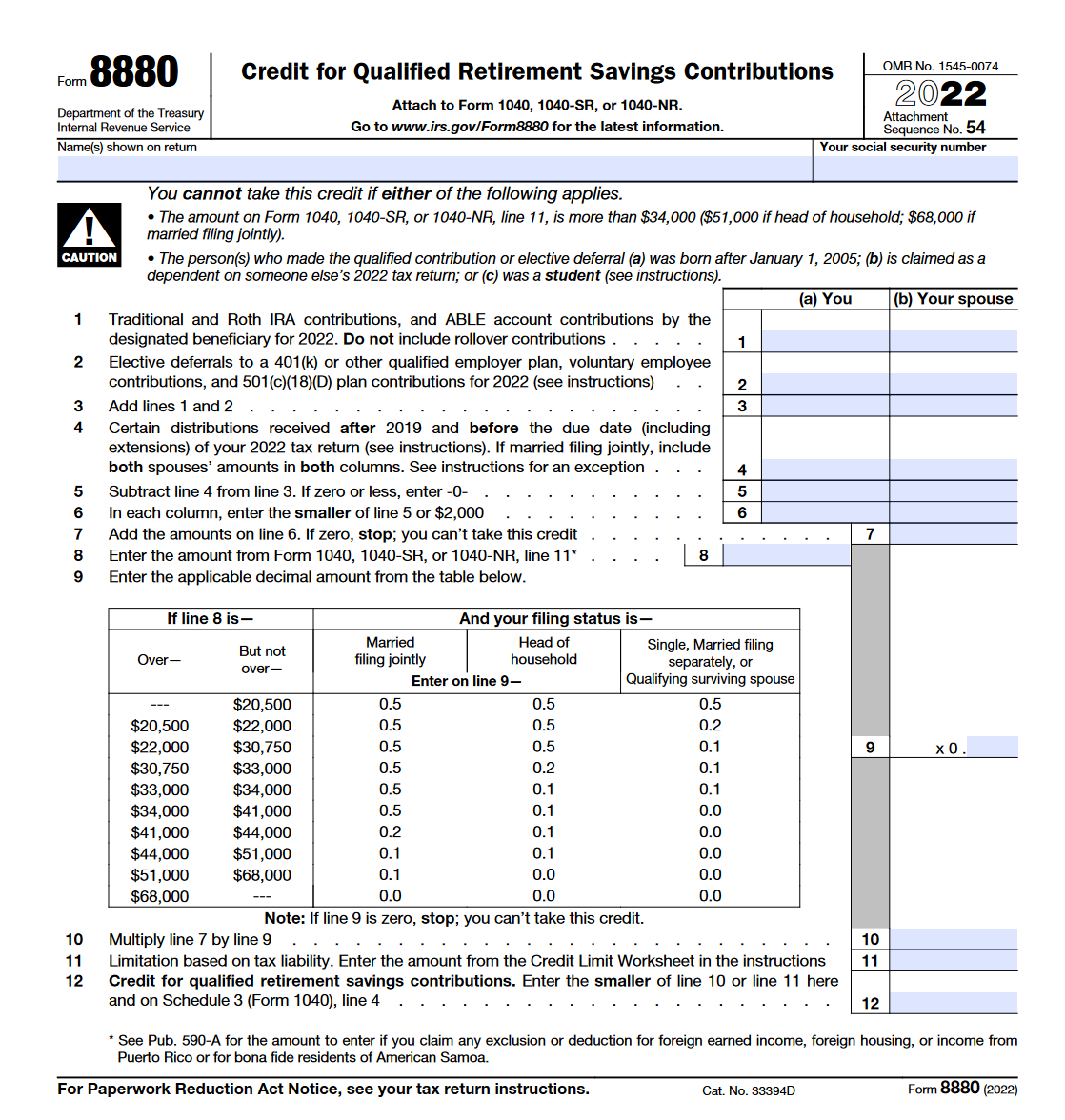

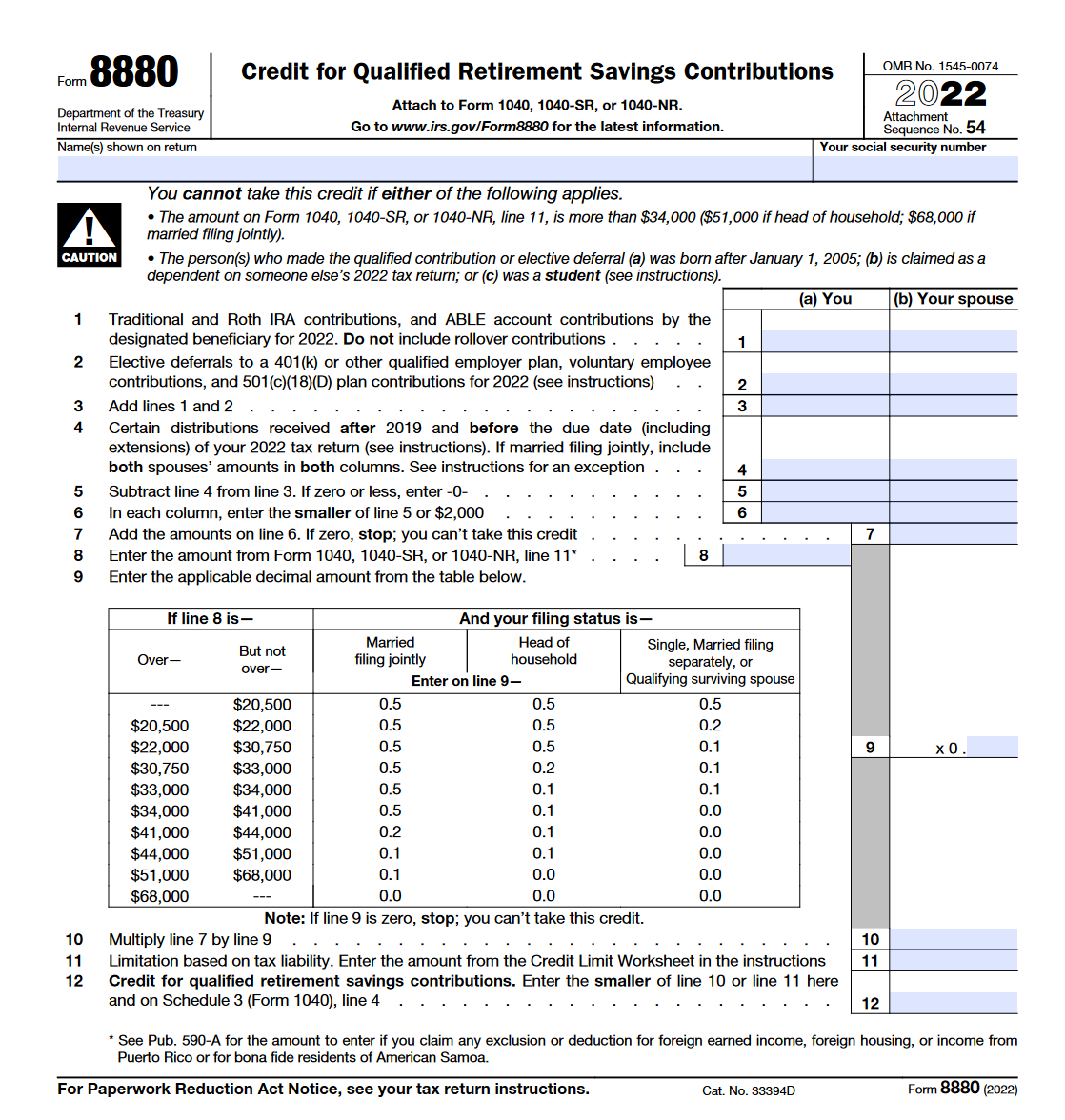

Retirement Savings Tax Credit 8880 Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit The maximum amount of the credit is 1 000 2 000 if married filing jointly TIP This credit can be claimed in addition to any IRA deduction claimed on Schedule 1 Form 1040 line 20

IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can make contributions and Information about Form 8880 Credit for Qualified Retirement Savings Contributions including recent updates related forms and instructions on how to file Form 8880 is used by individuals to figure the amount if any of their retirement savings contributions credit

Retirement Savings Tax Credit 8880

Retirement Savings Tax Credit 8880

https://apprisewealth.com/wp-content/uploads/2022/10/taxable-savings-in-retirement-buckets-1365x2048.jpg

IRS Form 8880 Walkthrough Credit For Qualified Retirement Savings

https://i.ytimg.com/vi/pj1CtSd0lXw/maxresdefault.jpg

Pin On Saving My Coins

https://i.pinimg.com/originals/35/f0/40/35f040a6833c28f8b602fb3d8ce89ebe.jpg

In order to claim the retirement savings credit you must use IRS form 8880 Eligible retirement plans Contributions you make to any qualified retirement plan can be used to satisfy the credit s eligibility requirements Qualified retirement plans include traditional IRAs Roth IRAs 401 k plans 403 b plans and 457 plans Taxpayers use IRS Form 8880 for the Qualified Retirement Savings Contribution Credit As of 2023 the credit is available to single taxpayers with a maximum income of 36 500

To claim the Saver s Credit use IRS Form 8880 Credit for Qualified Retirement Savings Contributions It s a one page form that you can print out a copy of from the IRS website complete it and mail it to the service The credit is based on 10 20 or 50 of the first 2 000 4 000 for joint filers you contribute to retirement accounts including 401 k s traditional IRAs and Roth IRAs rollover

Download Retirement Savings Tax Credit 8880

More picture related to Retirement Savings Tax Credit 8880

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

https://www.investopedia.com/thmb/9Rj4BAvEf2P_WLFphJolmALSRUw=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png

How To Complete IRS Form 8880 Credit For Qualified Retirement Savings

https://i.ytimg.com/vi/w7AdRIAZmWg/maxresdefault.jpg

Cost Of Living How To Build Your Pension Despite Rising Costs

https://www.vodafone.co.uk/newscentre/app/uploads/2023/03/PensionSavingsConcept-scaled.jpg

Form 8880 is used to compute the credit for qualified retirement savings contributions also known as the Saver s Credit This credit is designed to incentivize low and moderate income taxpayers to save for retirement and disabled persons to build savings with ABLE accounts Eligible taxpayers may use IRS Form 8880 to claim a credit for qualified retirement savings contributions known as the saver s credit In this article we ll walk through the retirement savings credit including How to calculate and claim a retirement savings credit on Form 8880 Eligibility requirements for claiming the saver s credit

What is IRS Form 8880 Form 8880 issued by the Internal Revenue Service IRS is a crucial tax form for savers looking to claim the Retirement Savings Contributions Credit This credit often called the Saver s Credit is a beneficial tax provision designed to motivate individuals to save for retirement You can use Form 8880 to calculate and claim the Saver s Tax Credit What Is the Saver s Tax Credit The saver s tax credit is available to eligible taxpayers who contribute to

IRS Form 8880 Credit For Qualified Retirement Savings Contributions

https://blanker.org/files/images/form-8880.png

Retirement Savings Contribution Credit Get A Tax Credit Just For

https://i.pinimg.com/736x/47/29/ea/4729ead6e83ebfcddc4d9218805c87bf.jpg

https://www.irs.gov/pub/irs-pdf/f8880.pdf

Use Form 8880 to figure the amount if any of your retirement savings contributions credit also known as the saver s credit The maximum amount of the credit is 1 000 2 000 if married filing jointly TIP This credit can be claimed in addition to any IRA deduction claimed on Schedule 1 Form 1040 line 20

https://www.investopedia.com/irs-form-8880-credit...

IRS Form 8880 calculates how much of a tax credit you may qualify for if you contribute to an eligible retirement savings plan Eligible plans to which you can make contributions and

What Is Retirement Savings Tax Credit Leia Aqui Why Am I Getting A

IRS Form 8880 Credit For Qualified Retirement Savings Contributions

Retirement Savings Tax Credit

Navigating The 2023 Retirement Savings Tax Credit A Simple Guide

Giving Tax Credit Where Credit Is Due

What One Essential Account Do You Need For Retirement Savings

What One Essential Account Do You Need For Retirement Savings

500 Rent Tax Credit Earnest Property Agents

Saver s Credit A Tax Credit For Retirement Savers MarylandSaves

10 Tips To Grow Your Retirement Savings Over 1 000 000 Savings And

Retirement Savings Tax Credit 8880 - In order to claim the retirement savings credit you must use IRS form 8880 Eligible retirement plans Contributions you make to any qualified retirement plan can be used to satisfy the credit s eligibility requirements Qualified retirement plans include traditional IRAs Roth IRAs 401 k plans 403 b plans and 457 plans