Tax Rebate On Loan For Plot Web 12 janv 2023 nbsp 0183 32 1 Plot Loan Tax Benefits under Section 80C Section 80C of the Income Tax Act 1961 states a plot owner can claim a tax rebate on a plot loan up to Rs 1 50

Web 30 sept 2022 nbsp 0183 32 How to avail the tax advantages of a plot loan Remember that tax benefits on plot loans can only be claimed once a building has Web Tax benefit under Section 80C As per Section 80C of the Income Tax Act you can avail deduction on the principal repayment component of your plot loan up to a maximum of

Tax Rebate On Loan For Plot

Tax Rebate On Loan For Plot

https://live.staticflickr.com/4251/34551343270_b4f72eef50_b.jpg

Income Tax Rebate On Home Loan For Plot Atlstudiodesigns

https://live.staticflickr.com/4271/34938718815_e3d2d159b4_b.jpg

Difference Between Home Loan And Plot Loan

https://dp5zphk8udxg9.cloudfront.net/wp-content/uploads/2016/08/Difference-between-home-loan-and-plot-loan.jpg

Web 28 f 233 vr 2023 nbsp 0183 32 Know All About Plot Loan Tax Benefits How To Avail It And the Best Cities To Buy A Plot In India Learn More About Tax Rebate On Plot Loan With Tata Capital Web 12 mai 2021 nbsp 0183 32 Yes you can A plot loan is used for buying a piece of land that could be developed later for residential purposes by the borrower for self use Lenders offer land

Web Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilit 233 Web 13 juil 2020 nbsp 0183 32 Any interest paid before possession is tax deductible in five instalments beginning from the year in which construction was completed subject to a cap of Rs 2 lakh if the property is self occupied Hence if

Download Tax Rebate On Loan For Plot

More picture related to Tax Rebate On Loan For Plot

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web Tax benefits on stamp duty You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA Web 19 avr 2022 nbsp 0183 32 While the loan repayment of this principal amount can be availed for tax deductions under Section 80C you can t avail the tax benefits for the interest component

Web 27 nov 2020 nbsp 0183 32 While the owned property can either be self occupied or let out the tax benefits differ In case of self occupied property you can claim deduction both on Web 18 juil 2018 nbsp 0183 32 Home loan becomes necessity to Purchase a house In this article we will discuss the tax benefits which one can avail under the Income Tax Act 1961 on

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

https://www.tatacapital.com/blog/loan-for-home/all-about-plot-loan-tax...

Web 12 janv 2023 nbsp 0183 32 1 Plot Loan Tax Benefits under Section 80C Section 80C of the Income Tax Act 1961 states a plot owner can claim a tax rebate on a plot loan up to Rs 1 50

https://www.hdfcsales.com/blog/is-a-plot-loa…

Web 30 sept 2022 nbsp 0183 32 How to avail the tax advantages of a plot loan Remember that tax benefits on plot loans can only be claimed once a building has

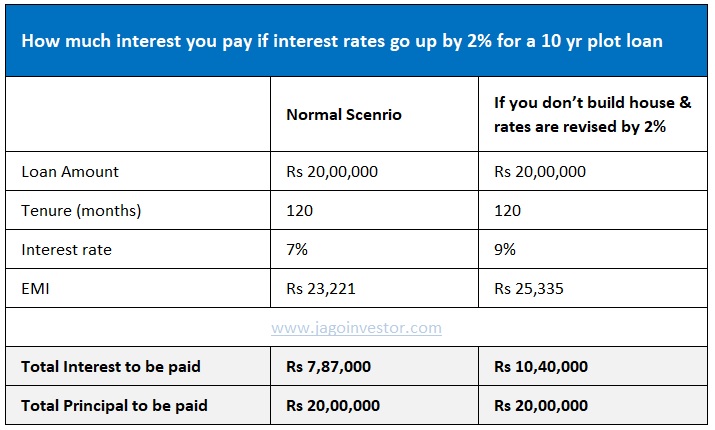

Can You Get A Plot Loan If You Don t Want To Construct A House

What Are Reuluations About Getting A Home Loan On A Forclosed Home

2007 Tax Rebate Tax Deduction Rebates

Microfinance Loan Application Form

PAcast

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Income Tax Rebate On Home Loan Fy 2019 20 A design system

Tax Rebate Under Section 87A Investor Guruji Tax Planning

What Does Rebate Lost Mean On Student Loans

Pin On Tigri

Tax Rebate On Loan For Plot - Web What comprises a Home Loan There are two components in a Home Loan repayment the principal amount and the interest paid on the loan amount You can avail of tax benefits