Recovery Rebate Credit 2024 Update Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

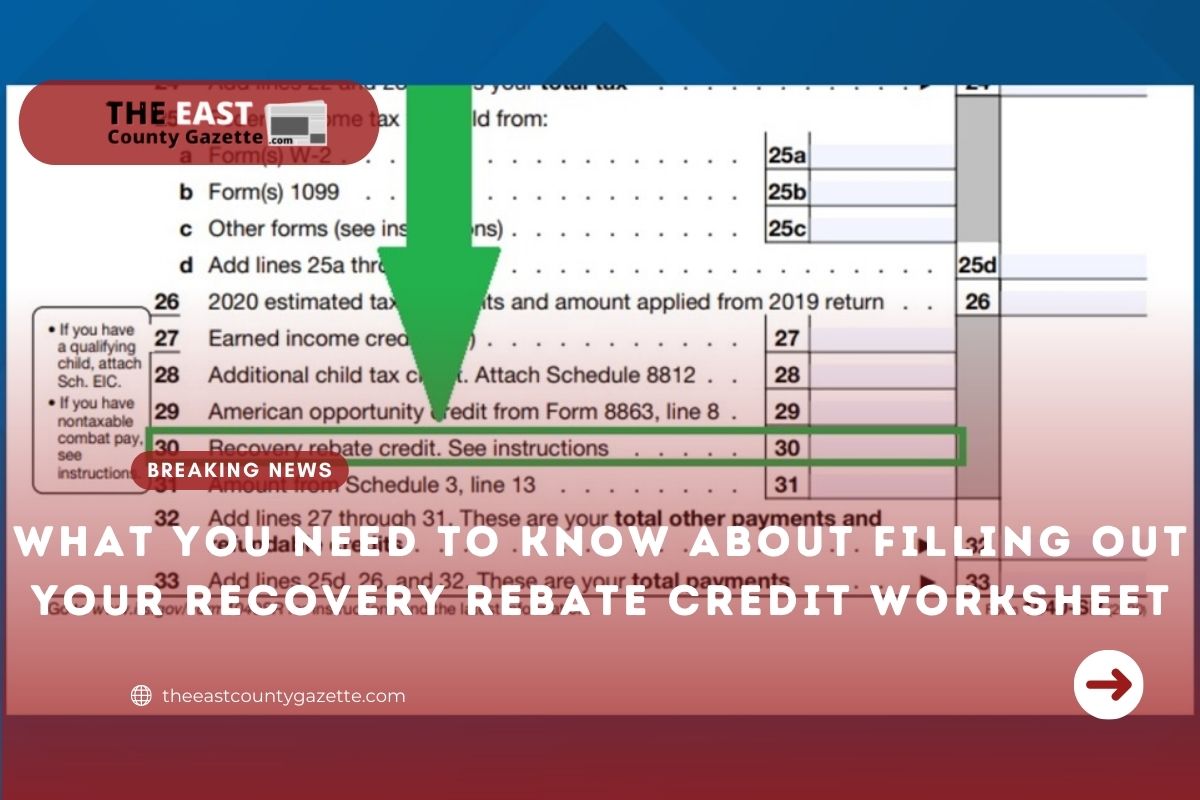

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline I know what you re thinking wasn t

Recovery Rebate Credit 2024 Update

Recovery Rebate Credit 2024 Update

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

Recovery Rebate Credit Here s How You Can Qualify For 1 400 Payments Marca

https://phantom-marca.unidadeditorial.es/d6b6bb8dde4d78d0f51f6bbc03766e1e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/01/31/16436644359926.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Sign in to your Online Account Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account January 25 2024 An Update to The Purchasing Power of American Households rather than waiting to claim a Recovery Rebate Credit on a tax return in 2022 the American Rescue Plan requires the IRS to establish an online portal for taxpayers to update relevant data for mid year payment adjustments for example the birth of a child

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers Get more info on the Recovery Rebate Credit Find updates from the IRS on Economic Impact Payments here Find Economic Impact Payment updates for Social Security SSDI Railroad Retirement and Veterans Affairs beneficiaries here Read more on Avoiding Economic Impact Payment Scams

Download Recovery Rebate Credit 2024 Update

More picture related to Recovery Rebate Credit 2024 Update

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

Recovery Rebate Credit 2023 Newborn Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2023-17.jpg

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

While federal stimulus payments might have ended there are still rebates on the table for taxpayers in 2024 The focus has shifted to economic recovery and additional stimulus checks are January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020 The initial stimulus payment provided up to 1 200 per qualifying adult and up to 500 per qualifying dependent Most of these payments went out to recipients in mid 2020

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit.jpg

The Recovery Rebate Credit Calculator ShauntelRaya

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

https://www.newsweek.com/will-there-new-stimulus-payment-2024-rebate-1856477

Residents should be eligible based on their 2023 2024 property taxes if their property qualifies as a homestead and they meet other criteria The amount available depends on several factors but

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Santa Barbara Tax Products Group

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit 2023 2024 Credits Zrivo

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet

What Is The Recovery Rebate Credit 2023 Detailed Information

Recovery Rebate Credit 2024 Update - If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers