Redundancy Tax Rates Over 55 Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Being made redundant

Unfortunately any redundancy payment over 30 000 is taxable and you will have to pay National Insurance Your payment will be added onto your earnings for the year and taxed accordingly Under the pensions regulations if you are over age 55 and your employer terminates your contract of employment on grounds of redundancy you are entitled to and must take

Redundancy Tax Rates Over 55

Redundancy Tax Rates Over 55

https://www.picserver.org/assets/library/2020-10-29/originals/income_tax_rates.jpg

Income Tax Rates Free Of Charge Creative Commons Typewriter Image

https://www.thebluediamondgallery.com/typewriter/images/income-tax-rates.jpg

Where Could Interest And Tax Rates Be Headed Gosline Retirement Planning

https://www.grplans.com/wp-content/uploads/2021/06/Where-Could-Interest-and-Tax-Rates-Be-Headed.jpeg

Workers made redundant with a pay off of 30 000 plus can generate extra free cash by asking their employer to pay a chunk of the Just in process if being made redundant I have an NHS pension which I have been advised that I can take as I m 55 years old My union rep strongly thinks that my employer has

If your redundancy payment is over 30 000 you will almost certainly be taxed Any redundancy package that is over this amount will be liable for tax but not for National Insurance contributions If you have received a bonus or other parting There should be no reduction penalty for taking the pension at 55 due to the organization making me redundant The answer from Northern Foods and Railways will be no

Download Redundancy Tax Rates Over 55

More picture related to Redundancy Tax Rates Over 55

Income Tax Rates Free Of Charge Creative Commons Suspension File Image

https://www.picpedia.org/suspension-file/images/income-tax-rates.jpg

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/04/Income-Tax-Rates-Slab.png

Guide On Proposed Sales Tax Rates For Various Goods pdf DocDroid

https://www.docdroid.net/file/view/6qyEKIM/guide-on-proposed-sales-tax-rates-for-various-goods-pdf.jpg

Redundancy pay is treated differently to your normal salary and won t be taxed if it s under 30 000 However any holiday pay bonuses and other entitlements that are paid as part of According to the ATO certain redundancy payments are tax free up to a limit based on the number of years of employment The only downside is that this rule applies only

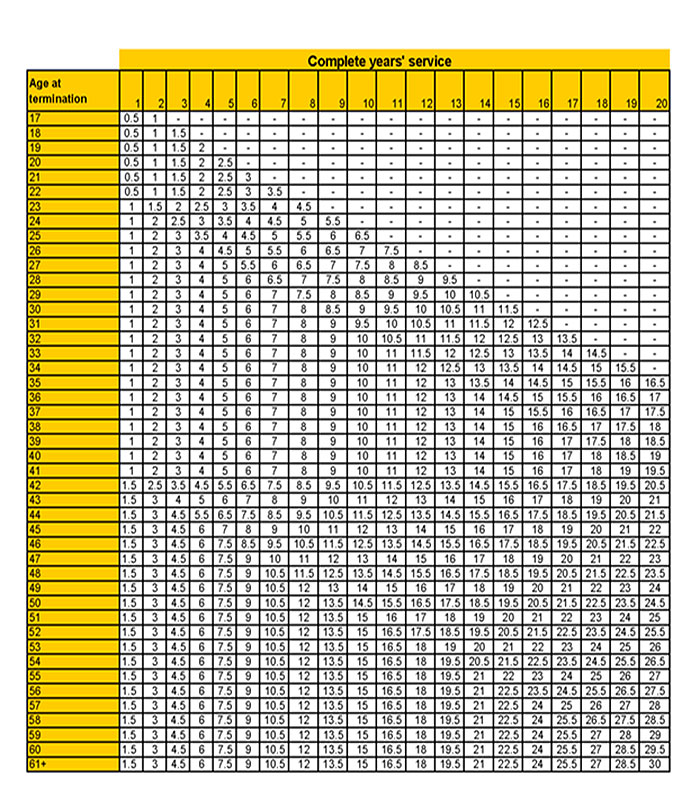

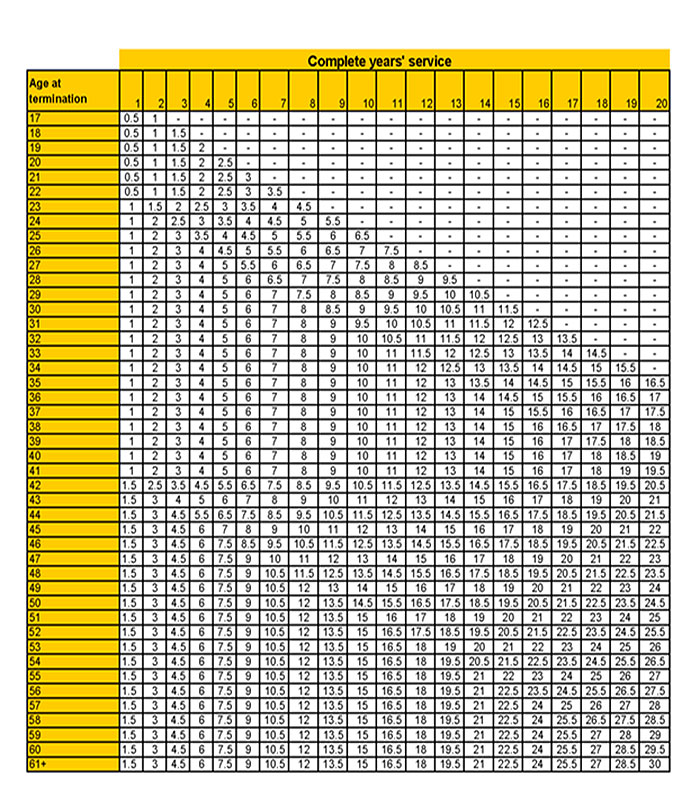

How much is redundancy pay for over 50s It depends on the length of tenure as longer lengths of service can result in larger redundancy payments In the UK redundancy pay is often calculated based on the According to a briefing from provider LV putting all or part of a redundancy payment into a pension could help savers top up their pots and benefit from savings of

Share Your Anecdotal Evidence That Trump Is Going To Win NeoGAF

https://files.taxfoundation.org/20170804133536/Average-Effective-Tax-Rate-on-the-Top-1-Percent-of-U.S.-Households.png

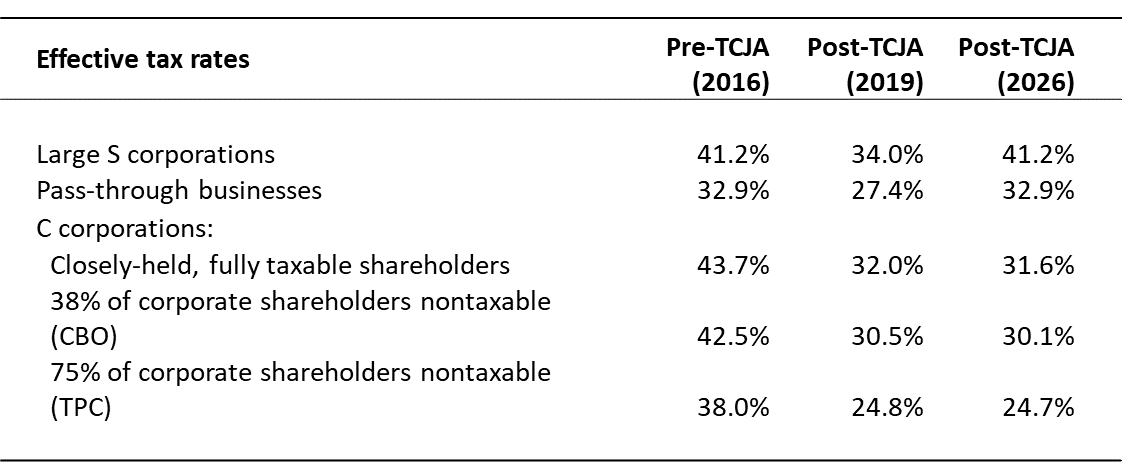

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

https://barberfinancialgroup.com/wp-content/uploads/2022/08/FIGURE-3-2017-Tax-Brackets-for-Married-Filing-Jointly-Tax-Rates-Sunset-in-2026-and-Why-That-Matters.png

https://www.gov.uk › redundancy-your-rights › tax-and...

Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Being made redundant

https://www.redundancyexpert.co.uk › financial...

Unfortunately any redundancy payment over 30 000 is taxable and you will have to pay National Insurance Your payment will be added onto your earnings for the year and taxed accordingly

NET EARNINGS AND TAX RATES

Share Your Anecdotal Evidence That Trump Is Going To Win NeoGAF

Redundancy Tax Calculator 2020 CALCULATORUK HJW

50 Ultimate Tips Unraveling Tax Rates A Comprehensive Guide 2023

Setup Tax Rates For Invoicing

Pay Tax Redundancy Pay Tax Calculator Uk

Pay Tax Redundancy Pay Tax Calculator Uk

Add Or Update State Payroll Tax Information Help Center Home

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA

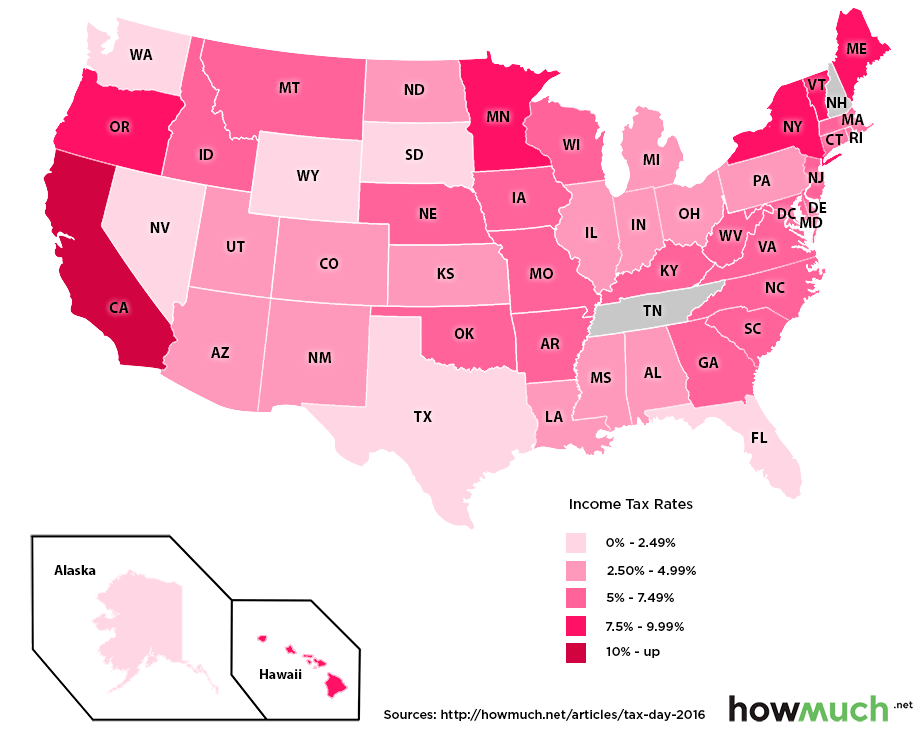

States With The Lowest Income Tax Rates

Redundancy Tax Rates Over 55 - For any redundancy pay over 30 000 your employer will usually take the tax at your normal tax rate If your employer pays you your final pay after you leave your job they ll take the tax from