Rebate Under Section 87a For Senior Citizens In the FY 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 can claim a rebate of Rs 25 000 under the new tax regime The eligibility criteria for claiming

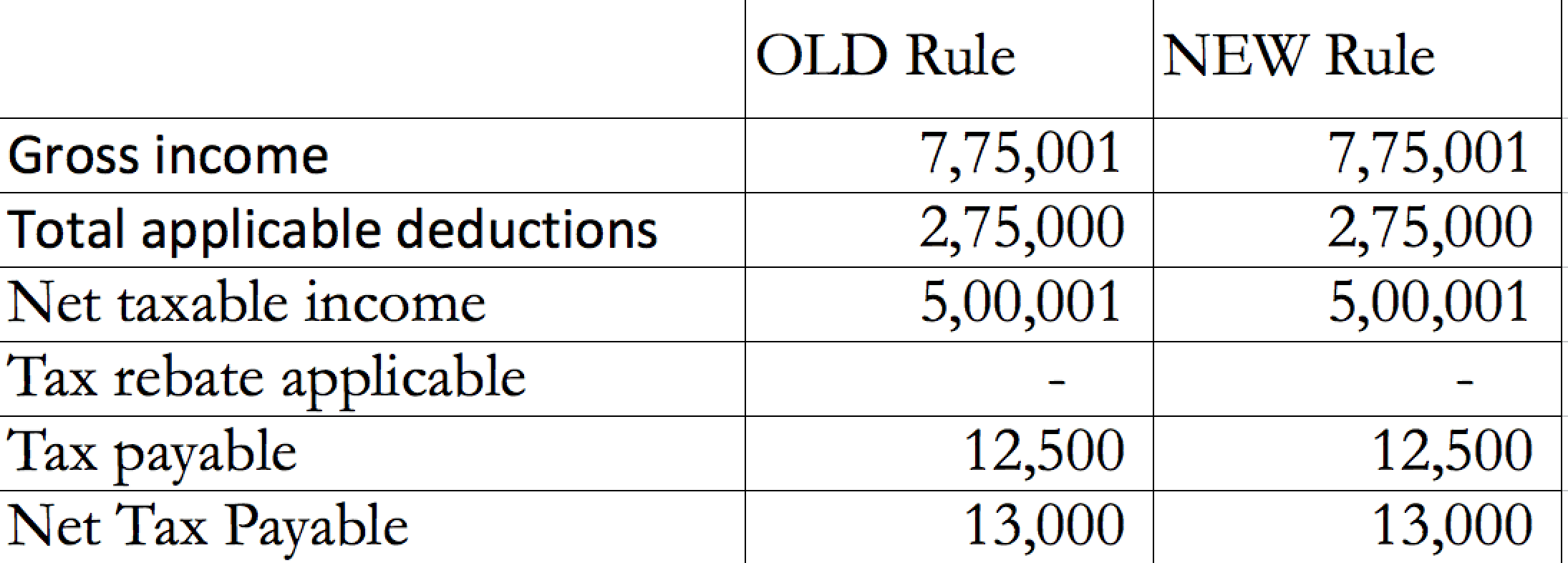

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not Rebate u s 87A Resident Individuals are also eligible for a Rebate of up to 100 of income tax subject to a maximum limit depending on tax regimes as under Total Income Old

Rebate Under Section 87a For Senior Citizens

Rebate Under Section 87a For Senior Citizens

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/87a-rebate.jpg

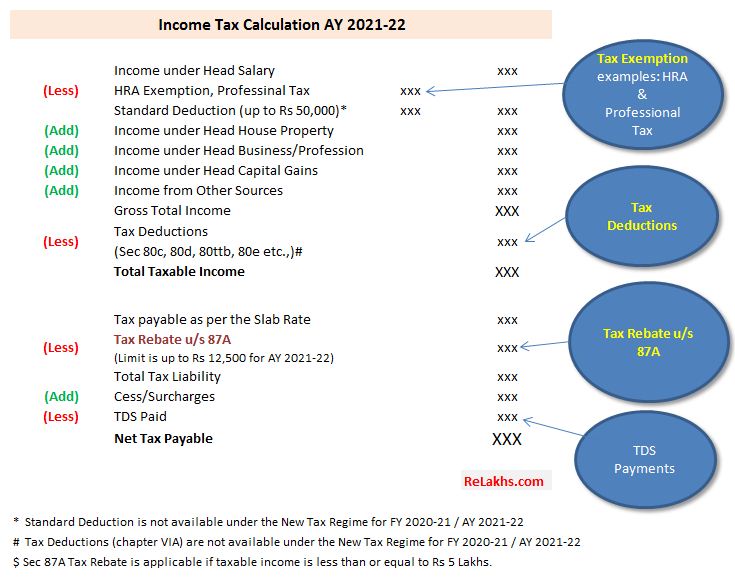

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an Senior citizens For tax liability on income other than equity fund long term gains you fully get a rebate under Section 87A

Senior citizens above 60 years and below 80 years are eligible to claim income tax rebate under section 87A Below mentioned is the way in which the calculation of taxable Here are a few examples of section 87A rebates for resident individuals including senior citizens for FY 2017 18 Total Income Rs Tax payable before cess Rs

Download Rebate Under Section 87a For Senior Citizens

More picture related to Rebate Under Section 87a For Senior Citizens

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/How-to-calculate-rebate-us-87A.jpg

Rebate Under Section 87A Of Income Tax Act Insights From StairFirst

https://stairfirst.com/blog/wp-content/uploads/2020/06/Adobe_Post_20200522_1633240.06060677195840691-1-2048x1536.png

Rebate Under Section 87A Of The Income Tax Act Fintrakk

https://blogassets.fintrakk.com/uploads/2016/05/Rebate-section-87A.jpg

The Section 87A rebate limit for AY 2023 24 is Rs 5 00 000 under the old tax regime and Rs 7 00 000 under the new tax regime making individuals eligible for the rebate if their Claiming a rebate under Section 87A provides significant tax relief to eligible individuals with an annual income up to 5 lakhs Section 87 A s rebate is a valuable provision aimed at

Notably while senior citizens aged 60 80 can seek a rebate super seniors or those above 80 are not eligible How Does One Check Net Taxable There are a few steps Is the income tax rebate under Section 87A applicable for senior citizens and super senior citizens The section 87A rebate applies to senior citizen taxpayers However resident

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

https://vakilsearch.com/advice/wp-content/uploads/2019/07/Income-tax-rebate-under-Section-87A.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

https://greatsenioryears.com/guide-rebate-u-s-87a-for-senior-citizens

In the FY 2023 24 AY 2024 25 senior citizens with taxable income up to Rs 7 00 000 can claim a rebate of Rs 25 000 under the new tax regime The eligibility criteria for claiming

https://tax2win.in/guide/section-87a

Senior citizens above 60 years and up to 80 years of age are eligible to claim rebates under Section 87A Super senior citizens above 80 years are not

Tax Rebate Under Section 87A All You Need To Know YouTube

Section 87A Income Tax Rebate Under Section 87A For FY 2019 20

Section 87A New Rebate 87A Of Income Tax In Budget 2023 Tax Save

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Rebate Of Income Tax Under Section 87A YouTube

Rebate Under Section 87A AY 2021 22 CapitalGreen

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Rebate Under Section 87a For Senior Citizens - Senior citizens For tax liability on income other than equity fund long term gains you fully get a rebate under Section 87A