Rental Tax Deduction Step I Determine the total annual gross rental income R from all sources of the individual Step II Deduct the threshold of 2 820 000 UGX Note No other deductions allowed R 2 820 0000 Chargeable income Step III Determine rental income tax at 12 Tax payable 12 x chargeable income

Deduct up to 50 of the annual gross rental income as allowance for expenditures and losses Declare ALL your sources of rental income in FULL for a given year of income The year of income is from 1st July to 30th June or a Substituted year RENTAL INCOME Taxation of Rental Income is provided for under S 5 of the Income Tax Act This is rent earned by persons and is segregated and taxed separately IMPORTANT STEPS For Individuals Step I Determine the total annual gross rents from all sources of the individual say R Step II Deduct 20 percent allowance for

Rental Tax Deduction

Rental Tax Deduction

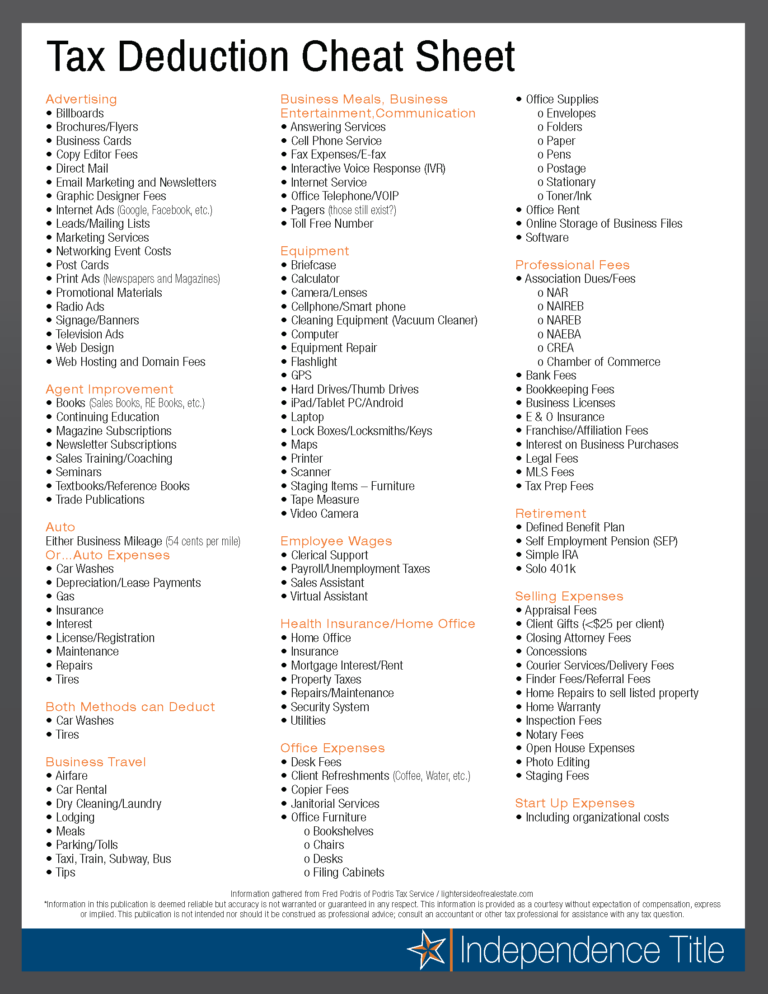

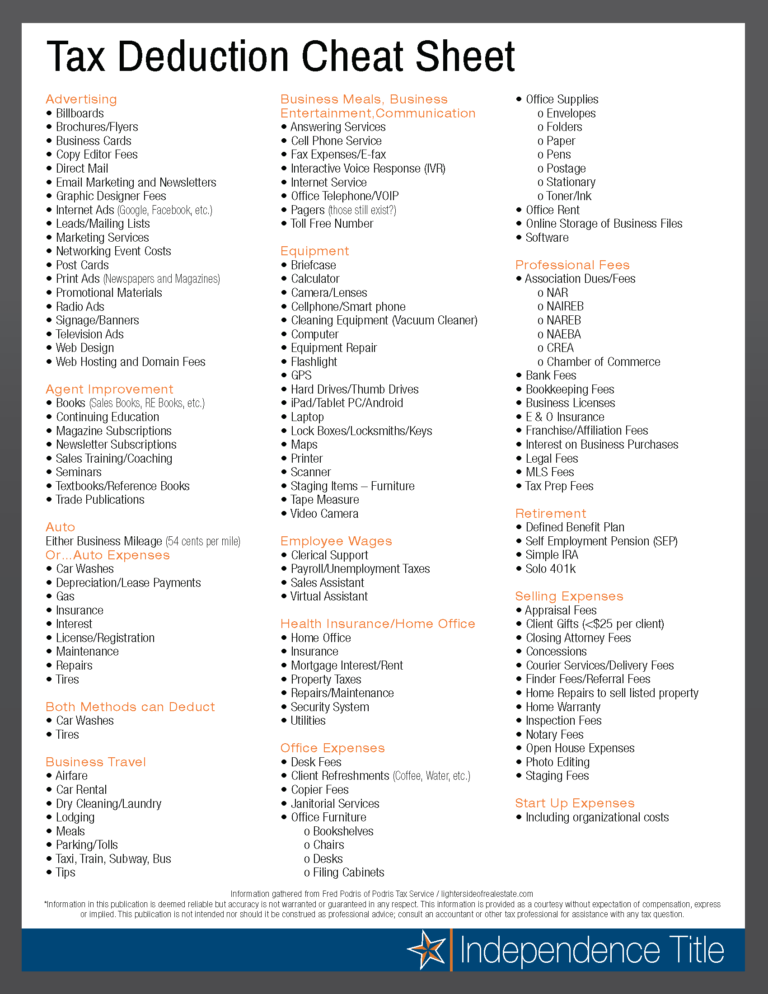

https://db-excel.com/wp-content/uploads/2019/09/tax-deduction-cheat-sheet-for-real-estate-agents-1-768x994.png

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

Precedent to the 2021 Income Tax Act individuals who earned rental income were allowed a 20 deduction of expenses incurred in the generation of the rental income in order to arrive at the chargeable income The rental tax would then be calculated by applying a 20 rate to this chargeable income Rental income is taxed separately from business income and it arises from leasing letting of immovable property in Uganda The Act does not define immovable property but it is generally understood to include both bare land and buildings

Prior to the 2020 and 2021 amendments individuals earning rental income were allowed a threshold 20 of expenses incurred in generation of rental income and thereafter apply 20 rate to the chargeable income while companies were allowed all their expenses and 30 to the remaining chargeable income The rental tax register has been increasing by 10 per cent annually for the last three years By law these are the kind of expenses that are allowed to be deducted directly from the annual rental income In addition to this a company is also allowed a deduction for an industrial building allowance

Download Rental Tax Deduction

More picture related to Rental Tax Deduction

5 Most Overlooked Rental Property Tax Deductions AccidentalRental

http://accidentalrental.com/wp-content/uploads/2017/11/Rental-Tax-Deductions.png

Itemized Deductions List Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/302/100302714/large.png

List Of Tax Deductions For Rental Property

https://i.pinimg.com/736x/16/64/a3/1664a3f5658b21869f01cafb36a299a3.jpg

If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs 14 Common Rental Property Tax Deductions Rental property owners can generally claim these deductions Property Depreciation Mortgage Interest Property Taxes Maintenance and Repairs Appliances Travel and Transportation Expenses Utilities Insurance Premiums Office Space Advertising and Marketing Costs Landscaping Employees and

[desc-10] [desc-11]

Special Tax Deduction On Rental Reduction Extension Jan 20 2022

https://cdn1.npcdn.net/image/1642686079f1fe8a348162e3762ee96d0d06b3984c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

10 Home Based Business Tax Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/01/business-tax-deductions-worksheet_472298.png

https://thetaxman.ura.go.ug

Step I Determine the total annual gross rental income R from all sources of the individual Step II Deduct the threshold of 2 820 000 UGX Note No other deductions allowed R 2 820 0000 Chargeable income Step III Determine rental income tax at 12 Tax payable 12 x chargeable income

https://ura.go.ug › en

Deduct up to 50 of the annual gross rental income as allowance for expenditures and losses Declare ALL your sources of rental income in FULL for a given year of income The year of income is from 1st July to 30th June or a Substituted year

10 Business Tax Deductions Worksheet Worksheeto

Special Tax Deduction On Rental Reduction Extension Jan 20 2022

5 Itemized Tax Deduction Worksheet Worksheeto

Tax Deduction Stock Photo Photo By LendingMemo Under CC 2 Flickr

Itemized Deductions Spreadsheet In Business Itemized Deductions

Photographer Tax Deduction Worksheet

Photographer Tax Deduction Worksheet

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

Tax deduction checklist Etsy

10 Tax Deduction Worksheet Worksheeto

Rental Tax Deduction - Prior to the 2020 and 2021 amendments individuals earning rental income were allowed a threshold 20 of expenses incurred in generation of rental income and thereafter apply 20 rate to the chargeable income while companies were allowed all their expenses and 30 to the remaining chargeable income