Recovery Rebate Delaying Tax Refund Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 24 f 233 vr 2023 nbsp 0183 32 SOLVED by TurboTax 690 Updated February 24 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or Web 20 d 233 c 2022 nbsp 0183 32 Your Recovery Rebate Credit on your 2020 tax return will reduce the amount of tax you owe for 2020 or be included in your tax refund Here s how eligible

Recovery Rebate Delaying Tax Refund

Recovery Rebate Delaying Tax Refund

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

When To Anticipate My Tax Refund The 2023 Refund Calendar MicroTechr

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/when-to-anticipate-my-tax-refund-the-2023-refund-calendar-microtechr.png?resize=658%2C1024&ssl=1

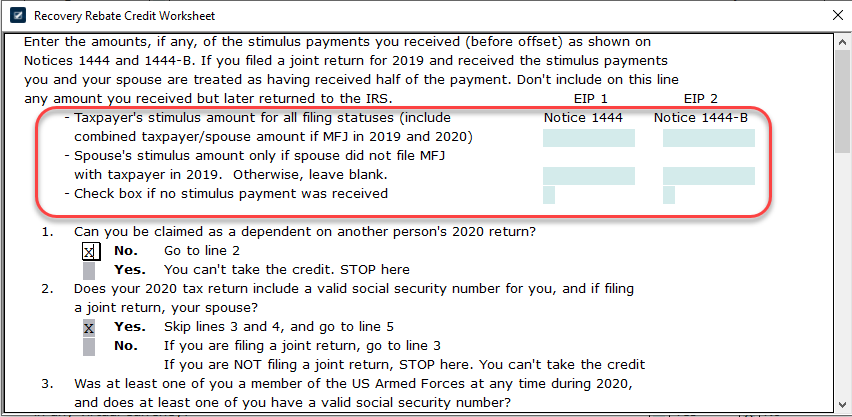

How Do I Claim The Recovery Rebate Credit On My Ta Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-example-studying-worksheets-53.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 30 d 233 c 2020 nbsp 0183 32 For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received

Web However those who claimed the credit can expect to see delays in getting their refunds The delay is caused because of the amount of time it taking the IRS to confirm whether the taxpayer claiming the Recovery Rebate Web 17 mai 2021 nbsp 0183 32 May 17 2021 6 41 AM MoneyWatch The IRS is falling behind in processing millions of income tax returns potentially delaying refunds for many Americans According to the Taxpayer Advocate

Download Recovery Rebate Delaying Tax Refund

More picture related to Recovery Rebate Delaying Tax Refund

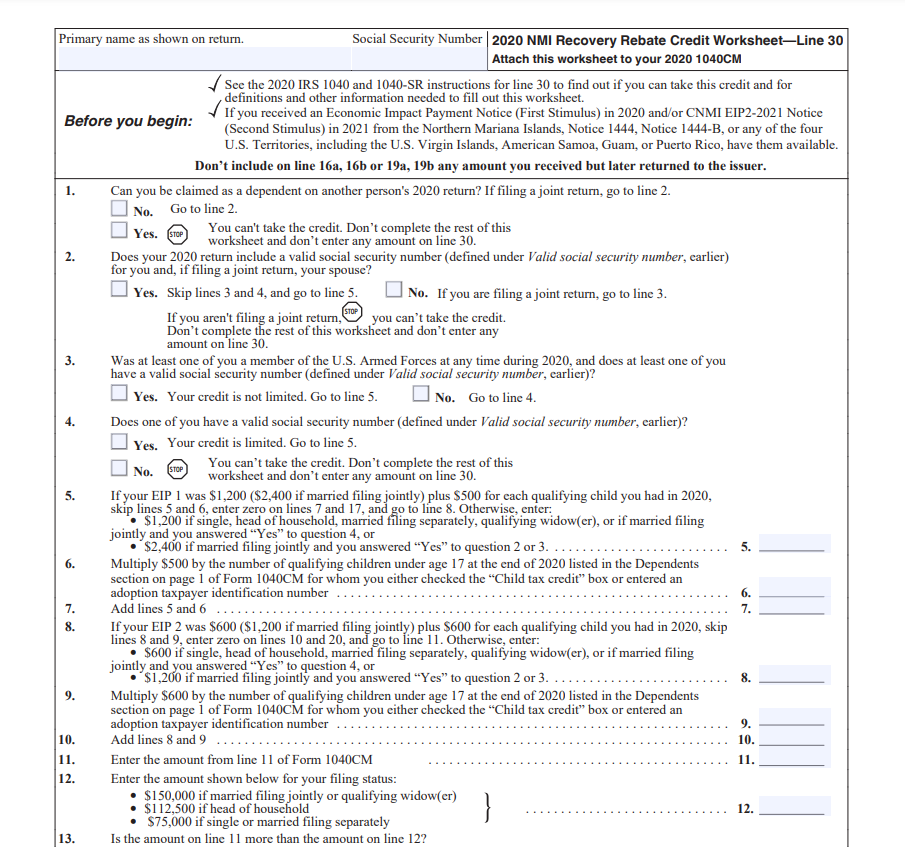

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

Web Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year Web 21 d 233 c 2022 nbsp 0183 32 There are many reasons that your recovery rebate may be delayed The most common reason is because you made a mistake when claiming the stimulus money

Web 1 d 233 c 2022 nbsp 0183 32 Observers sometimes refer to a quot tax rebate quot as a refund of taxpayer money after a retroactive tax decrease These measures are more immediate than tax refunds Web 26 mai 2023 nbsp 0183 32 The Recovery Rebate is available on federal income tax returns for 2021 If you re married couple who have two children and are tax dependent you could get as

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax...

Web 24 f 233 vr 2023 nbsp 0183 32 SOLVED by TurboTax 690 Updated February 24 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Rebate Credit Form Printable Rebate Form

How Do I Claim The Recovery Rebate Credit On My Ta

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

Recovery Rebate Credit 2020 Calculator KwameDawson

The Recovery Rebate Credit Calculator MollieAilie

Recovery Rebate Delaying Tax Refund - Web 3 mai 2023 nbsp 0183 32 CRA said it has recovered 237 million through offsets such as holding back tax refunds Gerry Campbell director of operations for Liberty Tax in Toronto said he s