Recovery Rebate Credit 2024 Calculator Sign in to your Online Account Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account

How to enter stimulus payments and figure the Recovery Rebate Credit in ProSeries Sign In Lacerte ProConnect ProSeries EasyACCT Quickbooks Online Accountant Intuit Tax Advisor Practice Management eSignature Hosting for Desktop Intuit Link Pay by Refund Quickbooks Discounts Learn support Account management E File Get ready for next year IRS Guidance Media Contacts IRS Statements and Announcements These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022

Recovery Rebate Credit 2024 Calculator

Recovery Rebate Credit 2024 Calculator

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEimxxHMVm4XxeDkVaSMSFoj9CX2XqGBjiPWj49fhO8klFSJrHN4Rbr5b3-zi4xSiAaa58C9r_f4Fc9AdeFh2CA51yQPsKTignpJ4wQvAhC7rp8drJR7xe5CxkmwSkVk1nWyZPNxWcqS2tVks6h4fP0QiW59YCZUG37lxHpjiqBAgggUng7A4gFgvhWK/s958/RRR.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in late December of 2020 and into 2021 The credit is available to those who did not receive the Economic Impact Payments or who received less than the full amount that they were eligible for When he files his 2020 return the drop in his income means he ll be eligible for an additional 375 250 for the first payment and 125 for the second Scenario 3 Recovery Rebate Credit and a new baby Jo and Nic married in January 2020 and had a baby in October 2020

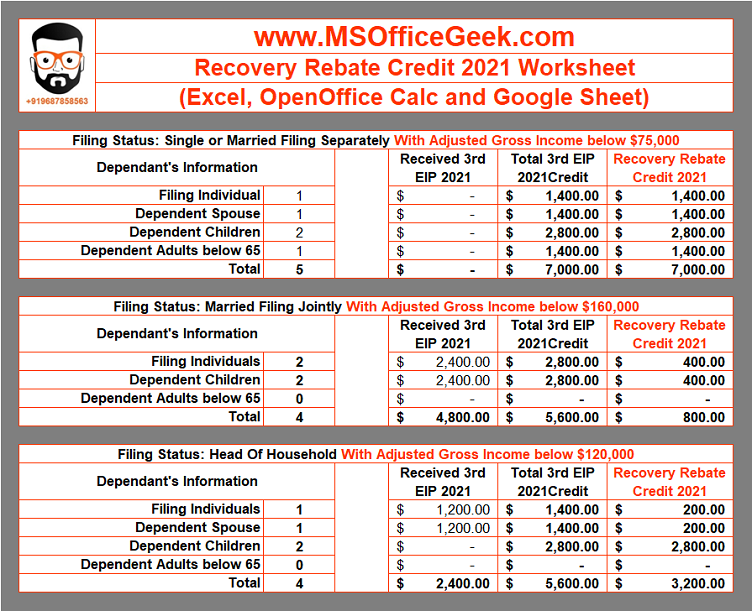

39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3 In March 2021 President Biden signed the American Rescue Plan Act which authorized a third round of federal stimulus checks worth up to 1 400 for each eligible person 2 800 for couples plus

Download Recovery Rebate Credit 2024 Calculator

More picture related to Recovery Rebate Credit 2024 Calculator

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

Recovery Rebate Credit 2022 Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/the-recovery-rebate-credit-calculator-zabeebkenzie-2.jpg

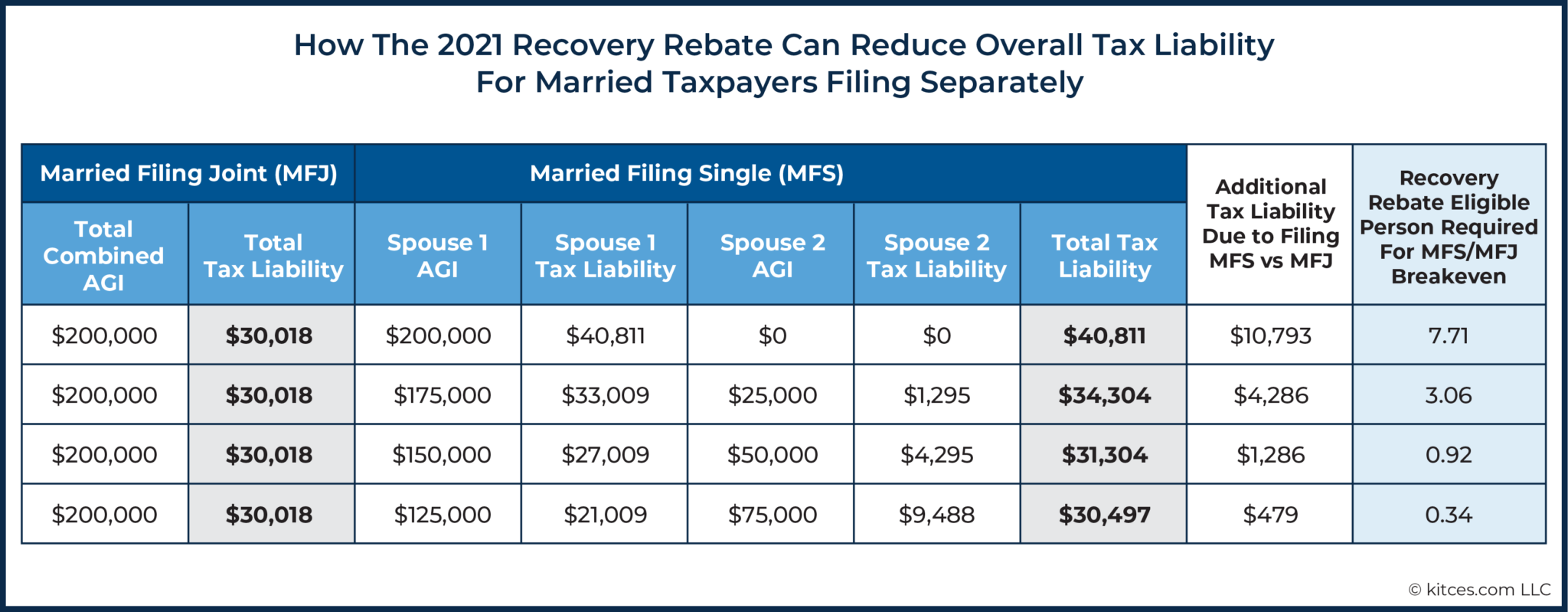

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

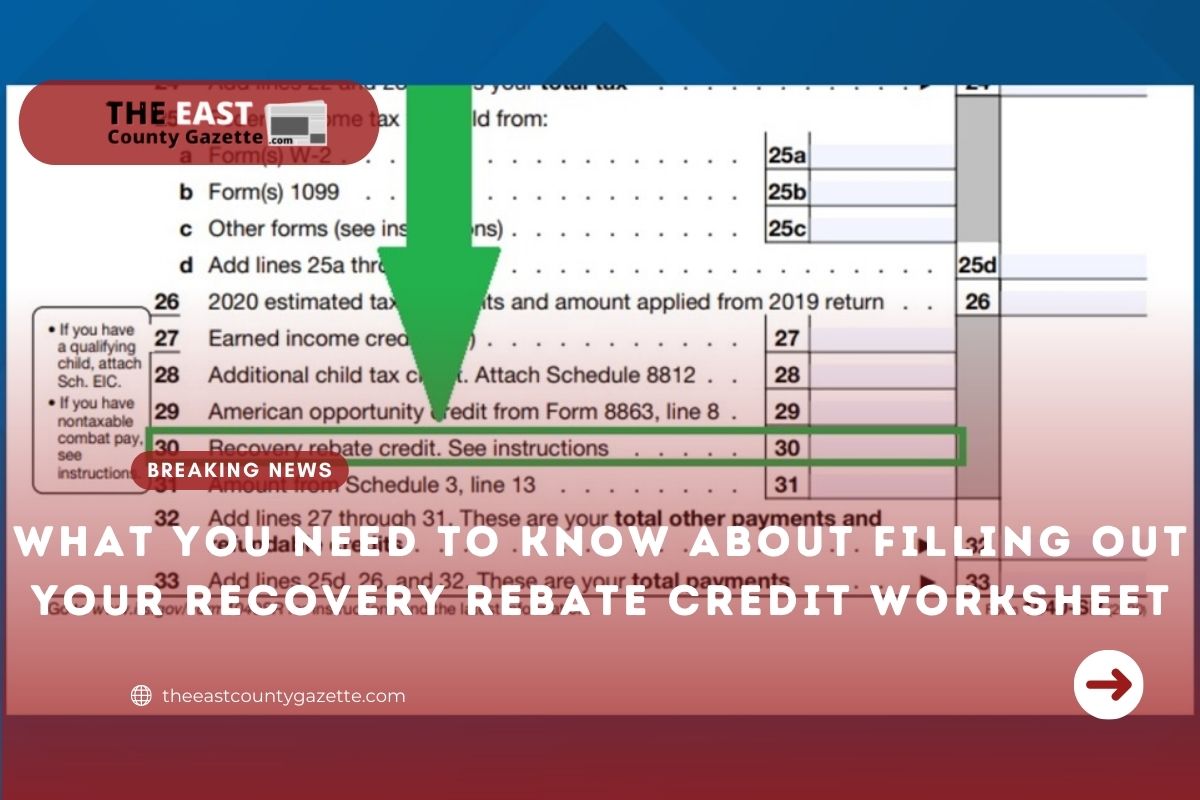

Recover y Rebate Credit Introduction The non filer form allows clients to quickly completea simplified tax return to register for the AdvCTC and claim any missed or incorrectly reduced 1st of2nd EIPs referred to as the Recovery Rebate Credit and is reported on line 30 of the 1040 The thirdEIP is not included in this calculation but will be Last updated October 12 2022 If you didn t get a third stimulus check or you only got a partial check then you certainly want to check out the recovery rebate tax credit when you file

The deadlines to file a return and claim the 2020 and 2021 credits are May 17 2024 and April 15 2025 respectively The Recovery Rebate Credit is a refundable credit for those who missed out on one or more Economic Impact Payments Economic Impact Payments also referred to as stimulus payments were issued in 2020 and 2021 Thursday January 25 2024 12 00 File HS 122 2024 PTC Calculator 1 xls 91 KB File Format Spreadsheet Tags Homestead Declaration Individuals Property Tax Credit

Recovery Rebate Credit Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Recovery-Rebate-Credit-Form-2023.png

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

https://www.irs.gov/coronavirus/economic-impact-payments

Sign in to your Online Account Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account

https://accountants.intuit.com/support/en-us/help-article/tax-credits-deductions/enter-stimulus-payments-figure-recovery-rebate/L2fDNZPKt_US_en_US

How to enter stimulus payments and figure the Recovery Rebate Credit in ProSeries Sign In Lacerte ProConnect ProSeries EasyACCT Quickbooks Online Accountant Intuit Tax Advisor Practice Management eSignature Hosting for Desktop Intuit Link Pay by Refund Quickbooks Discounts Learn support Account management E File Get ready for next year

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

The Recovery Rebate Credit Calculator ShauntelRaya

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet

What Is The Recovery Rebate Credit 2023 Detailed Information

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For People Moving Overseas And

Recovery Rebate Credit 2024 Calculator - Tax guide Recovery Rebate Credit Updated for filing 2021 tax returns What is the Recovery Rebate Credit The Recovery Rebate Credit makes it possible for any eligible individual who did not receive an Economic Impact Payment also known as an EIP or stimulus payment to claim the missing amount on the following tax return