Redundancy Pension Tax Free Lump Sum Web How much is your redundancy payment and how much of it is taxable for pensions purposes You can only contribute parts of your redundancy payment that qualify as

Web 12 Juni 2023 nbsp 0183 32 SCSB2 Signing the waiver and getting a higher tax free lump sum now but with no tax free pension lump sum now or later Web 10 Nov 2023 nbsp 0183 32 Any part of a lump sum redundancy payment that comes from salary payment in lieu of notice or holiday pay does count as relevant UK earnings The first

Redundancy Pension Tax Free Lump Sum

Redundancy Pension Tax Free Lump Sum

https://moneycube.ie/wp-content/uploads/2020/07/dimitry-anikin-zcZEsKiwFyo-unsplash.jpg

Is My Pension Lump Sum Tax free Nuts About Money

https://global-uploads.webflow.com/5efd08d11ce84361c2679ce1/627bc76e504d3aa0c4b4119e_pension-tax-free-lump-sum.png

Document 14841860

https://s2.studylib.net/store/data/014841860_1-63a9bb7aaba44d736d7c16e9178bbe3e-768x994.png

Web From 6 April 2023 the amount of tax free lump sum you can take is 25 of your pension pot up to a maximum of 25 of the standard lifetime allowance The current lifetime Web 7 Jan 2021 nbsp 0183 32 People who have tapped pots for any amount over and above their 25 per cent tax free lump sum are only able to put away 163 4 000 a year and still automatically qualify for tax relief from

Web If we re making an employee redundant do we have to take pension contributions from their redundancy pay The tax free redundancy payment up to 163 30 000 ie the lump Web Vor 2 Tagen nbsp 0183 32 This will limit the total value of tax free cash which can be taken in relation to certain specific authorised payments pension commencement lump sums PCLSs

Download Redundancy Pension Tax Free Lump Sum

More picture related to Redundancy Pension Tax Free Lump Sum

Cashing In Your Pension At 50 Ireland National Pension Helpline

https://nationalpensionhelpline.ie/wp-content/uploads/2023/01/Reasons-a-Deferred-member-should-transfer-out-of-a-DB-pension.jpg

Should You Take Your Pension Tax free Lump Sum To Kickstart Retirement

https://berryandoak.com/wp-content/uploads/2023/09/2.jpg

Should You Take 25 Tax Free Lump Sum From Pension 230

https://informeddecisions.ie/wp-content/uploads/2022/07/irina-jKh453Idils-unsplash.jpg

Web Lump sum payments received from an employer on retirement or redundancy may be taxable However there is a basic tax free exemption of 10 160 plus 765 for each Web Vor 2 Tagen nbsp 0183 32 It means that when considering what anti avoidance legislation may be introduced there are two separate periods to consider before and after April 2024 The

Web For example you may get a redundancy package that includes things that you have a contractual right to receive such as holiday pay for holiday you have built up but not Web 7 Okt 2020 nbsp 0183 32 Statutory and enhanced redundancy payments are free of tax and NI for the first 163 30 000 and has no effect on the tax rates paid on other income The excess above

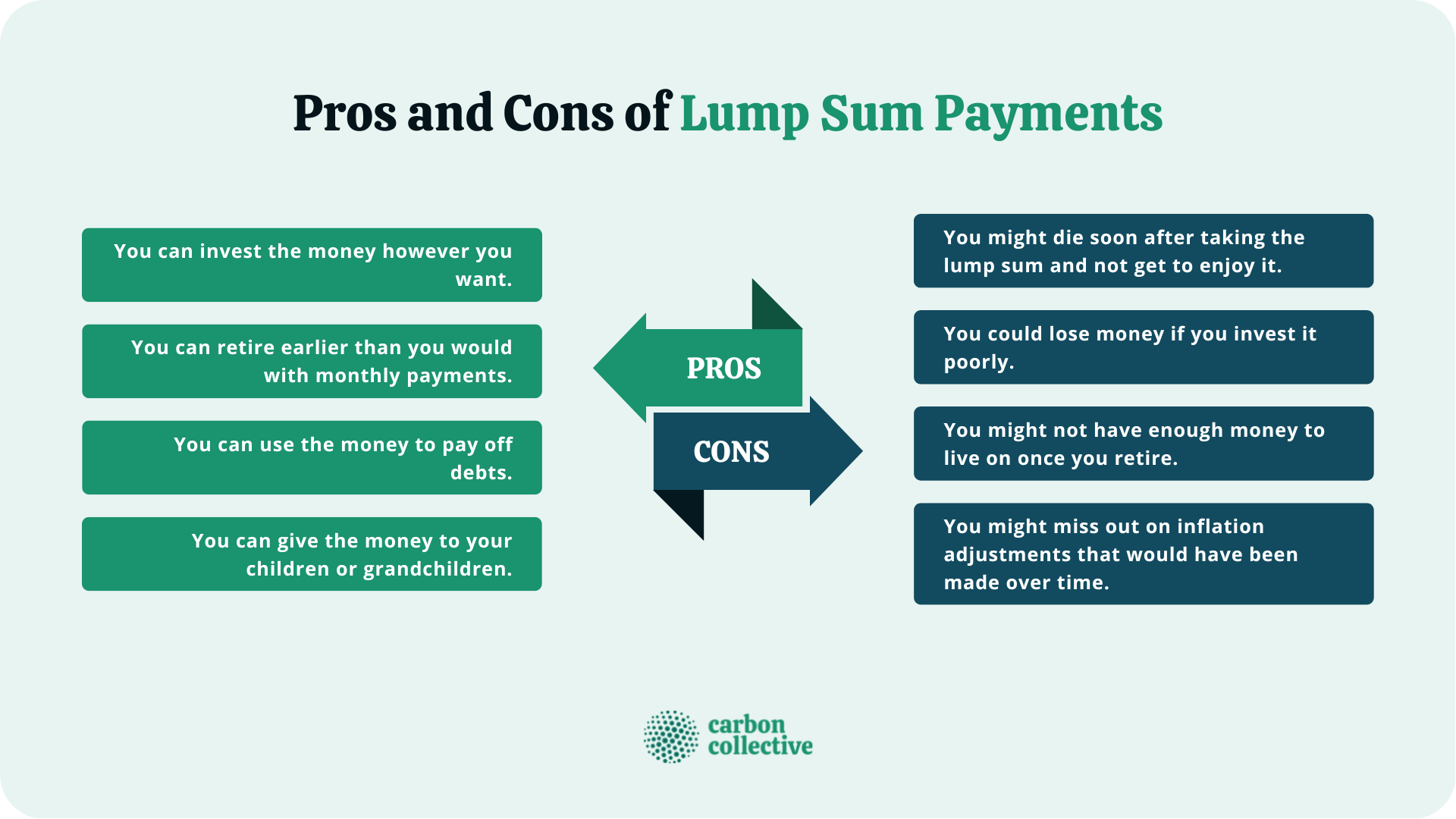

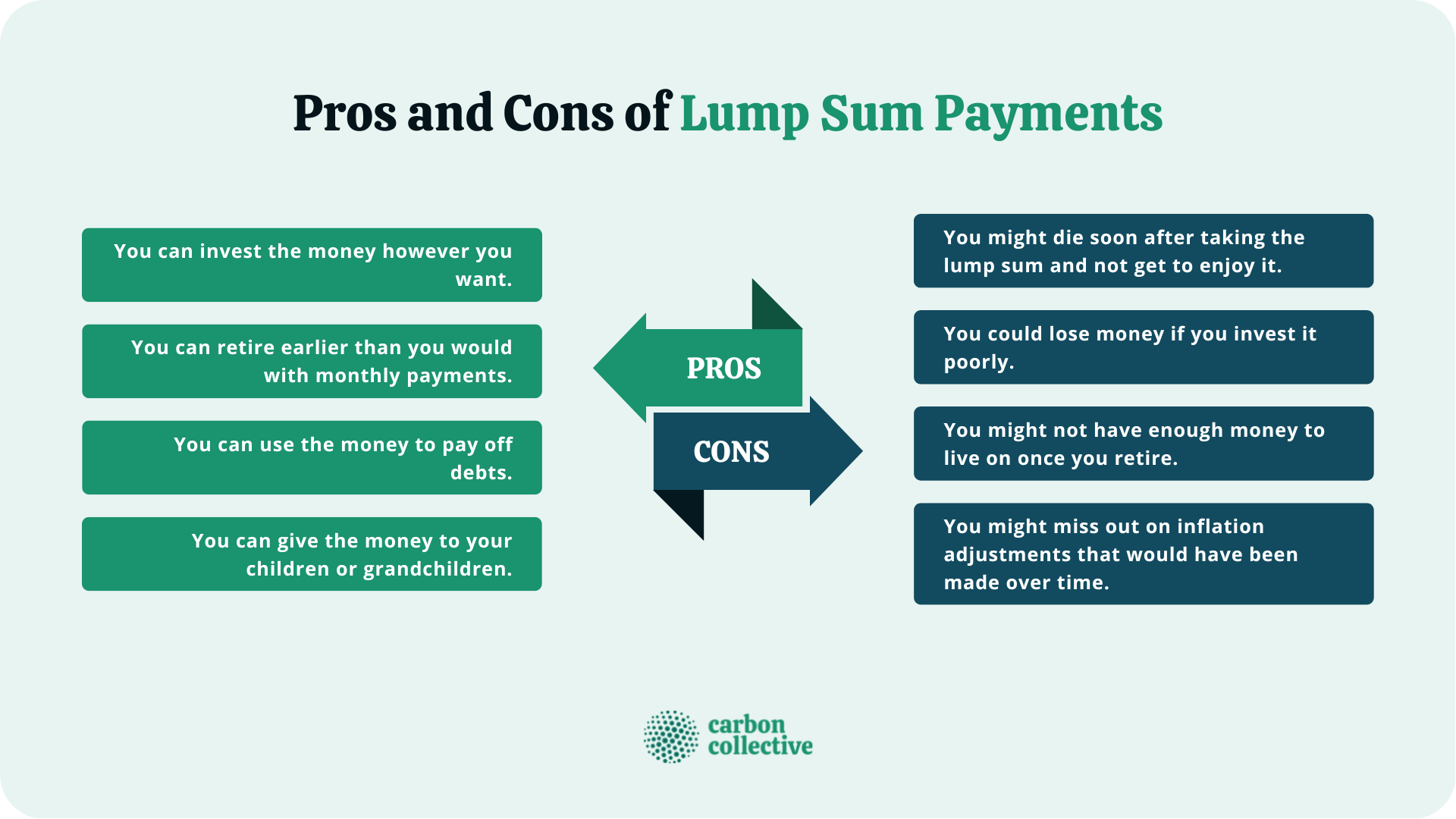

Lump Sum Payment What It Is How It Works Pros Cons

https://www.carboncollective.co/hs-fs/hubfs/Pros_and_Cons_of_Lump_Sum_Payments.png?width=5760&name=Pros_and_Cons_of_Lump_Sum_Payments.png

DB Tax Free Lump Sum T mobile

https://tmipensions.co.uk/wp-content/uploads/2019/08/Img001.jpg

https://www.moneyhelper.org.uk/en/work/losing-your-job/your-pension...

Web How much is your redundancy payment and how much of it is taxable for pensions purposes You can only contribute parts of your redundancy payment that qualify as

https://www.harvestfinancial.ie/pensions-and …

Web 12 Juni 2023 nbsp 0183 32 SCSB2 Signing the waiver and getting a higher tax free lump sum now but with no tax free pension lump sum now or later

Pension Trick That Could Get You A Second Tax free Lump Sum This Is Money

Lump Sum Payment What It Is How It Works Pros Cons

Understanding Tax On Pension Lump Sum Withdrawals

Suspension Of Employer s Obligation On Redundancy Payments Lifted

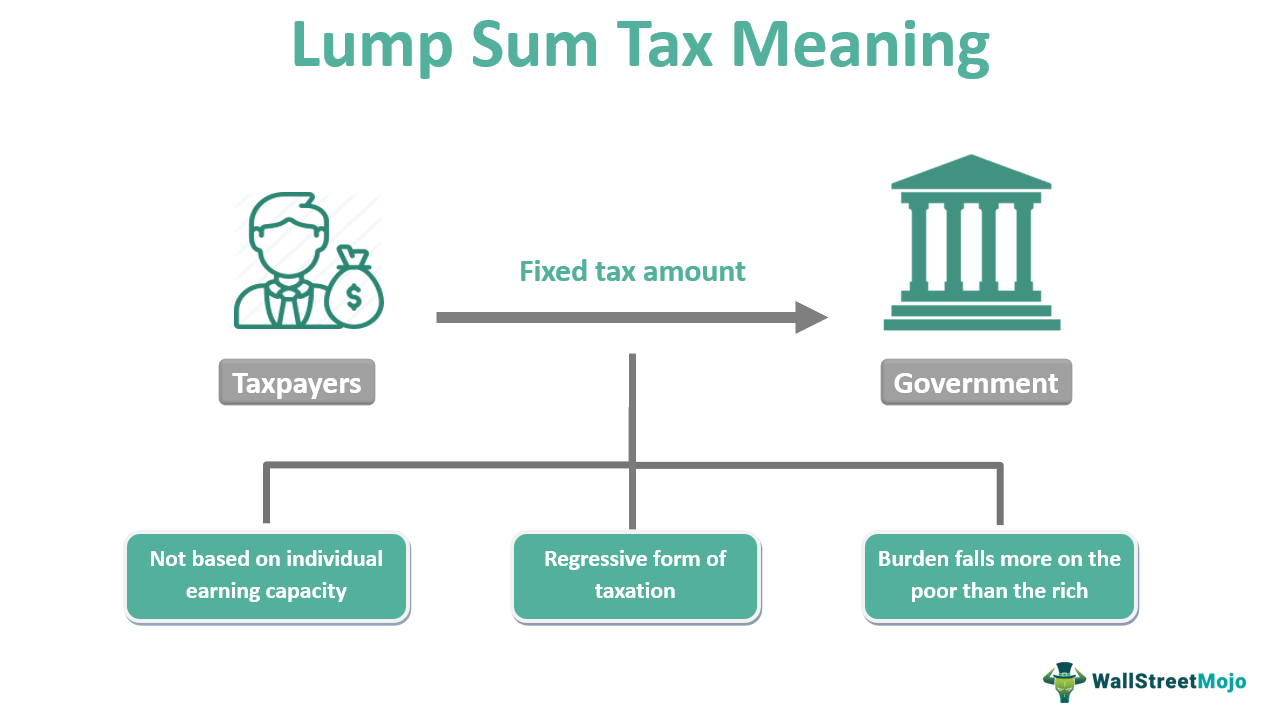

Lump Sum Tax What Is It Formula Calculation Example

Should You Take A Tax Free Lump Sum From Your Pension Beaufort Financial

Should You Take A Tax Free Lump Sum From Your Pension Beaufort Financial

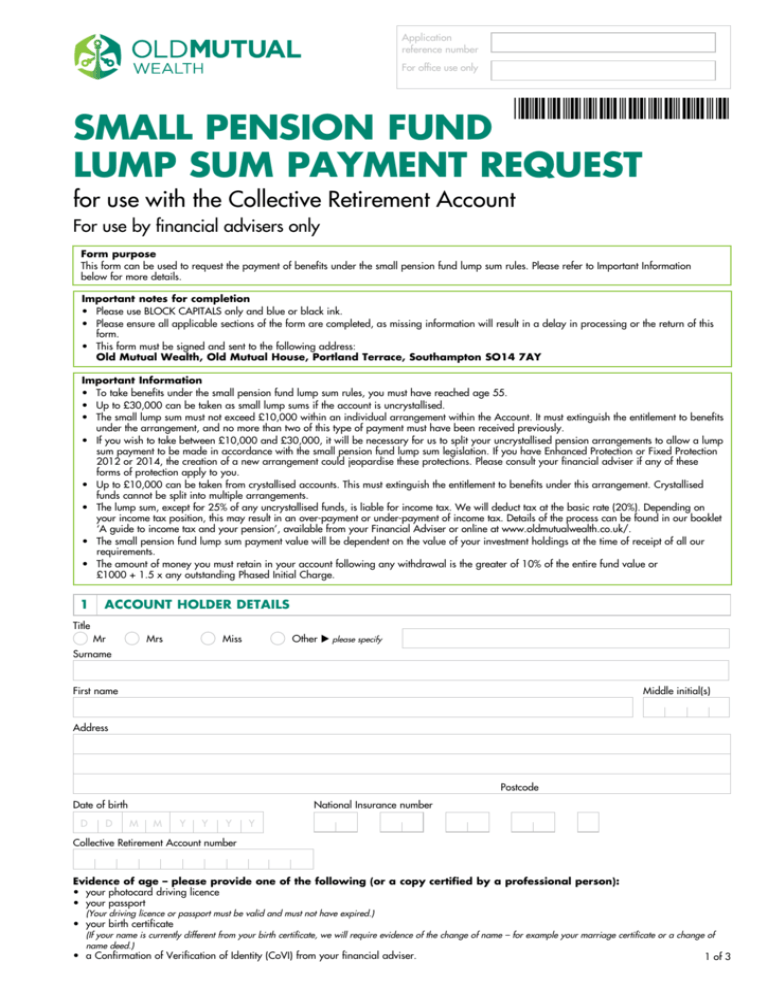

SMALL PENSION FUND LUMP SUM PAYMENT REQUEST

Why Taking Your Pension Tax free Lump Sum Could Leave You 1 000s Worse

How Would You Spend Your 25 Tax free Pension Lump Sum This Is Money

Redundancy Pension Tax Free Lump Sum - Web The tax free redundancy payment up to 163 30 000 ie the lump sum you d get for being made redundant isn t counted as pensionable earnings and therefore isn t subject to