Recovery Rebate Credit Amended Return Web 10 d 233 c 2021 nbsp 0183 32 The IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return You can use the Interactive Tax Assistant Should I File an Amended Return to help determine if you should amend your original tax return

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Recovery Rebate Credit Amended Return

Recovery Rebate Credit Amended Return

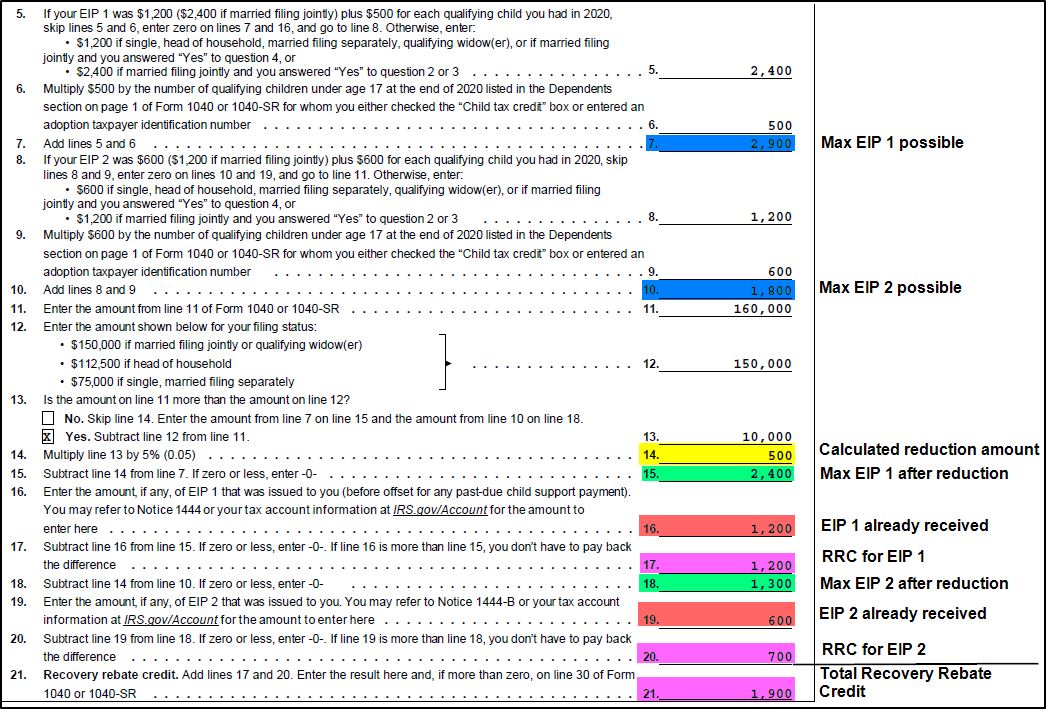

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

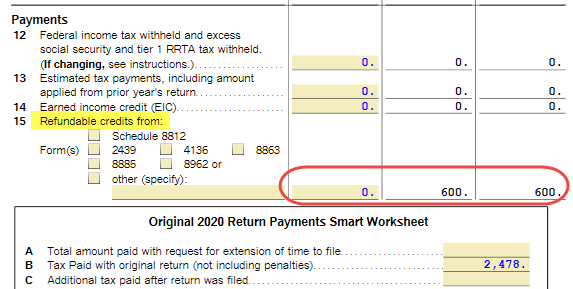

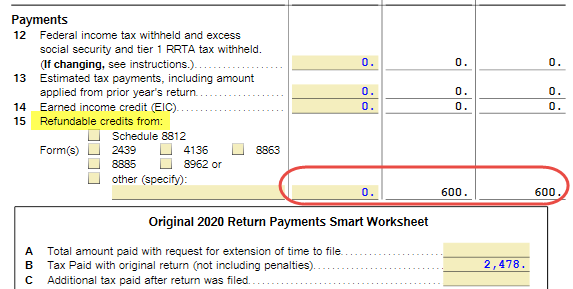

Recovery Rebate Credit Worksheet Tax Guru Ker Tetter Letter Recovery

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-on-amended-return.png

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Web 13 janv 2022 nbsp 0183 32 If your 2021 tax return has been processed and you didn t claim the credit on your return but are eligible for it you must file an amended return to claim the credit See the 2021 Recovery Rebate Credit FAQs Topic G Correcting issues after the 2021 tax return is filed Web 18 f 233 vr 2021 nbsp 0183 32 CatinaT1 Expert Alumni If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery Rebate Credit You ll need to amend your return to include the Recovery Rebate Credit

Web Income limitations changed this year s Recovery Rebate Credit fully reduces to 0 more quickly once your adjusted gross income AGI exceeds the income threshold How do I know if I m eligible to claim the tax credit Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate

Download Recovery Rebate Credit Amended Return

More picture related to Recovery Rebate Credit Amended Return

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

The Recovery Rebate Credit Calculator ShauntelRaya

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax Return or Form 1040 SR Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how we sent your Payment Where s My Refund An online tool that will track your tax refund Online Payment Agreements Apply for a payment plan to pay your balance over time

Web 8 juin 2022 nbsp 0183 32 The Internal Revenue Service is sending out notices to tax filers who made mistakes claiming that they were owed extra stimulus cash through the recovery rebate credit on their 2021 federal Web 6 avr 2021 nbsp 0183 32 Thus far the IRS has issued 2 5 million letters relating to issues with the Recovery Rebate Credit That s 10 4 of almost 24 million individual e filed tax returns received that claimed this

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/af2544cc-cc99-4803-9277-be1c0c86ef28.default.PNG

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 The IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return You can use the Interactive Tax Assistant Should I File an Amended Return to help determine if you should amend your original tax return

https://www.irs.gov/pub/taxpros/fs-2022-27.pdf

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet 2020 Ideas 2022

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

How Do I Claim The Recovery Rebate Credit On My Ta

How Do I Claim The Recovery Rebate Credit On My Ta

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Amended Return - Web 18 f 233 vr 2021 nbsp 0183 32 CatinaT1 Expert Alumni If you did not receive your first and or second stimulus payment or if the amount received is not correct you can claim it on your 2020 tax return as the Recovery Rebate Credit You ll need to amend your return to include the Recovery Rebate Credit