How To Get Tax Benefit On Joint Home Loan A joint home loan can be a great way to save on taxes and maximize your returns on a property purchase In this article we provide a detailed guide on how to

As you have read above there are multiple ways to obtain the tax benefits on a joint home loan The joint property owners can also claim registration and stamp duty Higher tax benefits By applying jointly for a home loan tax deduction available on home loan can be enjoyed by the co applicants separately provided they are co owners of the property and each of them is

How To Get Tax Benefit On Joint Home Loan

How To Get Tax Benefit On Joint Home Loan

https://i.ytimg.com/vi/2ChJKWNED9Y/maxresdefault.jpg

Tax Benefits On Joint Home Loan How To Claim Norms Benefits

https://assets-news.housing.com/news/wp-content/uploads/2020/01/27083526/How-to-claim-tax-benefits-on-joint-home-loans-FB-1200x700-compressed-686x400.jpg

Joint Home Loan Tax Benefit 3 Ways To Claim Tax Benefits For Joint Owners

https://images.moneycontrol.com/static-mcnews/2020/01/Home-loan.jpg?impolicy=website&width=770&height=431

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs A joint mortgage is a mortgage loan that s shared by multiple parties typically a home buyer and a friend partner or family member of theirs Some people apply for a parent child joint mortgage

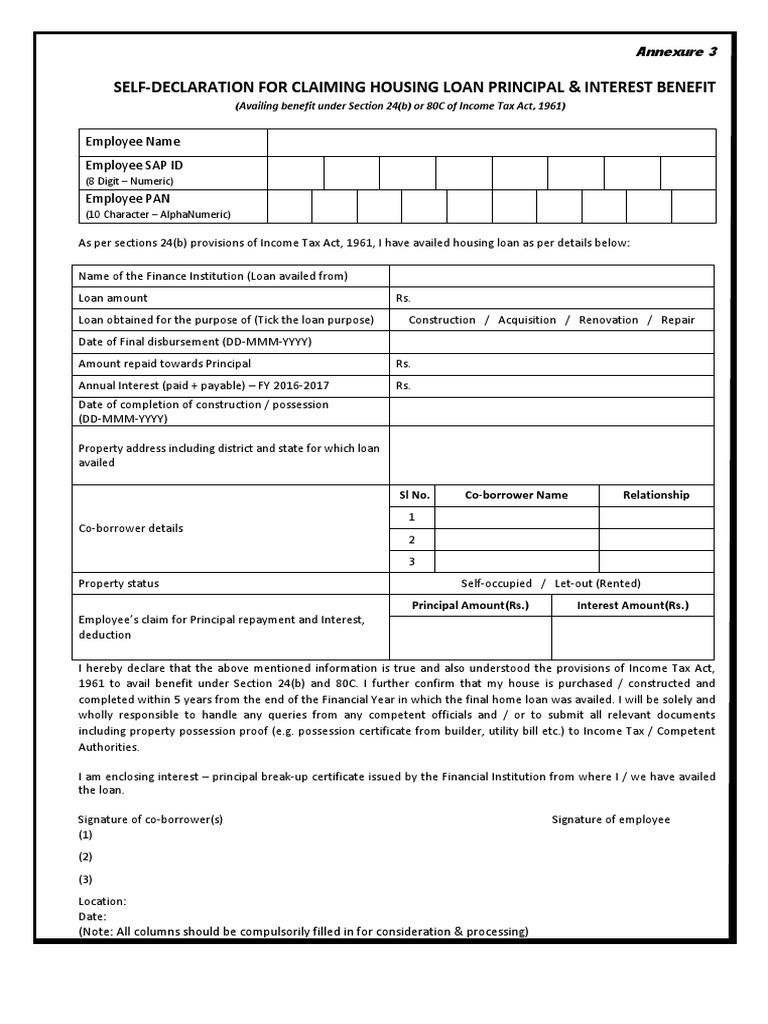

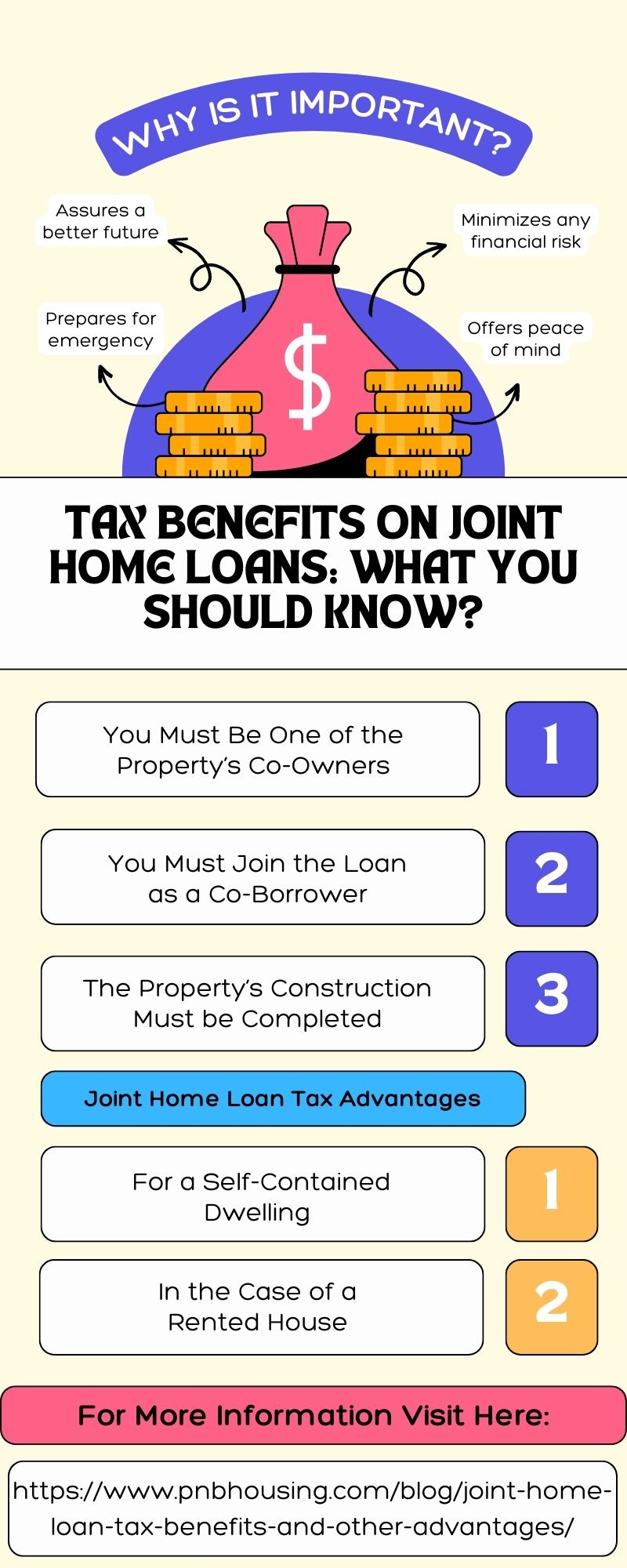

If you are servicing a joint Home Loan you must fulfil the following conditions to claim tax benefits 1 Both Must be Co owners of the Property Only those Joint Home Loans allow borrowers to increase income tax savings as each financial co applicant is eligible for the deduction provided the other conditions are met Here is how

Download How To Get Tax Benefit On Joint Home Loan

More picture related to How To Get Tax Benefit On Joint Home Loan

Self Declaration For Claiming Housing Loan Principal Interest Benefit

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Joint Home Loan Eligibility Tax Benefit Guide

https://assetyogi.com/wp-content/uploads/2017/06/joint-home-loan-eligibility-joint-home-loan-tax-benefit-889x500.jpg

Joint Home Loan 2020 Tax Benefits On Joint Home Loan In India What

https://i.ytimg.com/vi/81E2BLjpcoE/maxresdefault.jpg

Co borrowers of a joint Home Loan can claim a deduction of up to Rs 1 5 lakh on the principal repayment of the loan under Section 80C of the Income Tax Act Additionally Yes each co applicant of a joint home loan in India can claim individual tax benefits on the interest and principal components under Sections 24 and 80C of the

By going for joint home loans you can not only increase your loan eligibility but also become eligible for double tax benefits For large value home loans Income Tax benefits on Housing Loan for Joint Owner of Rs 2 Lakh each Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on

PPT 3 Ways To Get A Tax Benefits On Joint Home Loan PowerPoint

https://image5.slideserve.com/11280216/3-ways-to-get-a-tax-benefits-on-joint-home-loan-n.jpg

Home Loan Tax Benefits

https://www.ashar.in/wp-content/uploads/2021/03/Tax-benefits-of-home-loans-image.jpg

https://tax2win.in/guide/joint-home-loan-tax

A joint home loan can be a great way to save on taxes and maximize your returns on a property purchase In this article we provide a detailed guide on how to

https://www.pnbhousing.com/blog/joint-home-loan...

As you have read above there are multiple ways to obtain the tax benefits on a joint home loan The joint property owners can also claim registration and stamp duty

Joint Home Loan Tax Benefits On Joint Home Loan StayHome And Learn

PPT 3 Ways To Get A Tax Benefits On Joint Home Loan PowerPoint

Tax Benefits On Joint Home Loans What You Should Know By Amrita

Tax Benefits On Home Loan Know More At Taxhelpdesk

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Tax Benefits On Joint Home Loan Under Section Sec 80C Sec 24 Sec 80EEA

How To Claim Tax Benefits On Joint Home Loans

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

How To Get Tax Benefit On Joint Home Loan - A joint mortgage is a mortgage loan that s shared by multiple parties typically a home buyer and a friend partner or family member of theirs Some people apply for a parent child joint mortgage