Recovery Rebate Credit Is Calculated Using What Form Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will help individuals determine if they are eligible to claim the 2020 or 2021 Recovery Rebate Credit for missing stimulus payments

When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR Instructions can help you determine if you may be eligible to claim a Recovery Rebate Credit Both Form 1040 and Form 1040 SR included a line specifically for the Recovery Rebate Credit If you received a Recovery Rebate Credit it would have either increased the amount of your tax

Recovery Rebate Credit Is Calculated Using What Form

Recovery Rebate Credit Is Calculated Using What Form

https://phantom-marca.unidadeditorial.es/d6b6bb8dde4d78d0f51f6bbc03766e1e/resize/1320/f/jpg/assets/multimedia/imagenes/2022/01/31/16436644359926.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

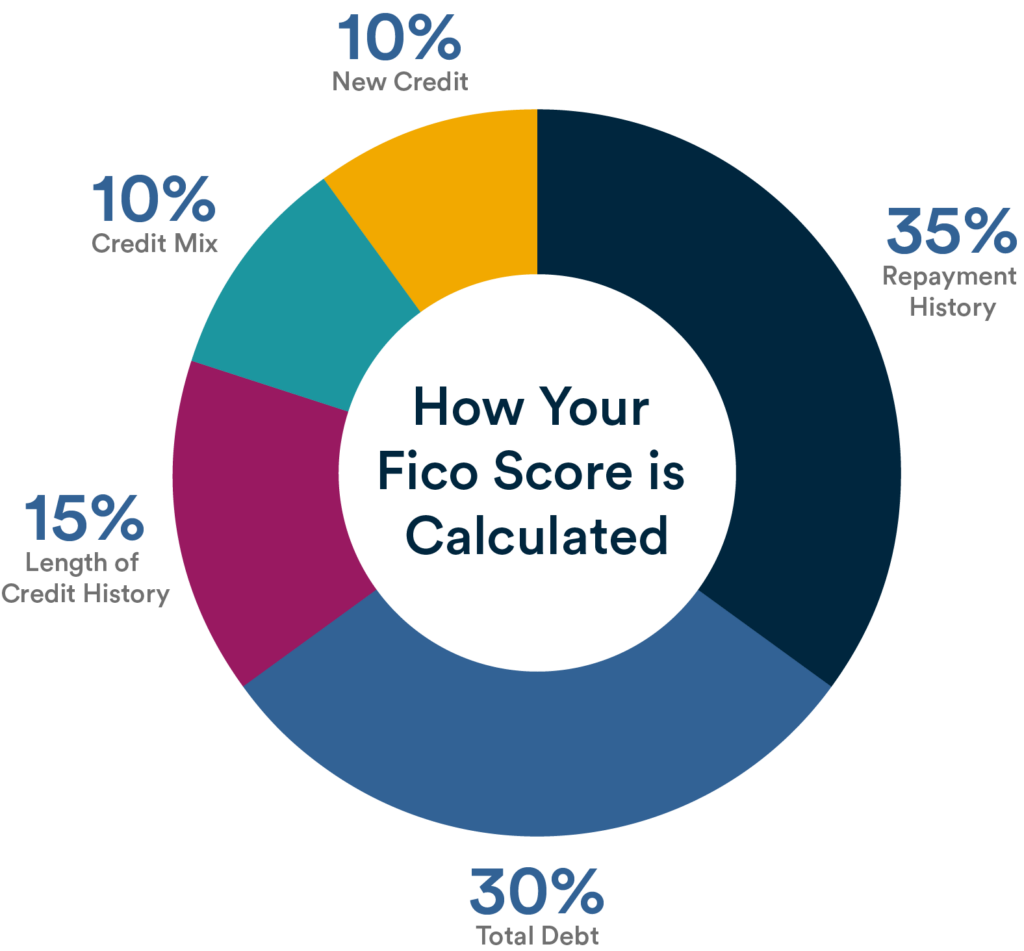

Your FICO Credit Score What Is It And Why Is It Important Laurel Road

https://www.laurelroad.com/wp-content/uploads/2021/11/How-Your-Fico-Score-is-Calculated-1024x951.png

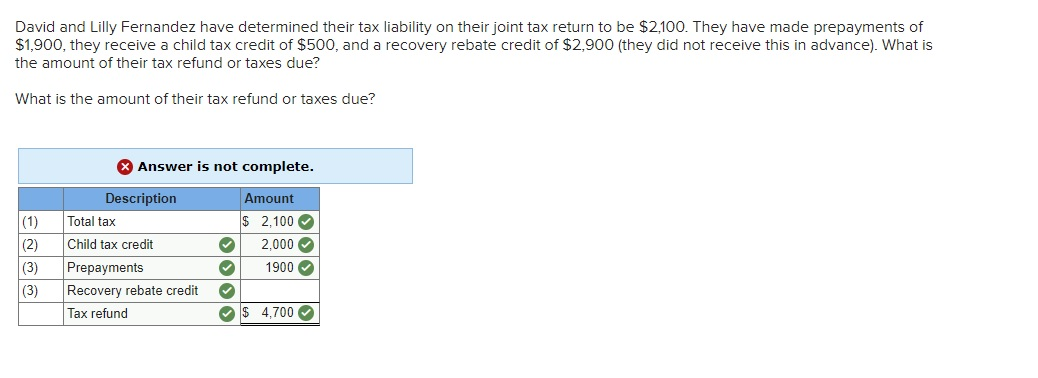

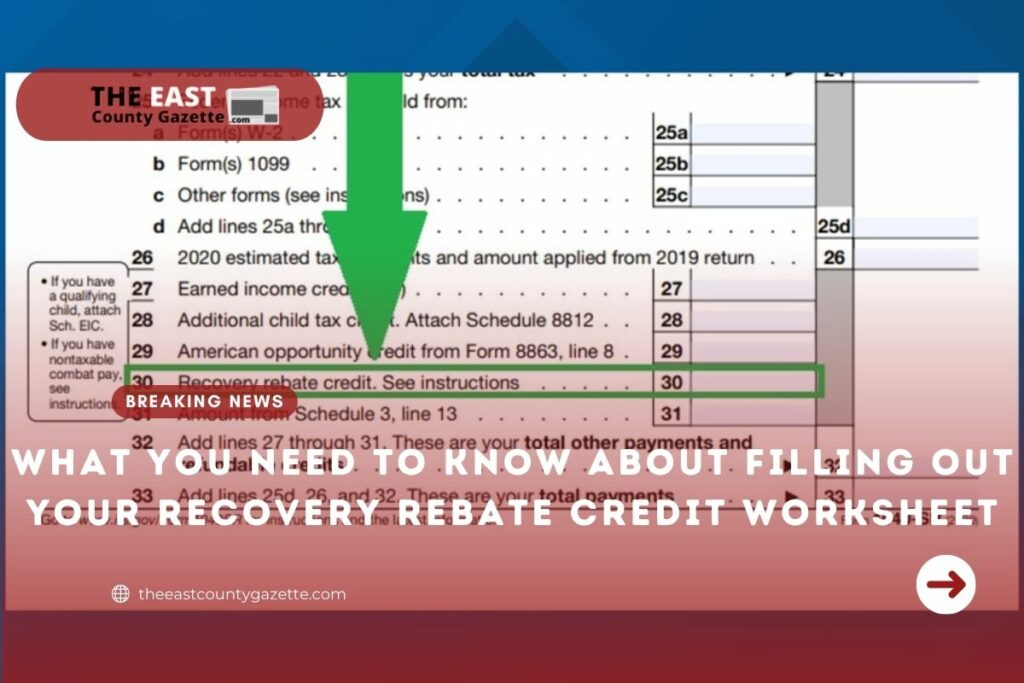

How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable If you are eligible and did not receive either or both EIPs you now must claim them as the RRC on the 2020 Form 1040 Individual Income Tax or Form 1040 SR U S Tax Return for Seniors

How is the Recovery Rebate Credit calculated The Recovery Rebate Credit amount is figured just like the third economic impact stimulus payment except that it uses your client s tax year 2021 information to determine eligibility and the amount rather than prior year returns The recovery rebate credit was paid out to eligible individuals in two rounds of advance payments called economic impact payments EIP You may be able to take this credit only if Your EIP 2 was less than 600 1 200 if married filing jointly plus 600 for each qualifying child you had in 2020

Download Recovery Rebate Credit Is Calculated Using What Form

More picture related to Recovery Rebate Credit Is Calculated Using What Form

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program Check the eligibility criteria to see if you qualify Then calculate the amount of the credit using tax software such as TurboTax or the 2020 tax forms Received veterans benefits Veterans receiving veterans benefits that meet all other

When filing your tax return you will use Line 30 of Form 1040 or Form 1040 SR to claim the Recovery Rebate Credit You will find instructions for how to calculate the credit in the instructions for either form If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

https://www.irs.gov › newsroom › recovery-rebate-credit

Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will help individuals determine if they are eligible to claim the 2020 or 2021 Recovery Rebate Credit for missing stimulus payments

https://www.irs.gov › newsroom

When calculating the 2020 Recovery Rebate Credit using tax prep software or the 2020 Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR Instructions can help you determine if you may be eligible to claim a Recovery Rebate Credit

How To Calculate Recovery Rebate Credit 2023 Rebate2022

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

How Is Rebate Recovery Credit Calculated Leia Aqui What Determines

Step By Step How To Fill Out The Recovery Rebate Credit Worksheet

What Is The Recovery Rebate Credit And Do You Qualify The

You Can STILL Claim Your 1 400 Stimulus Check With The Recovery Rebate

You Can STILL Claim Your 1 400 Stimulus Check With The Recovery Rebate

What You Need To Know About Filling Out Your Recovery Rebate Credit

Recovery Rebate Credit Questions Answers

How To Calculate My Credit Score The Fancy Accountant

Recovery Rebate Credit Is Calculated Using What Form - You report the final amount on Line 30 of your 2021 federal income tax return Form 1040 or Form 1040 SR The recovery rebate credit is a refundable credit which means you ll get a tax