Renewable Energy Tax Credits 2022 From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Clean vehicle credits Home energy credits Credits and deductions for businesses and other entities Advanced Energy Project Credit added May 31 2023

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

Renewable Energy Tax Credits 2022

Renewable Energy Tax Credits 2022

https://www.nortonrosefulbright.com/-/media/images/nrf/thought-leadership/us/us_43201_social-media-capital-account-implications-for-renewable-energy-tax-credits_1200.jpeg?revision=a5e6caf0-1dea-4076-9c5e-6774a98047b7&revision=5249587443937387904

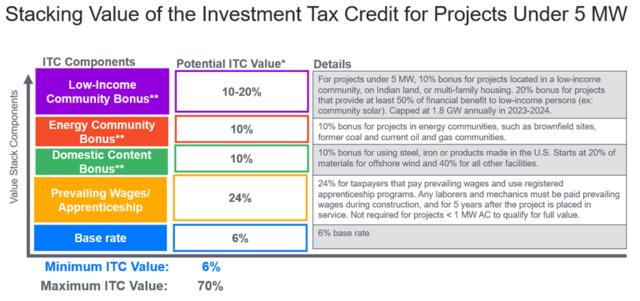

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

IRA Tax Provisions Prove Promising For The Renewables Sector Edison

https://uploads.edisonenergy.com/2022/08/25153840/Picture1-2-640x301.png

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance The renewable electricity production tax credit PTC is a per kilowatt hour kWh federal tax credit included under Section 45 of the U S tax code for electricity generated by qualified renewable energy resources

Renewable Energy Tax Credits Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems Tax Credit 30 for systems placed in service by 12 31 2019 There are two major energy tax credits available to homeowners the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit The U S government also offers

Download Renewable Energy Tax Credits 2022

More picture related to Renewable Energy Tax Credits 2022

Energy Tax Credits Meant To Help U S Suppliers May Be Hard To Get

https://static01.nyt.com/images/2023/06/07/multimedia/07energy-credits-01-zvqf/07energy-credits-01-zvqf-videoSixteenByNine3000.jpg

Residential Energy Tax Credits Changes In 2023 EveryCRSReport

https://www.everycrsreport.com/reports/IN12051.png

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

Those who install a PV system between 2022 and 2032 will receive a 30 tax credit That will decrease to 26 for systems installed in 2033 and to 22 for systems installed in 2034 If you ve already installed a system in 2022 your tax credit has increased from 22 to 30 if you haven t already claimed it Most provisions of the Inflation Reduction Act of 2022 became effective 1 1 2023 The Inflation Reduction Act incentives reduce renewable energy costs for organizations like Green Power Partners businesses nonprofits educational institutions and

To encourage this shift the IRS offers a range of renewable energy tax credits for alternative energy sources like solar wind and geothermal power For accountants understanding renewable energy tax credits and how they relate to individuals and businesses is essential in helping clients maximize their tax benefits The Inflation Reduction Act allows tax exempt and governmental entities to receive elective payments for 12 clean energy tax credits including the major Investment and Production Tax credits as well as tax credits for electric vehicles and charging stations

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

https://phantom-marca.unidadeditorial.es/ac74621e18bc098b394c3393658acfb3/resize/1200/f/jpg/assets/multimedia/imagenes/2023/01/17/16739726135614.jpg

Get Tax Credits For Energy Efficient Upgrades With The Residential

https://thewealthywill.files.wordpress.com/2023/06/ff_detailed_energy_a.png

https://www.irs.gov/credits-and-deductions-under...

From purchasing clean vehicles to making your home more energy efficient the Inflation Reduction Act of 2022 may have a significant effect on your taxes Clean vehicle credits Home energy credits Credits and deductions for businesses and other entities Advanced Energy Project Credit added May 31 2023

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a sufficient proportion

Energy Tax Credits Types Of Renewable Energy

Form 5695 Which Renewable Energy Credits Apply For The 2023 Tax

Should The U S Offer Tax Credits To Promote Renewable Energy WSJ

The Residential Renewable Energy Tax Credit Is A Little known

The Renewables 2022 Global Status Report In 150 Words REN21

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

Renewable Reboot The Inflation Reduction Act Of 2022 Released As

Extending Tax Credits For Renewable Energy Projects Is It An

2019 Renewable Energy Tax Credits In The U S SolarFeeds Magazine

Renewable Energy Tax Credits 2022 - Renewable Energy Tax Credits Under the Consolidated Appropriations Act of 2021 the renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems Tax Credit 30 for systems placed in service by 12 31 2019