Rebates Taxable Web 1 d 233 c 2022 nbsp 0183 32 What is a tax rebate The 2001 federal tax rebate Click to expand Getting money back Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make certain types of

Web De tr 232 s nombreux exemples de phrases traduites contenant quot taxable rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises Web 9 sept 2023 nbsp 0183 32 State stimulus check 2023 update Clarity from the IRS on so called state stimulus checks is essential because millions of taxpayers across the U S have

Rebates Taxable

Rebates Taxable

https://stimulusmag.com/wp-content/uploads/2022/12/is-recovery-rebate-taxable-1024x791.jpeg

Are GST Rebates Taxable Top 10 Reasons To Claim A GST Rebate

https://iimskills.com/wp-content/uploads/2021/07/ARE-GST-REBATES-TAXABLE-compressed-2048x779.jpg

Water Conservation Rebate Taxable WaterRebate

https://i0.wp.com/www.waterrebate.net/wp-content/uploads/2023/05/figure-1-from-saving-water-with-a-landscape-water-conservation-rebate-4.png?resize=980%2C730&ssl=1

Web Rebates Generally speaking the IRS considers transaction related points or rewards as rebates and not as taxable income Think of the rebate as a discount you ll receive on Web Tax Tax Accounting EXECUTIVE SUMMARY The IRS has attempted for many years to categorize rebates as deductions rather than exclusions so that the restrictions of IRC 167

Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Rebates Taxable

More picture related to Rebates Taxable

Mass Save Rebates BDL Heating And Cooling Mass Save Rebate

https://i0.wp.com/www.masssaverebate.net/wp-content/uploads/2023/05/mass-save-rebates-bdl-heating-and-cooling.jpg?fit=800%2C657&ssl=1

California Lawn Rebate 2023 Taxable Californiarebates

https://i0.wp.com/www.californiarebates.net/wp-content/uploads/2023/04/california-lawn-rebate-2022-artificial-grass-rebates-purchase-green-1.png

Worked Examples Not for profit Employers Completing Your FBT Return

https://www.ato.gov.au/uploadedImages/Content/SEO/Images/FBT_return_2023/n1067_FBT return_form_2023_example3.png?n=6015

Web 6 f 233 vr 2023 nbsp 0183 32 According to the Massachusetts Office of Administration and Finance All tax refunds including the 62F refunds are taxable by the federal government to the extent Web Our Neo Banking application helps employees to plan spend and earn rebates through our prepaid card named De tax card De tax Card is an All In ONE employee benefit Card

Web 28 ao 251 t 2023 nbsp 0183 32 The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 Web There are two basic arguments to support the conclusion that the rebate payments should not be taxable First it may be argued that the LI rebate should not be treated as a

Ca Electric Car Rebate Taxable 2022 Carrebate Californiarebates

https://www.californiarebates.net/wp-content/uploads/2023/04/ca-electric-car-rebate-taxable-2022-carrebate.png

Are Buyer Agent Commission Rebates Taxable In NYC YouTube

https://i.ytimg.com/vi/aJwAZbWrXb4/maxresdefault.jpg

https://turbotax.intuit.com/tax-tips/tax-relief/wh…

Web 1 d 233 c 2022 nbsp 0183 32 What is a tax rebate The 2001 federal tax rebate Click to expand Getting money back Federal state and local legislatures frequently issue tax rebates to encourage taxpayers to make certain types of

https://www.linguee.fr/anglais-francais/traduction/taxable+rebate.html

Web De tr 232 s nombreux exemples de phrases traduites contenant quot taxable rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises

Water Conservation Rebate Taxable WaterRebate

Ca Electric Car Rebate Taxable 2022 Carrebate Californiarebates

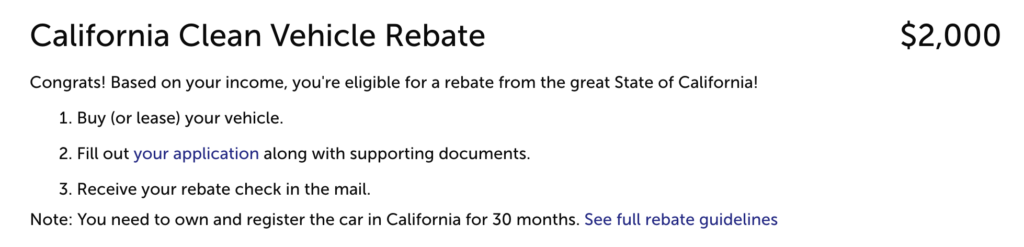

1 Billion In Health Insurance Rebates Taxable Or Tax free Kiplinger

Is Costco Rebate Taxable Income CostcoRebate

Putting The Spotlight On Taxable Commissions And Rebates HomeServices

IRS Has Decided That The Tax Rebate That Idahoans Received In 2022 Is

IRS Has Decided That The Tax Rebate That Idahoans Received In 2022 Is

Are Car Rebates Taxable In New York 2022 Carrebate

IRS Says California Most State Tax Rebates Aren t Considered Taxable

New Tax Regime Sec 87 A Rebate For Taxable Income More Than Rs 7

Rebates Taxable - Web 16 avr 2014 nbsp 0183 32 HM Revenue and Customs HMRC has published updated guidance on how it will tax clients receiving rebates from fund managers or platforms The guidance