Recovery Rebate Credit 2021 Tax Form File your 2021 tax return electronically and the tax software will help you figure your 2021 Recovery Rebate Credit Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund and can be direct deposited into your financial account

File a complete and accurate 2021 tax return to avoid People who either did not qualify to receive a third Economic Impact Payment or received less than the full amounts may be eligible to claim the 2021 Recovery Rebate Credit based on If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors

Recovery Rebate Credit 2021 Tax Form

Recovery Rebate Credit 2021 Tax Form

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Recovery Rebate Credit On The 2020 Tax Return

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20282e140c0ca200b-800wi

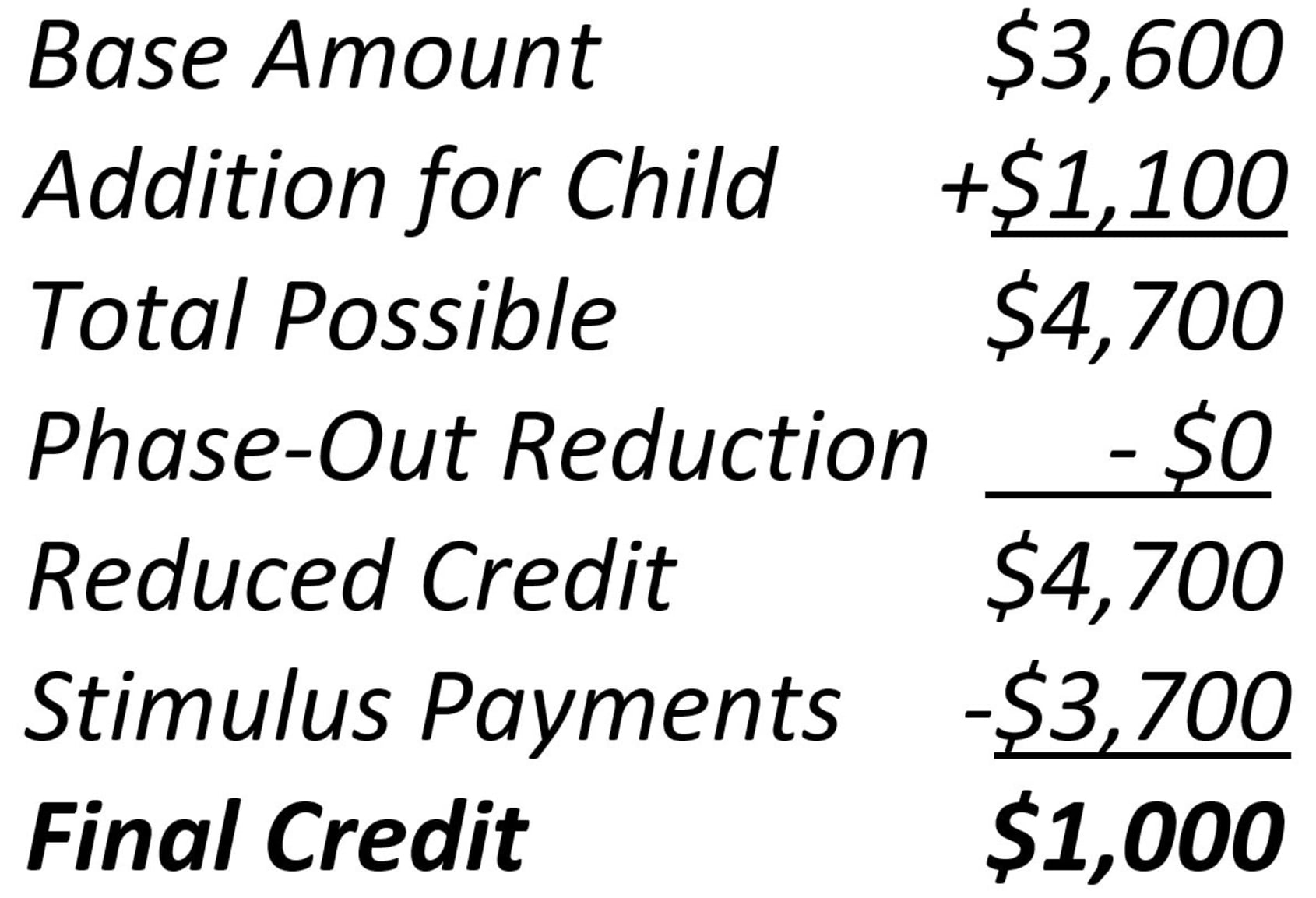

The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if You are eligible but were not issued an EIP 1 an EIP 2 or neither an EIP 1 or EIP 2 or Your EIP 1 was less than 1 200 2 400 if married filing jointly plus The Form 1040 and Form 1040 SR instructions include a worksheet you can use to figure the amount of any RRC for which you are eligible The eligibility criteria for the RRC is generally the same as for EIPs except that the RRC is based on tax year 2020 information instead of the tax year 2019 or tax year 2018 information used for EIP1 and

By Rocky Mengle last updated 12 October 2022 If you didn t get a third stimulus check or you only got a partial check then you certainly want to check out the recovery rebate tax File your taxes with confidence Your max tax refund is guaranteed Start Your Return Some people never received or didn t get their full stimulus payment amount in 2021 If this applies to you or if you gained any dependents in 2021 you might be able to claim the 2021 Recovery Rebate Credit even if you don t usually file taxes

Download Recovery Rebate Credit 2021 Tax Form

More picture related to Recovery Rebate Credit 2021 Tax Form

The Recovery Rebate Credit Calculator ShauntelRaya

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

Recovery Rebate Tax Credit 2020 Tax Refunds And Tips YouTube

https://i.ytimg.com/vi/aJ0tTzsDcBI/maxresdefault.jpg

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

https://i1.wp.com/www.gannett-cdn.com/presto/2022/01/31/PDTF/ed4d450c-c21d-4e0c-8df6-4637a89241b9-Lett_6475.jpg

Key Takeaways The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 If you met the income limits for the stimulus payments for 2020 and 2021 and you didn t receive one or more of the payments or if you received only a partial payment you may be eligible to file for the Recovery Rebate Credit To meet the requirements for the economic stimulus you must also meet these qualifications

Updated for filing 2021 tax returns What is the Recovery Rebate Credit The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment also known as an EIP or stimulus payment to claim the missing amount on the following tax return If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner

Irs Recovery Rebate Credit Error 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-6.png?fit=1060%2C795&ssl=1

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

https://www.irs.gov/newsroom/recovery-rebate-credit

File your 2021 tax return electronically and the tax software will help you figure your 2021 Recovery Rebate Credit Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund and can be direct deposited into your financial account

https://www.irs.gov/pub/irs-pdf/p5486b.pdf

File a complete and accurate 2021 tax return to avoid People who either did not qualify to receive a third Economic Impact Payment or received less than the full amounts may be eligible to claim the 2021 Recovery Rebate Credit based on

Should You Claim The Recovery Rebate Credit On Your 2021 Tax Return

Irs Recovery Rebate Credit Error 2023 Recovery Rebate

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

10 FAQs About Claiming The 2021 Recovery Rebate Credit TaxAct

10 FAQs About Claiming The 2021 Recovery Rebate Credit TaxAct

Recovery Rebate Credit Economic Impact Payment And Other Items For 2020

Recovery Rebate Worksheet 1040 Recovery Rebate

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

Recovery Rebate Credit 2021 Tax Form - The 2021 Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible for the credit The fastest way to get your tax refund is to file electronically and have it direct deposited contactless and free into your financial account