Recovery Rebate Credit 2021 Turbotax JillS56 Expert Alumni TurboTax will calculate the amount of Recovery Rebate Credit you should have received based on the information you are entered into your 2021 return The IRS issued a Recovery Rebate

For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received less than the full amount you may be eligible for the 2020 Recovery Rebate Credit RRC Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Recovery Rebate Credit 2021 Turbotax

Recovery Rebate Credit 2021 Turbotax

https://www.irsofficesearch.org/wp-content/uploads/2021/02/stimulus-qualification-1.png

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/01-Three-Checkpoints-When-The-IRS-Will-Determine-And-Issue-2021-Recovery-Rebates.png

Recovery Rebate Form 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Impact payment and any plus up payments to claim the 2021 Recovery Rebate Credit May 12 2022 6 21 AM Check your 2021 Form 1040 and see if there is an amount on line 30 If you see an amount there that is your recovery rebate credit If you were someone else s dependent for 2021 or if your income exceeded the limit then you may not have been eligible for the credit

2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t Why was my refund adjusted after claiming the Recovery Rebate Credit SOLVED by TurboTax 750 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received

Download Recovery Rebate Credit 2021 Turbotax

More picture related to Recovery Rebate Credit 2021 Turbotax

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

How To Claim The 2021 Recovery Rebate Credit On Tax Return

https://www.myexpattaxes.com/wp-content/uploads/Claim-the-2021-Recovery-Rebate-Credit-on-Your-US-Tax-Return.jpg

How To Claim The Recovery Rebate Credit Stimulus Checks On TurboTax

https://i.ytimg.com/vi/sI85dvHfsnc/maxresdefault.jpg

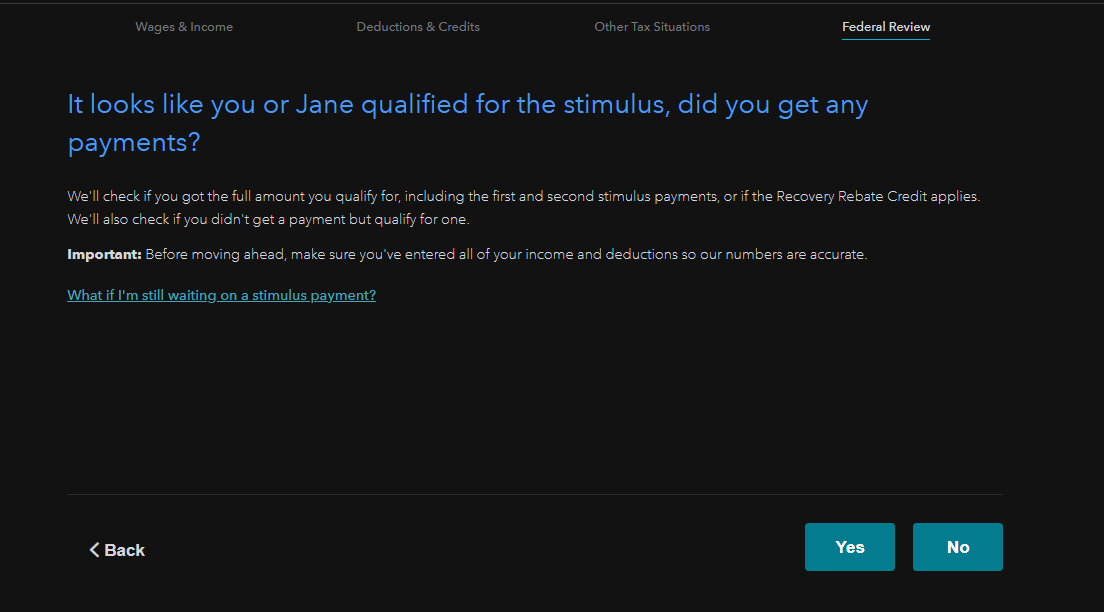

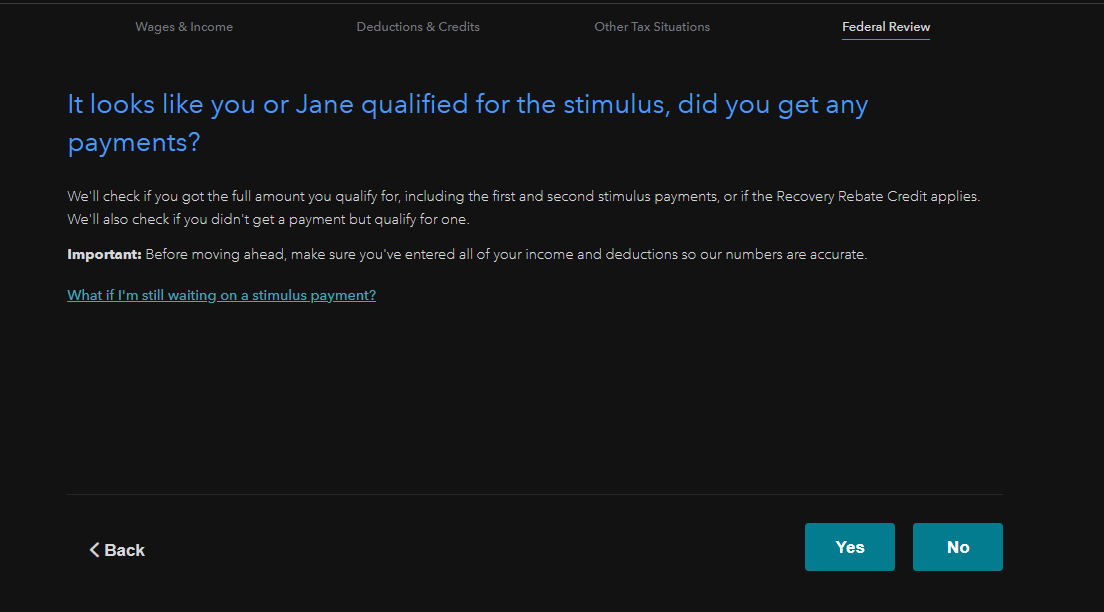

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility re If you didn t get the full stimulus amount you were eligible for then you may be able to claim those dollars through the Recovery Rebate Credit on your tax return So how do you know if you may be eligible to receive a third stimulus payment

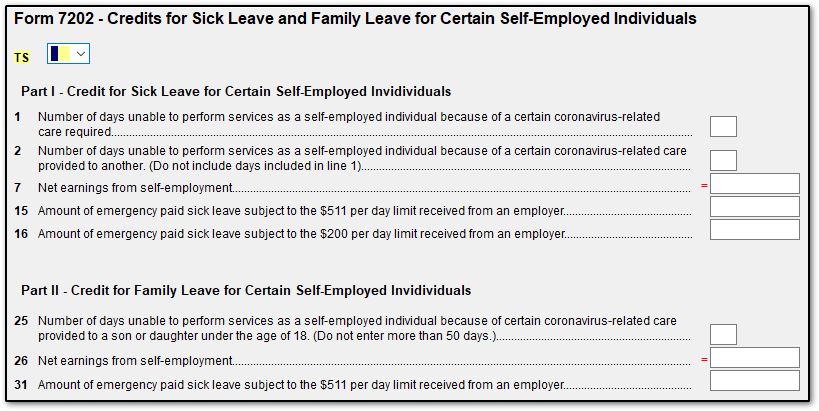

The Recovery Rebate Credit amount is figured just like the third economic impact stimulus payment except that it uses your client s tax year 2021 information to determine eligibility and the amount rather than prior year returns The credit will be reported on Form 1040 Schedule 3 line 30 2021 Recovery Rebate Credit 2021 Economic Impact Payments 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR U S Income Tax Return for Seniors

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Should You Claim The Recovery Rebate Credit On Your 2021 Tax Return

https://alloysilverstein.com/wp-content/uploads/2022/01/Tax-Tip-1.26.png

https://ttlc.intuit.com/community/after-you-file/...

JillS56 Expert Alumni TurboTax will calculate the amount of Recovery Rebate Credit you should have received based on the information you are entered into your 2021 return The IRS issued a Recovery Rebate

https://blog.turbotax.intuit.com/tax-deductions...

For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received less than the full amount you may be eligible for the 2020 Recovery Rebate Credit RRC

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Qu Es Un Cr dito De Recuperaci n De Reembolso TurboTax Blog Espa ol

Recovery Rebate Credit 2021 Tax Return

The Tax Year 2021 Recovery Rebate Credit Better Financial Counseling

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Credit 2021 Turbotax - 2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don t