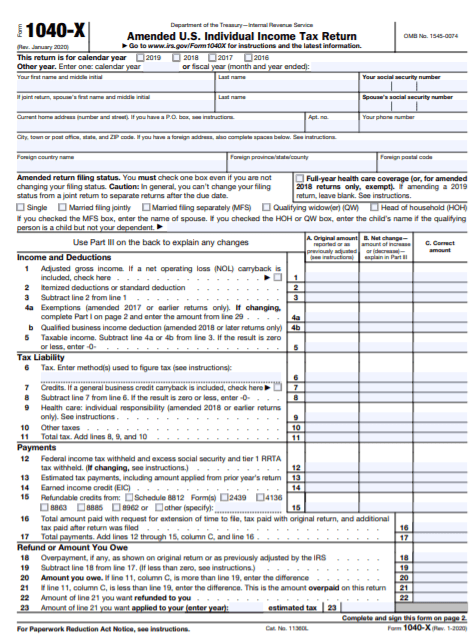

Federal Amended Tax Return Rebate Check Incorrect Web 10 d 233 c 2021 nbsp 0183 32 Those filing their Form 1040 X electronically or on paper can use the Where s My Amended Return online tool to check the status of their amended return DO

Web 6 avr 2021 nbsp 0183 32 Here s a list of what some people are doing wrong You were claimed as a dependent on another person s 2020 tax return If so you don t qualify for the first or Web 8 avr 2022 nbsp 0183 32 2 DO NOT file an amended tax return if you entered an incorrect amount for the 2021 Recovery Rebate Credit on your tax return

Federal Amended Tax Return Rebate Check Incorrect

Federal Amended Tax Return Rebate Check Incorrect

https://www.moneytalksnews.com/workers/images/width=1920/wp-content/uploads/1040x.jpg?s=1b04b101aa4519b765df31279a90448294a5bcae8dac2ecc9aea70dd62902477

Irs Amended Return Status Salods

https://www.handytaxguy.com/wp-content/uploads/2020/06/Page-one-1040x-Amended-Return.png

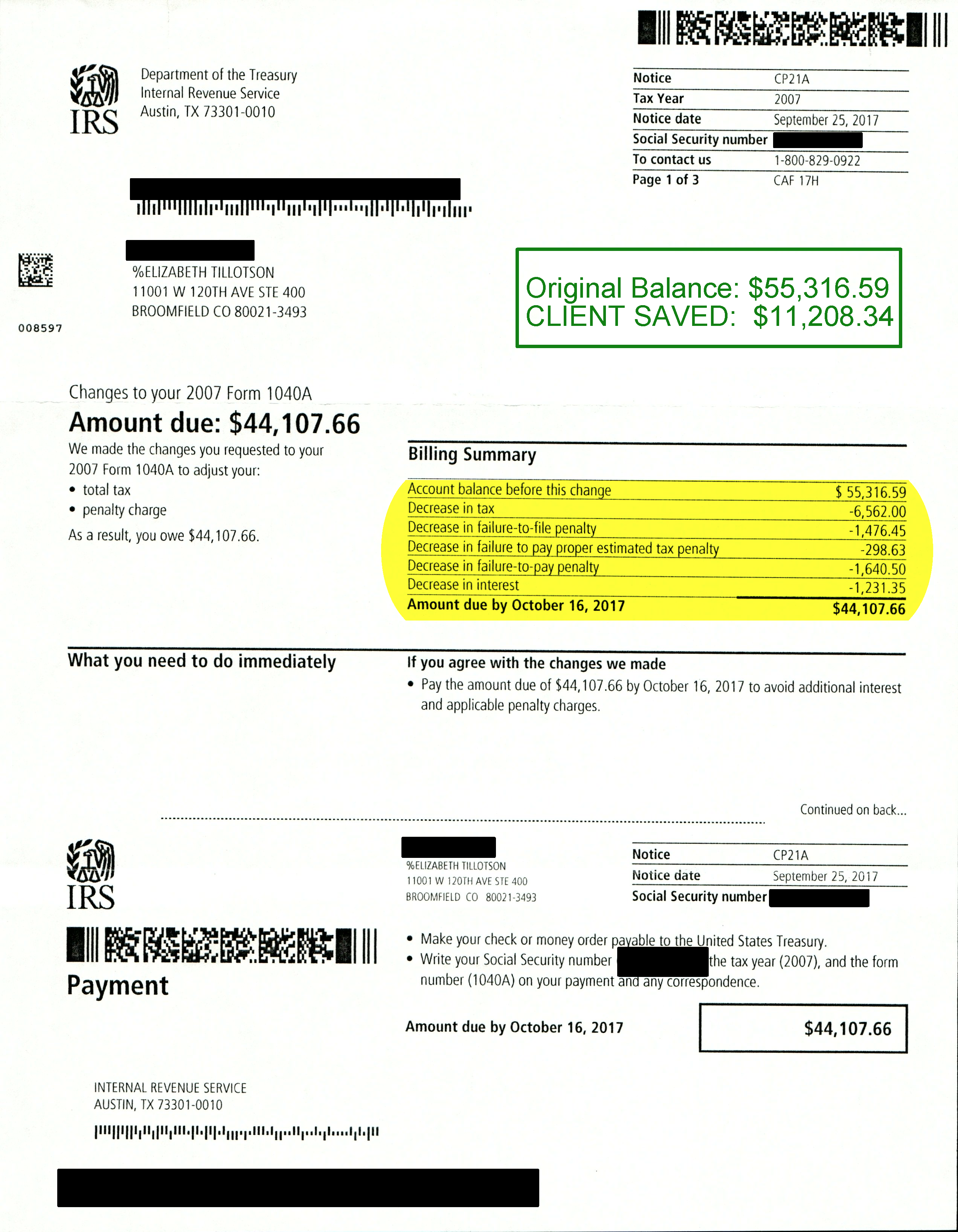

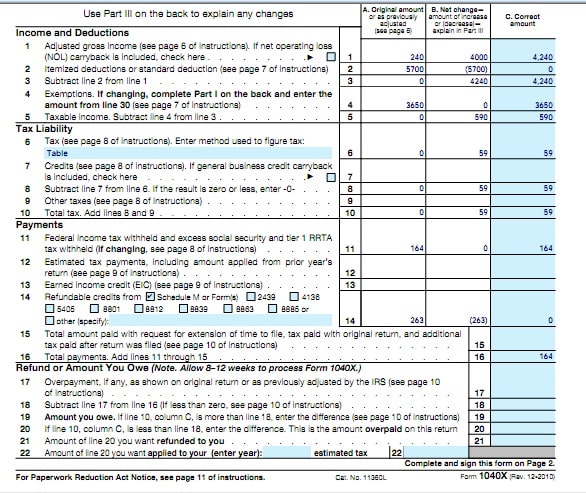

AMENDED RETURN BASED ON ERRORS FROM IRS CLIENT SAVES 5 5 Page 4

https://rtaxgroup.com/wp-content/uploads/2017/03/AMENDED-RETURN-BASED-ON-ERRORS-FROM-IRS_-CLIENT-SAVES-5-5_Page_4.png

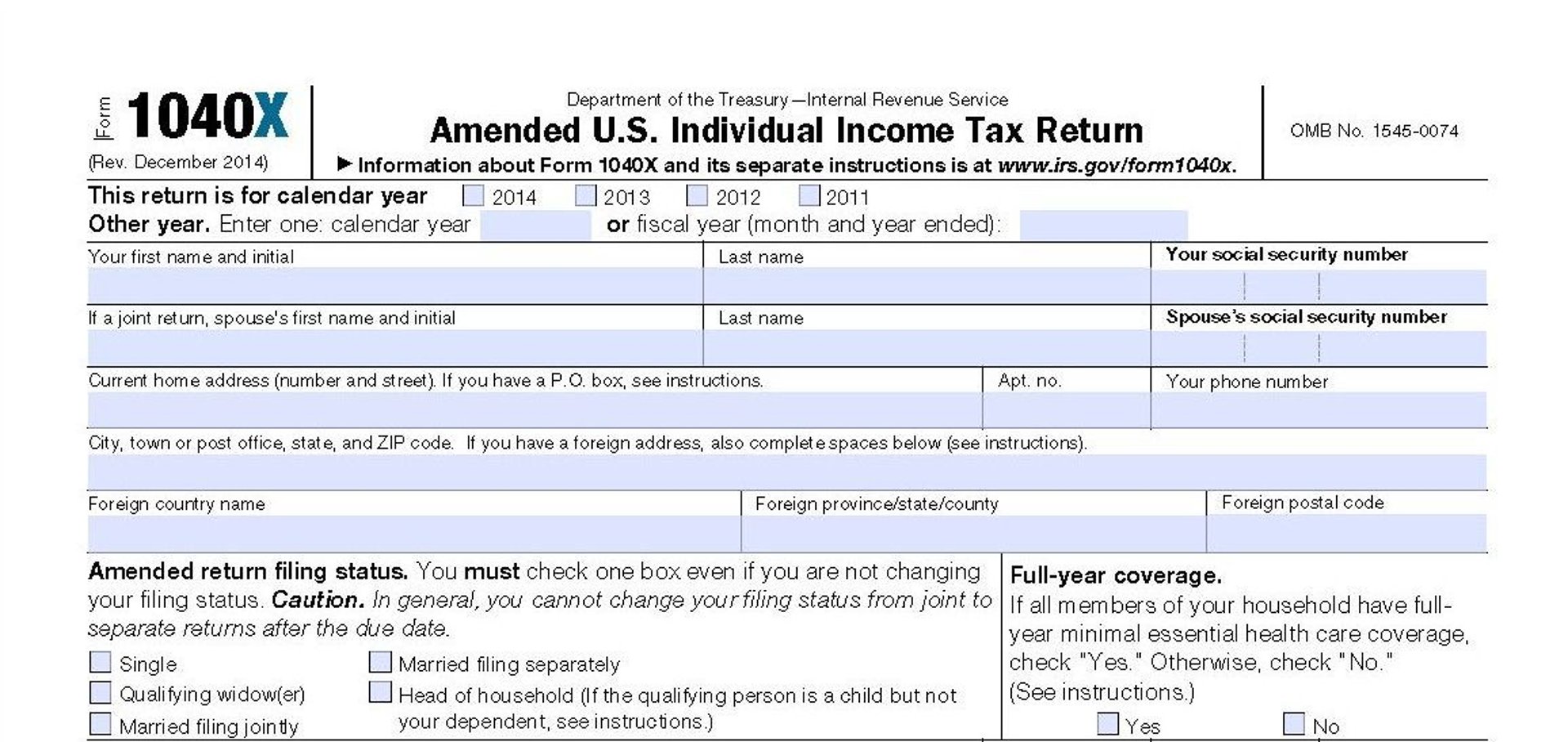

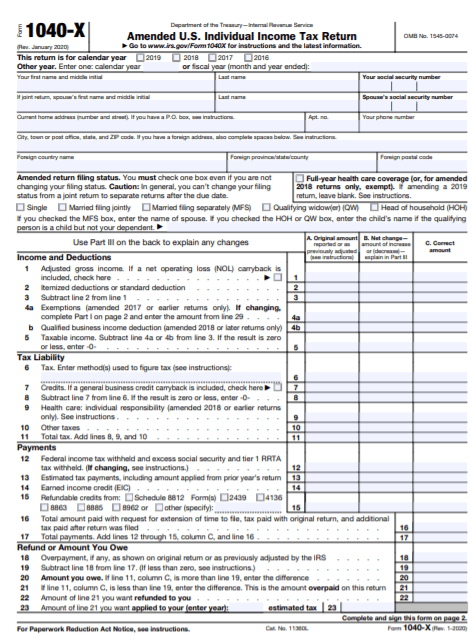

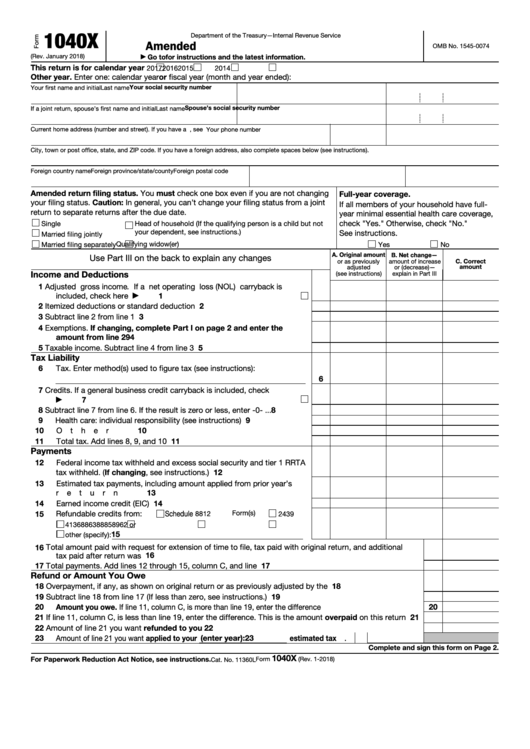

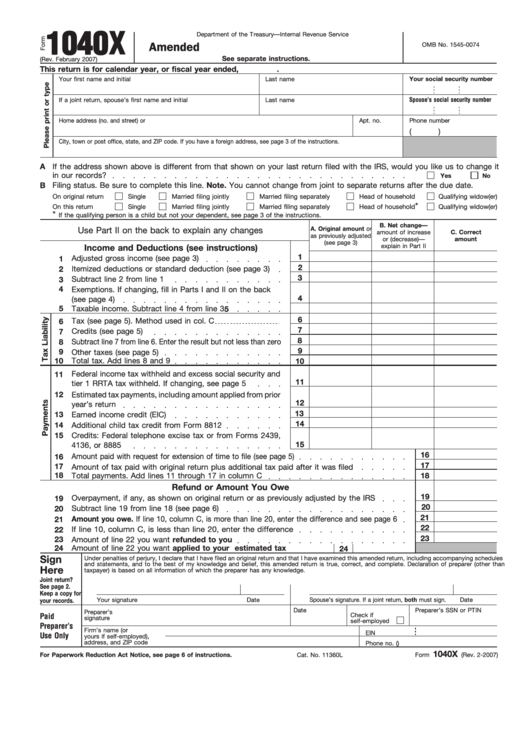

Web 10 avr 2023 nbsp 0183 32 Taxpayers can check the status of their Form 1040 X using the Where s My Amended Return online tool or by calling 866 464 2050 three weeks after filing Both Web 8 juin 2022 nbsp 0183 32 If you realize there was a mistake on your return you can amend it using Form 1040 X Amended U S Individual Income Tax Return For example a change to your

Web 8 f 233 vr 2022 nbsp 0183 32 If the IRS finds mistakes like a math error or missing schedule before you do you ll get an IRS notice The notice will tell you about the error and what information if Web 28 mai 2023 nbsp 0183 32 After submitting your claim you can keep track of the progress of your rebate claim by visiting the manufacturer or retailer s website and entering your tracking number

Download Federal Amended Tax Return Rebate Check Incorrect

More picture related to Federal Amended Tax Return Rebate Check Incorrect

Still Haven t Received My Tax Refund 2022 TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/amended-refund-completed-still-havent-received-it-it-says-completed.jpeg

5 Amended Tax Return Filing Tips Don t Mess With Taxes

http://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e201b8d2b560b8970c-800wi

Where s My Amended Refund IRS Where s My Amended Return 1040X

https://s3.amazonaws.com/cme_public_images/www_ehow_com/i.ehow.com/images/a04/km/he/file-amended-tax-return-800x800.jpg

Web 21 d 233 c 2021 nbsp 0183 32 Published December 21 2021 Last Updated May 16 2023 Incorrect Tax Return A tax return can be incorrect or incomplete for many different reasons from Web You had a change in income If your income was lower in 2021 the IRS could have used an incorrect AGI to calculate your third stimulus payment meaning you might qualify for

Web 8 f 233 vr 2023 nbsp 0183 32 Where s My Refund Espa 241 ol Ti ng Vi t Krey 242 l ayisyen You can check the status of your 2022 income tax refund 24 hours after Web 20 d 233 c 2022 nbsp 0183 32 You should amend your return if you reported certain items incorrectly on the original return such as filing status dependents total income deductions or credits

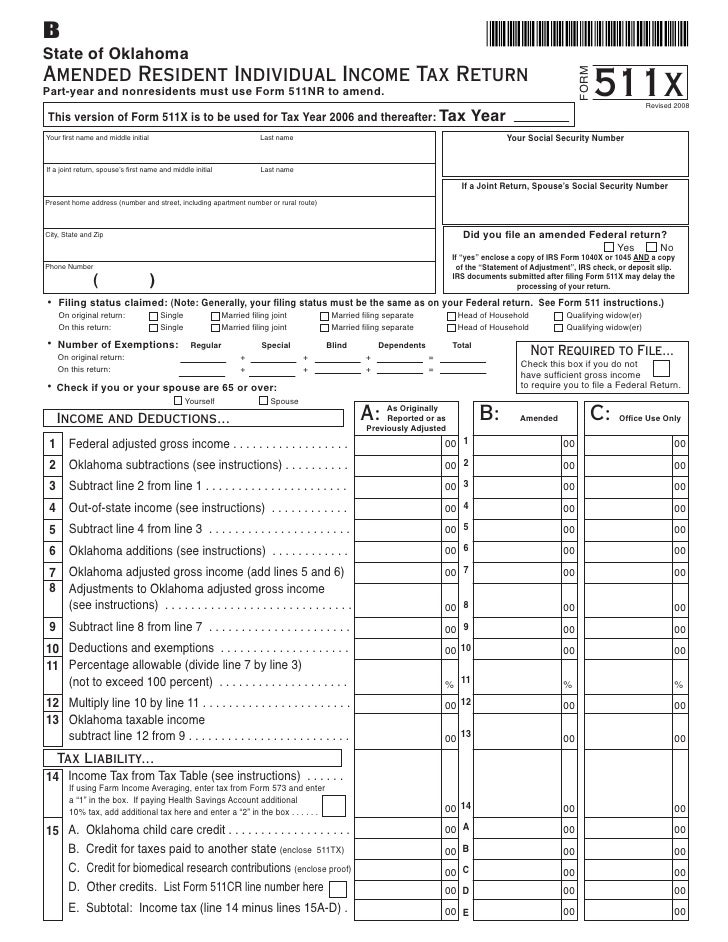

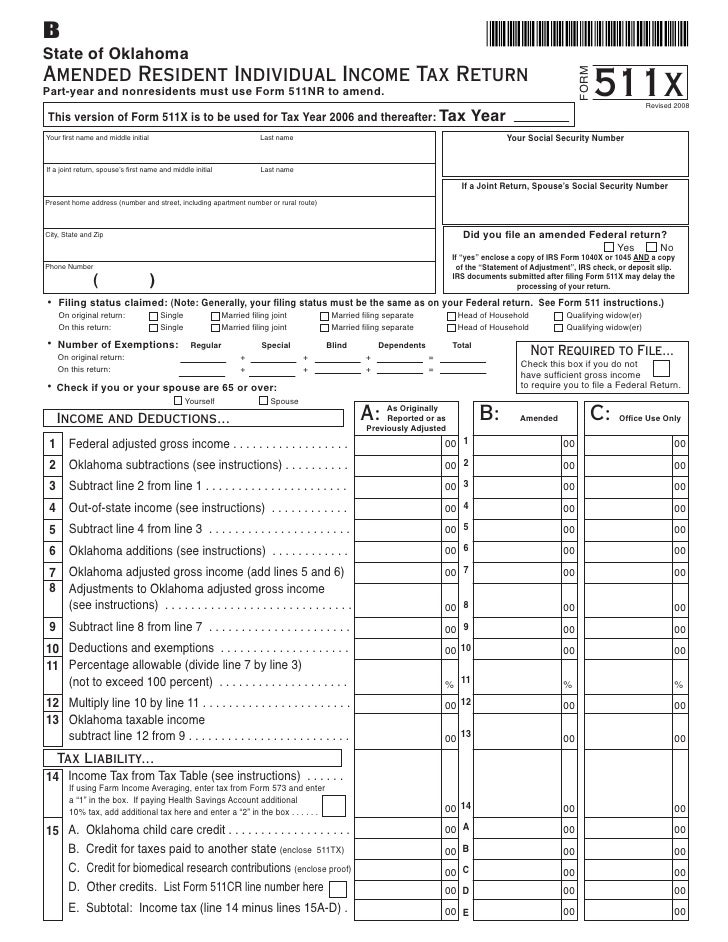

Amended Resident Individual Income Tax Return

https://image.slidesharecdn.com/1292366/95/amended-resident-individual-income-tax-return-2-728.jpg?cb=1239767429

Irs Amended Return Status Laderpd

https://www.incometaxpro.net/images/forms/2020/irs/form-1040x.png

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 Those filing their Form 1040 X electronically or on paper can use the Where s My Amended Return online tool to check the status of their amended return DO

https://www.freep.com/.../irs-tax-return-recovery-rebate-credit/7095670002

Web 6 avr 2021 nbsp 0183 32 Here s a list of what some people are doing wrong You were claimed as a dependent on another person s 2020 tax return If so you don t qualify for the first or

Fillable Form 1040x Amended U s Individual Income Tax Return

Amended Resident Individual Income Tax Return

Tax Rebate Checks Come Early This Year Yonkers Times

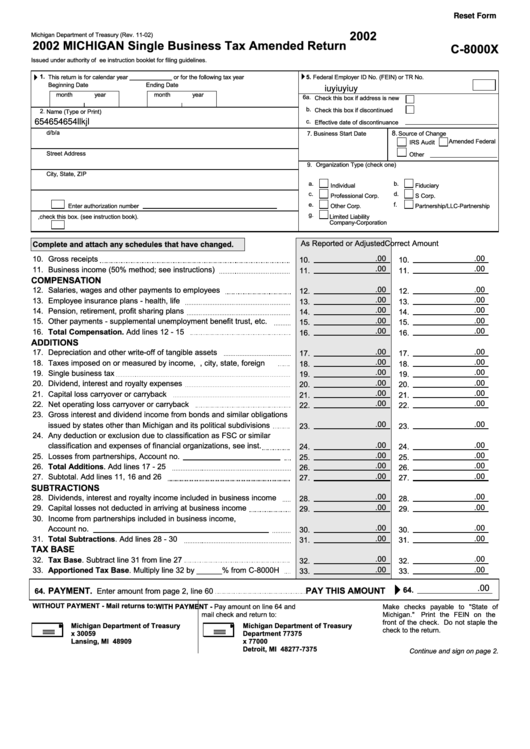

Fillable Form C 8000x Single Business Tax Amended Return 2002

How To Check Amended Tax Return Status TaxProAdvice

Federal Tax Refund Status Classictyred

Federal Tax Refund Status Classictyred

Sealsilope Blog

IRS Letter 89C Amended Return Required To Correct Account H R Block

How To Check My Amended Tax Return TaxProAdvice

Federal Amended Tax Return Rebate Check Incorrect - Web 8 juin 2022 nbsp 0183 32 If you realize there was a mistake on your return you can amend it using Form 1040 X Amended U S Individual Income Tax Return For example a change to your