Rebate Under Section 87a For Fy 2023 23 Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

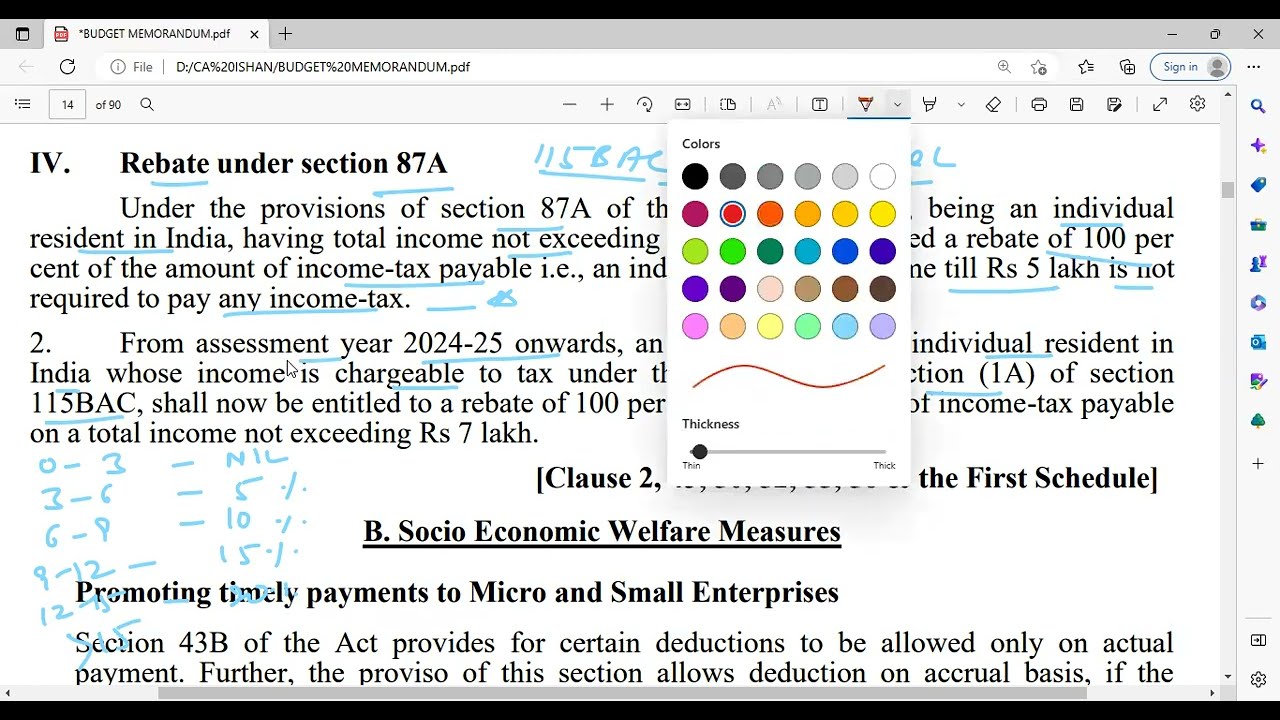

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an For the FY 2023 24 AY 2024 25 the rebate limit has been increased to Rs 7 00 000 under the new tax regime This means a resident individual with taxable

Rebate Under Section 87a For Fy 2023 23

Rebate Under Section 87a For Fy 2023 23

https://i.ytimg.com/vi/TYfP6LlV2QU/maxresdefault.jpg

BUDGET 2023 REBATE UNDER SECTION 87A NO TAX UPTO 7 LACS YouTube

https://i.ytimg.com/vi/N4MrLTq6axg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYACqgWKAgwIABABGGUgZShlMA8=&rs=AOn4CLDlZ2rIzaqaMuq5f6cG4o4ekWkZ3Q

Rebate Under Sec 87A On Basic Income Tax PY 2022 23 AY 2023 24

https://i.ytimg.com/vi/iBVPuOeMqvo/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGMgYyhjMA8=&rs=AOn4CLAkxwuVfXRiwLFdgZ5yJ77kkzr3_g

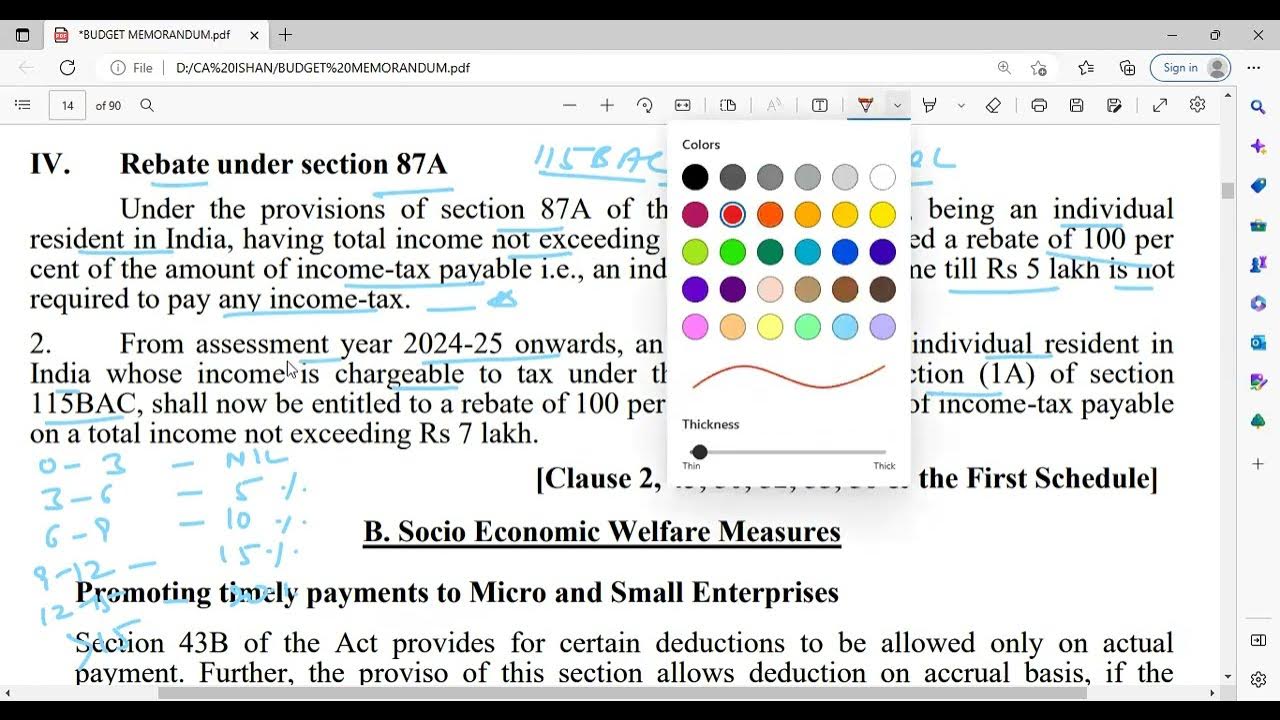

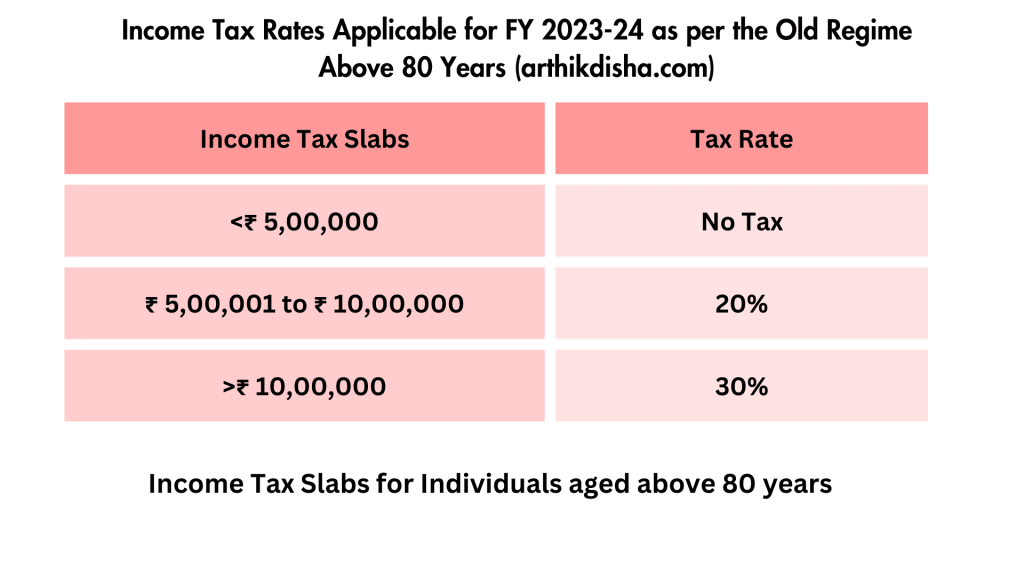

For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 the rebate u s 87A remains unchanged at Rs 12 500 In the FY 2023 24 AY 2024 25 senior citizens with Section 87A of the Income Tax Act 1961 provides for a 100 tax rebate if the income tax liability is up to Rs 12 500 in respect of AY 2023 24 and onwards for

Budget 2023 announced that individuals will not have to pay any tax if the taxable income does not exceed Rs 7 lakh in a financial year The maximum limit of rebate available under section 87A of the Income You can claim a maximum rebate of up to 12 500 under Section 87A of the Income Tax Act for the financial year 2022 23 The maximum amount of the 87A rebate has been

Download Rebate Under Section 87a For Fy 2023 23

More picture related to Rebate Under Section 87a For Fy 2023 23

Rebate Under 87a Of Income Tax For 2023 24 With Budget 2023 Changes

https://i.ytimg.com/vi/TQmyHGDz37M/maxresdefault.jpg

Income Tax Rebate U S 87A For AY 2024 25 FY 2023 24

https://arthikdisha.com/wp-content/uploads/2023/06/Income-Tax-Rates-Applicable-for-FY-2023-24-as-per-the-Old-Regime-Above-80-Years-arthikdisha.com_-1024x576.png

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-section-87a-tax-rebate-fy-2019-20-how-to-check-rebate-eligibility-from-87a-rebate-ay-2023-20-post.jpg?w=979&ssl=1

Under the new tax regime the highest surcharge rate of 37 on income above INR 5 00 00 000 has been reduced to 25 The threshold limit for total income eligible for The tax rebate limit under Section 87A has been increased from FY 2023 24 If you choose the new tax regime you will be eligible for a tax rebate of Rs 25 000

Under the new income tax regime the amount of the rebate under Section 87A for FY 2023 24 AY 2024 25 has been modified by Finance Act 2023 A resident To provide tax relief to individual taxpayers in the 5 tax slab section 87A provides a tax rebate from the total tax liability of an assessee a resident individual in

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

https://i.ytimg.com/vi/KePXPu9nUAQ/maxresdefault.jpg

Everything You Need To Know About 87a Rebate Ay 2023 20 And How To Use

https://i0.wp.com/www.freerebate.net/wp-content/uploads/2023/02/this-is-an-attachment-of-what-is-rebate-under-section-87a-for-ay-2020-21-financial-control-from-87a-rebate-ay-2023-20-post.jpg

https://taxguru.in/income-tax/marginal-relief-u …

Section 87A rebate does not allow in old regime if your income go above 5 00 000 But A New proviso inserted in section 87A by the Finance Act 2023 w e f 1 4 2024 Applicable from FY 2023 24

https://m.economictimes.com/wealth/tax/who-is...

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

Section 87A Of The Income Tax Act In 2023 Budgeting Rebates Tax

Rebate Under 87a Of Income Tax REBATE UNDER 87A OF INCOME TAX ACT FOR

Know New Rebate Under Section 87A Budget 2023

Rebate Under Section 87A

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Is Section 87A Rebate For Everyone SR Academy India

Is Section 87A Rebate For Everyone SR Academy India

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rates TDS On Salaries And Rebate Under Section 87A

Know New Rebate Under Section 87A Budget 2023 PropertyRebate

Rebate Under Section 87a For Fy 2023 23 - For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 the rebate u s 87A remains unchanged at Rs 12 500 In the FY 2023 24 AY 2024 25 senior citizens with