Rebates For Heating And Air Conditioning Systems The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime Pricing Offers Rebates Tax Credits Find ways to save on your system with rebates special offers and tax credits including new credits from the Inflation Reduction Act IRA Find local offers View tax credit incentives Rebates and tax credits near you Unlock rebates and tax credits on select products What are rebates

Rebates For Heating And Air Conditioning Systems

Rebates For Heating And Air Conditioning Systems

https://storage.googleapis.com/sos-websvc/uploads/0030227DEA003212/images/ameren-rebate-screenshot-A.png

Palm Coast Heating Air Conditioning Announces New TRANE System

https://www.prlog.org/11655643-1250-instant-rebate.jpg

Vasill Heating And Air Conditioning Rebates St Louis MO

https://storage.googleapis.com/sos-websvc/uploads/0030227DEA003212/images/ameren-rebate-screenshot-Bv2.png

Homeowner Resources Rebates and tax credits for eligible equipment purchases are great ways to help reduce the overall expense of installing a heating and cooling system in your home Ways to Save High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Save Up to 1 200 on Energy Efficiency Home Improvements Claim 30 up to 1 200 for these qualifying energy property costs and certain energy efficient home improvements Windows Skylights Doors Insulation Water Heaters Natural Gas Oil Propane Furnaces Boilers Central Air Conditioners Electric Panel Upgrade Home Energy Audit

Download Rebates For Heating And Air Conditioning Systems

More picture related to Rebates For Heating And Air Conditioning Systems

Potomac Edison HVAC Rebate Program Air Doctor Heating And Air

https://airdoctorhvac.com/wp-content/uploads/2019/03/Potomac-Edison-HVAC-Rebates.jpg

Ladwp Air Conditioner Rebate Air Conditioner Rebate Explained Here

https://www.confortexpert.com/wp-content/uploads/2020/05/CE-Promotion-Fujitsu-AN-052020.jpg

Connecticut Rebates

https://www.star-supply.com/images/content/cover_ct_heating_and_cooling.PNG

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is available Furnaces Heat Pumps Ductless Systems More Products Thermostats Smart Thermostats Healthy Homes Air Monitors Air Purifiers Humidifiers More Products Check Air Quality Infinity System What is Infinity Infinity Advantages

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners Any combination of heat pumps heat pump water heaters and biomass Central air conditioners water heaters furnaces boilers and heat pumps Biomass stoves and boilers Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500

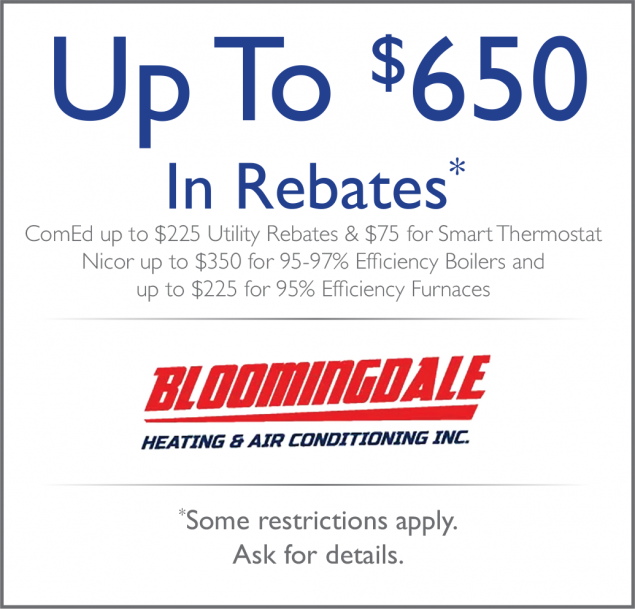

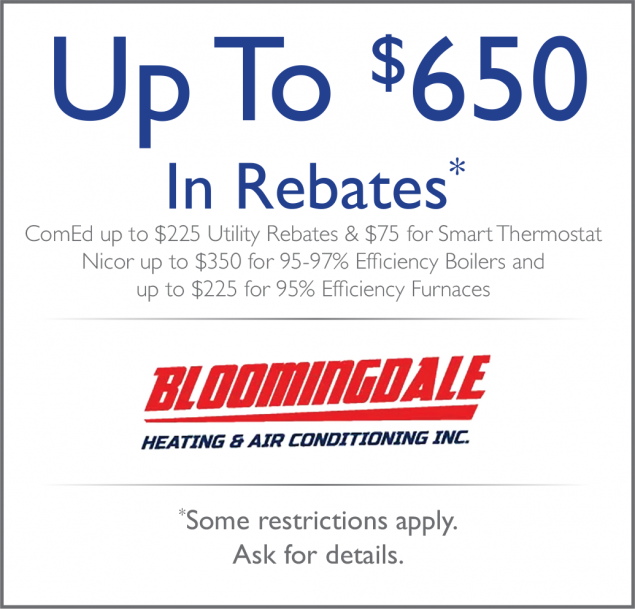

Bloomingdale HVAC Web Coupons 650 Rebates Bloomingdale Heating Air

https://bloomingdalehvac.com/wp-content/uploads/2020/06/Bloomingdale_HVAC_Web_Coupons_650_Rebates-e1606339305835.png

Heating Cooling Coupons Rebates Specials Southern MD

https://irp-cdn.multiscreensite.com/8d8b4f85/dms3rep/multi/TCA--100+Off-Installation-Coupon.jpg

https://www.energy.gov/scep/home-energy-rebates-program

The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S

https://www.irs.gov/credits-deductions/energy...

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime

AC And Pool Heating Coupons AC Rebate Special

Bloomingdale HVAC Web Coupons 650 Rebates Bloomingdale Heating Air

Purchase A High Efficiency Furnace And Air Conditioning System And

National Grid Air Conditioner Rebate National Grid Offers Ways To

HVAC Coupon Rebates Arctic Air Heating Cooling

Spring 2018 Rebate Girard Heating And Air Conditioning Hampden County

Spring 2018 Rebate Girard Heating And Air Conditioning Hampden County

Pge Water Heater Rebate

AC And Pool Heating Coupons AC Rebate Special

Heating Air Rebates Roswell GA Air Control Heating And Air

Rebates For Heating And Air Conditioning Systems - The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers