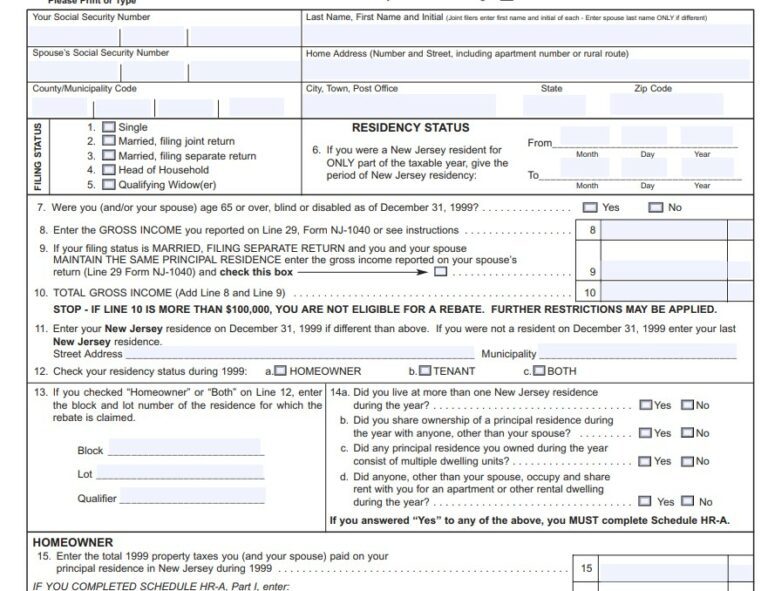

Renters Tax Credit New Jersey This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline New Jersey has launched a new program to help homeowners and renters save on property taxes The ANCHOR program short for the Affordable New Jersey Communities for Homeowners and Renters

Renters Tax Credit New Jersey

Renters Tax Credit New Jersey

https://www.rent.com/blog/wp-content/uploads/2019/03/tax_credits-min.jpg

How The New Jersey Child Tax Credit Became Law New Jersey Policy

https://www.njpp.org/wp-content/uploads/2022/07/image.png

New Jersey Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023-768x591.jpg

About two million New Jersey homeowners and renters will get property tax rebates in the coming year under a new 2 billion property tax relief program included in the 50 6 billion state Hundreds of thousands of New Jerseyans who rent their homes are eligible for 450 in property tax relief under the ANCHOR Program Tenants and renters who were previously ineligible because their unit was covered by a PILOT agreement can now apply for the ANCHOR benefit

New Jersey homeowners and renters now have until Jan 31 to apply for relief and renters who were previously ineligible because their unit is under a Payment in Lieu of Taxes PILOT The task force recommended a unified application for the three property tax relief programs be open from Feb 1 to Oct 31 2025 Residents under the age of 65 who are ineligible for awards under Stay NJ or Senior Freeze would use the same unified application when seeking Anchor benefits

Download Renters Tax Credit New Jersey

More picture related to Renters Tax Credit New Jersey

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

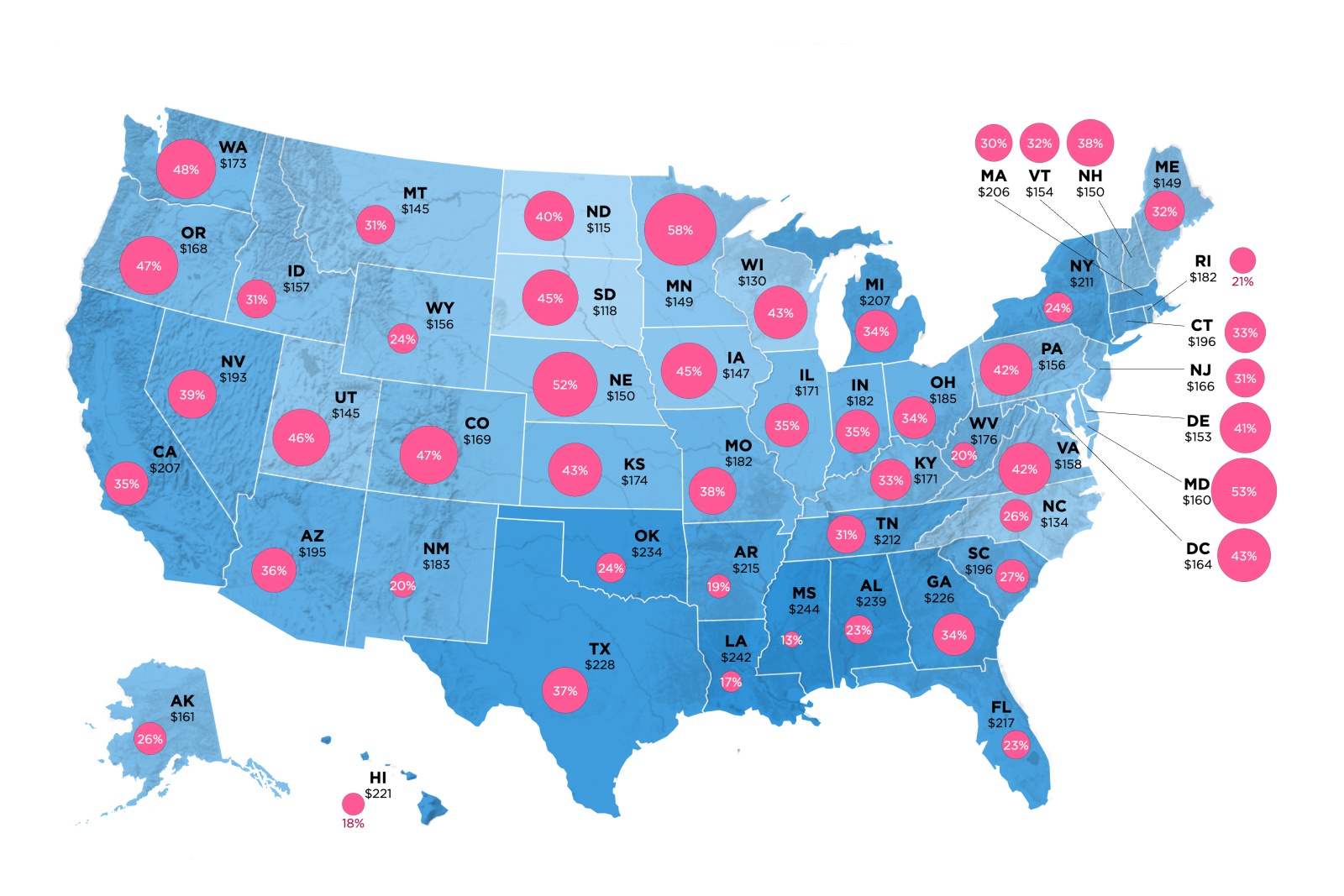

Looking At Average Renters Insurance Rates Across All 50 States

https://cdn.howmuch.net/articles/cover-f8e3.jpg

New Jersey Renters Insurance

https://assets-global.website-files.com/619e763bb3de7b56e6107aeb/638944504ca6eb6b53e2fdb7_Blog_renters-insurance-New-Jersey_Dec22.png

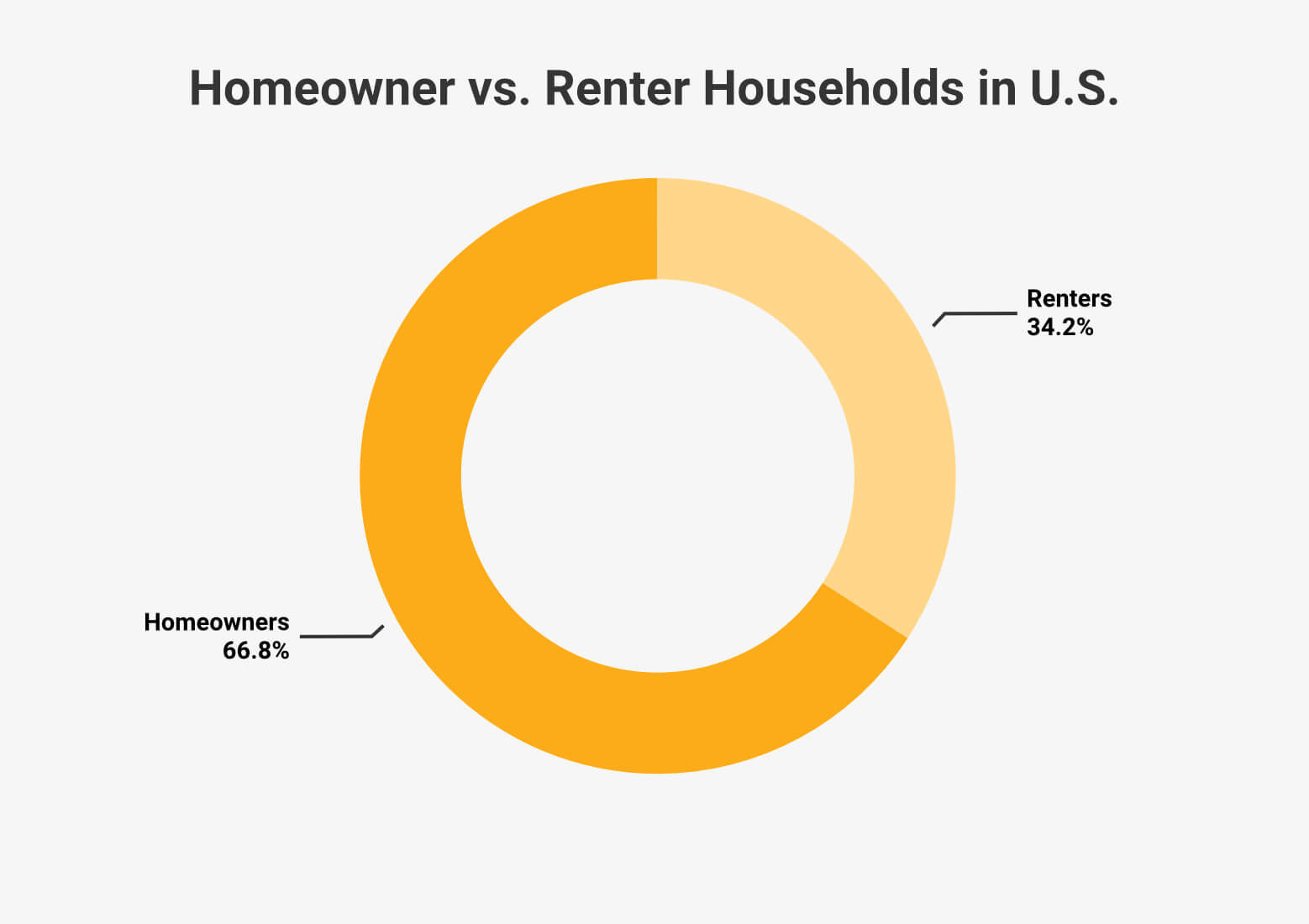

Renters The ANCHOR proposal notably includes renters in property tax relief Renters on average have lower incomes than homeowners in New Jersey where median homeowner income 112 000 is more than For homeowners the write off allows them to deduct from their state taxable income the amount paid annually in local property taxes up to 15 000 For renters who don t pay property taxes directly the write off generally allows them to deduct up to 18 of their annual rent payments

Renters can apply online or download the application from the Taxation website and return by mail there is no phone option for tenants as this is the first time this group will be eligible for property tax relief The deadline for filing is December 30 2022 The Affordable New Jersey Communities for Homeowners and Renters ANCHOR Program is designed to offer property tax relief to both homeowners and renters residing in the state of New Jersey To be eligible for the ANCHOR benefit individuals or families must maintain their principal residence within New Jersey and

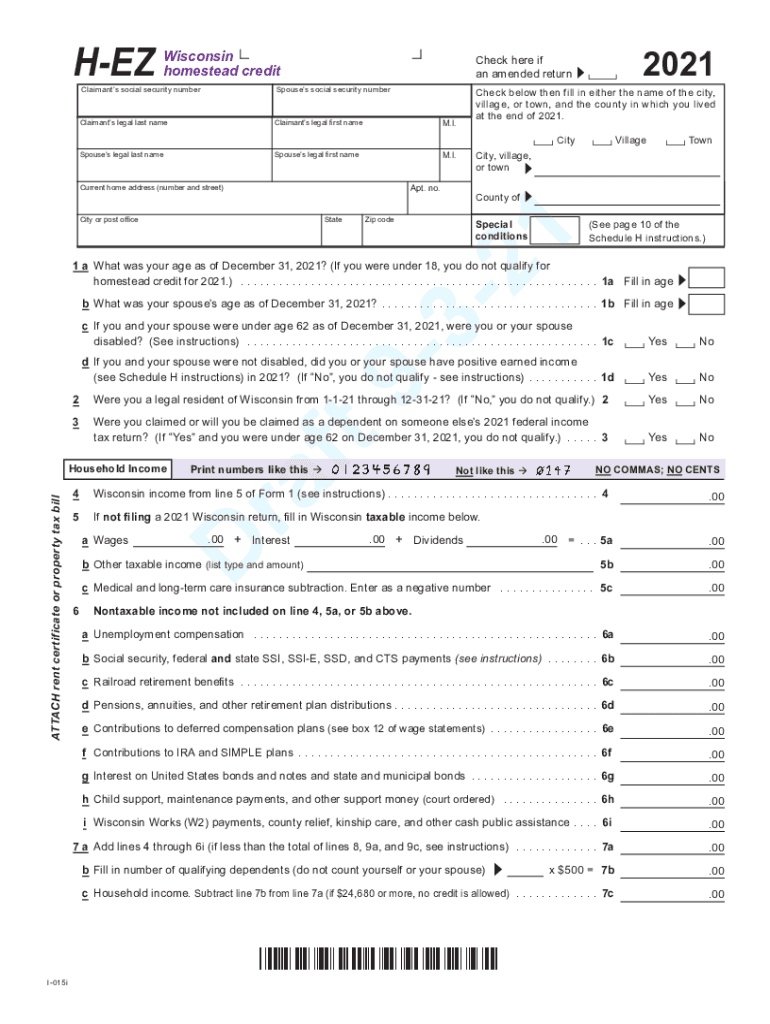

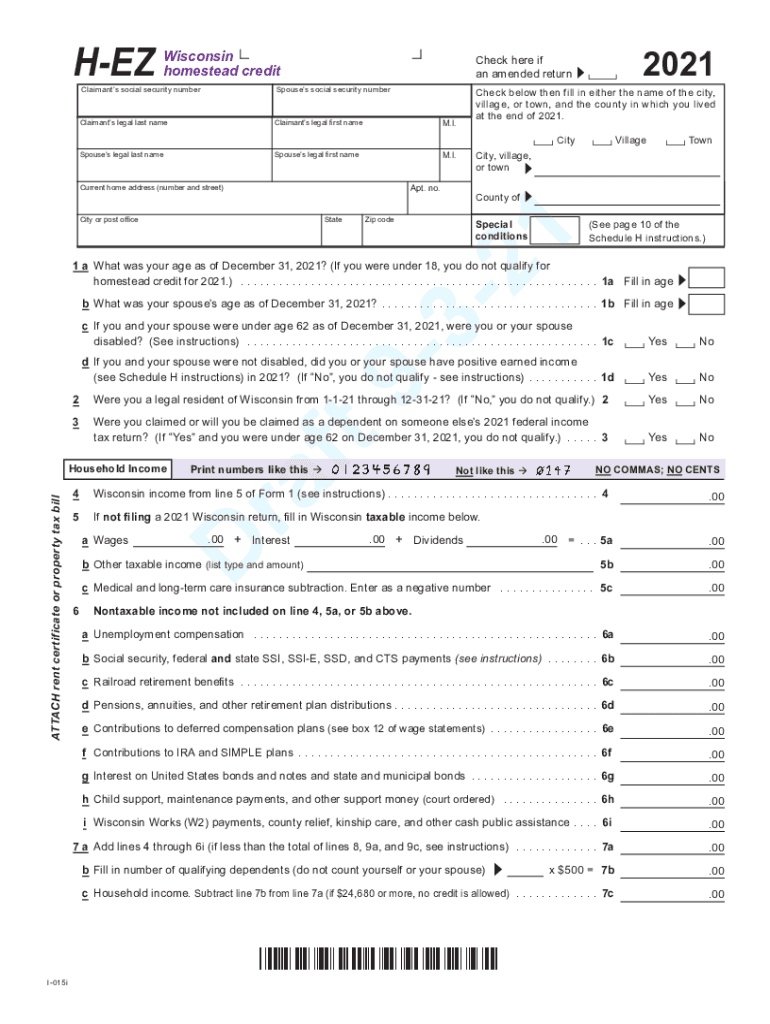

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

https://www.signnow.com/preview/573/344/573344198/large.png

Mn Renters Tax Refund Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/478/598/478598222/large.png

https://nj.gov/treasury/taxation/anchor/index.shtml

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age

https://nj.gov/treasury/taxation/anchor/tenant.shtml

This program provides property tax relief to New Jersey residents who own or rent property in New Jersey as their principal residence and meet certain income limits The current filing season for the ANCHOR benefit is based on 2020 residency income and age Filing Deadline

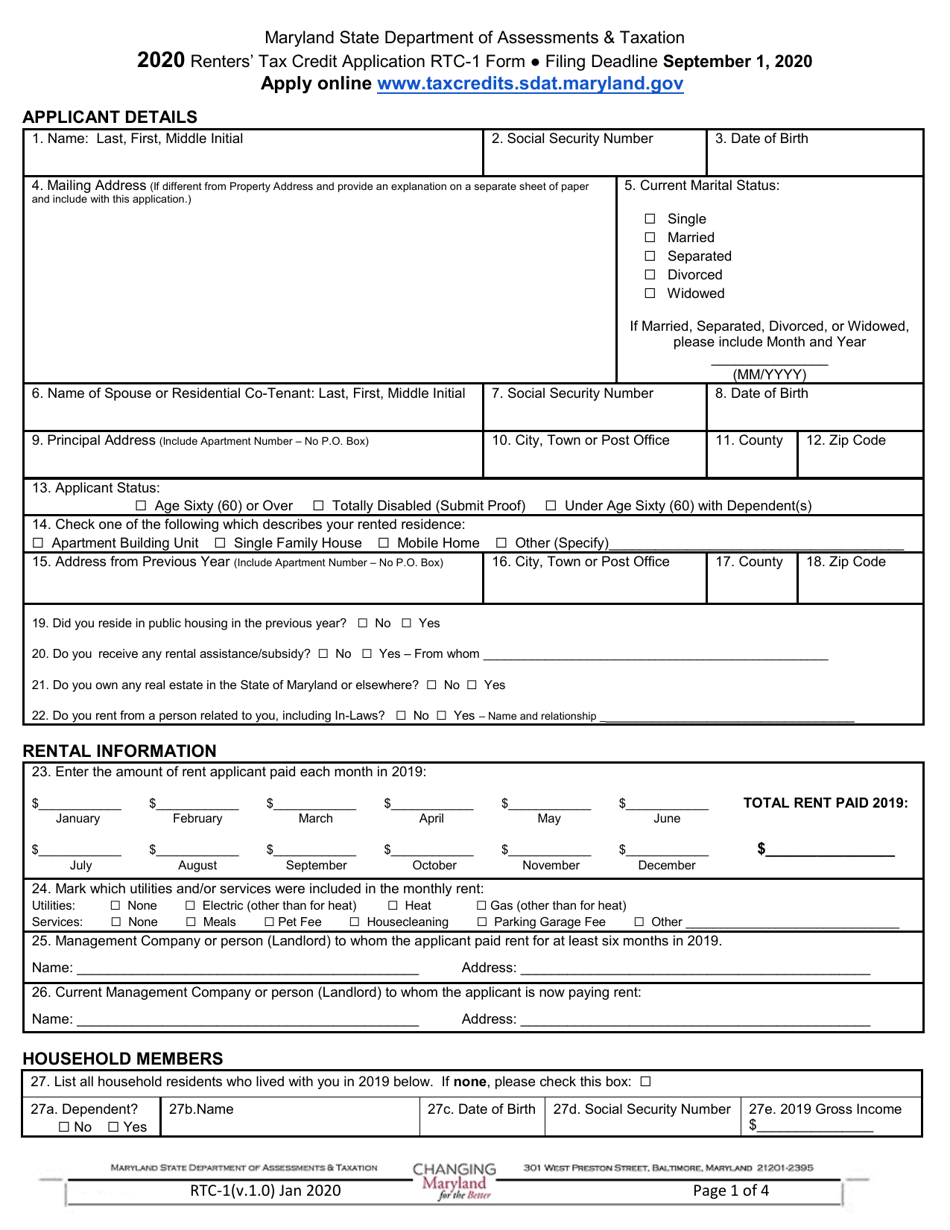

Rtc Form Printable Printable Forms Free Online

Wisconsin Homestead Credit 2021 2024 Form Fill Out And Sign Printable

Homeowners Vs Renters Statistics 2024

Renter s Insurance Why Your Tenant Needs It ProRealty HOA Condo

Real Property Tax Credit For Homeowners Honolulu PROPERTY HJE

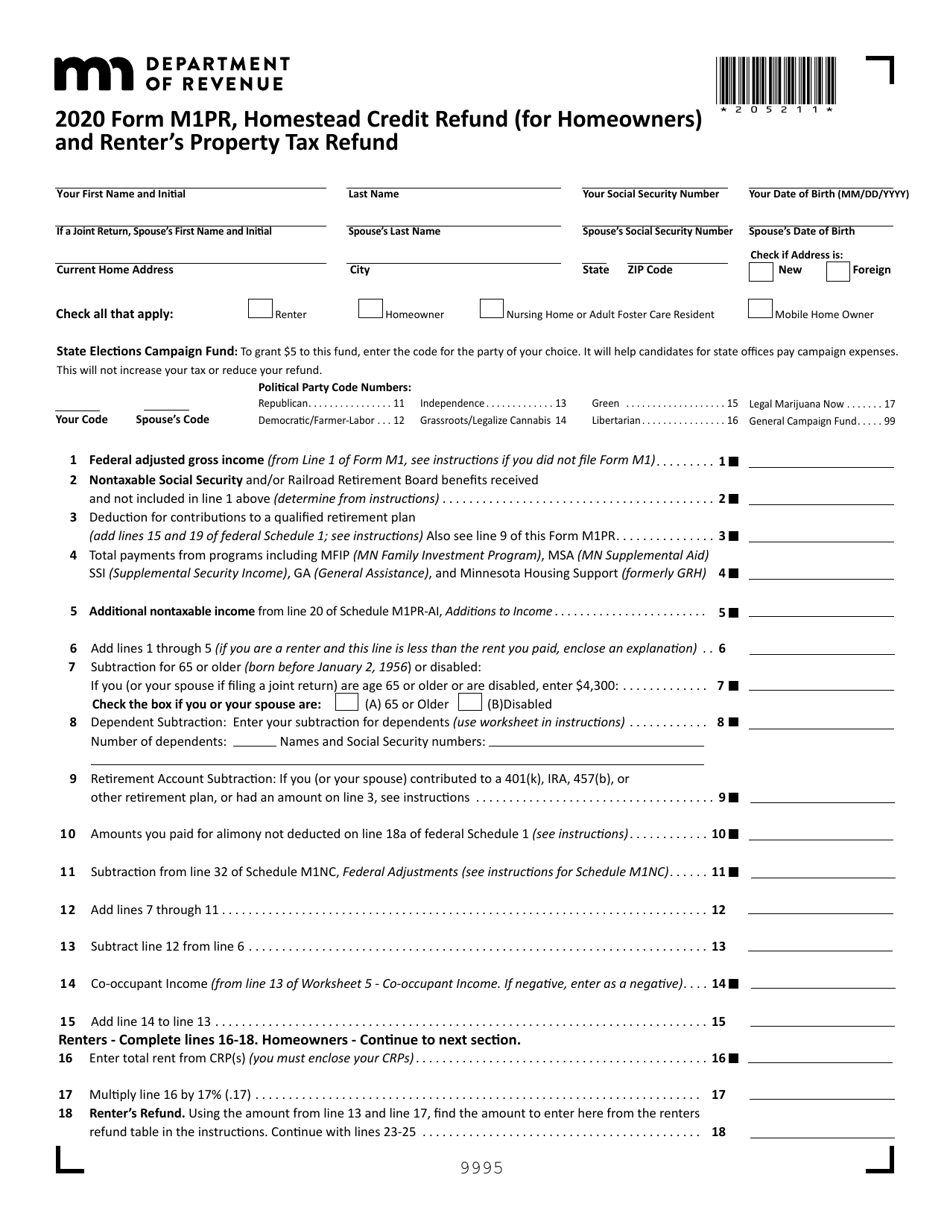

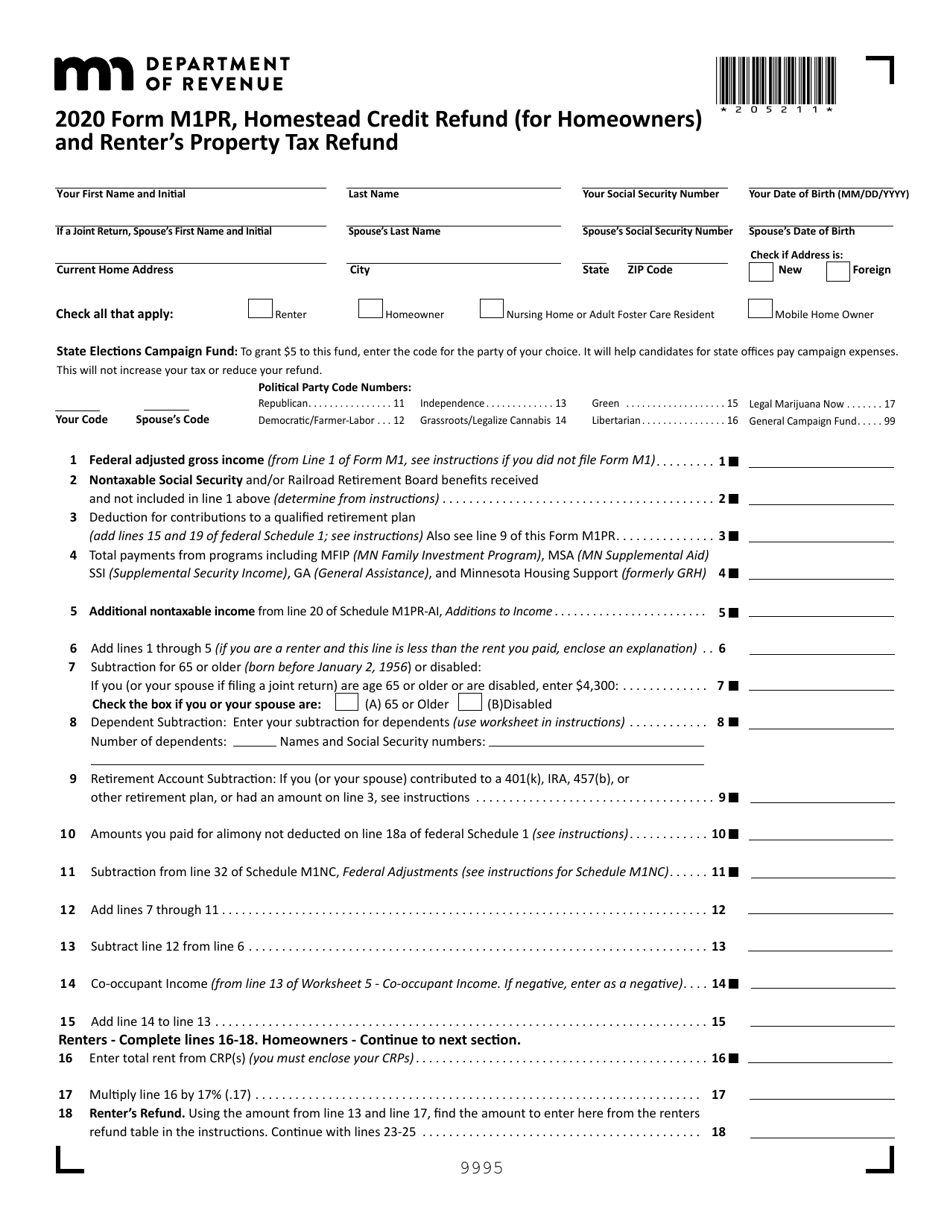

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Form M1PR Download Fillable PDF Or Fill Online Homestead Credit Refund

Making New Jersey Affordable For Families The Case For A State Level

Renters Tax Credit It Could Provide Key Relief For Coronavirus Fortune

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

Renters Tax Credit New Jersey - Under current law New Jersey renters can generally take a state income tax deduction worth 18 of their annual rent payments as a form of state subsidized property tax relief Likewise homeowners are also able to deduct from their state taxable income the amount paid annually in local property taxes up to 15 000