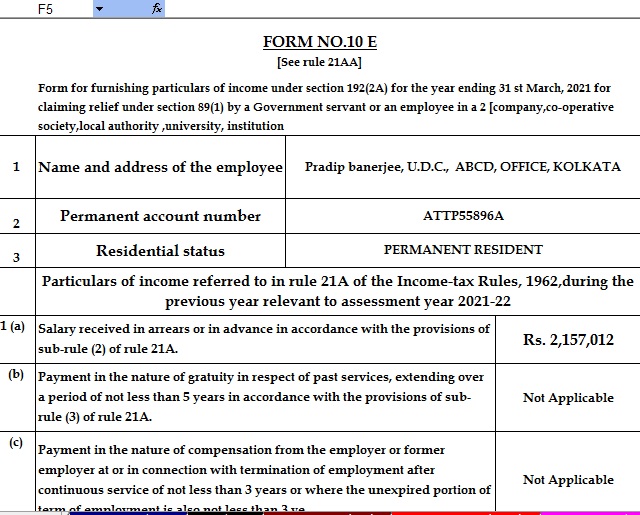

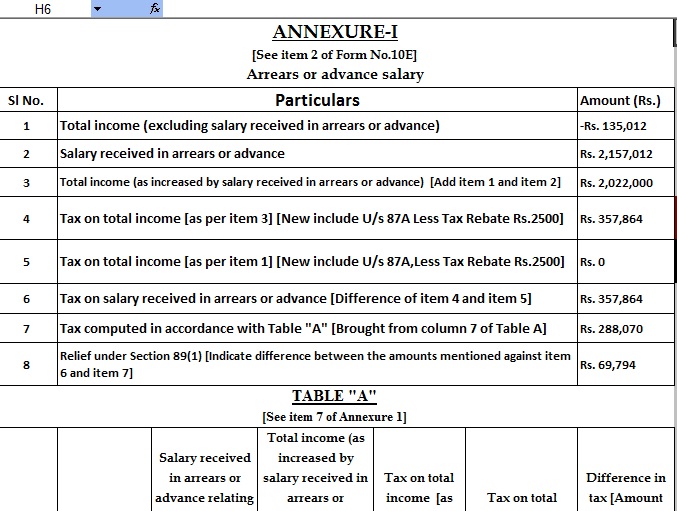

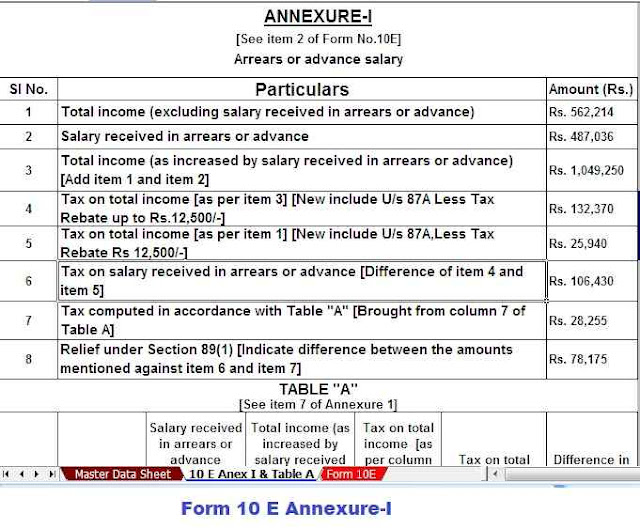

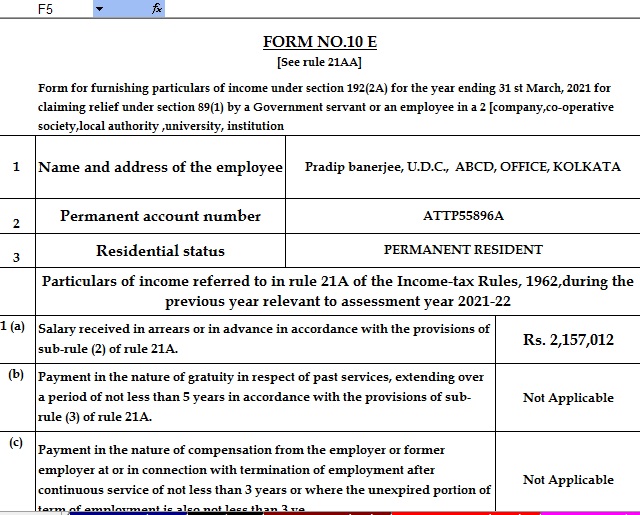

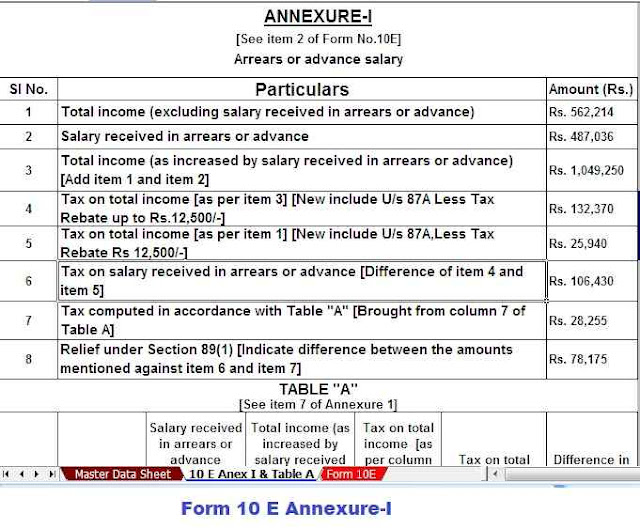

Rebate U S 89 Income Tax Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous Web 11 mai 2023 nbsp 0183 32 The income tax department allows tax relief u s 89 of the Income Tax Act to save the taxpayer from the additional tax burden Thus the employer will calculate relief u s 89 and report in Form 16 The

Rebate U S 89 Income Tax

Rebate U S 89 Income Tax

https://4.bp.blogspot.com/-EOL2jGqAQKY/WmXD8hZl14I/AAAAAAAADe8/58IR8RHU32YfNfk94vMgBJraNfBEovoSwCLcBGAs/s1600/89.gif

Income Tax Arrears Relief Calculator U s 89 1

https://1.bp.blogspot.com/-CUOeUQ2PcCI/XrgE24ehJLI/AAAAAAAAM9Q/kY90MOXKZQAkGf2nEh3APPKmSp1Ld0E5gCNcBGAsYHQ/s1600/3.jpg

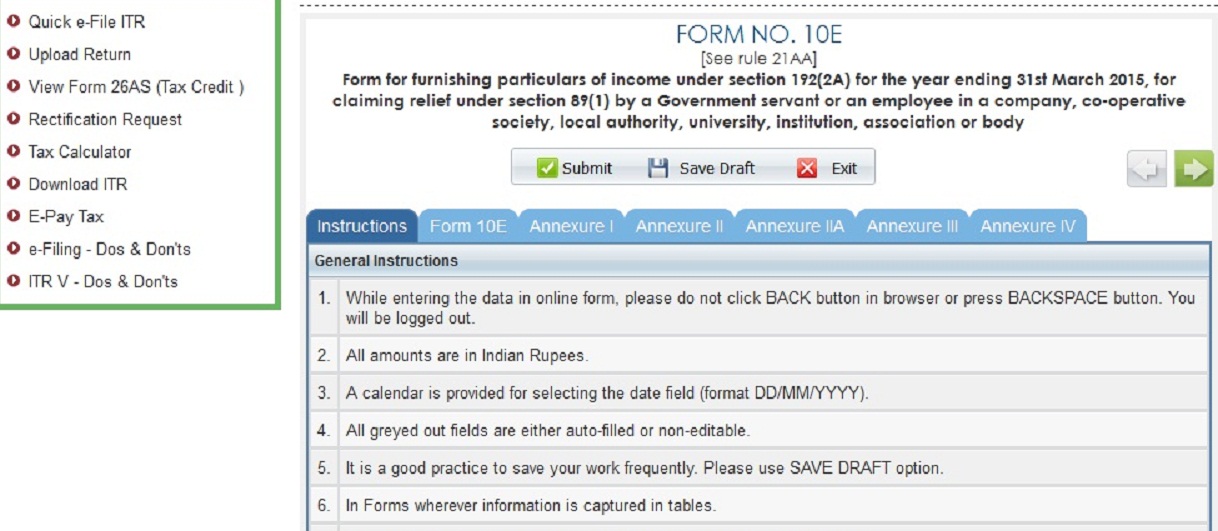

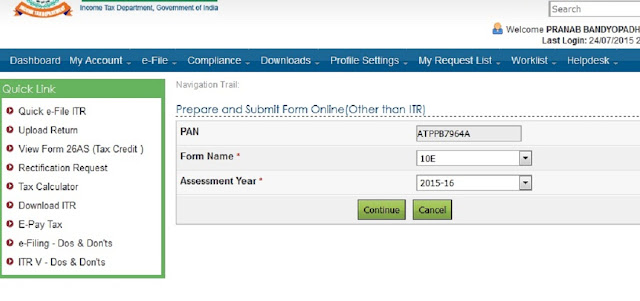

Now It Is Compulsory To Upload Form 10E For Claim Relief U s 89 1 To

https://3.bp.blogspot.com/-VUGVEtBq7no/VhZ6S0o3RDI/AAAAAAAAAiA/GM4Igc-S6Zc/s1600/2-2.jpg

Web 28 mai 2012 nbsp 0183 32 If an individual receives any portion of his salary in arrears or in advance or receives profit in lieu of salary or has received salary in any financial year for more than Web It has to be filed online at the e filing portal of the income tax department As per Section 89 1 tax relief is provided by recalculating tax for the year in which arrears are received and the year to which the arrears pertain

Web 1 oct 2021 nbsp 0183 32 When tax relief u s 89 is claimed one need to file form 10e in order to claim tax relief on arrears salary discuss on our next video Topic covered in this video Web 8 mai 2023 nbsp 0183 32 Taxpayers who have claimed relief under Section 89 1 but have not filed form 10E have received an income tax notice from the Tax Department stating that The

Download Rebate U S 89 Income Tax

More picture related to Rebate U S 89 Income Tax

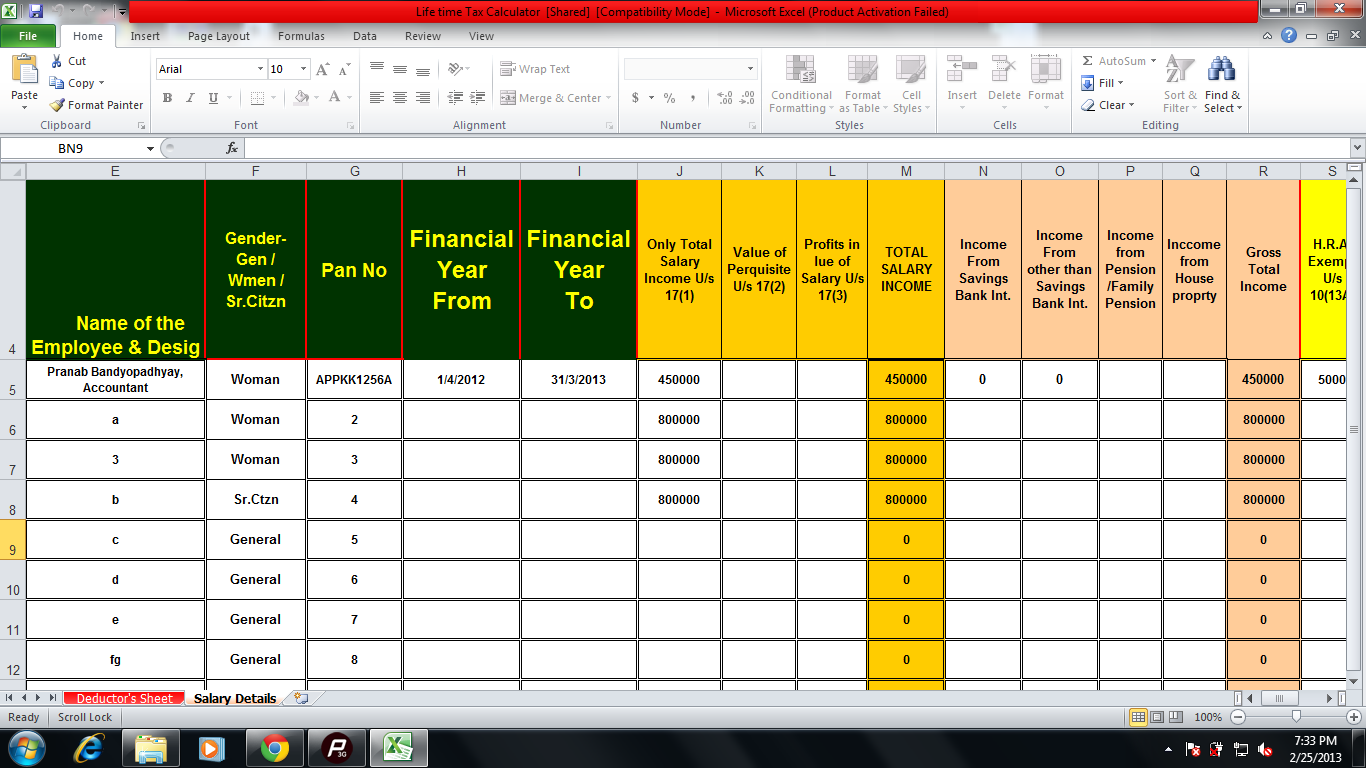

Relief Under Section 89 1 For Arrears Of Salary With Automated Income

https://1.bp.blogspot.com/-tZFrTAS5gvo/XhUd-5p6j3I/AAAAAAAALfQ/Bb1lpmHCvMk08MD2EPLY5qHVFx-Gt0TlgCNcBGAsYHQ/s1600/Picture%2B5%2Bof%2BArrears%2BRelief%2BCalculator%2B%2B19-20.jpg

Download Auto Calculate Income Tax Arrears Relief Calculator U s 89 1

https://1.bp.blogspot.com/-Ipsw29iUnkc/XuXc-jYh0sI/AAAAAAAANdM/-Y63uNNLCDYYME4lvkjYUc1f27RxYOyjgCNcBGAsYHQ/s1600/2.jpg

Income Tax Relief Under Section 89 1 Read With Rule 21A With

https://1.bp.blogspot.com/-NfC7vVdLCss/WfQvjk7wqdI/AAAAAAAAFtA/l58RcloHSosIKsLbvc_gpycm49-JzfVNgCLcBGAs/w1200-h630-p-k-no-nu/Arrears%2BRelief%2BPage%2B1.jpg

Web 15 oct 2022 nbsp 0183 32 As per section 89 1 of the Income Tax Act 1961 relief for income tax has been provided when in a financial year an employee receives salary in arrears or Web 27 f 233 vr 2020 nbsp 0183 32 As per the Income Tax Act 1961 the Income Tax Section 89 1 a taxpayer can receive relief of salary relevant to the previous year s earning Section 89 1 is

Web 1 oct 2020 nbsp 0183 32 In case you receive your salary or pension in arrears you can claim relief under section 89 1 on the excess tax you pay in the year of receipt The relief is more more Income Tax Web To save you from any additional tax burden due to delay in receiving income the tax laws allow a relief under section 89 1 In simple words you do not pay more taxes if there

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

https://www.caclubindia.com/editor_upload/671907_20211129141713_form_10_e_annexure_i.jpg

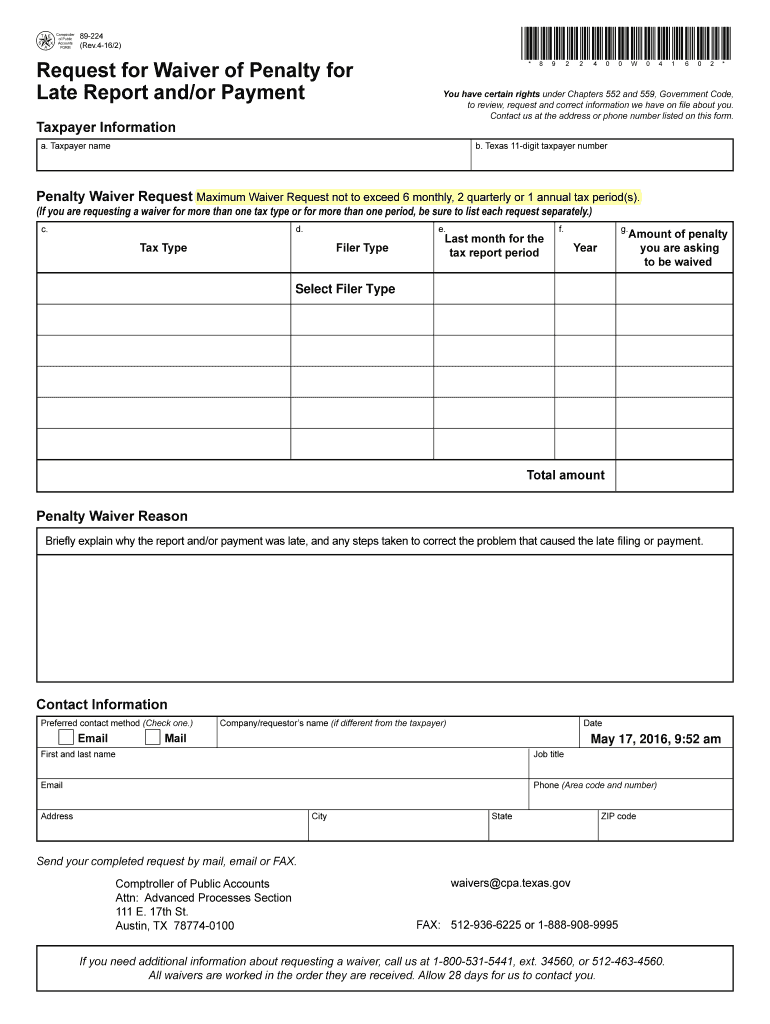

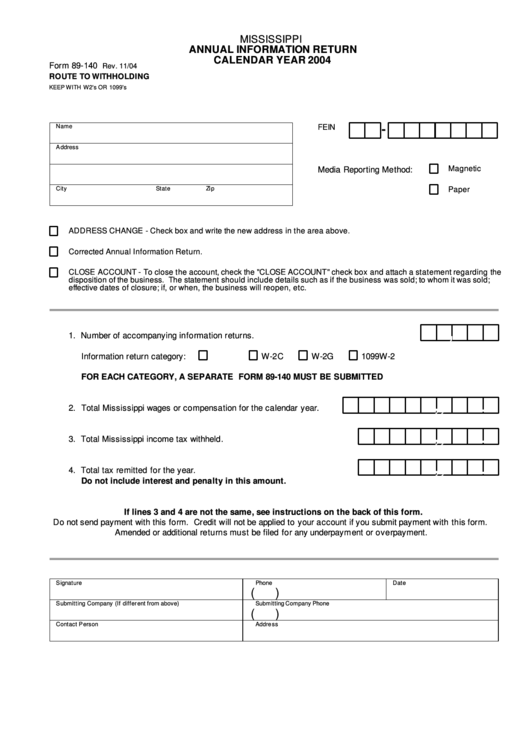

Form 89 224 Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/378/489/378489801/large.png

https://incometaxindia.gov.in/Pages/tools/relief-under-section-89.aspx

Web Description Amount in Rs Salary received in arrear Rule 21A 2 Enter details Gratuity received for past services extending a period of not less than 5 years but less than

https://maxutils.com/income/calculate-tax-relief-us89

Web Any one who has received arrears of salary allowances pension and likes to avail tax relief u s 89 1 i e treating the amount of arrears for taxability to the period of previous

Form 10E Claim Income Tax Relief Under Section 89 1 Tax2win

Automated Income Tax Arrears Relief Calculator U s 89 1 With Form 10E

Calculate Your Income Tax Relief U s 89 1 For A Y 2012 13 Absolutely

How To E filing For Upload 10E Form For Claim Relief U s 89 1 To The

Form 89 140 Annual Information Return 2004 Printable Pdf Download

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Form 10E Is Mandatory To Claim Section 89 Relief SAP Blogs

Income Tax Relief Indian Income Tax Relief U S 89

Procedure To Claim Relief U s 89 1 Or How To Upload 10E Form

Rebate Relief Section 87A Section 89 1 Income Tax

Rebate U S 89 Income Tax - Web 8 mai 2023 nbsp 0183 32 Taxpayers who have claimed relief under Section 89 1 but have not filed form 10E have received an income tax notice from the Tax Department stating that The