Recovery Rebate Credit 2020 Letter From Irs WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected

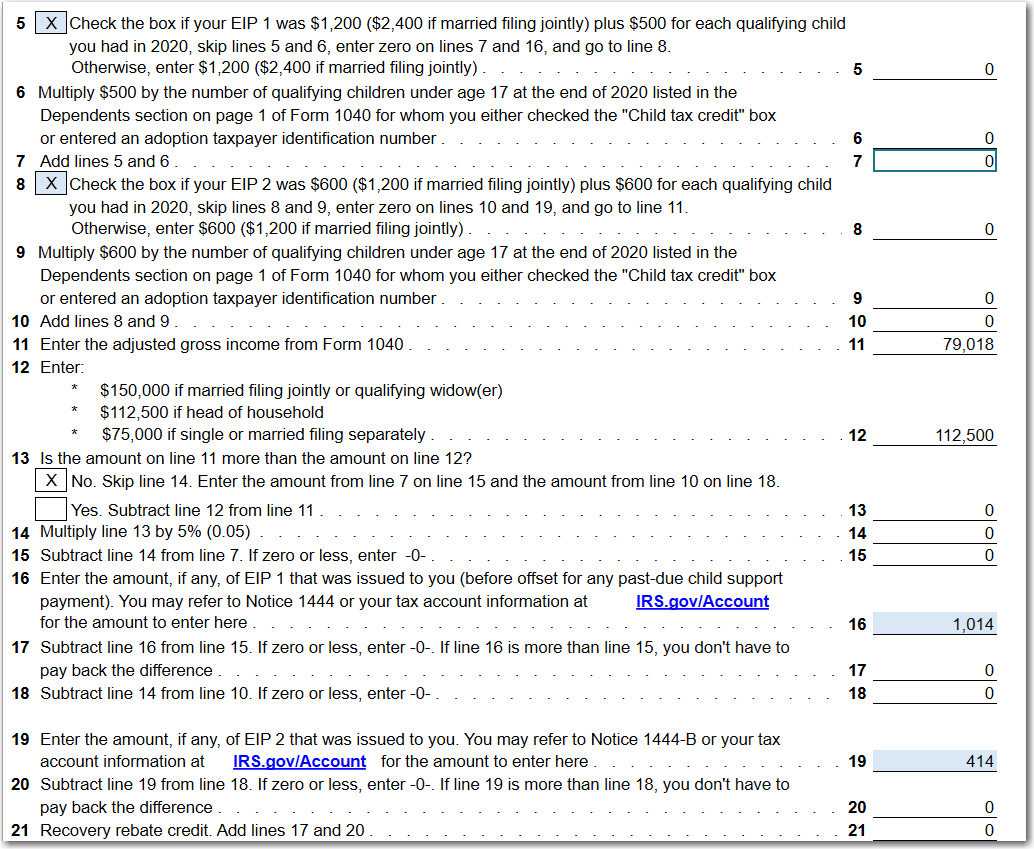

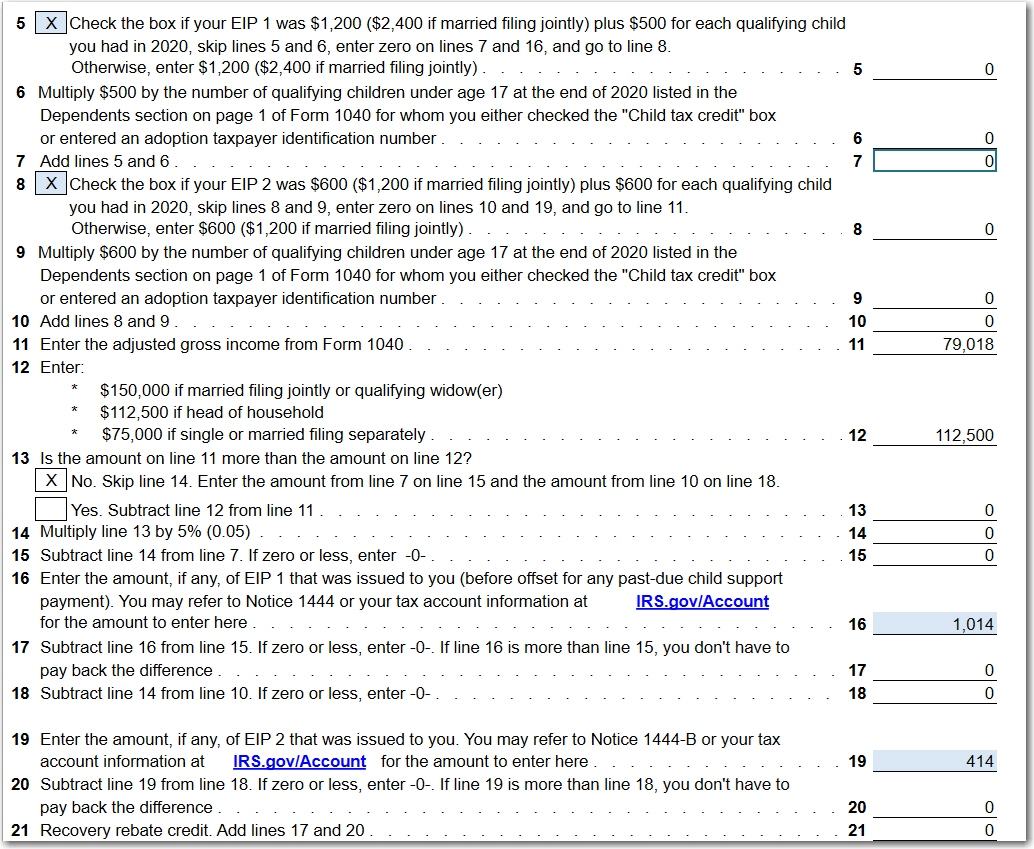

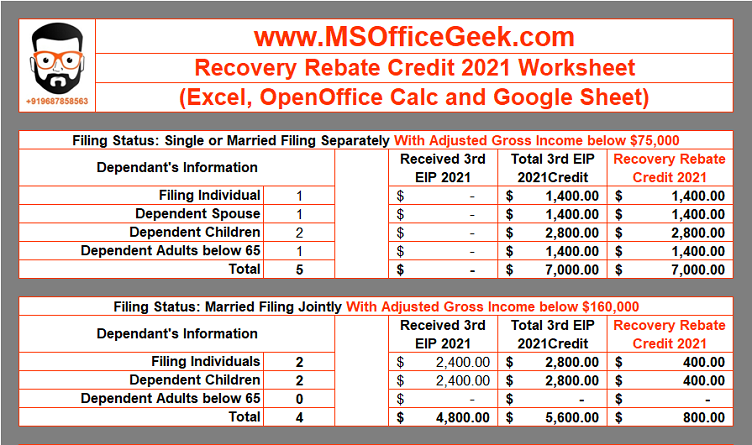

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020 Form 1040 SR Taxpayers who receive a letter or notice saying the IRS changed the amount of their 2020 credit should read the letter or notice Then they should review their 2020 tax return the requirements for the credit and the worksheet in the Form 1040 and Form 1040 SR instructions

Recovery Rebate Credit 2020 Letter From Irs

Recovery Rebate Credit 2020 Letter From Irs

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-rebate-credit-worksheet-atx-line-30-covid-19-atx-community.jpg

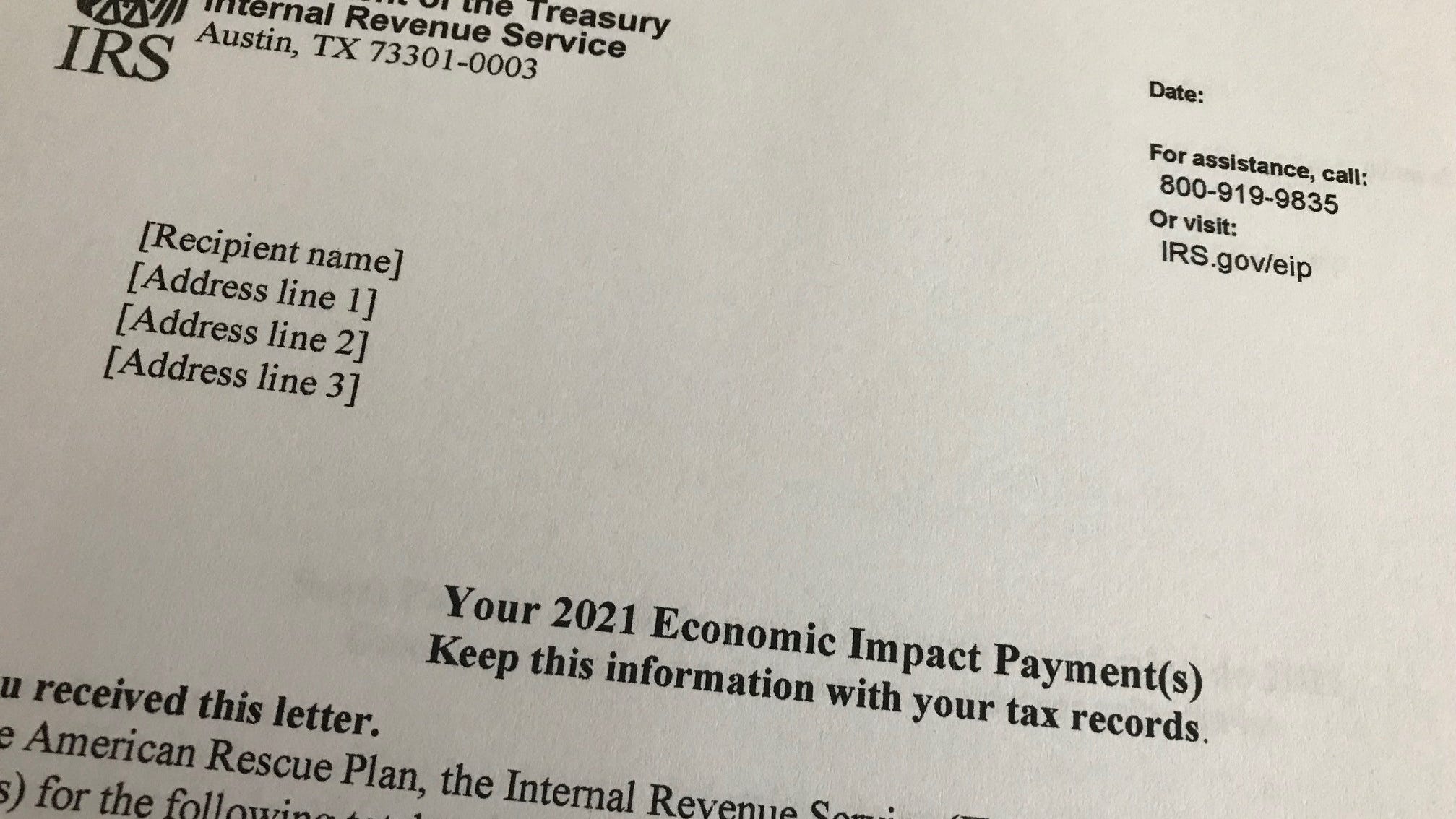

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

The IRS is sending letter 6475 ahead of filing their 2021 tax returns It can help determine if you are owed more money with Recovery Rebate Credit IRS gov has a special section Correcting Recovery Rebate Credit issues after the 2020 tax return is filed that provides additional information explaining what errors may have occurred Taxpayers who disagree with the IRS calculation should review their letter as well as the questions and answers for what information they should have

The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for each qualifying child you had in 2020 Taxpayers claiming the 2020 or 2021 Recovery Rebate Credit on their Form 1040 Individual Income Tax Return should be aware that the IRS has the authority to offset their refund and apply it to certain federal and state liabilities

Download Recovery Rebate Credit 2020 Letter From Irs

More picture related to Recovery Rebate Credit 2020 Letter From Irs

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

https://www.expatforum.com/attachments/1633512360704-png.100433/

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

The vast majority of those eligible for Economic Impact Payments related to Coronavirus tax relief have already received them or claimed them through the Recovery Rebate Credit The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent

Individuals who were eligible for an economic impact payment but did not receive one or were eligible for a larger payment than they received may be able to claim a recovery rebate credit when they file their income tax return for 2020 If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference

IRS Letter Regarding 2020 Recovery Rebate Credit Northside Tax Service

http://static1.squarespace.com/static/5f973ae52ec0c32dc9ec873d/t/63054b5795541569678e422b/1661291354135/12+IRS+Letter+Regarding+2020+Recovery+Rebate+Credit+1200+x+628.jpg?format=1500w

Recovery Rebate Tax Credit 2020 Tax Refunds And Tips YouTube

https://i.ytimg.com/vi/aJ0tTzsDcBI/maxresdefault.jpg

https://www.irs.gov › newsroom

WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The IRS is mailing letters to some taxpayers who claimed the 2020 credit and may be getting a different amount than they expected

https://www.irs.gov › newsroom

To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form 1040 and Form 1040 SR Instructions PDF Enter the computed amount from the worksheet onto line 30 Recovery Rebate Credit of your 2020 Form 1040 or 2020 Form 1040 SR

2020 Recovery Rebate Credit FAQs Updated Again Business IT IS

IRS Letter Regarding 2020 Recovery Rebate Credit Northside Tax Service

Recovery Rebate Credit 2020 Calculator KwameDawson

What Is The Recovery Rebate Credit And Do You Qualify The

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

Recovery Rebate Credit 2020 Calculator KwameDawson Recovery Rebate

Recovery Rebate Credit 2023

Irs Recovery Rebate Credit Number IRSYAQU

Recovery Rebate Credit 2020 Letter From Irs - The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021