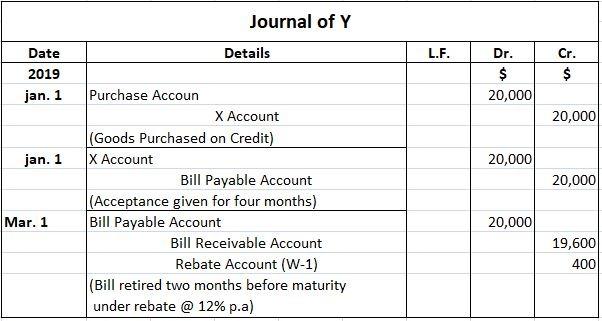

Rebate Receivable Journal Entry From a vendor rebate accounting entry to customer rebates accounting this guide will cover all you need to know At the same time we will cover the common challenges that rebate accounting can cause

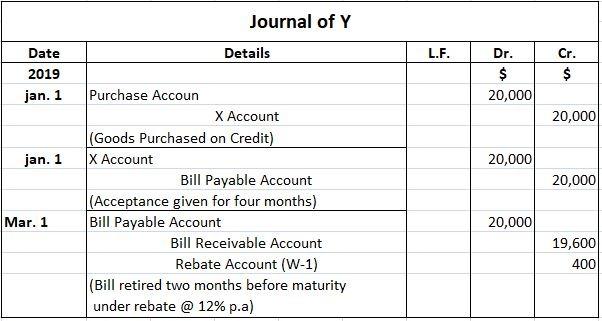

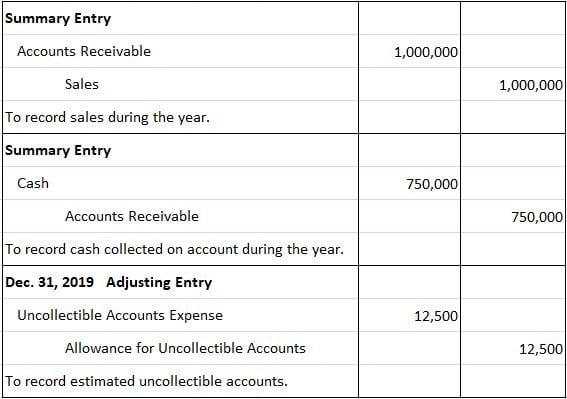

This standard is critical in the context of rebates as it outlines the criteria for identifying performance obligations and recognizing revenue It is particularly relevant when assessing The system creates journal entries to recognize the rebate liability 4 percent of the order amount Debit accrual discount 4 percent 50 000 2 000 Credit rebate payable 2 000

Rebate Receivable Journal Entry

Rebate Receivable Journal Entry

https://learn.financestrategists.com/wp-content/uploads/2019/08/Bill-of-Exchange-Retired-Under-Rebate-Journal-Entries.jpg

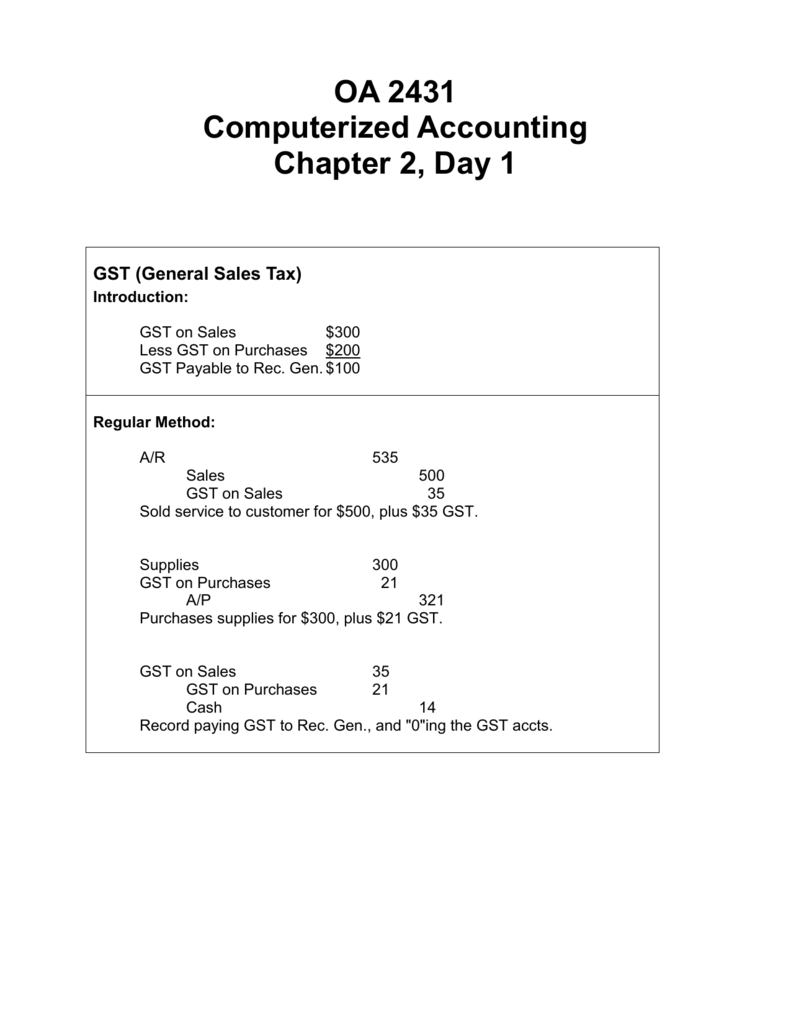

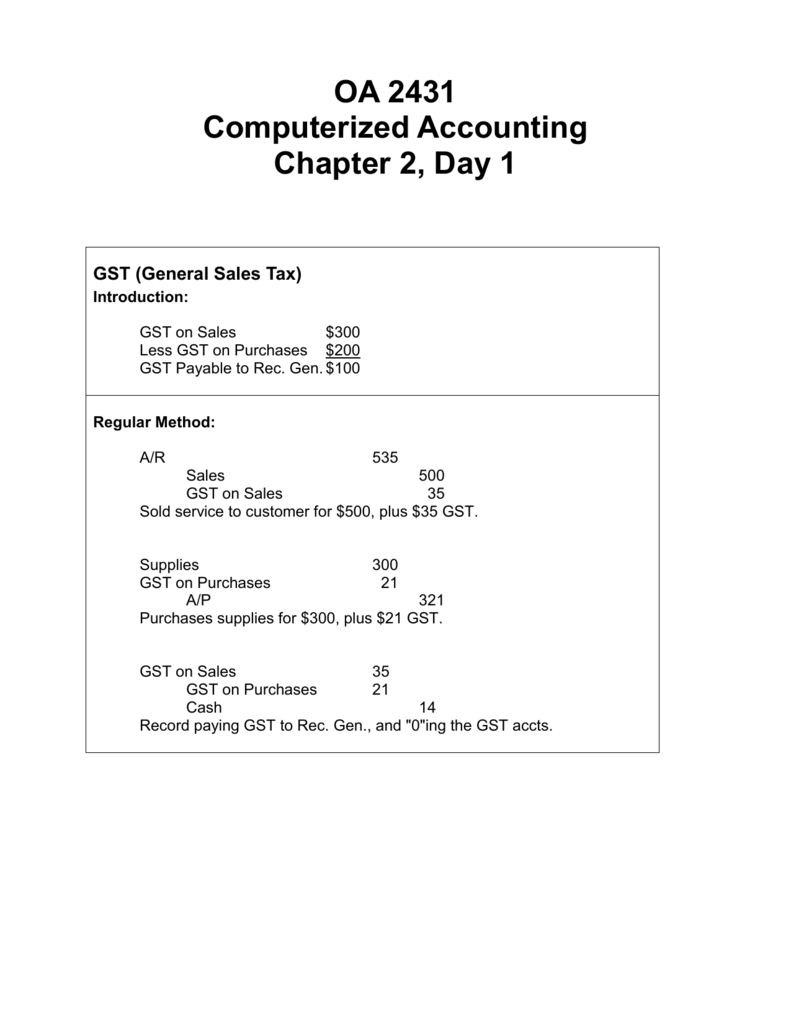

GST PST Journal Entries

https://s3.studylib.net/store/data/009029385_1-2ec045439c3cced7bd76d6e4c2d03b50.png

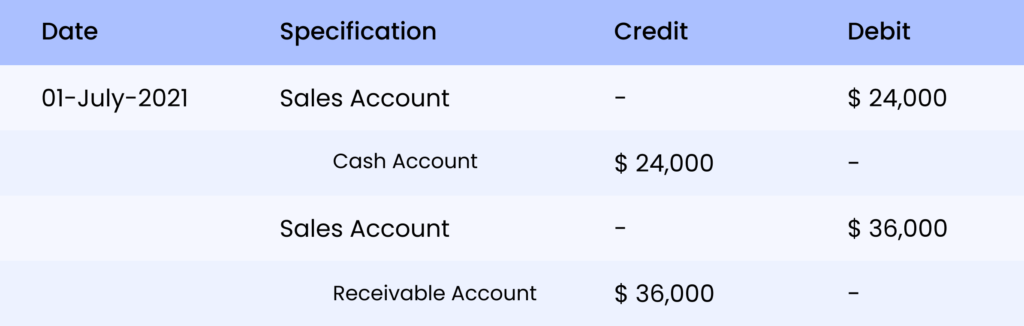

Sales Return Journal Entry Explained With Examples 2023

https://www.zetran.com/wp-content/uploads/2021/11/sales-return-journal-entry-example-1--1024x326.png

An under accrual occurs when the estimated amount of a rebate accrual journal entry falls short Consequently an under accrual of a rebate boosts profit for the recording period whereas an under accrual of rebate revenue Journal entries for rebates are straightforward if the purpose of the accounting entry is considered A rebate is an amount repaid to a customer who has made a certain quantity or value of purchases with an enterprise

Rebates are typically used by manufacturers wholesale distributors financial services firms and retailers as a mechanism for Boosting sales by increasing demand for a This IFRS Viewpoint provides our views on the purchaser s accounting treatment for the different types of rebate and discount along with some application examples Our IFRS Viewpoint

Download Rebate Receivable Journal Entry

More picture related to Rebate Receivable Journal Entry

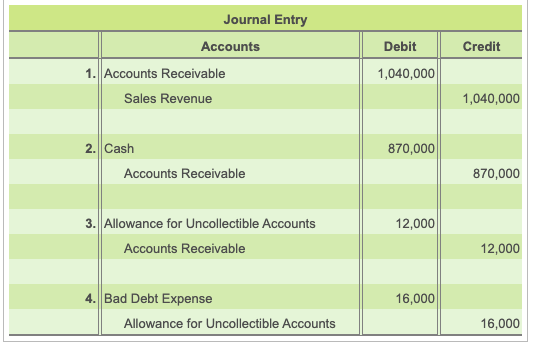

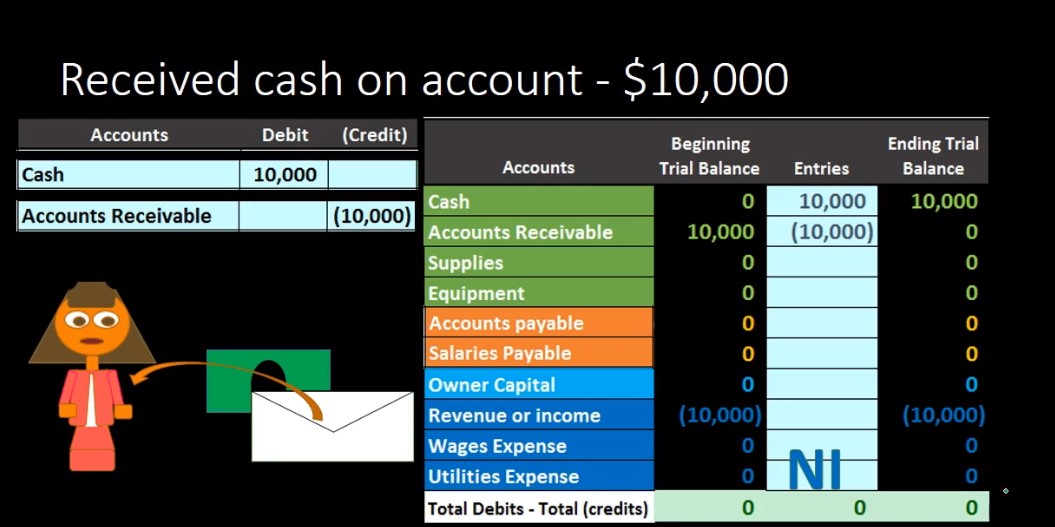

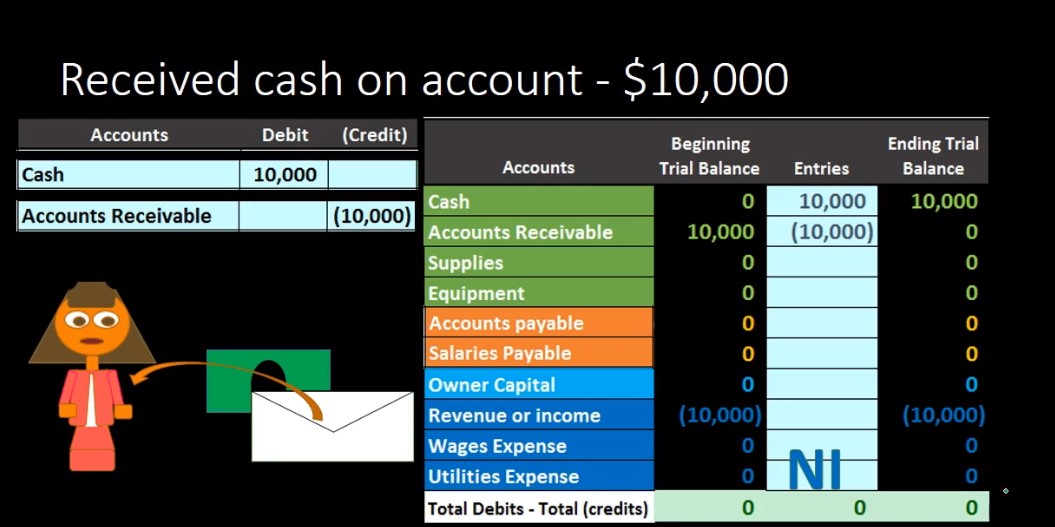

Accounts Receivable Journal Entry

https://media.cheggcdn.com/media/1e2/1e20ea39-b020-49e9-93a4-5e8ca3492ac2/phpE5xbnX.png

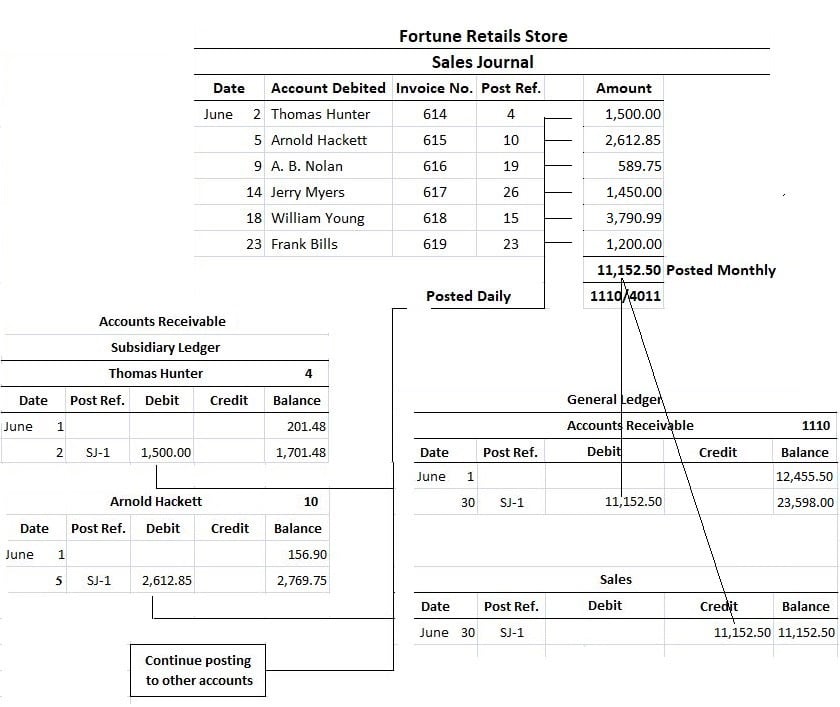

Sales Journal Advantages Format Calculation And Examples

https://learn.financestrategists.com/wp-content/uploads/Sales-Journal-Posting-Entries-to-general-Ledger-and-Subsidiary-Accounts-1.jpg

Accounts Receivable Journal Entry

https://learn.financestrategists.com/wp-content/uploads/2019/11/Journal-Entries-to-record-original-estimate.jpg

For your rebates accounting entry you ll adjust your business expenses and cost of goods sold Supplier rebates can come in many forms For example a supplier can offer a volume rebate A rebate is a refund given after a purchase not at the point of sale It s a bit like a delayed discount that customers can claim once they ve bought something In retail rebates

So here are my journal entries to record the receipt of the Prepaid MasterCard Rebate rec d by vendor and the subsequent use of the Prepaid MasterCard Please let me know if I am Understanding the journal entry for refunds received is important In this article we ll cover the journal entries for refunds for 1 returned inventory purchases 2 returned

Accounts Receivable Journal Entries 230 Accounting Instruction Help

https://accountinginstruction.info/wp-content/uploads/2020/05/1-63.jpg

Entr e De Journal Pour Remise Autoris e Et Re ue StackLima

https://media.geeksforgeeks.org/wp-content/uploads/20220414185713/Discreceivq-660x313.PNG

https://www.solvexia.com/blog/rebate-acc…

From a vendor rebate accounting entry to customer rebates accounting this guide will cover all you need to know At the same time we will cover the common challenges that rebate accounting can cause

https://insights.enable.com/hubfs/dl/wp/Enable...

This standard is critical in the context of rebates as it outlines the criteria for identifying performance obligations and recognizing revenue It is particularly relevant when assessing

Withholding Tax Receivable Manager Forum

Accounts Receivable Journal Entries 230 Accounting Instruction Help

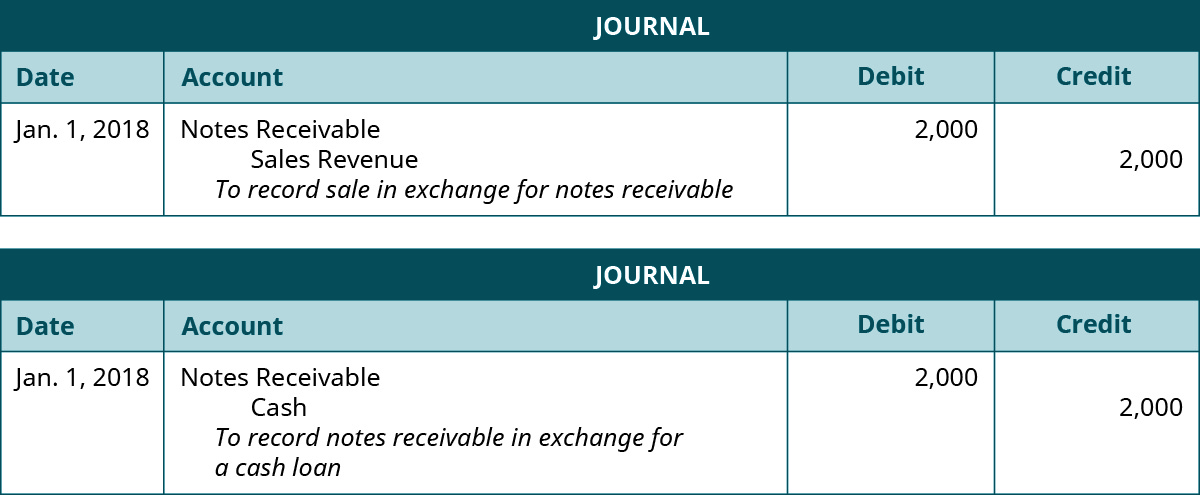

Explain How Notes Receivable And Accounts Receivable Differ SPSCC

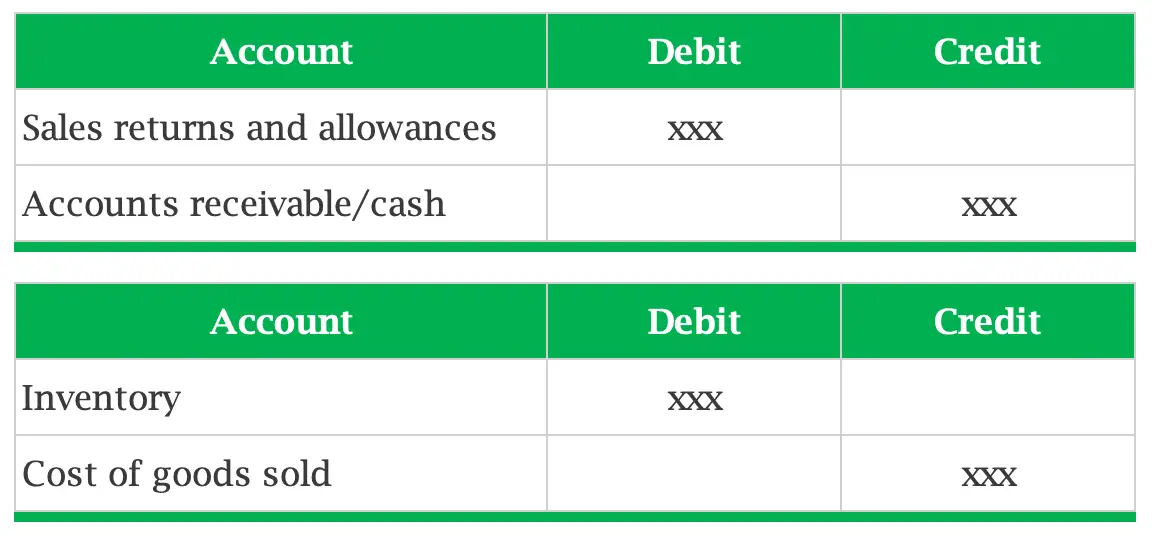

Accounting For Sales Return Journal Entry Example Accountinguide

IKL333 Rebate Frame Louvre IKON Aluminium Systems Ltd

Account For Withholding Tax On Sales Invoices Manager

Account For Withholding Tax On Sales Invoices Manager

Journal Entry August 30 2015 Ramakant Maharaj Dakshina

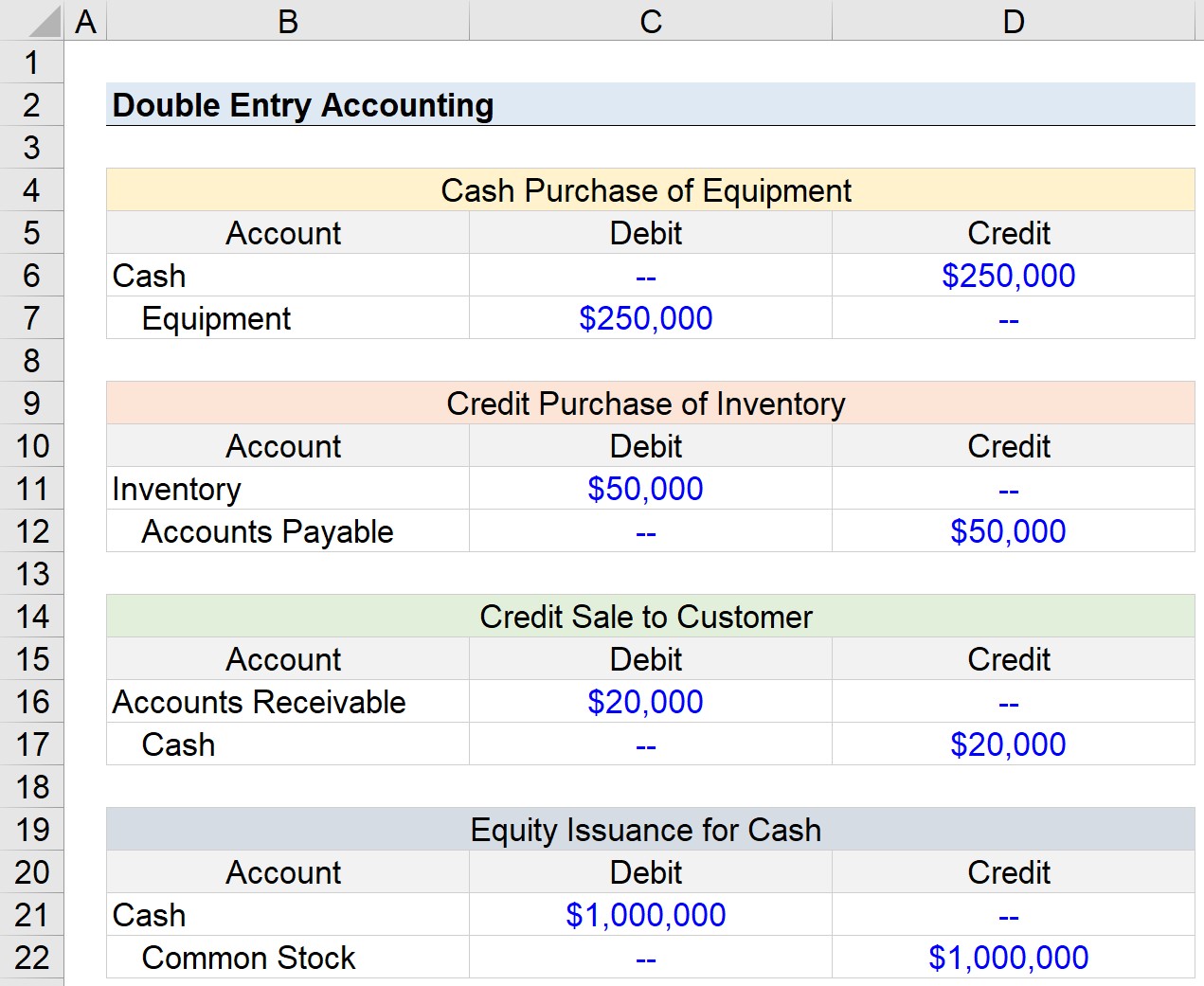

What Is Double Entry Bookkeeping Debit Vs Credit System

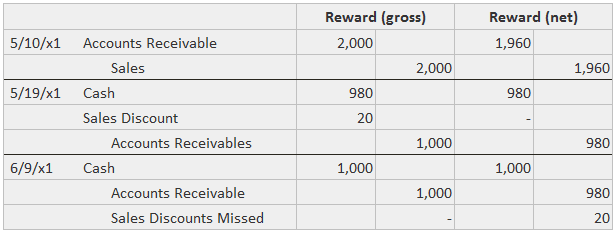

Treatment Of Cash Discounts Explanation Journal Entry And Examples

Rebate Receivable Journal Entry - An under accrual occurs when the estimated amount of a rebate accrual journal entry falls short Consequently an under accrual of a rebate boosts profit for the recording period whereas an under accrual of rebate revenue