Recovery Rebate Credit Refund Delay Web 13 janv 2022 nbsp 0183 32 A4 Your 2021 tax refund will include your 2021 Recovery Rebate Credit To claim any refund you generally must file your tax return within 3 years from the date the

Web 13 avr 2022 nbsp 0183 32 If your calculation does not match the IRS calculation the processing of the return will be delayed the 2020 Recovery Rebate Credit amount will be adjusted to Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information

Recovery Rebate Credit Refund Delay

Recovery Rebate Credit Refund Delay

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-is-my-refund-2021-refund-delay-explained-by-irs-enrolled-agent.jpg?fit=1280%2C720&ssl=1

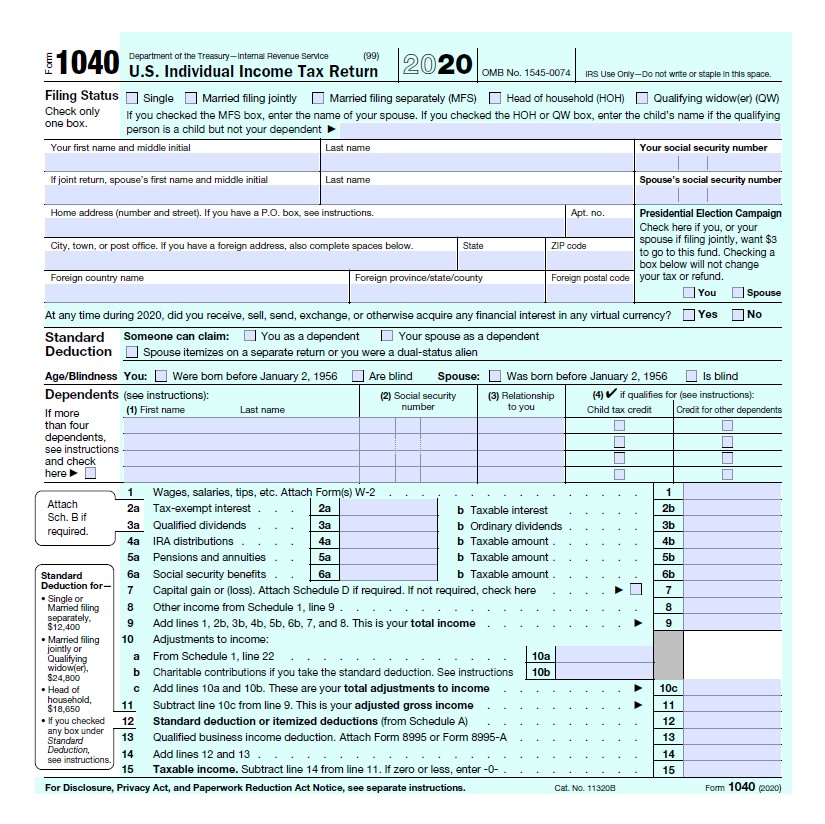

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Tax Refund Adjusted Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/adjusted-refunds-due-to-recovery-rebate-credit-carrie-houchins-witt-1.jpg?resize=1024%2C390&ssl=1

Web 24 f 233 vr 2023 nbsp 0183 32 Why was my refund adjusted after claiming the Recovery Rebate Credit SOLVED by TurboTax 690 Updated February 24 2023 The IRS will adjust your Web 13 janv 2022 nbsp 0183 32 The IRS says most refunds are issued within 21 days of the return being filed But this year it could take longer than that for a few reasons

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web FS 2022 26 April 2022 This Fact Sheet revises the frequently asked questions FAQs for the 2020 Recovery Rebate Credit Frequently Asked Questions FAQs This update

Download Recovery Rebate Credit Refund Delay

More picture related to Recovery Rebate Credit Refund Delay

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

What Is A Recovery Refund Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/who-gets-recovery-rebate-credit.jpg

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/2a696912-02a3-4d66-8e1c-7e0b97b75688.default.png

Web 12 oct 2022 nbsp 0183 32 Simply claiming the recovery rebate credit won t by itself delay the processing of your tax return or any tax refund However mistakes on your return Web However those who claimed the credit can expect to see delays in getting their refunds The delay is caused because of the amount of time it taking the IRS to confirm whether the taxpayer claiming the Recovery Rebate

Web 6 avr 2021 nbsp 0183 32 The Internal Revenue Service is correcting plenty of mistakes that are being made after people plug in the wrong number for the Recovery Rebate Credit on their Web 21 d 233 c 2022 nbsp 0183 32 Heads of households will also see their recovery rebate refunds drop to 112 500 People who did not receive the full stimulus payments could be eligible to

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Federal Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040-5.jpg?fit=1140%2C641&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 A4 Your 2021 tax refund will include your 2021 Recovery Rebate Credit To claim any refund you generally must file your tax return within 3 years from the date the

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-e...

Web 13 avr 2022 nbsp 0183 32 If your calculation does not match the IRS calculation the processing of the return will be delayed the 2020 Recovery Rebate Credit amount will be adjusted to

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Cares Act Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

1040 Line 30 Recovery Rebate Credit Recovery Rebate

When Can You Expect Your Tax Refund To Arrive In 2021 Recovery Rebate

When Can You Expect Your Tax Refund To Arrive In 2021 Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Refund Delay Recovery Rebate

When To Anticipate My Tax Refund The 2023 Refund Calendar MicroTechr

Recovery Rebate Credit Refund Delay - Web 18 d 233 c 2022 nbsp 0183 32 There are several reasons why your Recovery Rebate could be delayed The most common cause for delay is due to a mistake made when claiming tax credit or