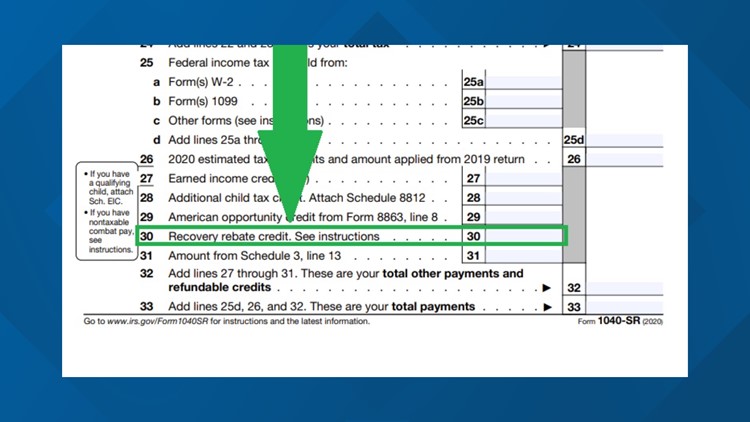

Recovery Rebate Credit On Line 30 Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

Web 13 janv 2022 nbsp 0183 32 If you entered an amount greater than 0 on line 30 and made a mistake on the amount the IRS will calculate the correct amount of the Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 2020 Form 1040 and Form 1040 SR instructions PDF can also help determine if you are eligible for the credit

Recovery Rebate Credit On Line 30

Recovery Rebate Credit On Line 30

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

https://dontmesswithtaxes.typepad.com/.a/6a00d8345157c669e20282e140c0ca200b-800wi

2022 Form 1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-form-1040-individual-income-tax-return-2022-nerdwallet-1.png

Web 10 d 233 c 2021 nbsp 0183 32 If you entered an amount on line 30 of your 2020 tax return but made a mistake in calculating the amount the IRS will calculate the correct amount of the Web 9 f 233 vr 2021 nbsp 0183 32 February 9 2021 at 6 40 p m EST President Donald Trump s name is seen on a stimulus check issued by the IRS AP Photo Eric Gay This will be a frustrating tax season for a lot of reasons

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

Download Recovery Rebate Credit On Line 30

More picture related to Recovery Rebate Credit On Line 30

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912448/large/line30.PNG?1612073698

How To Fill Out The Recovery Rebate Credit Line 30 Form 1040 Otosection

https://i0.wp.com/kb.erosupport.com/assets/img_5ffe30e292b09.png?resize=650,400

Web 17 mars 2022 nbsp 0183 32 In this video I discuss how to fill out the Recovery Rebate Credit worksheet The Recovery Rebate Credit is a tax credit that is calculated based on any 2021 Web Multiply 500 by the number of qualifying children under age 17 at the end of 2020 listed in the Dependents section on page 1 of Form 1040 or 1040 SR for whom you either

Web How do I get the recovery rebate credit to be calculated on Form 1040 line 30 Due to COVID 19 most eligible taxpayers received a third economic impact payment between Web 25 f 233 vr 2021 nbsp 0183 32 February 25 2021 Editor s Note This article was originally published on December 31 2020 Stimulus payments have been a critical lifeline for many

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/tax-implications-of-covid-19-passport-software-inc.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 Compute the 2021 Recovery Rebate Credit amount using tax preparation software or the line 30 worksheet found in 2021 Form 1040 and Form 1040 SR

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-h...

Web 13 janv 2022 nbsp 0183 32 If you entered an amount greater than 0 on line 30 and made a mistake on the amount the IRS will calculate the correct amount of the Recovery Rebate Credit

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Credit Printable Rebate Form

Norfolk s Leading Local News Weather Traffic Sports And More

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit On Line 30 - Web 1 f 233 vr 2022 nbsp 0183 32 Where is the Recovery Rebate Credit on the 1040 tax form The Recovery Rebate Credit is found on page two Line 30 of the 1040 tax form for 2021 Is the third