Rebate On Home Loan Interest In Income Tax Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions Web The Income Tax Act 1961 offers various provisions for a tax rebate on home loans The following are the three major areas where such a borrower can claim exemptions

Rebate On Home Loan Interest In Income Tax

Rebate On Home Loan Interest In Income Tax

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

![]()

Section 24 Income Tax Benefit Of A Housing Loan OneMint

https://cdn.shortpixel.ai/client/q_lossy,ret_img,w_580/http://www.onemint.com/wp-content/uploads/2011/11/Tax-Benefit-of-Home-Loan-Repayment.png

Income Tax Rebate On Home Loan Fy 2019 20 A design system

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

Web 5 sept 2023 nbsp 0183 32 Under Section 80EEA of the Income Tax Act in India first time homebuyers investing in affordable property with the help of a home loans get Rs 1 50 lakh income Web 2 avr 2022 nbsp 0183 32 New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less

Web 3 mars 2023 nbsp 0183 32 How Much Tax Save on a Home Loan 5 Income Tax Benefits on Home Loan Income Tax Rebate on Home Loan for Interest Paid Income Tax Rebate for Interest Paid on Loan During the Initial Web Joint home loan borrowers can claim individual home loan rebates in income tax up to Rs 2 lakh on interest paid and Rs 1 5 lakh on the principal amount Are there any other

Download Rebate On Home Loan Interest In Income Tax

More picture related to Rebate On Home Loan Interest In Income Tax

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Home Loan Interest Rebate On Home Loan Interest In Income Tax

https://3.bp.blogspot.com/-o4djNyyA8DU/T2P0RGOd-fI/AAAAAAAAAys/XWfuzicFqlk/w1200-h630-p-k-no-nu/Untitled.gif

Income Tax Deductions List FY 2020 21 Save Tax For AY 2021 22

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Web Most homeowners can deduct all of their mortgage interest The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From

Web 4 janv 2023 nbsp 0183 32 Standard deduction rates are as follows Single taxpayers and married taxpayers who file separate returns 12 950 for tax year 2022 Married taxpayers who Web 1 f 233 vr 2021 nbsp 0183 32 So if the home loan is taken jointly then each borrower can claim a deduction for home loan interest under Section 24B up to Rs 2 lakh each and principal repayment

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE-662x400.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

https://cleartax.in/s/section-80ee-income-tax-deduction-for-interest...

Web 4 avr 2017 nbsp 0183 32 Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these deductions

Form 12BB New Form To Claim Income Tax Benefits Rebate

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

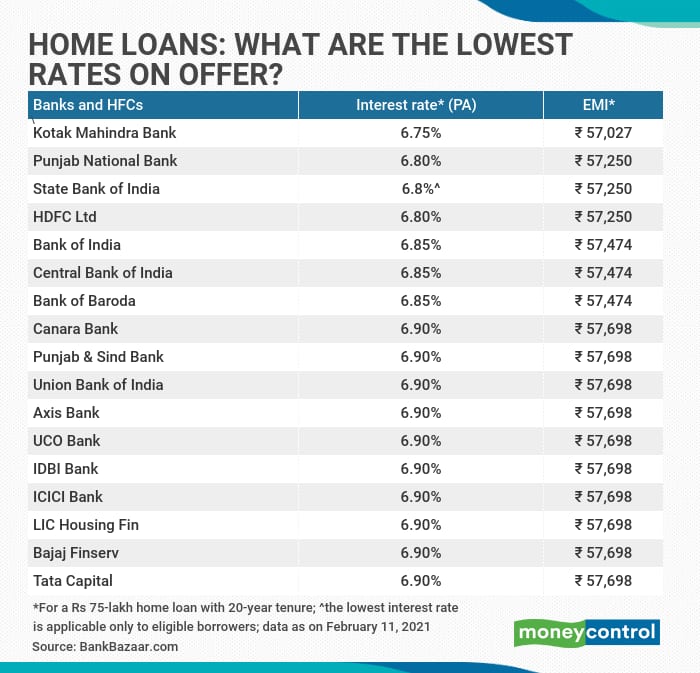

Home Loan Interest Rates Top 15 Banks That Offer The Lowest Mint

Oct 2016 Best Home Loan Interest Rates In 2016

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

Rising Home Loan Interests Have Begun To Impact Homebuyers

Interest Rate For Housing Loan 2021 Sbi Home Loan Sbi Home Loan

Rebate On Home Loan Interest In Income Tax - Web Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your