Rebate On Rent Paid In Income Tax Verkko 5 toukok 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid

Verkko 13 jouluk 2022 nbsp 0183 32 The deduction is primarily made from capital income such as dividends or rental income If you have no such income there will be a credit from your earned Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Some 367 000 people in Finland received rental income in 2022 according to figures from the Tax Administration The total rent received last year was

Rebate On Rent Paid In Income Tax

Rebate On Rent Paid In Income Tax

https://www.pennlive.com/resizer/9__l3v8PgaVRb7vyfHFdyNzfxkM=/800x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/OPZBRT6KQNA2DBHYBAEUKDMWK4.png

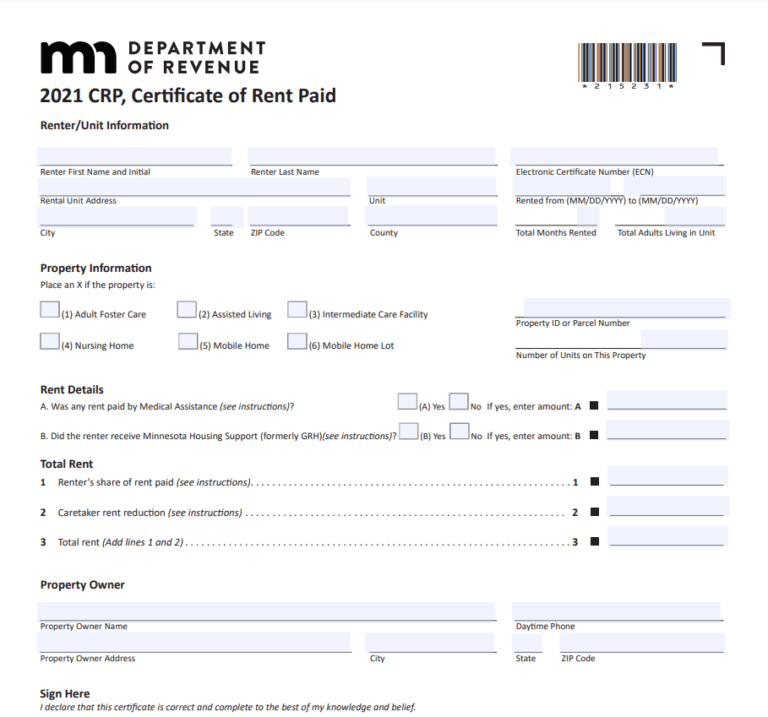

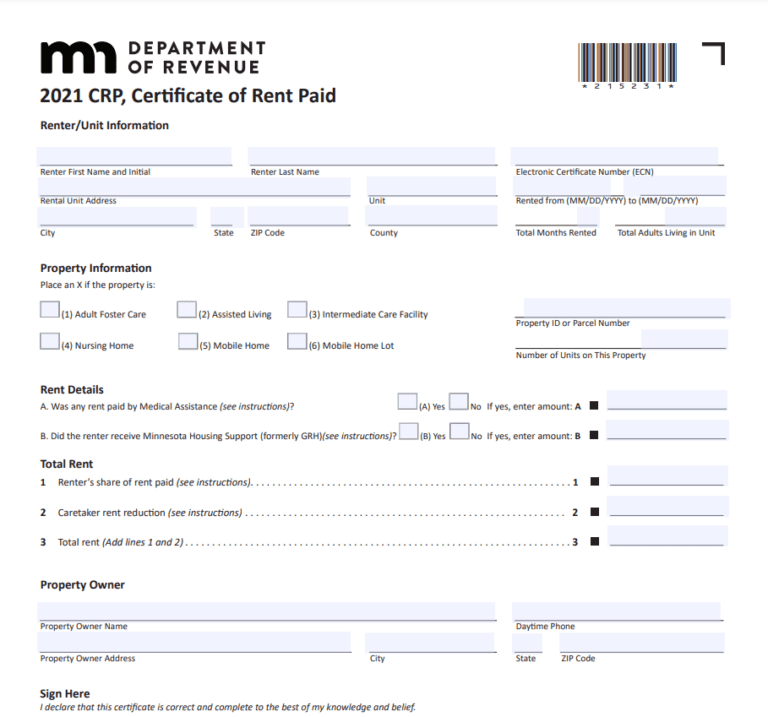

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

Verkko 26 kes 228 k 2018 nbsp 0183 32 Section 80GG Deduction on Rent paid CA Sandeep Kanoi Income Tax Articles Download PDF 26 Jun 2018 1 665 113 Views 167 comments Deductions is respect of rents paid Under Verkko 21 marrask 2021 nbsp 0183 32 Amount Eligible for Deduction Quantum of deduction shall be least of the following A 5000 per month B 25 of Adjusted Total Income C Actual rent

Verkko 18 maalisk 2022 nbsp 0183 32 However the deduction is restricted to 25 of the total income or excess of rent actually paid over 10 of the total income Moreover the maximum deduction that can be claimed in a Verkko 18 elok 2021 nbsp 0183 32 Income Tax Act 1961 allows a rebate on this allowance if you are living on rent However if you are self employed or do not receive HRA and living on rent

Download Rebate On Rent Paid In Income Tax

More picture related to Rebate On Rent Paid In Income Tax

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Due Date Extension Under Income Tax And Benami Law

https://img.indiafilings.com/learn/wp-content/uploads/2019/07/12004316/Income-Tax-Due-Date-Extended.jpg

Rent Rebate Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021.jpg

Verkko HRA or the House Rent Allowance is one of the sub components of the employee s salary for which deductions are fully or partially taxable under Section 10 13A of the Verkko 2 p 228 iv 228 228 sitten nbsp 0183 32 HRA tax exemption guide As the year ends employees often have to deal with tax matters and investment declarations especially those living in rented

Verkko 11 helmik 2021 nbsp 0183 32 The tax rebate is to be claimed through the online filing of the TA24 The deadline for the submission of the TA24 and payment of the tax on rental income Verkko First the maximum standard rebate is increasing from 650 to 1 000 Second the income cap for both renters and homeowners will be made equal and increase to

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189550-Z9C3QJVKXYFO4N04VXT7/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_2.jpg

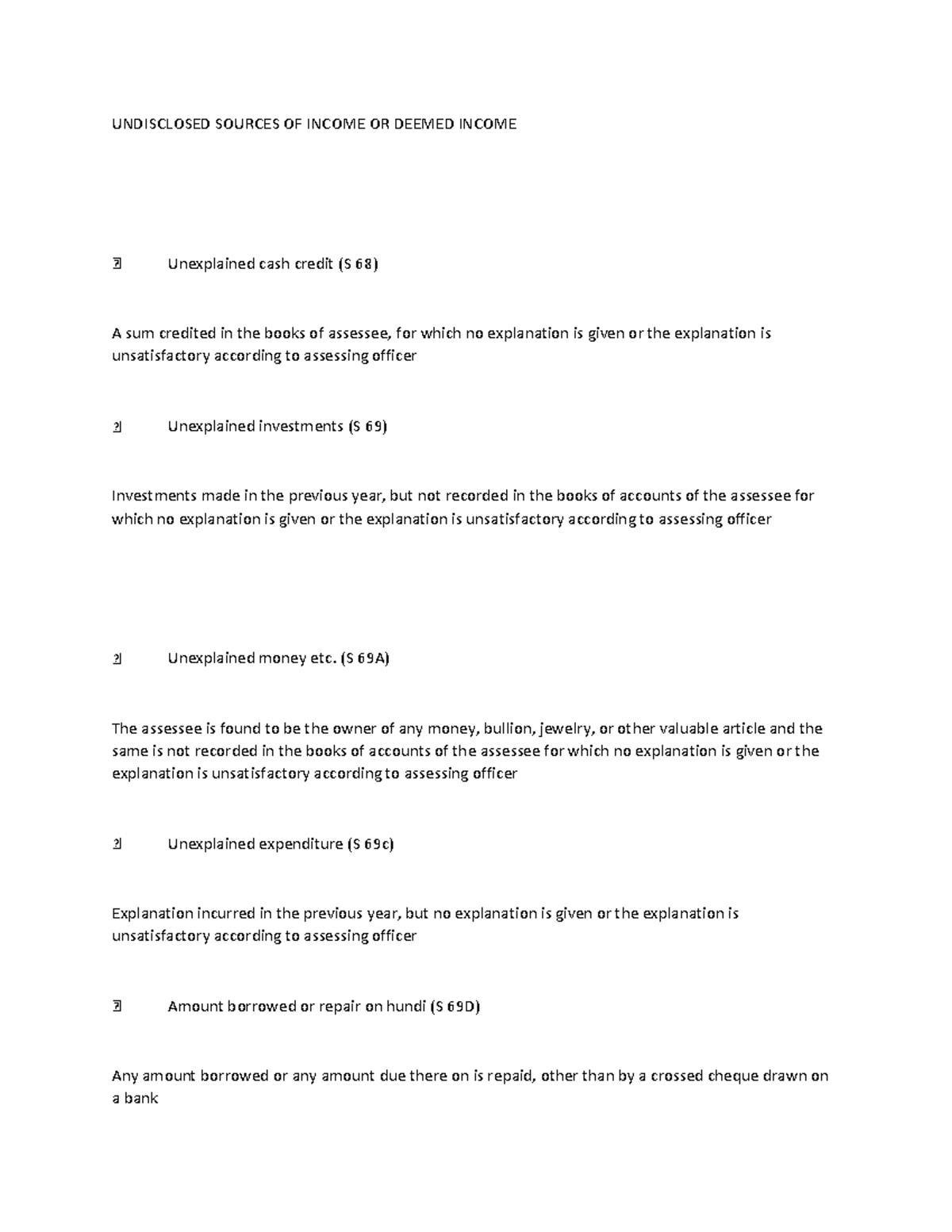

Document In This Notes About Undisclosed Source Of Income In Income

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/df429db1b5f472adb16157417bc4c332/thumb_1200_1553.png

https://taxguru.in/income-tax/house-rent-all…

Verkko 5 toukok 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko 13 jouluk 2022 nbsp 0183 32 The deduction is primarily made from capital income such as dividends or rental income If you have no such income there will be a credit from your earned

Form For Renters Rebate RentersRebate

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Income Tax Slabs Budget 2021 No Changes In Income Tax Slabs In 2021 And

Deadline For Tax And Rent Relief Extended

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Muth Encourages Eligible Residents To Apply For Extended Property Tax

Income Tax Appellate Tribunal Recruitment Https www itat gov in

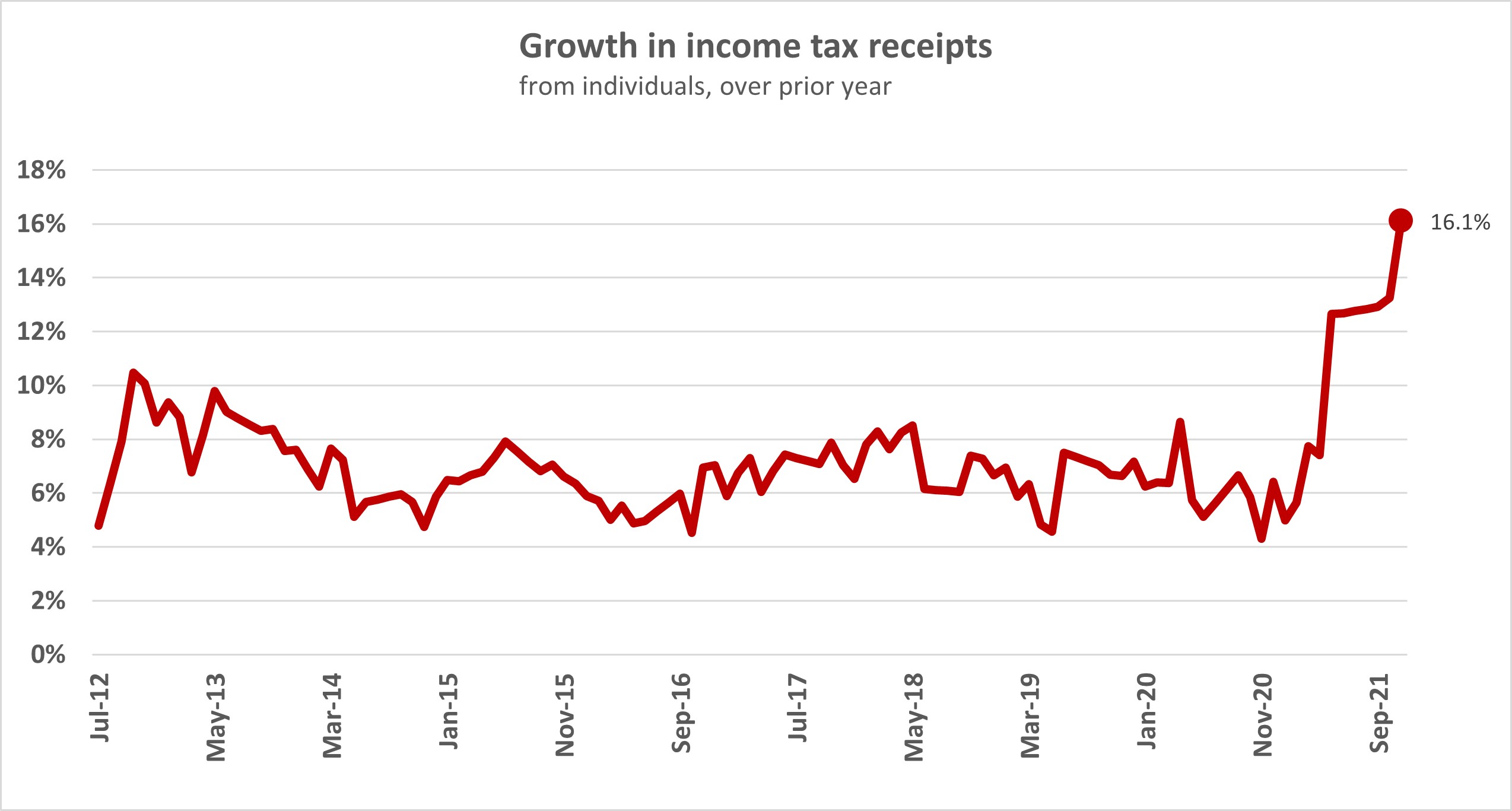

Income Taxes Paid By Individuals Eclipse Previous High Interest co nz

Property Tax Rebate Pennsylvania LatestRebate

Rebate On Rent Paid In Income Tax - Verkko 21 marrask 2021 nbsp 0183 32 Amount Eligible for Deduction Quantum of deduction shall be least of the following A 5000 per month B 25 of Adjusted Total Income C Actual rent