Property Tax Rebate Kansas Web The property tax relief claim K 40PT is for homeowners that were 65 years of age or older with a household income of 22 000 or less and a resident of Kansas all of 2022

Web SAFESR claimants with a 2021 general property tax of 936 or more will receive a SAFESR refund in excess of 700 936 X 75 702 Thus those eligible for a Web The property tax relief claim K 40PT is for homeowners that were 65 years of age or older with a household income of 22 000 or less and a resident of Kansas all of

Property Tax Rebate Kansas

Property Tax Rebate Kansas

https://printablerebateform.net/wp-content/uploads/2023/03/Kansas-Tax-Rebate-2023-768x672.png

Wyandotte Offering Seniors Assistance With Tax Rebate Programs The

https://i0.wp.com/www.communityvoiceks.com/wp-content/uploads/2022/12/010623-senior-tax-rebate.png?fit=1200%2C800&ssl=1

KCK Man Misses Out On 50K Tax Rebate Program

https://ewscripps.brightspotcdn.com/dims4/default/b95c17c/2147483647/strip/true/crop/1165x655+0+0/resize/1280x720!/quality/90/?url=https:%2F%2Fewscripps.brightspotcdn.com%2F74%2Fdd%2F2cc5a9e248799fdb4d37890c6818%2Fkckhomeownersqueezer.jpg

Web The Property Tax Relief claim K 40PT allows a refund of property tax for low income senior citizens that own their home The refund is 75 of the property taxes actually Web Qualifications for Property Tax Relief for Low Income Seniors K 40PT Must be a Kansas resident the entire tax year Home owner during the tax year Age 65 or older for the

Web property tax relief act that provides residential property tax refunds providing for an expiration of the selective assistance for effective senior relief credit and homestead Web HOMESTEAD REFUND CLAIM Homestead claims K 40H Property Tax Relief claims K 40PT NEW Property Tax Relief claims for seniors and disabled veterans K 40SVR

Download Property Tax Rebate Kansas

More picture related to Property Tax Rebate Kansas

Hecht Group How To Pay Your Kansas Property Taxes Online

https://img.hechtgroup.com/1662909487018.Document

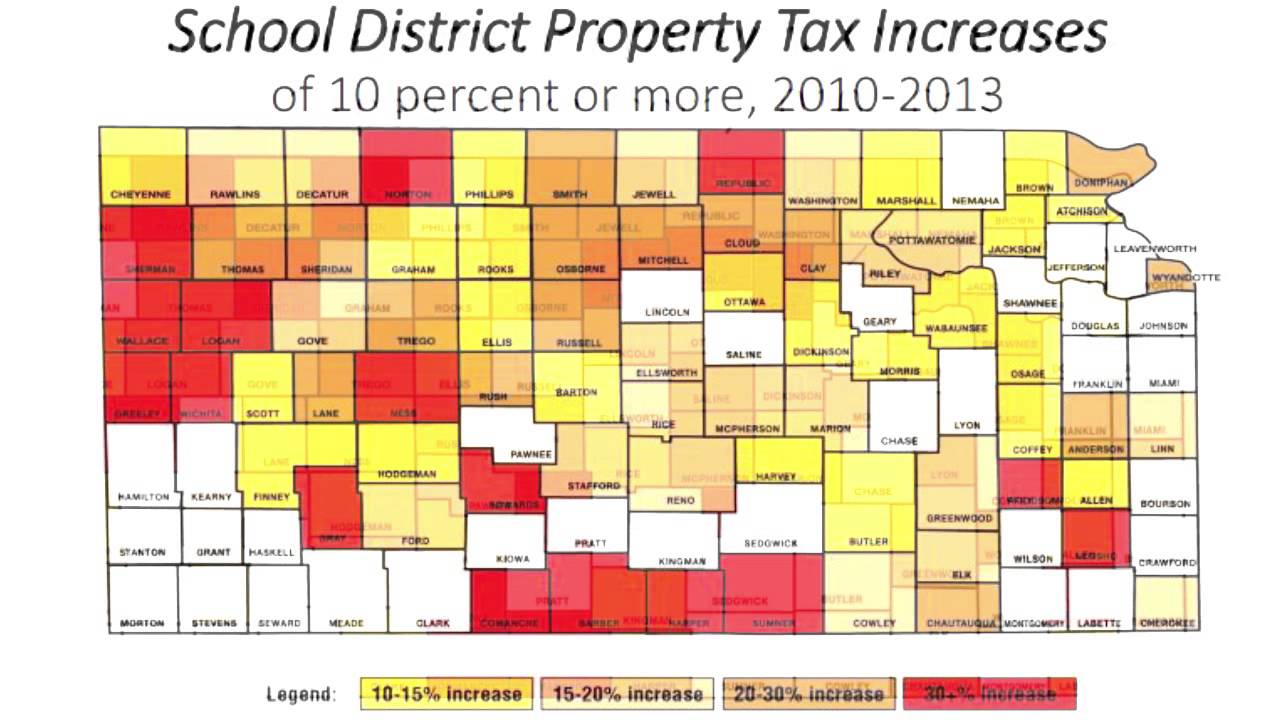

Kansas Property Taxes Have Gone Up 300 Million In Three Years YouTube

https://i.ytimg.com/vi/DJyAEUCs0Ic/maxresdefault.jpg

Kansas Democrats Float Proposal To Lower Property Taxes By Reviving

https://kansasreflector.com/wp-content/uploads/2022/09/P9263142-1-1024x768.jpg

Web How to Claim Your Refund A Homestead SAFESR or SVR property tax refund claim must be completed and filed with the Kansas Department of Revenue each year between Web 25 avr 2023 nbsp 0183 32 Apr 25 2023 Governor Kelly Calls for 450 Tax Rebate to Kansas Resident Taxpayers Here s What They re Saying TOPEKA Governor Kelly announced

Web 14 avr 2022 nbsp 0183 32 Homeowner property tax relief highlights 310 million tax cut law signed by Kansas governor Jason Alatidd Topeka Capital Journal Gov Laura Kelly on Thursday Web 1 janv 2010 nbsp 0183 32 As a Kansas resident for all of 2010 you are eligible for a refund of up to 700 if your total quot household income quot is 30 800 or less AND you were born before

How To Get Property Tax Rebate PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

Tax Rebate On Rental Property PropertyRebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/form-pa-1000-download-fillable-pdf-or-fill-online-property-tax-or-rent-9.png?fit=950%2C1222&ssl=1

https://ksrevenue.gov/homesteadbook22.html

Web The property tax relief claim K 40PT is for homeowners that were 65 years of age or older with a household income of 22 000 or less and a resident of Kansas all of 2022

https://www.ksrevenue.gov/safesenior.html

Web SAFESR claimants with a 2021 general property tax of 936 or more will receive a SAFESR refund in excess of 700 936 X 75 702 Thus those eligible for a

Proposal To Update Ailing PA Rent Property Tax Rebate Program Would

How To Get Property Tax Rebate PropertyRebate

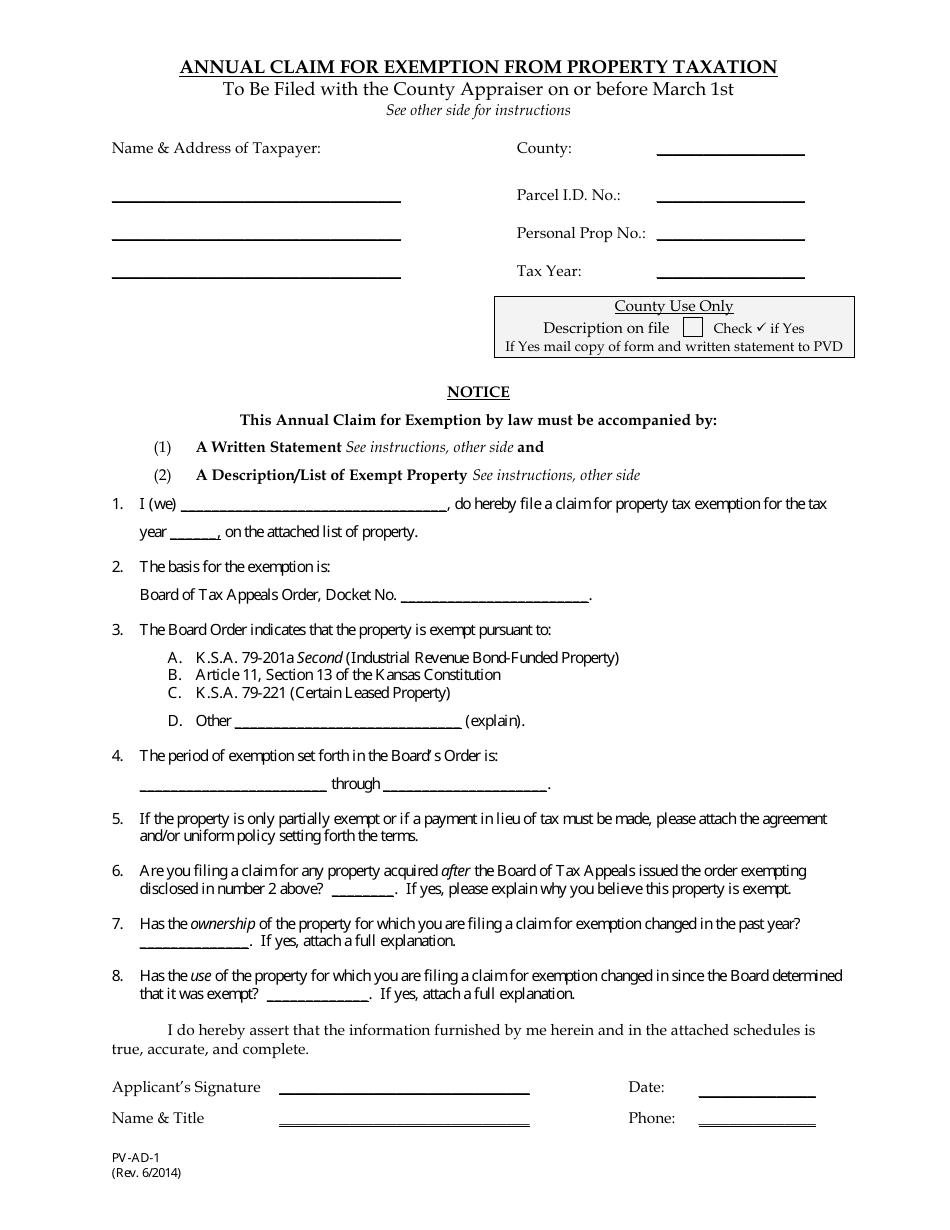

Form PV AD 1 Download Printable PDF Or Fill Online Annual Claim For

Ky Tangible Property Tax Return 2021 Fill Online Printable Fillable

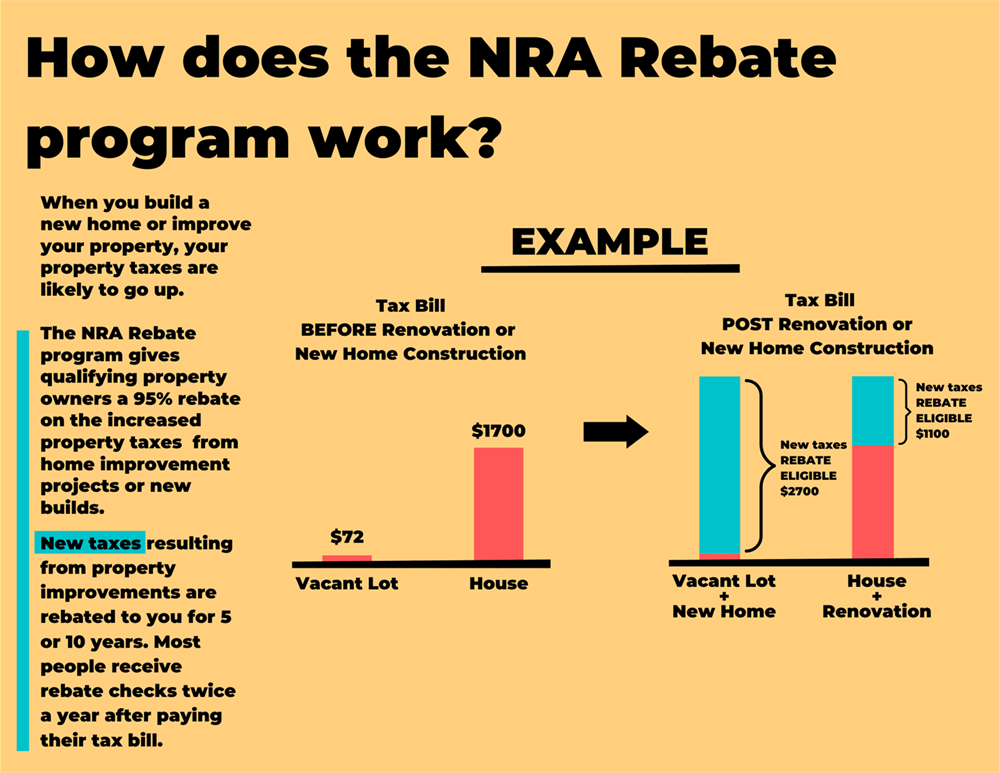

Incentives Unified Government Of Wyandotte County And Kansas City

Gov Kelly Proposes One time Income Tax Rebates Of 250 To Kansas

Gov Kelly Proposes One time Income Tax Rebates Of 250 To Kansas

Nagpur Civic Body Announces 5 Percent Rebate On Property Tax

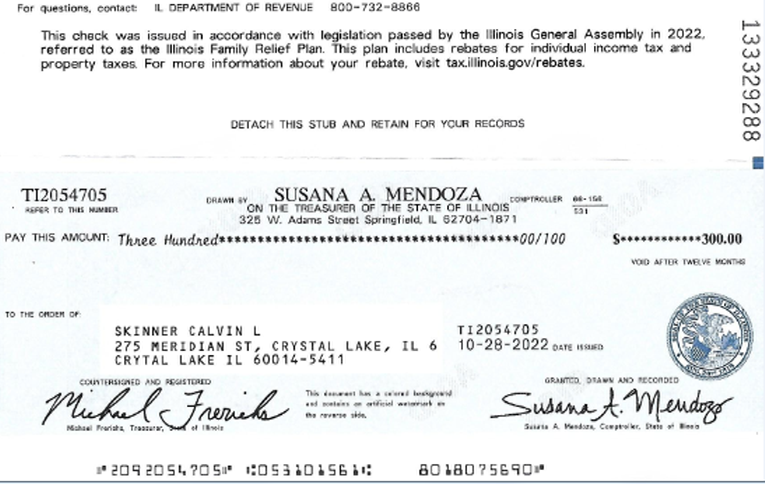

300 Check Allegedly A Real Estate Tax Rebate Arrives Eight Days

Chesterfield County Leaders Approve Next Year s Budget And Real Estate

Property Tax Rebate Kansas - Web HOMESTEAD REFUND CLAIM Homestead claims K 40H Property Tax Relief claims K 40PT NEW Property Tax Relief claims for seniors and disabled veterans K 40SVR