Recovery Rebate Credit Adjusted Refund Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit amount will be reduced if the adjusted gross income AGI amount is less than these amounts above but is more than Web 10 d 233 c 2021 nbsp 0183 32 A11 The 2020 Recovery Rebate Credit has the same adjusted gross income limitations as the first and second Economic Impact Payments Your 2020

Recovery Rebate Credit Adjusted Refund

Recovery Rebate Credit Adjusted Refund

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

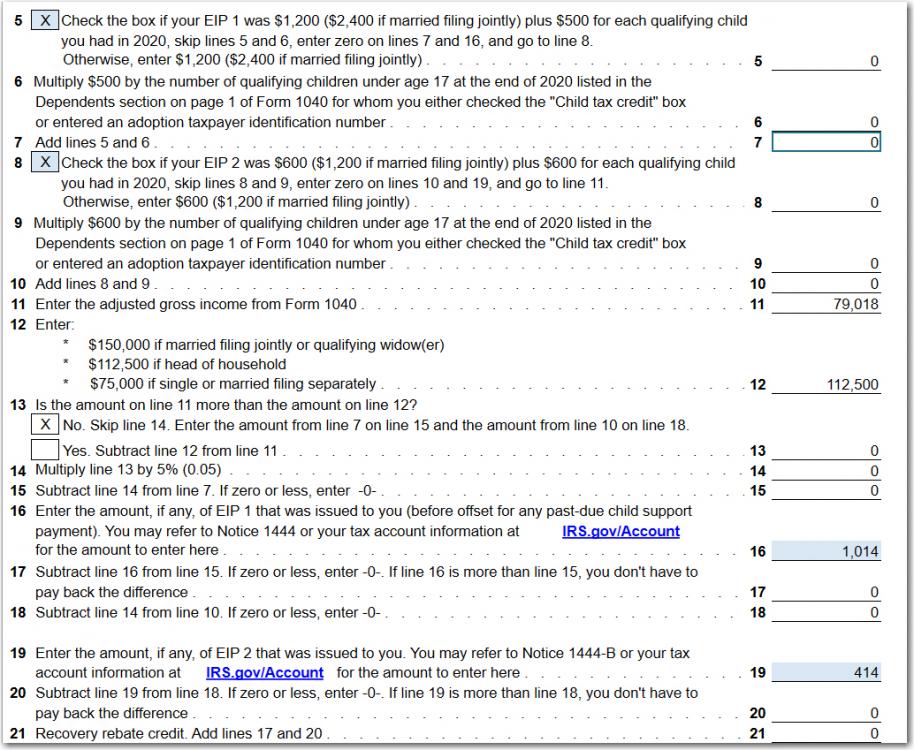

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

What Is A Recovery Refund Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/who-gets-recovery-rebate-credit.jpg

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web 3 sept 2021 nbsp 0183 32 Adjusted Refunds Due to Recovery Rebate Credit Carrie Houchins Witt CFP 174 EA Carrie Houchins Witt Many clients have received letters from the IRS

Web 9 sept 2022 nbsp 0183 32 Recovery Rebate credits are distributed to taxpaying taxpayers who are eligible in advance This means that you don t need to adjust the amount of your refund Web 2 janv 2023 nbsp 0183 32 Tax Refund Adjusted Recovery Rebate Credit January 2 2023 by tamble Tax Refund Adjusted Recovery Rebate Credit The Recovery Rebate offers

Download Recovery Rebate Credit Adjusted Refund

More picture related to Recovery Rebate Credit Adjusted Refund

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-third-stimulus-stimulusinfoclub.png?w=1370&ssl=1

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 8 mars 2023 nbsp 0183 32 Recovery Rebate Credit Refund March 8 2023 by tamble Recovery Rebate Credit Refund The Recovery Rebate offers taxpayers the opportunity to Web Recovery Rebate Credit The IRS adjusted the return for the manual entries you made for the Recovery Rebate Credit The IRS will reconcile filed returns with the first and

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 8 juin 2022 nbsp 0183 32 The Internal Revenue Service is sending out notices to tax filers who made mistakes claiming that they were owed extra stimulus cash through the recovery rebate

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit amount will be reduced if the adjusted gross income AGI amount is less than these amounts above but is more than

Recovery Rebate Credit Worksheet 2020 Ideas 2022

The Recovery Rebate Credit Calculator MollieAilie

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

Recovery Rebate Credit Form Printable Rebate Form

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Stimulus Checks From The Government Explained Vox Recovery Rebate

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Adjusted Refund - Web 2 janv 2023 nbsp 0183 32 Tax Refund Adjusted Recovery Rebate Credit January 2 2023 by tamble Tax Refund Adjusted Recovery Rebate Credit The Recovery Rebate offers