Super Contributions Tax Rebate For Low Income Earners Web If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO

Web Eligibility for low income super tax offset You may be eligible for a low income super tax offset if all of the following apply to you your adjusted taxable income ATI was less Web Unlike the Division 293 tax which reduces the net tax benefit achieved by higher income earners for contributing to super the Low Income Super Tax Offset provides an

Super Contributions Tax Rebate For Low Income Earners

Super Contributions Tax Rebate For Low Income Earners

https://i.ytimg.com/vi/G-TA38Ikrhk/maxresdefault.jpg

Council Tax Rebates For Low Income Earners Lowesrebate

https://i0.wp.com/www.lowesrebate.net/wp-content/uploads/2022/08/council-tax-rebates-for-low-income-earners-1024x768.jpg?resize=980%2C735&ssl=1

Fair Go For Low Income Earners

https://cdn.magzter.com/1417508370/1682467254/articles/pe1JyJsoG1682511224867/FAIR-GO-FOR-LOW-INCOME-EARNERS.jpg

Web 22 lignes nbsp 0183 32 From 1 July 2017 the government introduced the low income super tax offset LISTO to assist low income earners to save for their retirement If you earn an Web If you re eligible for a low income super tax offset the government will automatically refund the tax you paid on any before tax contributions like salary sacrifice and employer

Web 13 juin 2023 nbsp 0183 32 That means if you earn under the lower threshold of 42 016 you ll need to add 1 000 of your own money to your super to get the maximum 500 co contribution from the government That entitlement Web The government will pay 15 of the before tax contributions made into your super account back into your super up to a maximum of 500 per financial year If you re

Download Super Contributions Tax Rebate For Low Income Earners

More picture related to Super Contributions Tax Rebate For Low Income Earners

WalletHub Tax Burdens For Low income Earners In Each State

https://s.hdnux.com/photos/01/00/74/56/17025976/5/1200x0.jpg

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Maximum Super Contribution Base Ento

https://ento.com/wp-content/uploads/2016/12/super.png

Web 24 ao 251 t 2023 nbsp 0183 32 If you have a low income the government might help you grow your super There are limits on the amount you can put into your super known as contribution caps Web 12 nov 2021 nbsp 0183 32 The low income super tax offset will pay up to 500 a year into your chosen super fund provided you meet certain eligibility criteria They include that you must earn 37 000 or less in a financial year and

Web If you are a low income earner earning less than 37 000 a year then you should be entitled to the Low Income Super Tax Offset LISTO The LITSO basically provides Web If you earn 37 000 or less the tax is paid back into your super account through the low income super tax offset LISTO If your income and super contributions combined

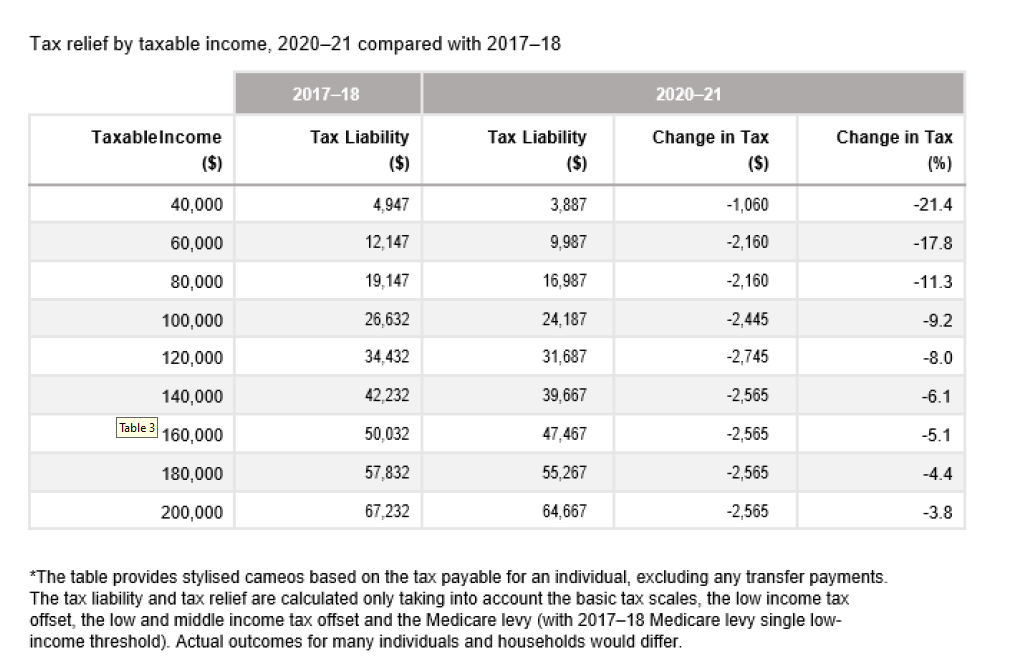

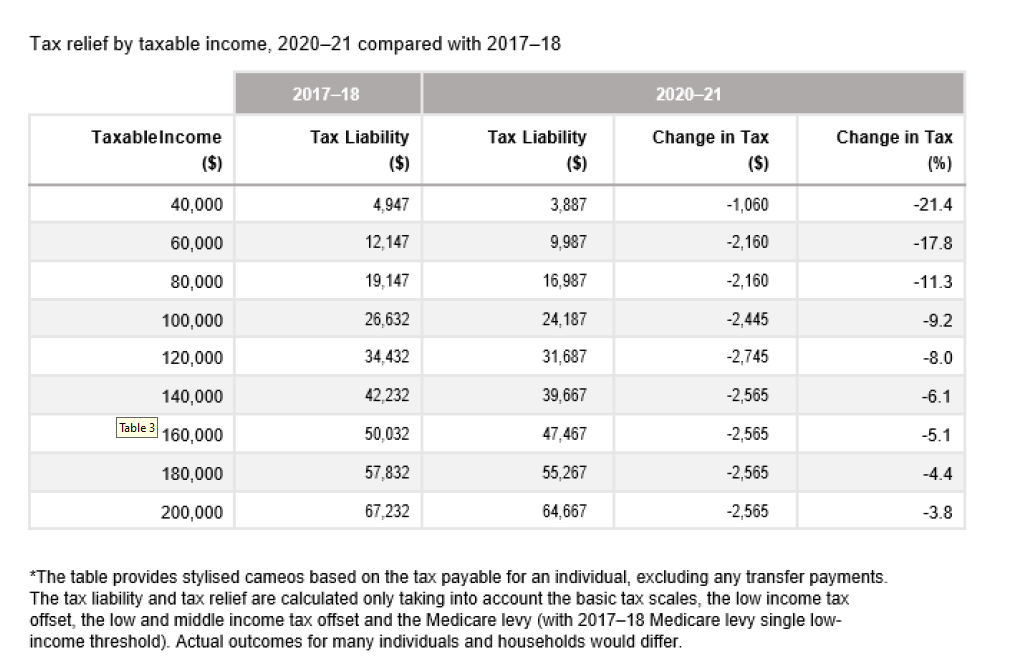

Budget 2020 Individuals Tax Accounting Adelaide

https://www.taxaccountingadelaide.com/wp-content/uploads/2020/10/00.png

How To Claim Super Contributions On Tax Returns SMB Accounting

https://www.smbaccounting.com.au/wp-content/uploads/2022/01/How-to-claim-Super-Contributions.png

https://www.ato.gov.au/.../Low-income-super-tax-offset

Web If you earn up to 37 000 a year you may be eligible to receive a low income super tax offset LISTO payment of up to 500 You don t need to do anything to receive a LISTO

https://www.ato.gov.au/.../2022/In-detail/Government-super-contributions

Web Eligibility for low income super tax offset You may be eligible for a low income super tax offset if all of the following apply to you your adjusted taxable income ATI was less

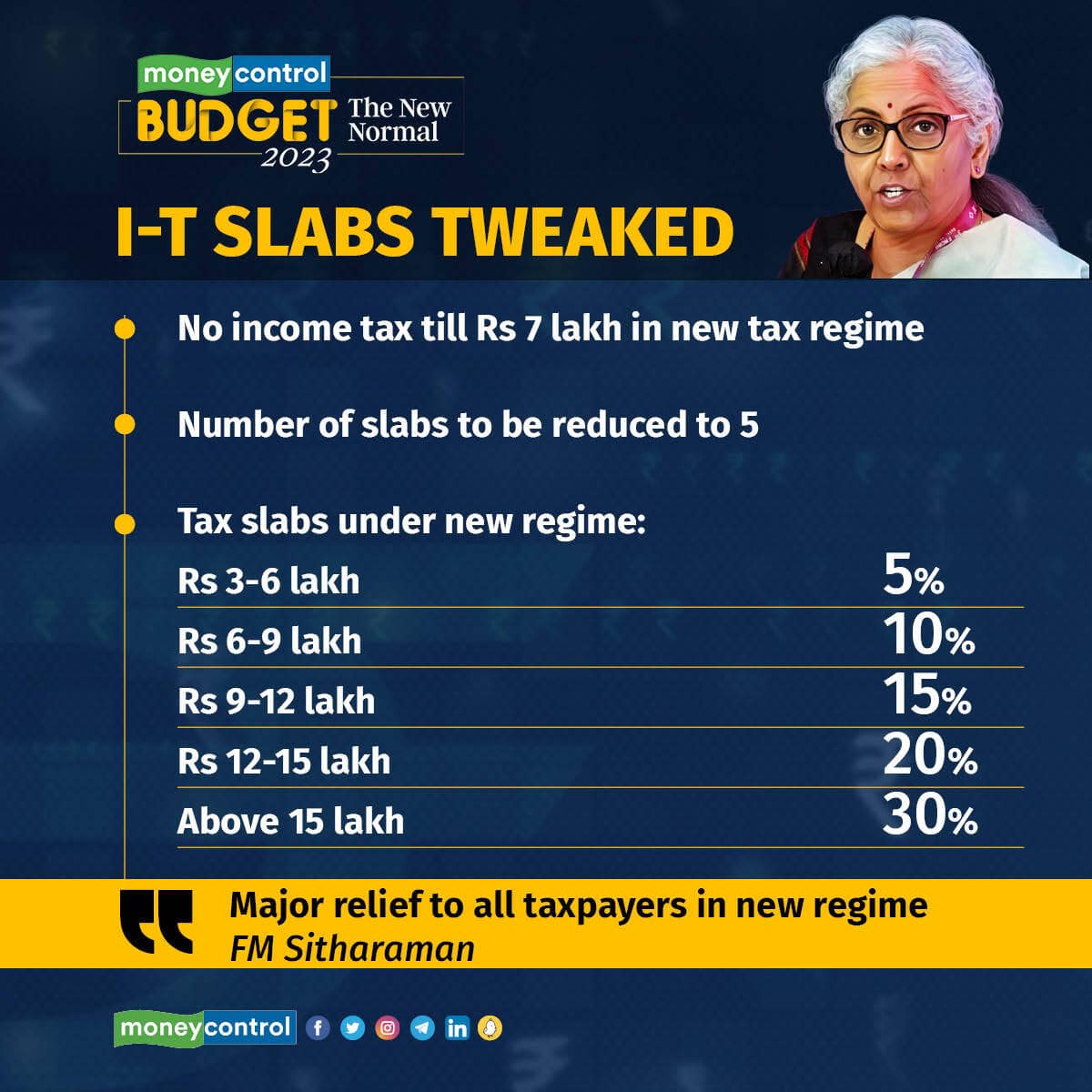

New Slabs More Rebate 5 Big Personal Income Tax Changes In Budget 2023

Budget 2020 Individuals Tax Accounting Adelaide

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

DiZoglio Criticizes State Tax Rebate Plan Because It Leaves Out Lowest

Is My Super Contribution Tax Deductible Section 290

Georgia Income Tax Rebate 2023 Printable Rebate Form

Georgia Income Tax Rebate 2023 Printable Rebate Form

After Tax Super Contributions How Much Can I Contribute

Super Contributions Tax Needs Rethink

DPM News Updates

Super Contributions Tax Rebate For Low Income Earners - Web The super co contribution scheme is an incentive for low or middle income earners to make voluntary post tax contributions to their superannuation to better financially