How To Get Tax Exemption On Plot Loan A plot loan has tax benefits associated with it dependent on certain conditions You need to be clear on the use of your plot before you apply for a plot

Interest payments on plot loans are eligible for deductions under Section 24 of the Income Tax Act up to Rs 2 lakh provided the loan is converted to a regular home loan after To claim the plot loan tax exemption under Section 24 the construction of the house much be completed and the borrower should occupy the house Then they

How To Get Tax Exemption On Plot Loan

How To Get Tax Exemption On Plot Loan

https://1.bp.blogspot.com/-rLHsC57CHIo/YU224KQcu4I/AAAAAAAAAk4/yEY41NJRd3EbURQyf2XvKXcVMUCNIyvnACLcBGAsYHQ/s16000/Webp.net-compress-image.jpg

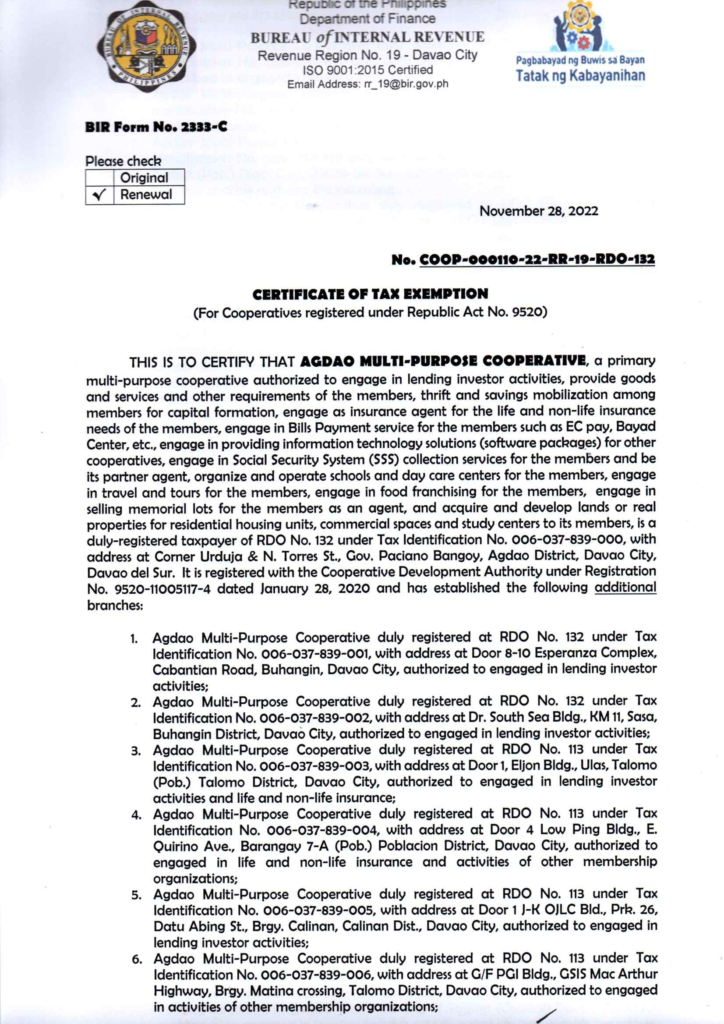

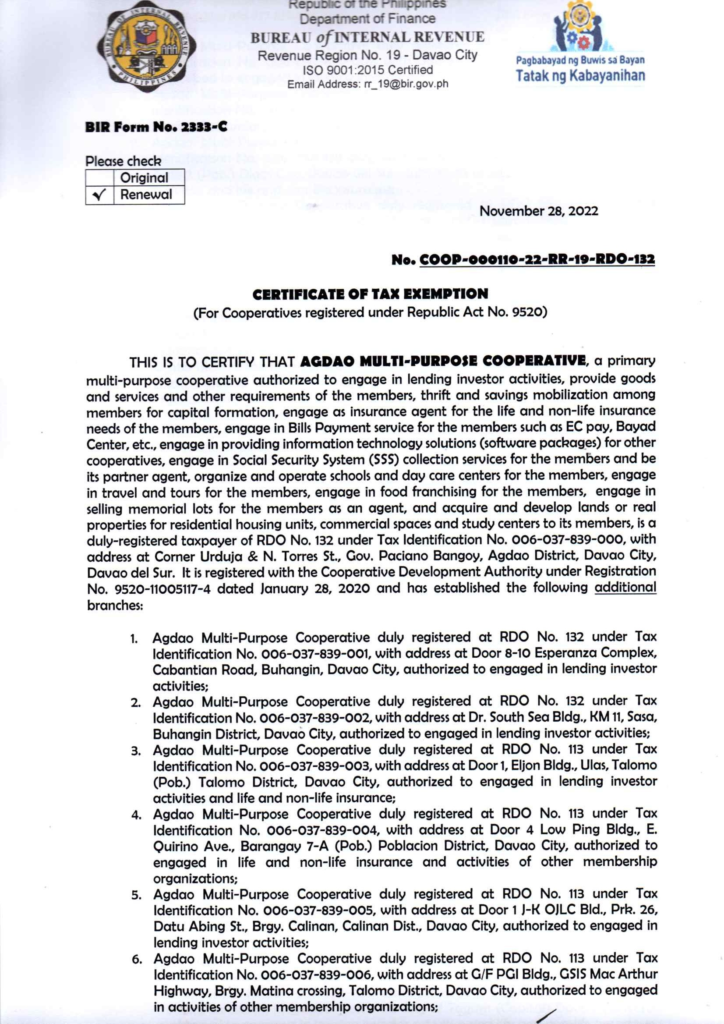

BIR Certificate Of Tax Exemption AMPC

https://agdaocoop.com/wp-content/uploads/2023/01/page-1-724x1024.png

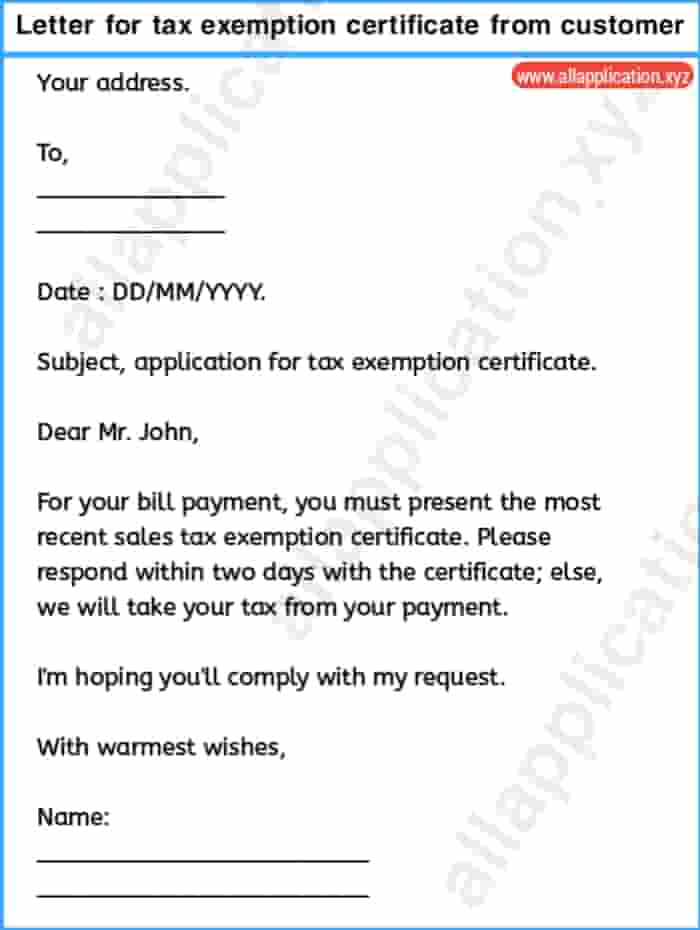

Request Letter For Tax Exemption And Certificate SemiOffice Com

https://i0.wp.com/semioffice.com/wp-content/uploads/2021/08/Request-Letter-for-Tax-Exemption-and-Certificate.png?w=530&ssl=1

Section 24 of the Income Tax Act allows you to claim tax breaks of up to 2 lakh but you must convert the plot loan into a conventional house loan to qualify Don t miss out on valuable tax benefits for your plot purchase loan Learn everything you need to know about plot loan tax benefits and how to avail them

When you re mortgaging your property in exchange for a loan you are eligible to get certain income tax benefits Read further to know about tax benefits on Loan Against Property Explore income tax benefits on plot loans exemptions rebates and deductions Learn about tax advantages for plot purchase and construction loans

Download How To Get Tax Exemption On Plot Loan

More picture related to How To Get Tax Exemption On Plot Loan

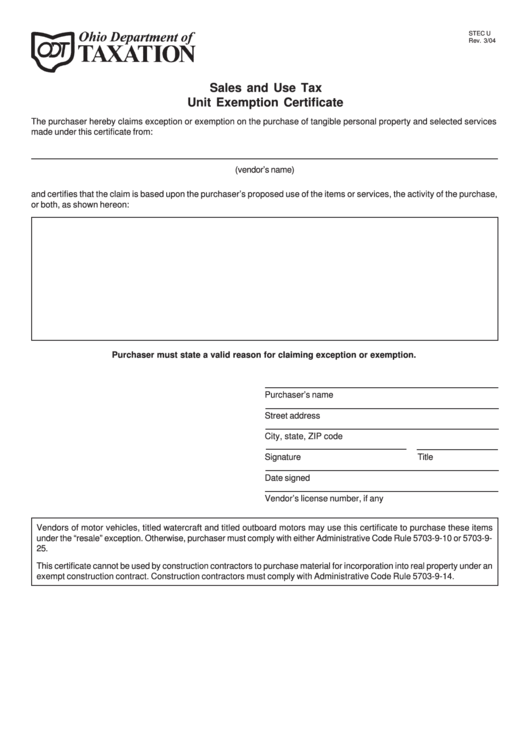

Texas Sales And Use Tax Exemption Blank Form

https://data.formsbank.com/pdf_docs_html/327/3275/327552/page_1_thumb_big.png

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/589/100589137/large.png

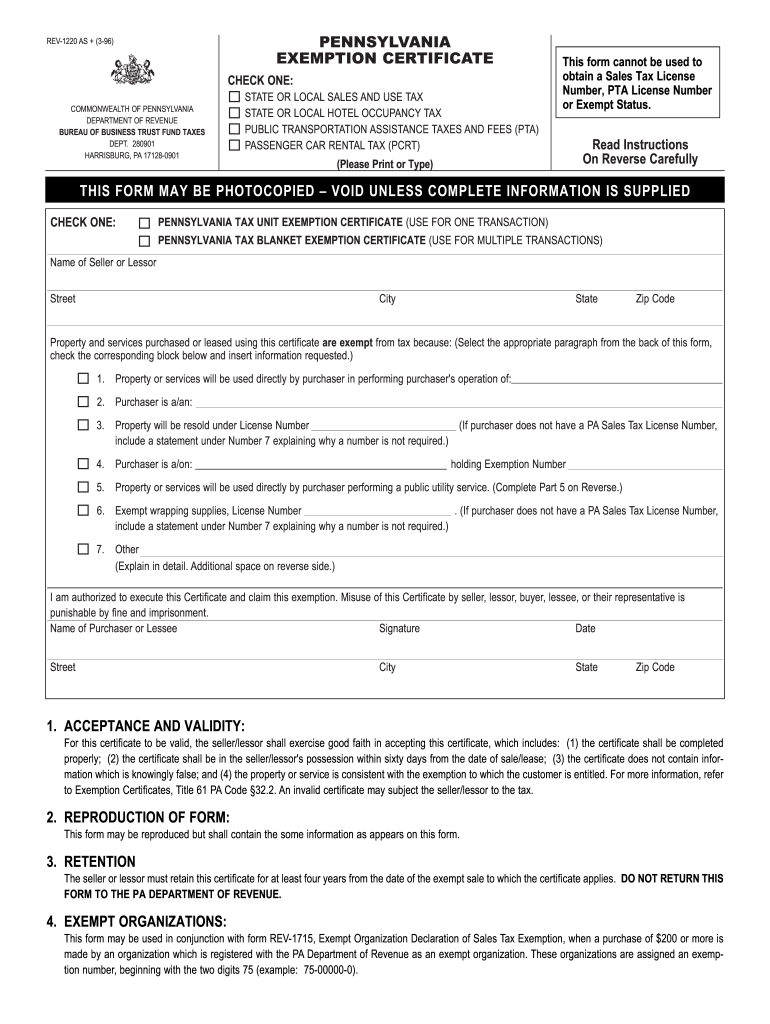

Revenue Rev 1220 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/0/211/211460/large.png

If you are acquiring a home by taking a loan then you can claim deductions on interest portion that you repay as a part of EMI in accordance with the regulations of Section 24 of income tax act Know about income tax deductions under Section 24 from house property income Find out the conditions for claiming Interest on home loan

The Income Tax Act of 1961 provides supplementary tax benefits for plot purchase loans through a lower pre construction interest rate If a borrower initiates Yes you can show the stamp duty and registration fees under deduction section 80C Find out the stamp duty exemption registration charges which are related to the transfer of

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Exemption Letters In USA Florida GOST EXPERT

https://www.gost-expert.com/wp-content/uploads/2019/05/exemption_letter.jpg

https://www.magicbricks.com/blog/plot-loan-tax...

A plot loan has tax benefits associated with it dependent on certain conditions You need to be clear on the use of your plot before you apply for a plot

https://www.bankbazaar.com/home-loan/tax-benefit-on-plot-loan.html

Interest payments on plot loans are eligible for deductions under Section 24 of the Income Tax Act up to Rs 2 lakh provided the loan is converted to a regular home loan after

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

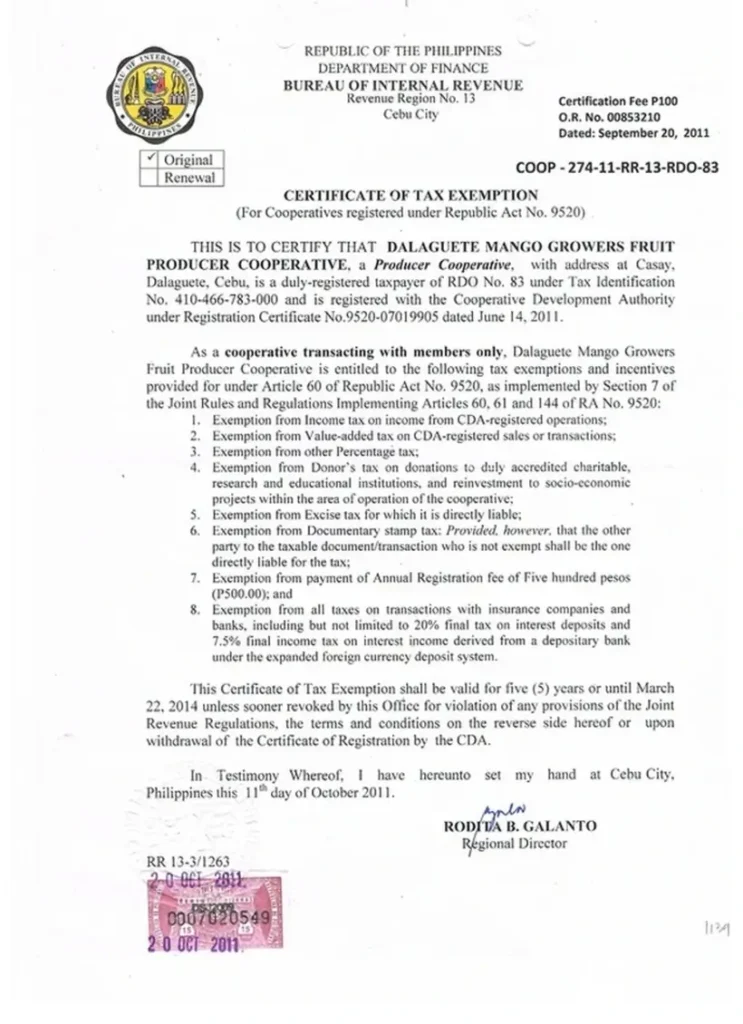

Paano Kumuha Ng Certificate Of Tax Exemption Sa Pilipinas

California Tax Exempt Form Fill Out Sign Online DocHub

Exemption Letter Fill Out Sign Online DocHub

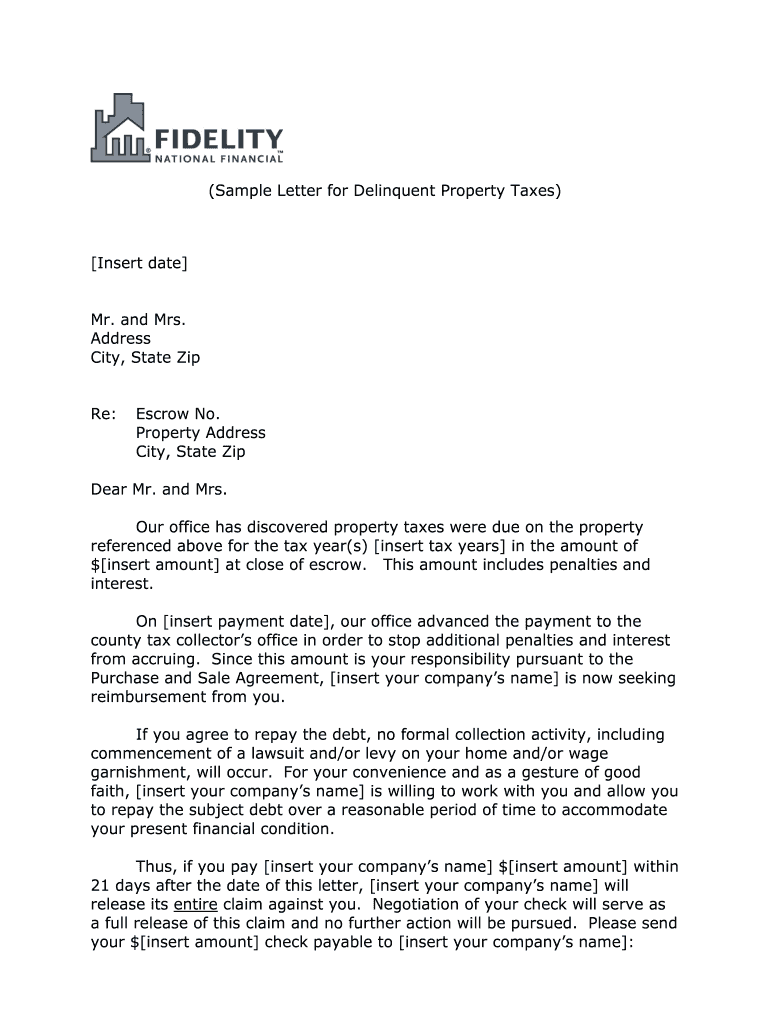

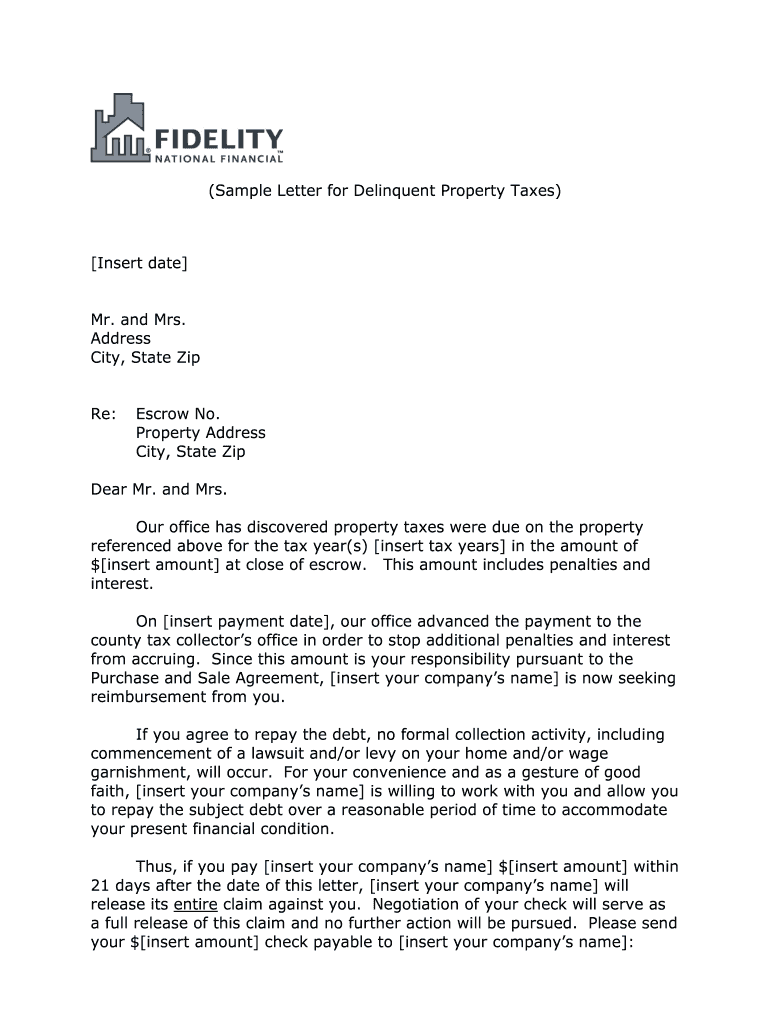

Delinquent Property Tax Letter Samples Fill Online Printable

Delinquent Property Tax Letter Samples Fill Online Printable

Tax Benefits On Home Loan Know More At Taxhelpdesk

Filing Exempt On Taxes For 6 Months How To Do This

Sample Letter Exemptions Form Fill Out And Sign Printable PDF

How To Get Tax Exemption On Plot Loan - While a housing loan is available for buying an apartment or a property banks and finance companies offer you loans to even buy a plot A plot loan is