Uniform Tax Rebate Reviews Web review taxrefund co uk

Web 5 oct 2022 nbsp 0183 32 If you re a high rate taxpayer entitled to the standard flat rate uniform allowance you can get uniform tax rebates for 2022 23 2021 22 2020 21 2019 20 and Web 29 d 233 c 2022 nbsp 0183 32 If your employer pays for your uniform or provides facilities for it to be cleaned you are unlikely to be able to claim the uniform tax rebate What is a uniform

Uniform Tax Rebate Reviews

Uniform Tax Rebate Reviews

https://i.ytimg.com/vi/EkEAqlPW3As/maxresdefault.jpg

How Does Uniform Tax Rebate Work Tax Refund Tax Rebates

https://i.pinimg.com/originals/2c/22/92/2c22924c724898c314be2c631dcef679.png

Uniform Tax Rebate Built By Submarine Guernsey Rebates Guernsey

https://i.pinimg.com/originals/2e/46/48/2e4648b74afac18e9d63ec2b1a5441d1.jpg

Web There is 1 review about Uniform Tax Rebate Their average score is 10 where 100 of the customers have indicated that they would order from Uniform Tax Rebate again In Web Find out how much you re owed it takes seconds HERE S HOW TO FIND OUT IF YOU RE ELIGIBLE FOR UNIFORM TAX RELIEF If you meet all of the following three

Web You can claim tax relief for a uniform A uniform is a set of clothing that identifies you as having a certain occupation for example nurse or police officer Web The standard rebate flat rate for most UK employees who claim for their current year amp the previous 4 years as permitted by HMRC is 163 108 this consists of 163 48 in a backdated

Download Uniform Tax Rebate Reviews

More picture related to Uniform Tax Rebate Reviews

Uniform Tax Rebate Official Website Claim Tax Relief Refunds

https://www.uniformtaxrebate.co.uk/content/images/utr.svg

Uniform Tax Rebates Claim Your Tax Relief Today

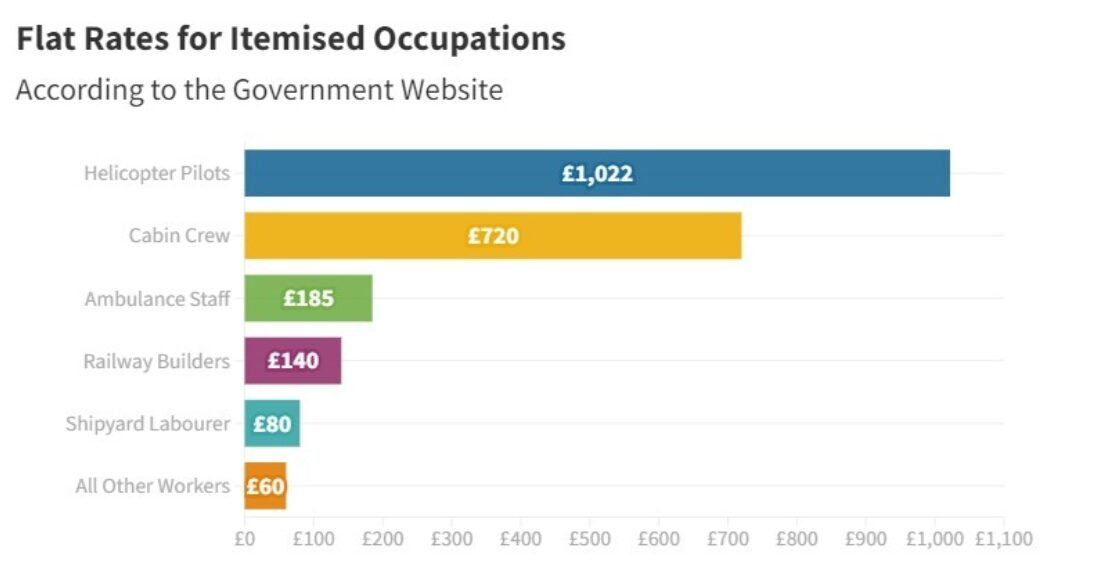

https://cheap-accountants-in-london.co.uk/wp-content/uploads/2021/10/Allowances-and-Uniform-tax-rebate-rates-uk.png

Tax Rebate For Uniform Process Times Money Back Helpdesk

https://moneybackhelpdesk.co.uk/images/articles/Uniform-Tax-Rebate/_articleHero/Flat-Rates-for-Itemised-Occupations.jpeg

Web 18 mars 2022 nbsp 0183 32 It doesn t seem reasonable especially when you solely possess it and look for the garments as a result of your profession You may be able to recoup 20 or 40 Web Airline staff Pharmacy workers Police workers Construction workers Engineering Prison staff Carpenters How Much Can You Claim for the Uniform Tax Rebate The tax rebate you can claim is based on The

Web 26 mai 2015 nbsp 0183 32 Online Tax Rebates Limited has collected 373 reviews with an average score of 4 45 There are 330 customers that Online Tax Rebates Limited rating them as Web 30 juin 2023 nbsp 0183 32 Limited company categories Crunch is an award winning pay monthly online accountant Save money and get your accounts done fast for as little as 163 24 50 per

Do You Wear A Fast Food Uniform At Work Claim Your Tax Rebate Online

https://i.pinimg.com/originals/6c/d1/5c/6cd15ca21a9042c81b523eb74a35a592.jpg

Uniform Tax Refund How To Claim A Uniform Tax Rebate From HMRC

https://www.extremecouponing.co.uk/wp-content/uploads/2020/09/uniform-tax-rebate-768x432.jpg

https://uk.trustpilot.com/review/uniformtaxrebate.co.uk

Web review taxrefund co uk

https://blog.pleo.io/en/hmrc-uniform-tax

Web 5 oct 2022 nbsp 0183 32 If you re a high rate taxpayer entitled to the standard flat rate uniform allowance you can get uniform tax rebates for 2022 23 2021 22 2020 21 2019 20 and

Uniform Tax Rebates Claim Your Tax Relief Today

Do You Wear A Fast Food Uniform At Work Claim Your Tax Rebate Online

Tax Rebate For Uniform Work Uniform Tax Refund Online

Uniform Tax Allowance Rebate My Tax Ltd

Claim A Tax Rebate For Your Uniform Rmt

The Benefits And Allowances You Could Be Entitled To For Wearing A Uniform

The Benefits And Allowances You Could Be Entitled To For Wearing A Uniform

Uniform Tax Rebate

Download Form P87 For Claiming Uniform Tax Rebate DNS Accountants

Uniform Tax Rebate Calculator Uniform Tax Rebate Calculator Uk

Uniform Tax Rebate Reviews - Web There is 1 review about Uniform Tax Rebate Their average score is 10 where 100 of the customers have indicated that they would order from Uniform Tax Rebate again In