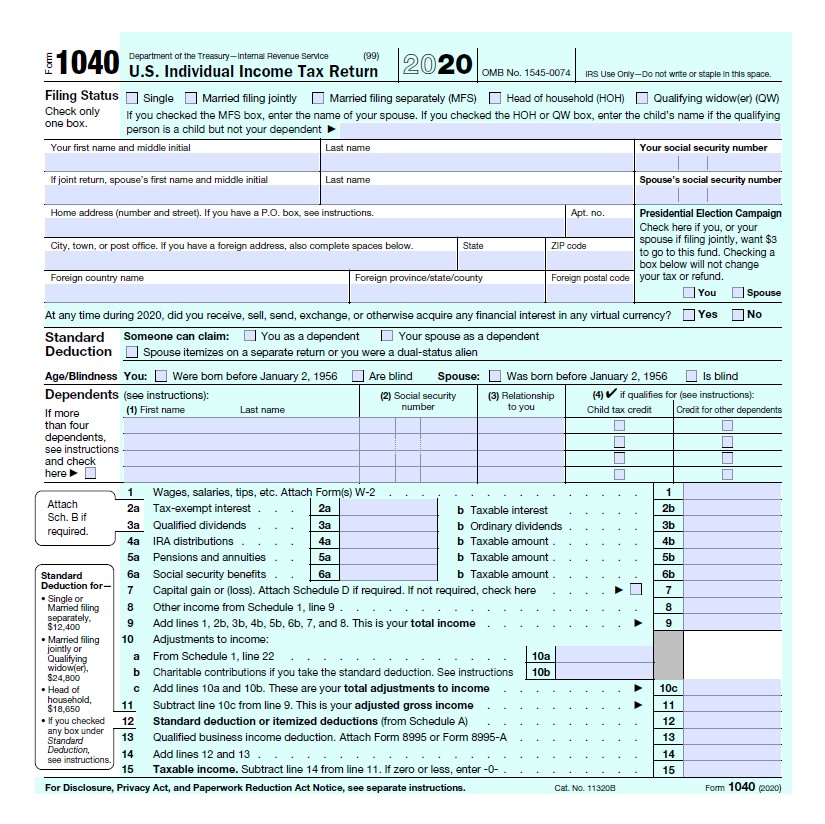

Recovery Rebate Credit Status Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Recovery Rebate Credit Status

Recovery Rebate Credit Status

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

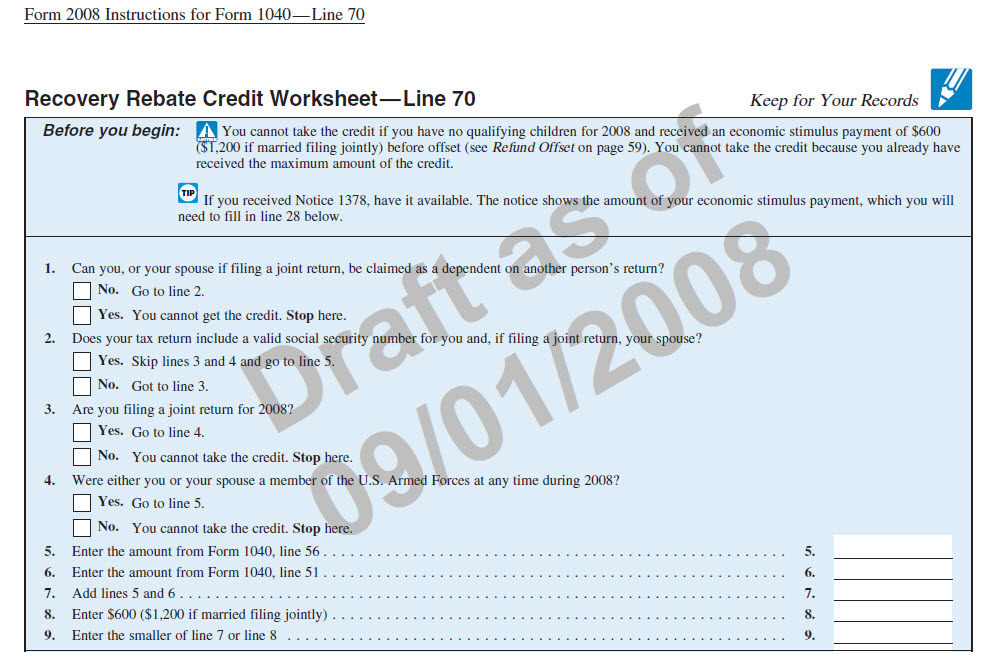

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is a Web 10 d 233 c 2021 nbsp 0183 32 If the IRS agrees to make a change to the amount of 2020 Recovery Rebate Credit you are owed and it results in a refund you may check the status of your refund

Download Recovery Rebate Credit Status

More picture related to Recovery Rebate Credit Status

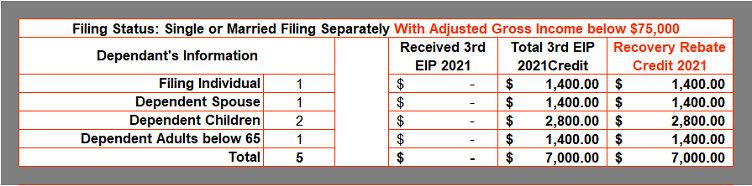

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/RRC-2021-Single-or-Married-Filing-Separately.png?is-pending-load=1

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/kb.erosupport.com/assets/img_5ffe32d18d56f.png

Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments Web The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020 These payments were referred to as Economic Impact Payments

Web 27 mai 2021 nbsp 0183 32 How can you check on the status of a missing stimulus payment It s easy to check the status of your third stimulus check through the Get My Payment tool You ll Web 29 mars 2021 nbsp 0183 32 This tax season a recovery rebate credit has been added to returns in order for people to file for any unpaid stimulus check funds But you need to send in a

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 Enter the amount in your tax preparation software or in the Form 1040 Recovery Rebate Credit Worksheet to calculate your credit Having this information will

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

Fill Free Fillable TheTaxBook PDF Forms Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Taxes Recovery Rebate Credit Recovery Rebate

1040 Recovery Rebate Credit Drake20

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

Recovery Rebate Credit Status - Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the