Recovery Tax Deduction This reduction is commonly referred to as a clawback but is formally known as a recovery tax Your current global taxable income determines if you will pay the recovery tax If so it will be deducted in the

If you have to pay back part of your Old Age Security pension this year an appropriate amount will be deducted from your future OAS pension payments as a recovery tax This way you will Income Will Be Lower Request a Recovery Tax Reduction If you know your 2024 income will be substantially lower so that your clawback will be less or even zero you can complete Form T1213 OAS to request a reduction of the

Recovery Tax Deduction

Recovery Tax Deduction

https://vibrantfinserv.com/kb/wp-content/uploads/2023/06/34.Tax-deduction-for-PF-under-80C.jpg

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

Payroll Statutory Deductions And Reporting

https://docs.oracle.com/cd/E18727-01/doc.121/e13563/img/hr_451.gif

You may have had OAS recovery tax withheld from your 2024 OAS benefits The amount deducted is shown in box 22 of your 2024 T4A OAS slip Do not claim this amount on line When you file an Old Age Security Recovery Tax OASRI return and have a balance owing due to the OAS clawback the amount you owe typically needs to be repaid

The Old Age Security OAS clawback is another name for the OAS pension recovery tax It kicks in if your net annual income line 234 on your income tax return is above a threshold amount 90 997 for 2024 That change meant that many Canadians whose residence history would otherwise qualify them for full OAS benefits must repay some benefits received The mechanism through which that limitation of benefits was to be achieved

Download Recovery Tax Deduction

More picture related to Recovery Tax Deduction

100 Tax Deduction On Your Donation In Malaysia Jul 26 2021 Johor

https://cdn1.npcdn.net/image/16272778521a6ef50158b79f67207a9ee7fe2b2eb3.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

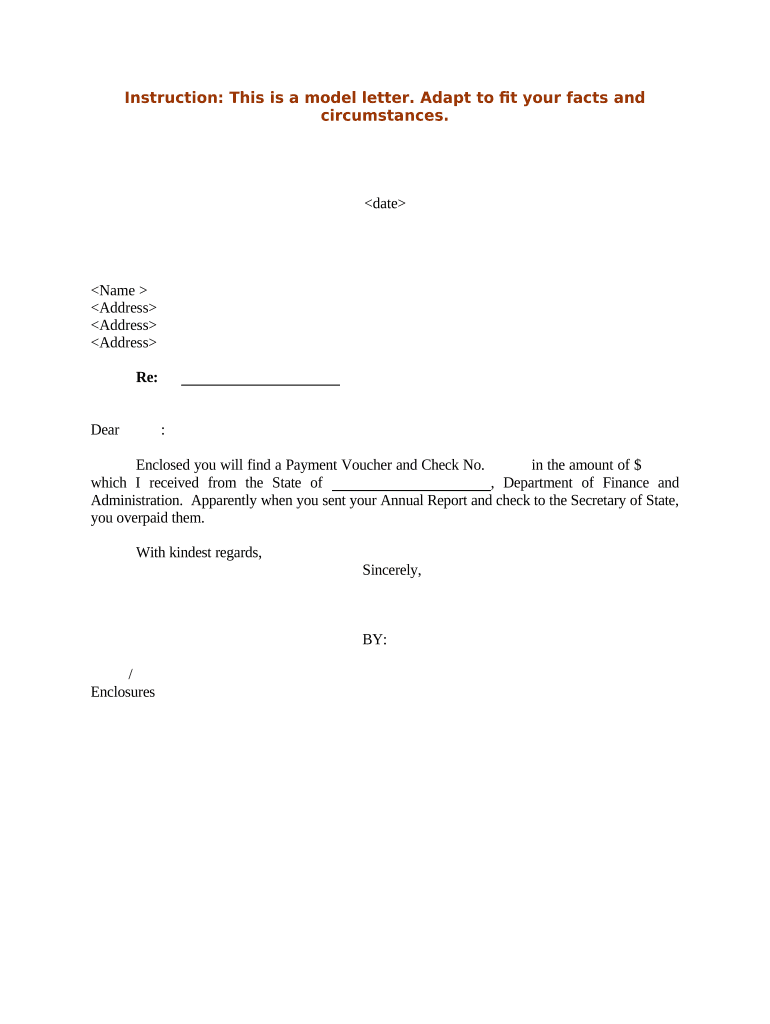

Sample Letter Of Overpayment Of Wages Form Fill Out And Sign

https://www.signnow.com/preview/497/328/497328319/large.png

New Recovery Tax Credit Offered For Employers Valley Recovery

https://valleyrecoveryandtreatment.com/wp-content/uploads/2019/04/AdobeStock_176848381-2048x1363.jpeg

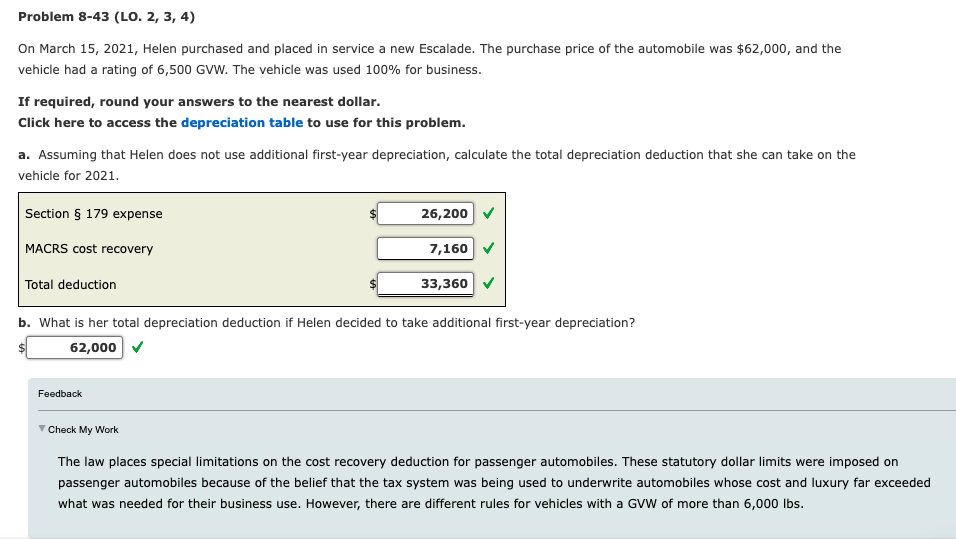

Provides a deduction for state and local and foreign taxes not previously described that were paid or accrued within the taxable year in carrying on any trade or business or an activity If you didn t claim the Recovery Rebate Credit on your 2021 tax return and were eligible you may receive a payment by direct deposit or check and a letter in January 2025

PAYE tax rate Rate of tax Annual earnings the rate applies to above the PAYE threshold Starter tax rate 19 Up to 2 827 Basic tax rate 20 From 2 828 to 14 921 A common approach to such cost recovery is to allow a deduction for a portion of the cost ratably over some period of years The U S system refers to such a cost recovery deduction as

Example Tax Deduction System For A Single Gluten free GF Item And

https://www.researchgate.net/profile/Julio-Bai/publication/274087526/figure/tbl1/AS:391861509345282@1470438472540/Example-tax-deduction-system-for-a-single-gluten-free-GF-item-and-calculations-for-tax.png

Tax Deduction Planner Graphic By Watercolortheme Creative Fabrica

https://www.creativefabrica.com/wp-content/uploads/2021/07/17/Tax-Deduction-Planner-Graphics-14848059-3.jpg

https://www.wealthsimple.com › en-ca › lear…

This reduction is commonly referred to as a clawback but is formally known as a recovery tax Your current global taxable income determines if you will pay the recovery tax If so it will be deducted in the

https://www.canada.ca › en › services › benefits › public...

If you have to pay back part of your Old Age Security pension this year an appropriate amount will be deducted from your future OAS pension payments as a recovery tax This way you will

A Look At The Tax Deduction Potential Of Strata Rates

Example Tax Deduction System For A Single Gluten free GF Item And

Tax Deductions Guide Sunlight Tax

Deduction Cartoons Illustrations Vector Stock Images 6664 Pictures

Kurzstudie Tax Deduction Scheme Belgien EUKI

Premium Photo Tax Deduction

Premium Photo Tax Deduction

What Will My Tax Deduction Savings Look Like The Motley Fool

What Are Pre tax Deductions Before Tax Deduction Guide

Solved Income Tax Procedure 1 Chapter 8 HW 5 Euclid Chegg

Recovery Tax Deduction - Commonly seen recoveries that can be excluded from income are recoveries of deductions related to itemized deductions such as state income tax and property tax refund However tax