Replacement Geothermal Heat Pump Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

Find products that are eligible for this tax credit Your go to resource for the latest advice from ENERGY STAR experts on saving energy at home and work Who can use this credit The taxpayer spends 12 000 to install a new geothermal heat pump property in 2022 The geothermal heat pump is replacing a prior geothermal heat pump previously installed in 1995

Replacement Geothermal Heat Pump Tax Credit

Replacement Geothermal Heat Pump Tax Credit

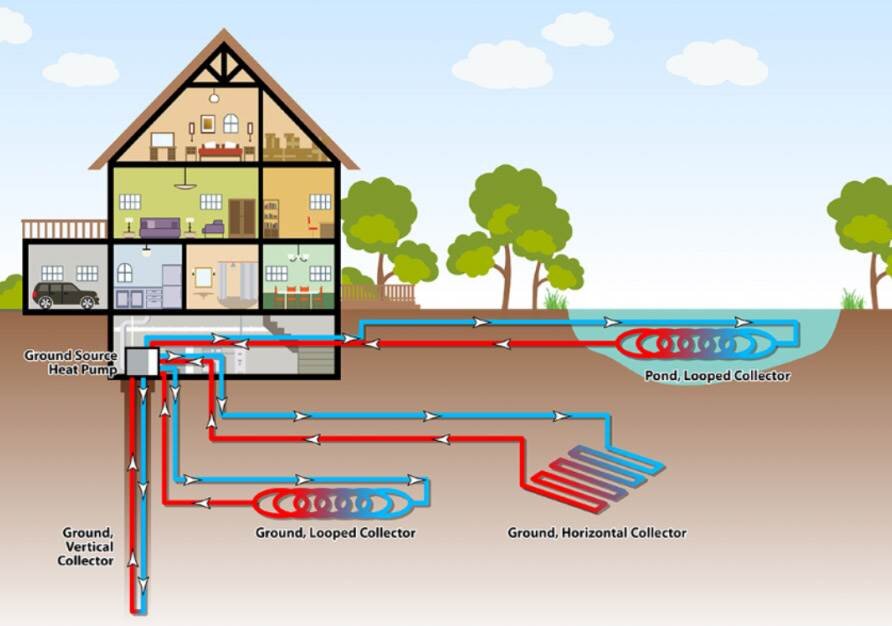

https://blog.factmr.com/wp-content/uploads/2022/05/Geothermal-Heat-Pumps.jpg

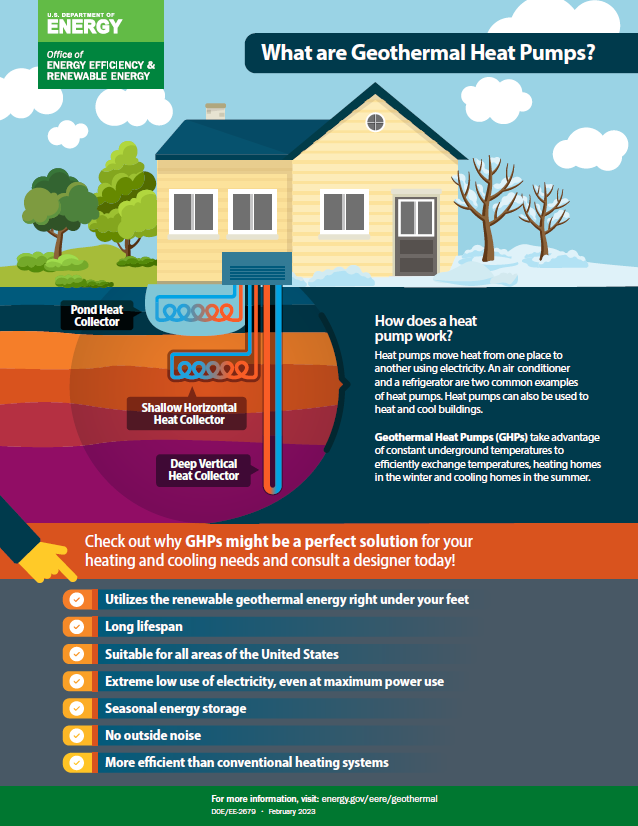

Tax Credits Incentives And Technical Assistance For Geothermal Heat

https://www.energy.gov/sites/default/files/2023-05/2679-geothermal-heatpumps-overview-2023.png

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

Qualified geothermal heat pump property expenditures include replacement units as long as they meet the eligibility requirements In addition to the federal tax credits outlined above many The Inflation Reduction Act IRA of 2022 introduced enhanced tax credits for energy efficiency and extended them through 2032 They cover many improvements including

It is a nonrefundable credit that can reduce or eliminate the amount of tax you owe The credit cannot be refunded The energy efficient home improvement credit has a yearly A taxpayer claiming the credit for electric or natural gas heat pump water heaters electric or natural gas heat pumps central air conditioners natural gas propane or oil water

Download Replacement Geothermal Heat Pump Tax Credit

More picture related to Replacement Geothermal Heat Pump Tax Credit

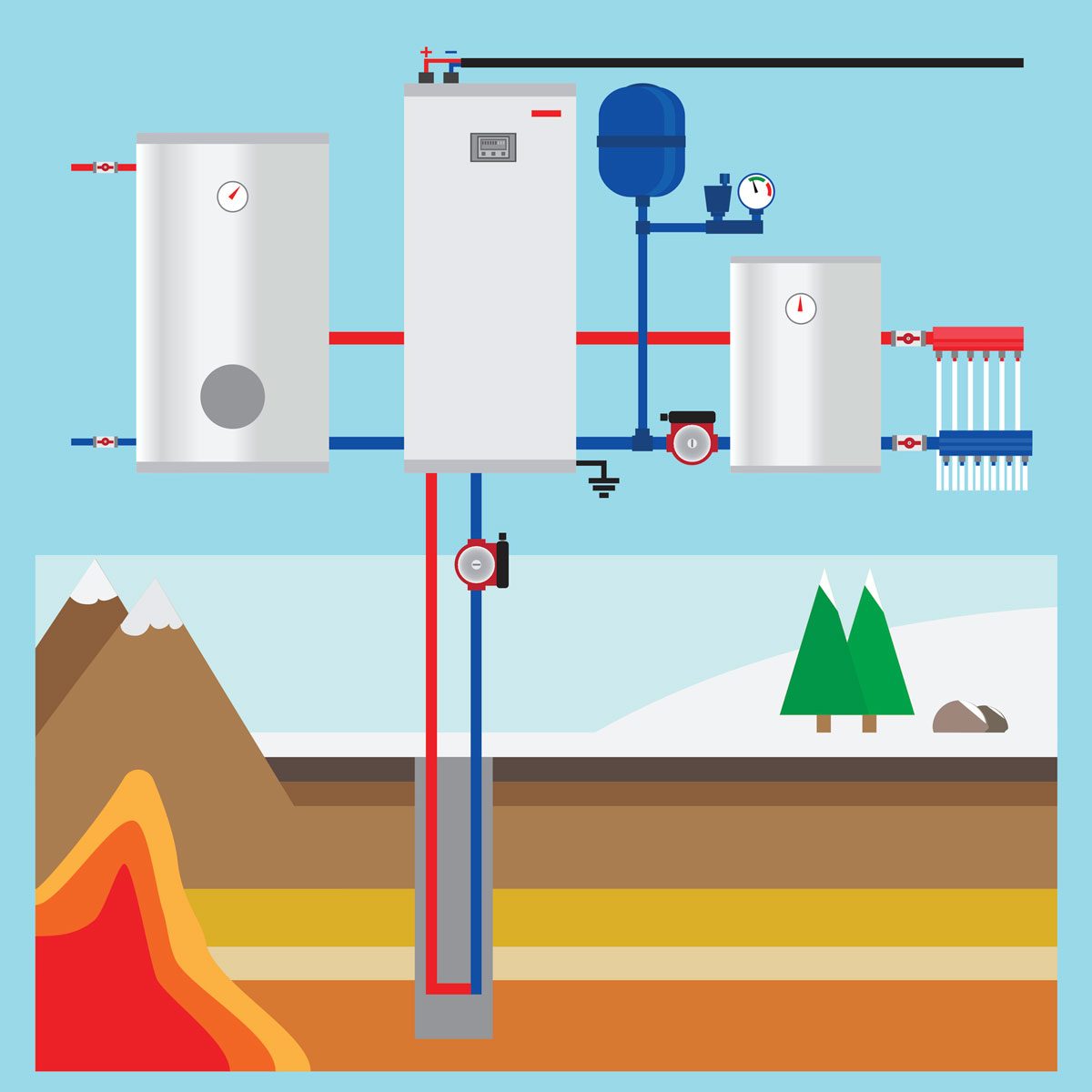

Geothermal Vitt Heating Cooling

http://vittheating.com/wp-content/uploads/2021/03/geothermal-st-louis-scaled.jpeg

5 Ton 24 4 EER 2 Stage ClimateMaster Tranquility 30 Geothermal Heat

https://cdn.iwae.com/media/catalog/product/cache/1/image/9df78eab33525d08d6e5fb8d27136e95/5/-/5-ton-24.4-eer-2-stage-climatemaster-tranquility-30-geothermal-heat-pump-vertical-package-unit-downflow-ha16148-01.3269.jpg

Geothermal Heat Pump Lake Country Geothermal

https://lakecountrygeothermal.com/wp-content/uploads/2016/02/GSHP-SCHEMATIC-WITH-TEMP-copy.png

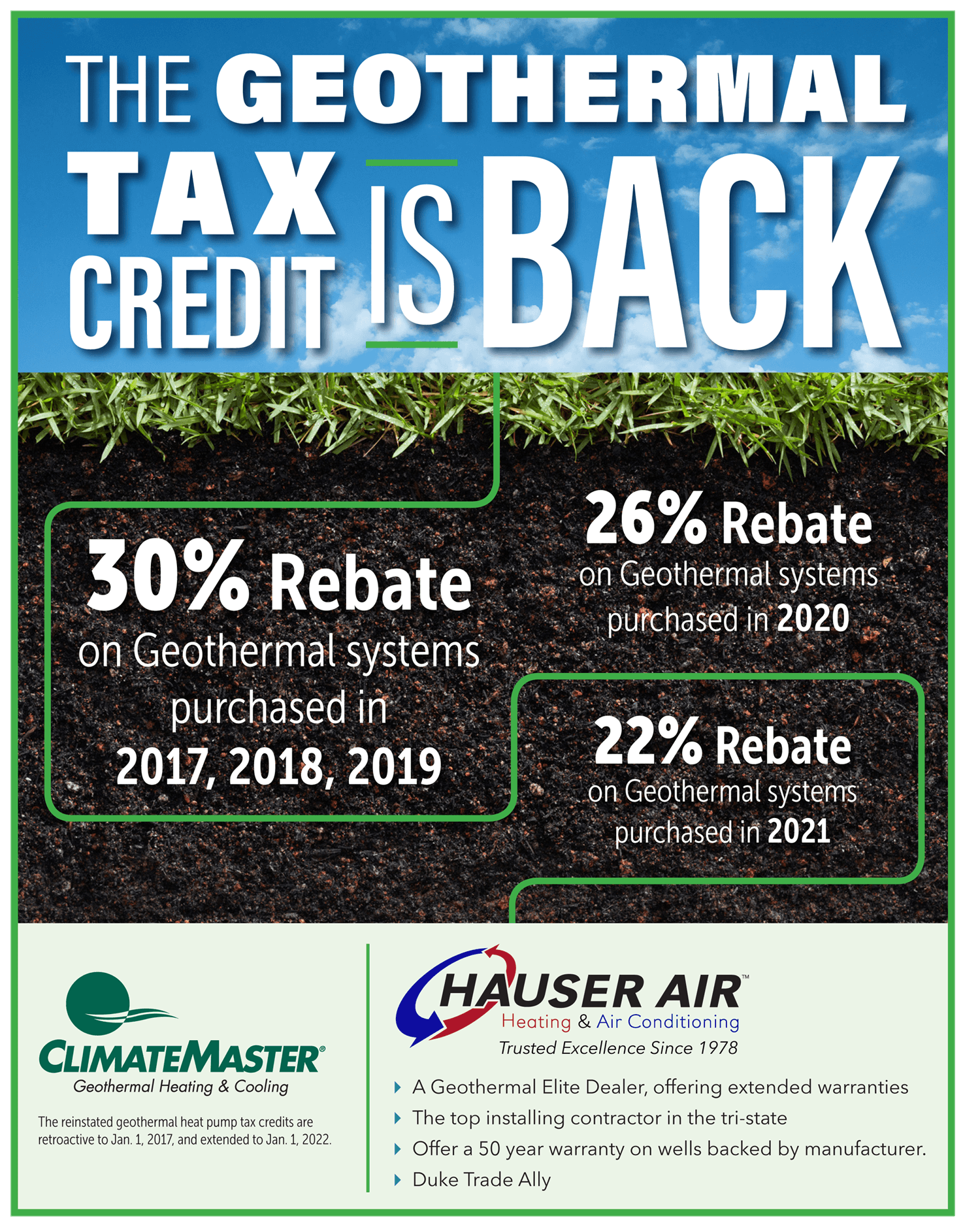

The IRS released favorable final regulations on new technology neutral energy credits on Jan 7 but key questions remain over the qualification for projects involving A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032 The incentive will be lowered to 26 for systems that are

Under the Inflation Reduction Act of 2022 IRA the federal tax credit for residential geothermal system installations was increased from 26 to 30 effective January 1 2023 The 30 tax credit runs through 2032 and The existing Production Tax Credit and Investment Tax Credit will be available to projects that began construction before 2025 Qualifying projects placed in service after

Calam o Why Should I Use Geothermal Heat Pumps

https://p.calameoassets.com/100513001445-00087f0d21618b2bc9aba0ebb402c6ef/p1.jpg

Heat Pump Geothermal Tax Credit PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/form-rpd-41346-geothermal-ground-coupled-heat-pump-tax-credit-claim.png?fit=530%2C749&ssl=1

https://www.irs.gov › credits-deductions › energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through

https://www.energystar.gov › ... › geothermal-heat-pumps

Find products that are eligible for this tax credit Your go to resource for the latest advice from ENERGY STAR experts on saving energy at home and work Who can use this credit

Gulf Power Geothermal Heat Pumps Rebates PumpRebate

Calam o Why Should I Use Geothermal Heat Pumps

A Guide To Geothermal Heat Pumps Family Handyman

Congress Reinstates Geothermal Heat Pump Tax Credits 2018 02 09

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

Geothermal System Repairs Geothermal Heating Omaha NE

Geothermal System Repairs Geothermal Heating Omaha NE

Is A Geothermal Heat Pump Right For You Colorado Country Life Magazine

Geothermal Heating Cooling HVAC Contractors Repair Install

Geothermal Heating Cooling Systems In Cincinnati HAUSER AIR

Replacement Geothermal Heat Pump Tax Credit - In August 2022 the 30 tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations placed in service on January 1 2022 or