Rebate Under 87a For Ay 2024 25 Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

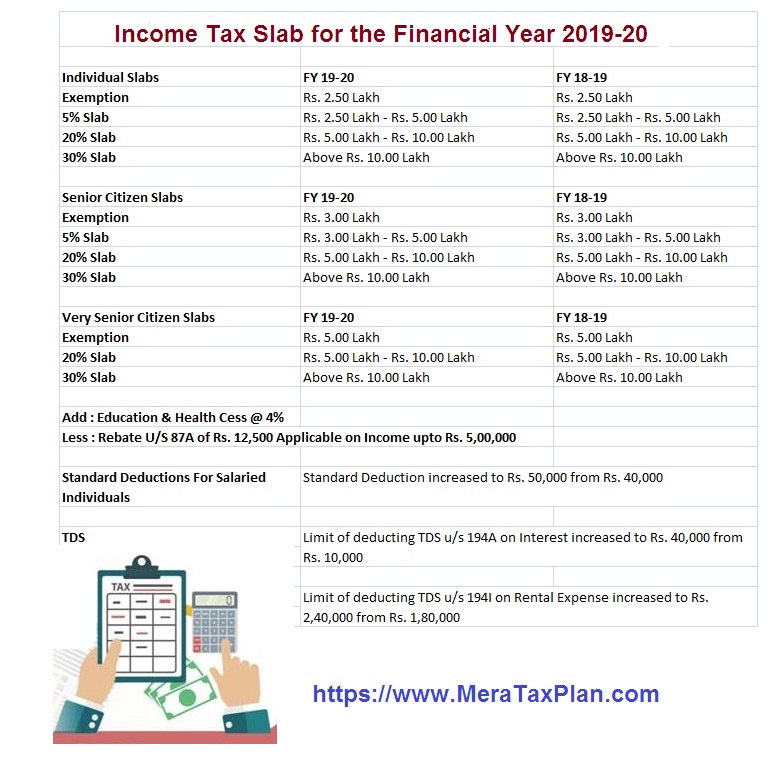

This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident HUF Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in the Financial Y Key Takeaways Senior citizens can claim a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 the rebate u s 87A remains unchanged at Rs 12 500

Rebate Under 87a For Ay 2024 25

Rebate Under 87a For Ay 2024 25

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg?is-pending-load=1

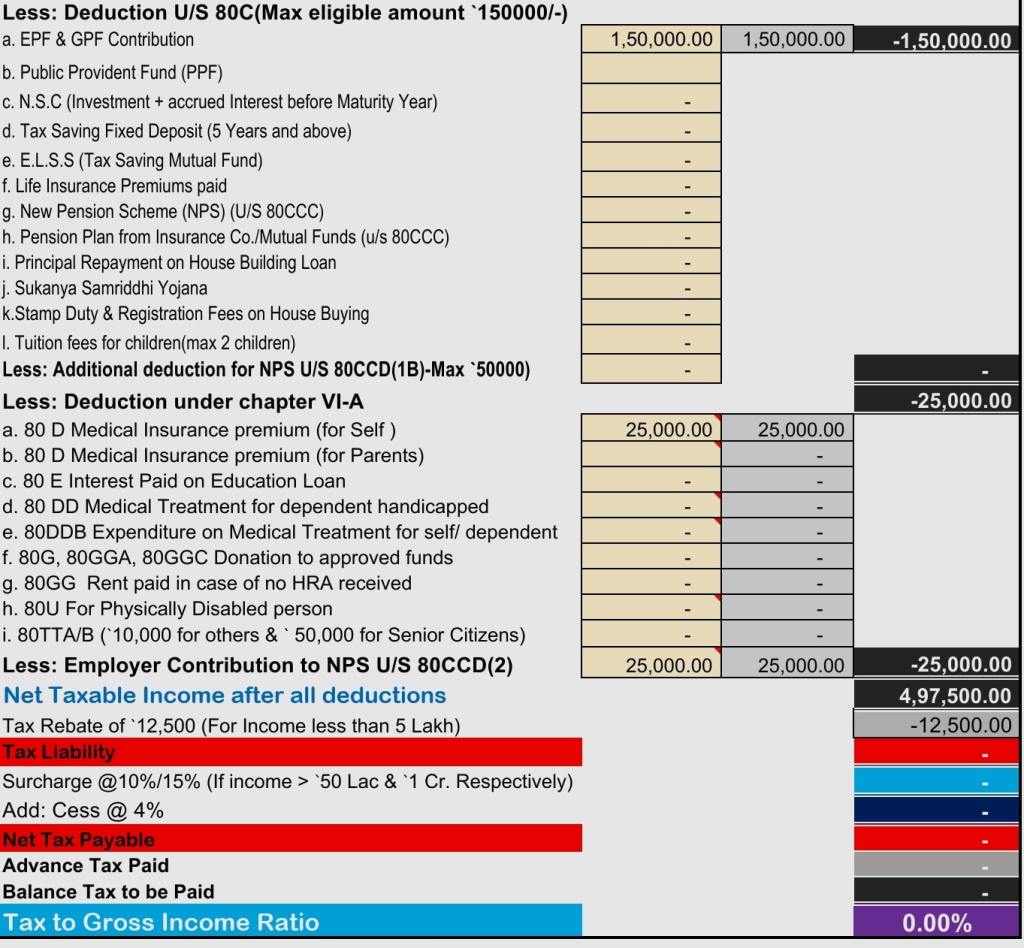

New Income Tax Slab And Tax Rebate Credit Under Section 87A With Automated Income Tax Revised

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://i0.wp.com/arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rebate-US-87A-for-AY-2024-25-FY-2023-24-1-1.png?resize=1024%2C576&ssl=1

The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000 AY 2024 25 of an individual or Hindu undivided family or association of persons other than a co operative society or body of individuals whether incorporated or not or an Rebate under section 87A From assessment year 2024 25 onwards an assessee being an individual resident in India whose income is chargeable to tax under sub

35 778 Views 10 comments Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the previous year does not exceed Rs 5 00 000 Income Tax Rebate under section 87A of Income Tax Act 1961 provides a rebate from income tax up to Rs 12500 to an individual resident assessee whose total income taxable income does not exceed Rs five lakhs

Download Rebate Under 87a For Ay 2024 25

More picture related to Rebate Under 87a For Ay 2024 25

Examples Of Rebate U s 87A For A Y 2020 21 And A Y 2019 20 Fully Explained YouTube

https://i.ytimg.com/vi/R8TJaxFoAE8/maxresdefault.jpg

Tax Rebate Under Section 87A In Old New Tax Regime FinCalC

https://fincalc-blog.in/wp-content/uploads/2023/02/tax-rebate-under-section-87A.webp

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/Screenshot_20230524_084225_Microsoft-365-Office.jpg

Rebate under section 87A of the Income Tax Act helps taxpayers to reduce their tax liability Resident individuals with a net taxable income less than or equal to INR 5 00 000 can claim a tax rebate of a maximum of INR 12 500 or the amount of tax payable whichever is lower under both tax regimes Who is eligible for tax rebate under Section 87A The rebate under Section 87A is available to only resident individuals Taxpayers such as non resident individuals NRIs Hindu Undivided Family HUF and firms are not eligible for the rebate under Section 87A Rebate u s 87A for FY 2022 23 AY 2023 24

To provide tax relief to individual taxpayers in the 5 tax slab section 87A provides a tax rebate from the total tax liability of an assessee a resident individual in India whose total income is not more than 5 00 000 Income u s 111A 112 112A etc shall be taxable special rates New Tax rates are default and optional Rebate under Section 87A If TTI Rs 7 lacs in the PFY rebate u s 87A Rs 25 000 or tax liability whichever is less before summing up cess and surcharge Cess Health Education Cess 4 is to be added on tax and surcharge Surcharge Surcharge is applicable to tax liability

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/05/SmartSelect_20230524_092110_Microsoft-365-Office-1024x654.jpg

https://caclub.in/income-tax-rebate-u-s-87a-individuals/

Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for resident individuals with taxable income up to Rs 500 000 under the existing tax regime

https://taxguru.in/income-tax/income-tax-rates-fy-2023-24-ay-2024-25.html

This article summarizes Income Tax Rates Surcharge Health Education Cess Special rates and rebate relief applicable to various categories of Persons viz Individuals Resident Non Resident HUF Firms LLP Companies Co operative Society Local Authority AOP BOI artificial juridical persons for income liable to tax in the Financial Y

Rebate Under 87A Income Tax Act 1961 Ay 2021 2022 YouTube

Tax Rebate Under Section 87A A Detailed Guide On 87A Rebate

Income Tax Rebate Under U s 87a And Sec 89 Relief Of Income Tax Act For AY 2020 21 YouTube

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

Rebate Under Section 87A AY 2021 22 Old New Tax Regimes

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Union Budget 2023 24 Finance Bill 2023 Rates Of Income Tax Rates Of TDS On Salaries And

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24 June 2023 Dec 2023 Exam

Income Tax Rebate U s 87A For The Financial Year 2022 23

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

Rebate Under 87a For Ay 2024 25 - The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a tax rebate of Rs 25 000