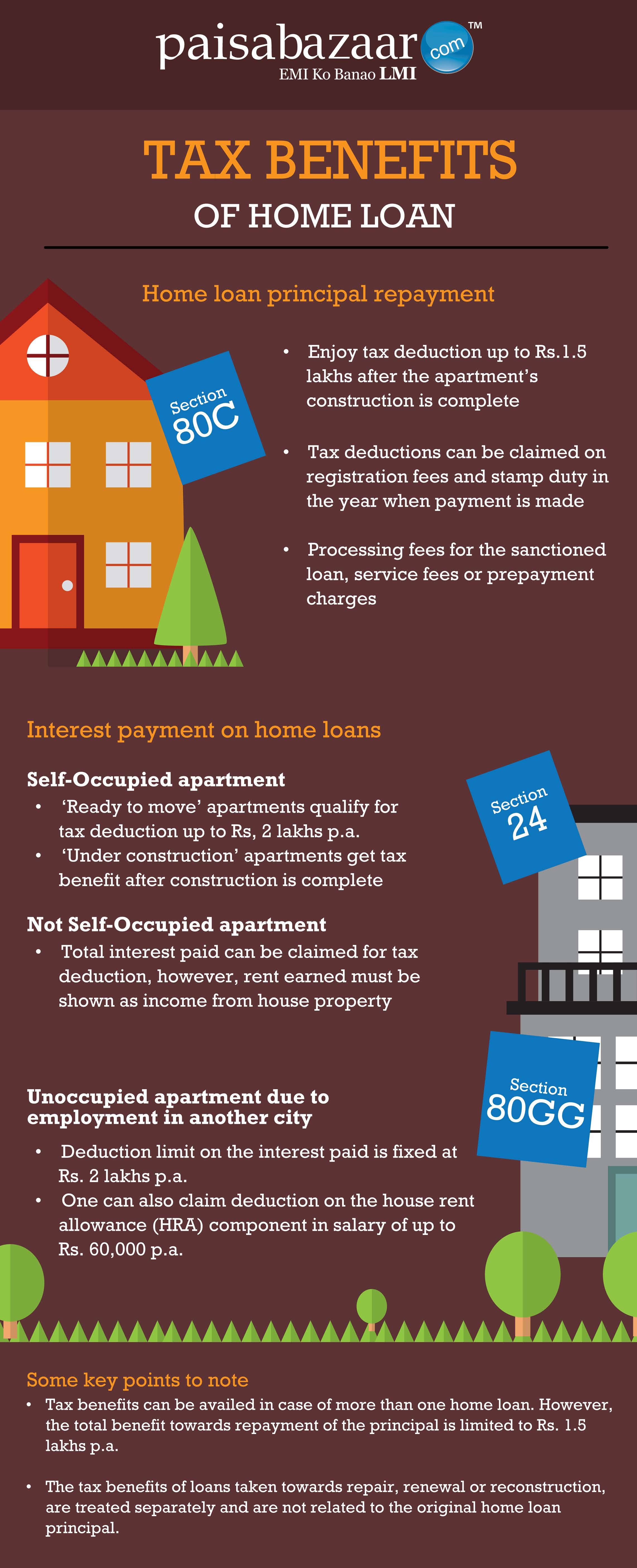

Home Loan Tax Benefits In India Important Facts

https://propertyadviser.in/assets/front/images/real-estate-news/s1/income-tax-rebate-on-home-loan-819-s1.jpg

Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only Web Income tax rebate on home loan Joint mortgage deductions Borrowers may deduct up to Rs 2 lakhs in interest and Rs 1 5 lakh in principle from their house loan but only if they

Web 25 mars 2016 nbsp 0183 32 To understand the key tax benefit on a home loan we are bifurcating the repayment techniques into four major elements tax benefits on principal repaid tax Web As per the new income tax rule starting April 2023 no new home loans sanctioned in FY23 24 will be eligible to claim the tax benefits under section 80 EEA Sections of the

Download Rebate Income Tax House Building Loan

More picture related to Rebate Income Tax House Building Loan

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Education Rebate Income Tested

https://i.pinimg.com/originals/2f/ba/b9/2fbab97c42c295256188fa95c9fb2bbe.png

Home Loan Interest Exemption In Income Tax Home Sweet Home

https://apps.indianmoney.com/images/article-images/Tax save 22.jpg

Web income tax Sections that provide tax rebate when you take a home loan you make the home loan repayment to the lender in equated monthly installments EMIs the home Web 11 janv 2023 nbsp 0183 32 By Sunita Mishra January 11 2023 Home loan tax benefits in 2023 The government offers various tax rebates especially if the property has been purchased

Web For both self occupied and let out properties you can claim up to a maximum of Rs 1 5 lakh every year from taxable income on principal repayment Stamp duty and registration Web 25 mai 2021 nbsp 0183 32 You can claim an additional deduction of Rs 50 000 per financial year towards interest payments if you are a first time homebuyer You can claim this benefit

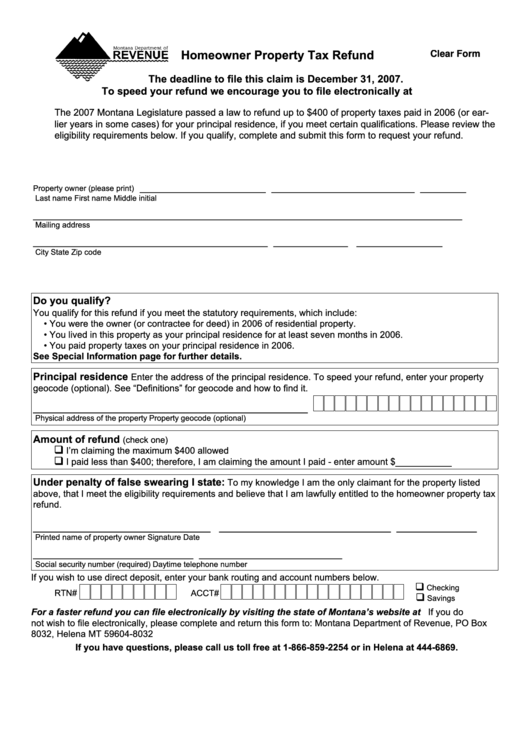

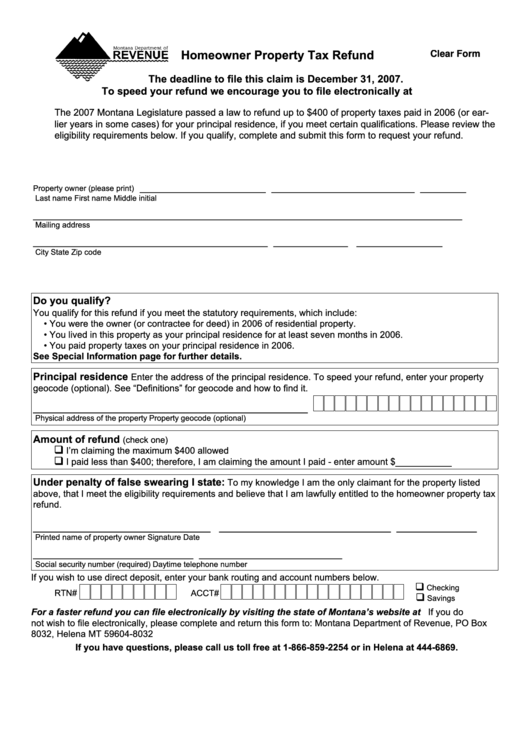

Fillable Homeowner Property Tax Refund Form Montana Department Of

https://data.formsbank.com/pdf_docs_html/177/1774/177484/page_1_thumb_big.png

New Housing Tax Rebate Canada Home Tax Rebate

https://image.slidesharecdn.com/newhousingtaxrebate-canadahometaxrebate-160829074318/95/new-housing-tax-rebate-canada-home-tax-rebate-2-638.jpg?cb=1472456628

https://money.stackexchange.com/questions/27738

Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get

https://construction-maison.ooreka.fr/astuce/voir/309935

Web Les travaux 233 ligibles 224 MaPrimeR 233 nov Comme pour le cr 233 dit d imp 244 t MaPrimeR 233 nov concerne de nombreux travaux de r 233 novation 233 nerg 233 tique sous r 233 serve que les

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Fillable Homeowner Property Tax Refund Form Montana Department Of

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

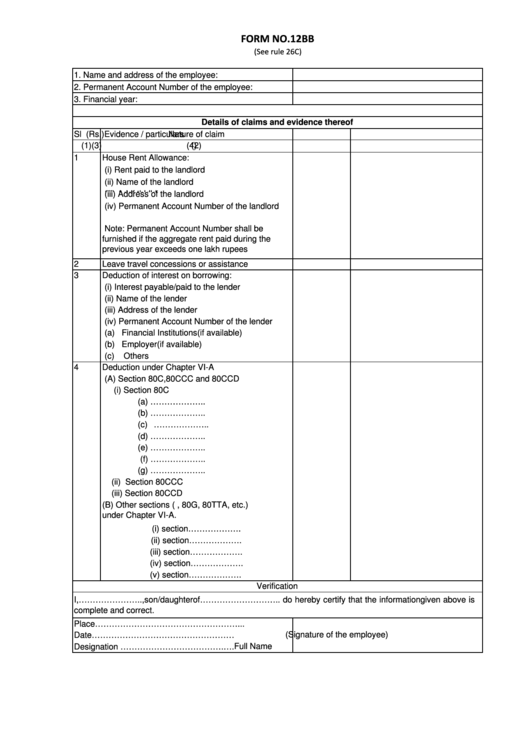

Form 12 Bb Form To Claim Income Tax Benefits Rebate Printable Pdf

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Interim Budget 2019 20 The Talk Of The Town Trade Brains

Due Date Extended For Availing A 5 Rebate On Property Tax In Bangalore

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

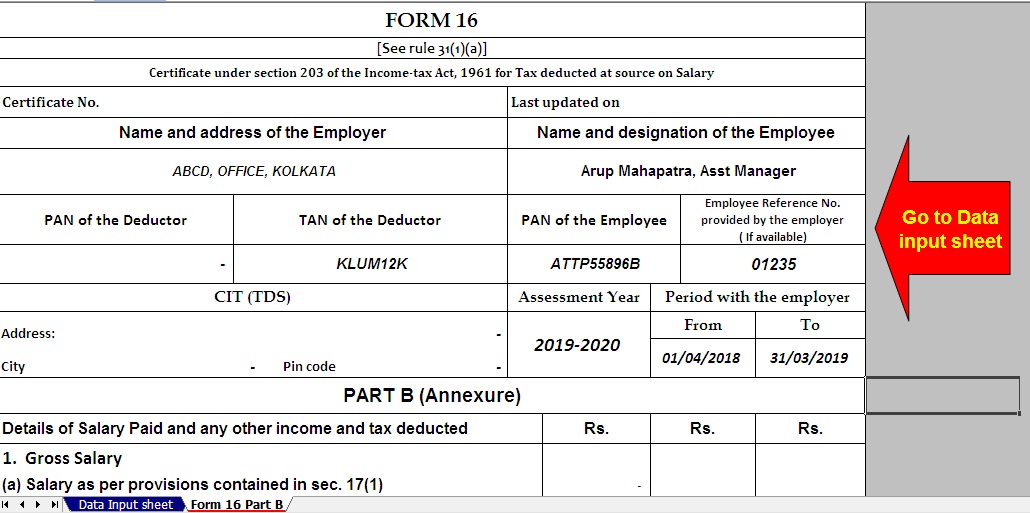

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

Rebate Income Tax House Building Loan - Web 25 mars 2016 nbsp 0183 32 To understand the key tax benefit on a home loan we are bifurcating the repayment techniques into four major elements tax benefits on principal repaid tax