Reimbursement Vs Credit Reimbursed expenses are amounts paid by an employee or client which a business then repays to them Examples of reimbursed expenses are travel expenses

Revenues are typically recorded as an increase in cash or a receivable typically a debit to cash or a receivable and a credit to revenue On the other hand a reimbursement is typically recorded as a Both small as well large corporations are increasingly looking at corporate credit cards as the future of expense reimbursement Yet a choice between the two will depend on what suits your organization the best

Reimbursement Vs Credit

Reimbursement Vs Credit

https://w3ll.com/wp-content/uploads/2021/12/test-blog-4-scaled-2.jpg

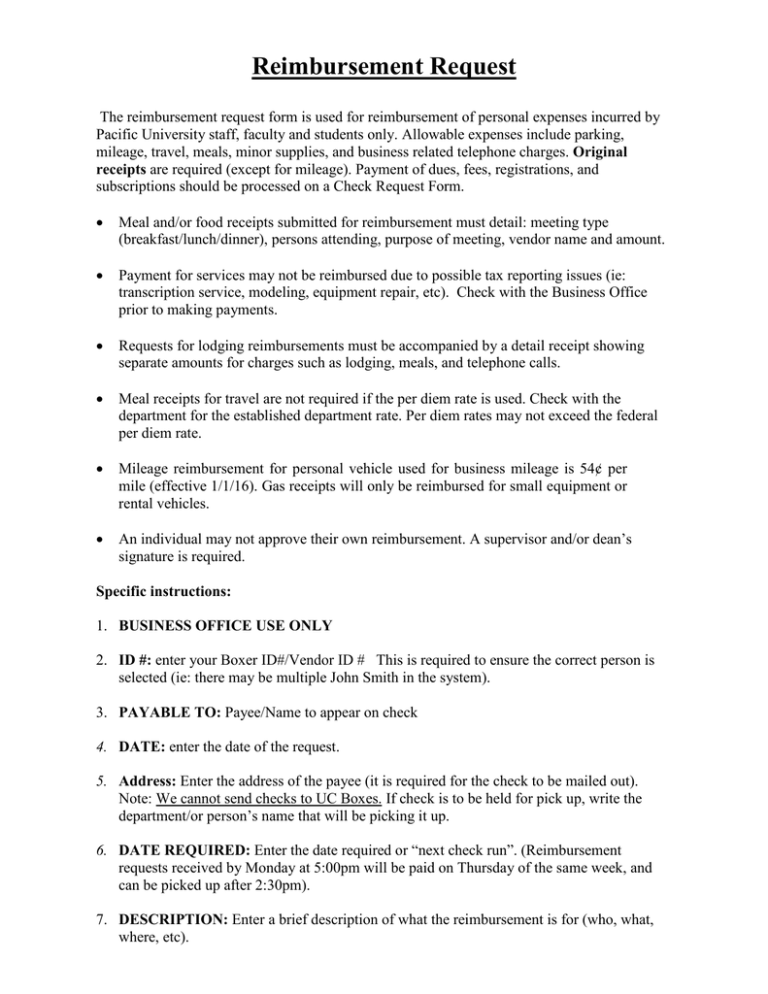

Reimbursement Plan AGMA Retirement And Health Fund

https://www.agmaretirement-health.org/wp-content/uploads/2022/10/reimbursement-768x512.jpg

Reimbursement

https://uploads-ssl.webflow.com/62f1307825e801c7b111bb1b/6324a8af134c6e6a188803fc_MIMOSA SEO.png

You can pay a lot of business expenses with a company credit card but sometimes employees might have to use their own funds to cover an unexpected cost And that means the company has to make a It s important to distinguish between reimbursements and allowances An allowance is a predetermined amount of money given to an individual to cover expenses whereas a

When it comes to reimbursement vs disbursement the term reimbursement refers to the payment refunded for the original disbursement When a business sends a While a disbursement is a payment made from a fund bank or business or the one that has been debited from a payer s account and credited to a payee s account reimbursement has a compensatory

Download Reimbursement Vs Credit

More picture related to Reimbursement Vs Credit

Reimbursement

https://s2.studylib.net/store/data/010833731_1-aa59eaf108144916b94036ff4eb7c4f7-768x994.png

Expense Reimbursement Vs Company Credit Cards What Skagit County

https://skagitcountytaxservices.com/wp-content/uploads/2021/05/5-10-2120Tax20Business20Email20-20Purchase20Cards20vs20Expense20Reimbursement-800x675.jpeg

Reimbursement Nextherapy

https://nextherapy.ch/wp-content/uploads/2022/11/reimbursement-files.png

Corporate Credit Cards vs Employee Expense Reimbursements Pros and Cons from a Risk Assessment Perspective There are a lot of approved business related expenses that employees Reimbursable expenses are payments and purchases made by employees on behalf of their company It is the company s legal and moral obligation to fully reimburse employees for such expenses

Employee expense reimbursement is an area that s sometimes overlooked by business owners Employees who spend their own money on job related items often In these situations the funds received from the other party should be recorded as a reimbursement of expenses and not as revenue Revenue should only be recorded as

Reimbursement For Lost Wages

https://www.dreishpoon.com/wp-content/uploads/2014/08/Queens-Reimbursement-for-Lost-Wages.jpg

Regulatory Changes Affecting Radiology Reimbursement In 2018

https://info.hapusa.com/hubfs/Regulatory Changes Affecting Radiology Reimbursement in 2018.jpg

https://www.accountingtools.com/articles/record...

Reimbursed expenses are amounts paid by an employee or client which a business then repays to them Examples of reimbursed expenses are travel expenses

https://hm.cpa/revenue-reimbursement

Revenues are typically recorded as an increase in cash or a receivable typically a debit to cash or a receivable and a credit to revenue On the other hand a reimbursement is typically recorded as a

Billing Reimbursement Essentials CPhT Training Center

Reimbursement For Lost Wages

Reimbursement Invoice Format Under Gst Prosecution2012

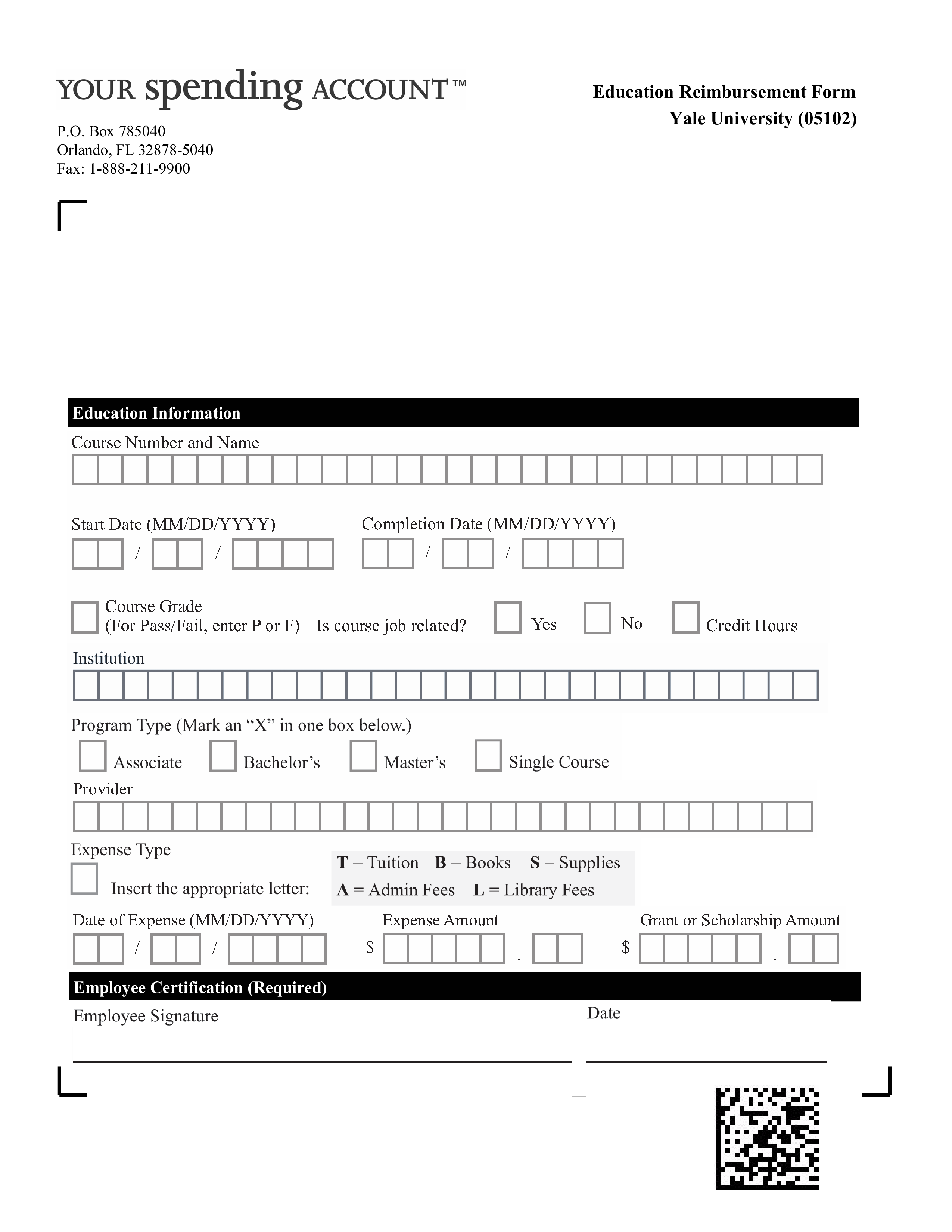

Education Reimbursement Form Templates At Allbusinesstemplates

Reimbursement Recovery SellerBench FAQ

Reimbursement Scholarships IDA Arizona

Reimbursement Scholarships IDA Arizona

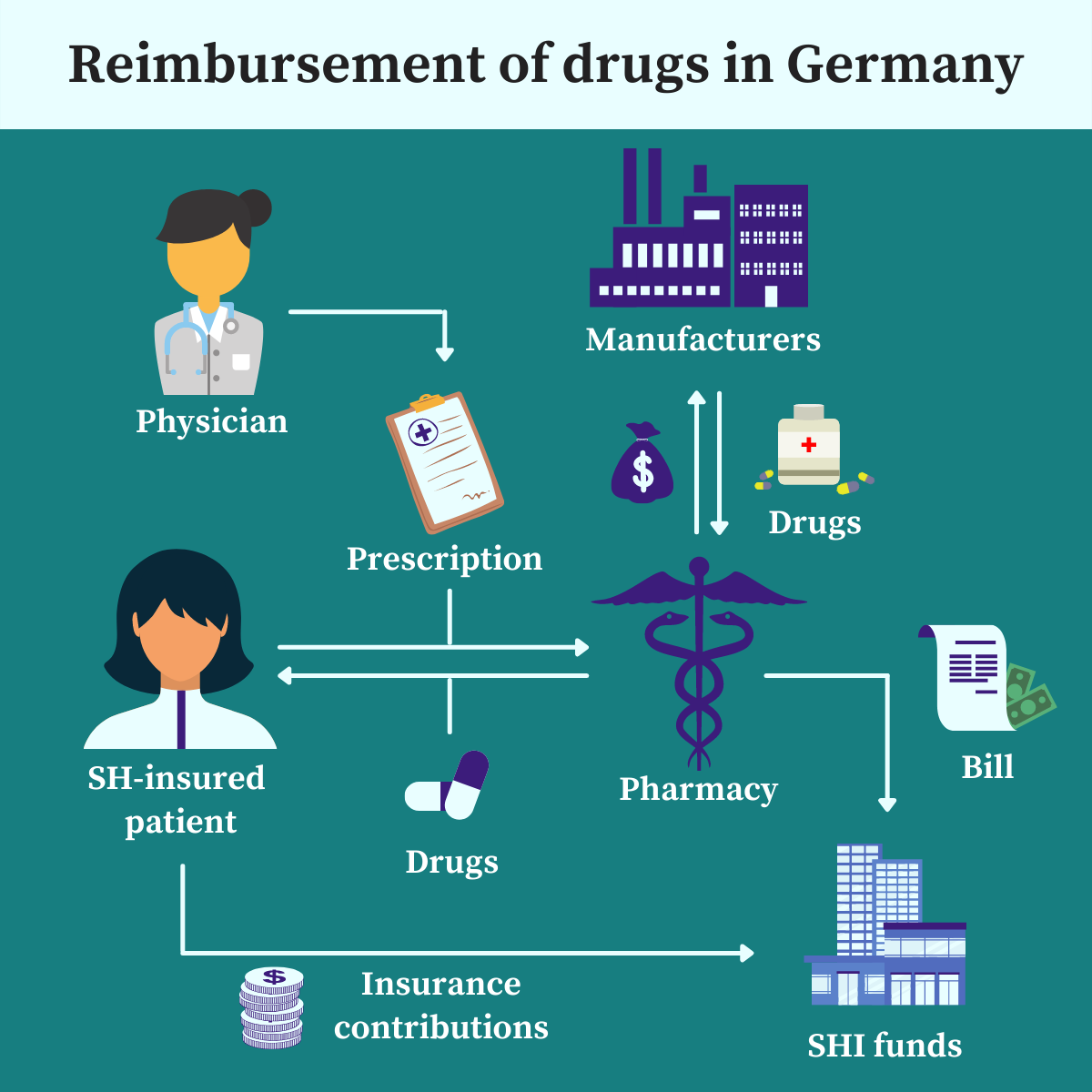

Are You Interested In Drug Reimbursement In Germany

Employer Tuition Reimbursement Explained Graduate Programs For Educators

Reimbursement Submit Fill Online Printable Fillable Blank PdfFiller

Reimbursement Vs Credit - Knowing the difference between disbursement and reimbursement is important for effective cash management In this article we will discuss disbursements and reimbursements