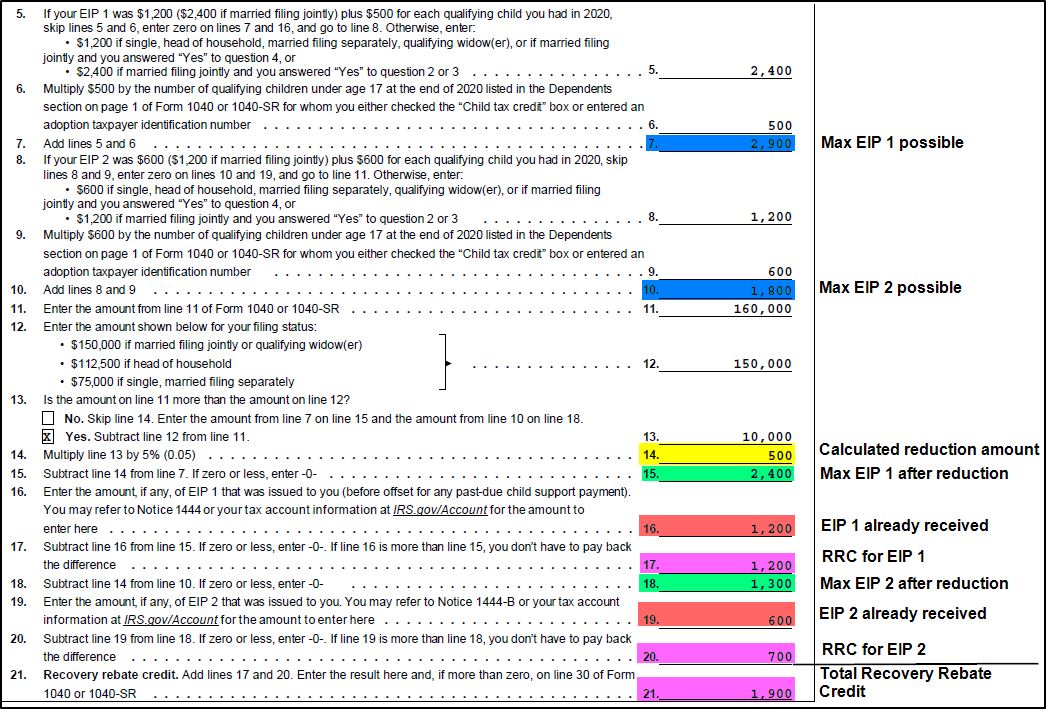

Recovery Rebate Credit Income Phase Out Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted

Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Recovery Rebate Credit Income Phase Out

Recovery Rebate Credit Income Phase Out

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

The Recovery Rebate Credit Explained Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/03/Recovery-Rebate.jpg

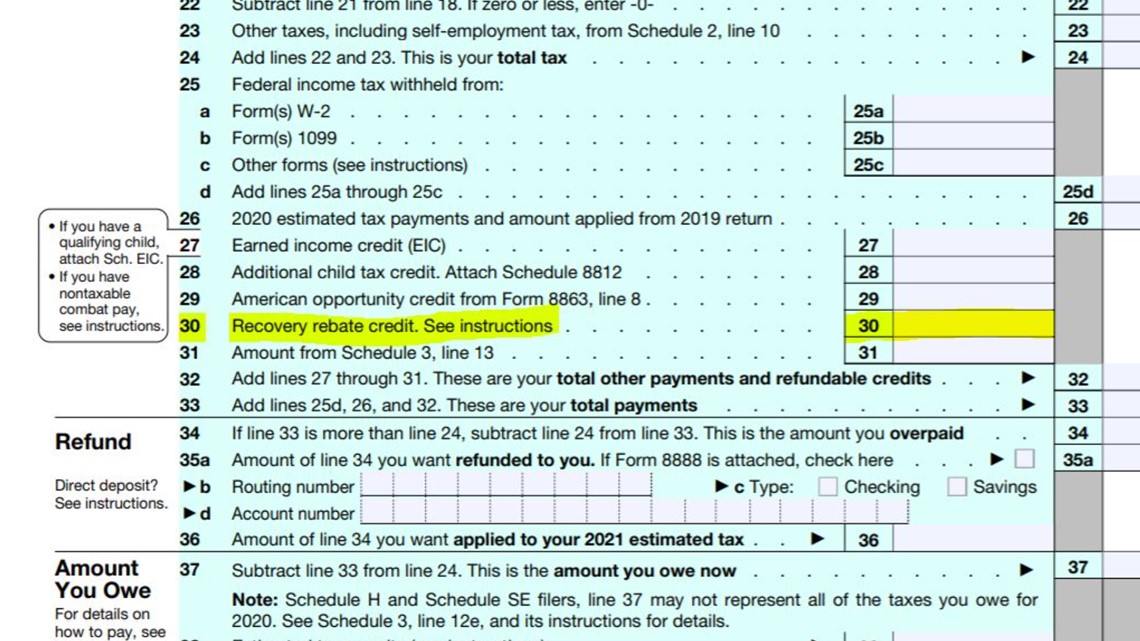

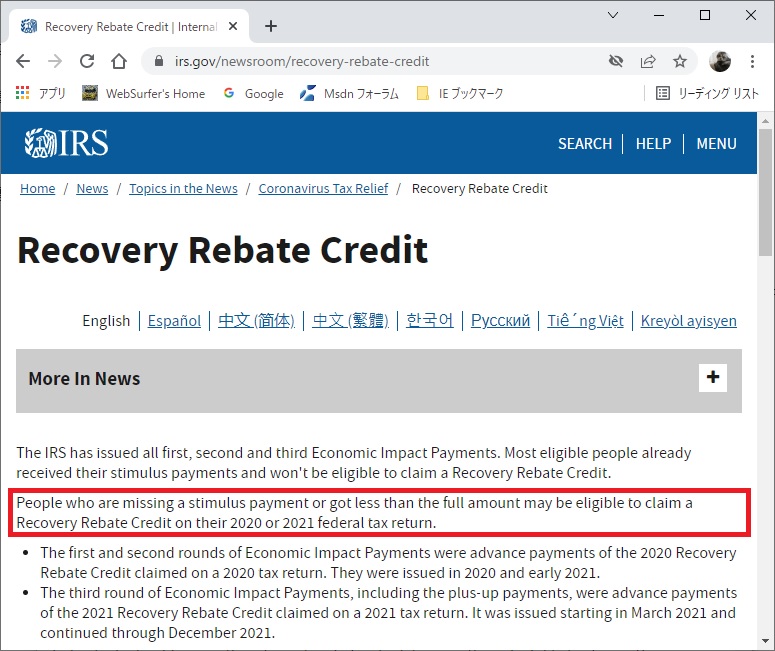

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit Wcnc

https://media.wcnc.com/assets/WCNC/images/7710c714-dfb9-48c1-b286-e0823fd4abe6/7710c714-dfb9-48c1-b286-e0823fd4abe6_1140x641.jpg

Web 20 d 233 c 2022 nbsp 0183 32 It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Web 28 avr 2021 nbsp 0183 32 The maximum potential amount of an individual s 2021 Recovery Rebate is equal to 1 400 times the number of eligible individuals which includes the taxpayer s Web In addition anyone who didn t receive a first or second Economic Impact Payment that is EIP1 or EIP 2 or got less than the full amounts can claim the Recovery Rebate Credit

Download Recovery Rebate Credit Income Phase Out

More picture related to Recovery Rebate Credit Income Phase Out

Learn About The Recovery Rebate Credit ATC Income Tax

https://www.atcincometax.com/wp-content/uploads/2021/01/Picture1-1.png

Phase Out For Recovery Rebate Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/what-is-the-recovery-rebate-credit-cd-tax-financial-57.png

2020 Recovery Rebate Credit FAQs Updated Again Edmonds Income Tax

https://edmondstax.com/wp-content/uploads/2022/04/2020-recovery-rebate-credit-faqs-updated-again.png

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 30 mars 2022 nbsp 0183 32 Payments were phased out for those with incomes above those levels and cut off completely for individuals with 80 000 in adjusted gross income heads of

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 10 d 233 c 2021 nbsp 0183 32 IRS Guidance Media Contacts IRS Statements and Announcements These updated FAQs were released to the public in Fact Sheet 2022 26 PDF April 13 2022 If

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Credit Karma Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/credit-karma-tax-income-limit-taxw.png

https://www.taxpayeradvocate.irs.gov/covid-19-home/3rd-eip-and-2021-rrc

Web The 2021 RRC amount was 1 400 or 2 800 in the case of a joint return plus an additional 1 400 per each dependent of the taxpayer for all U S residents with adjusted

https://www.journalofaccountancy.com/news/2022/jan/faqs-calculation...

Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

How Do I Claim The Recovery Rebate Credit On My Ta

All Posts Tagged IRS

How To Claim My Stimulus Check For My Newborn Do You Qualify For A

Track Your Recovery Rebate With This Worksheet Style Worksheets

Recovery Rebate Credit Phase Out 2022 Recovery Rebate

Recovery Rebate Credit Phase Out 2022 Recovery Rebate

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

If The Stimulus Recovery Rebate Credit Isn t Income Why Do I Have To

Recovery Rebate Credit Won t Be Applied To Past due Federal Income Tax

Recovery Rebate Credit Income Phase Out - Web In addition anyone who didn t receive a first or second Economic Impact Payment that is EIP1 or EIP 2 or got less than the full amounts can claim the Recovery Rebate Credit