Roof Rebates 2024 Business use of home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible clean energy expenses is as follows Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use

SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News Published January 25 2024 Written by CLEAResult We expect 2024 to be a year in which Inflation Reduction Act IRA Home Energy Rebate programs will achieve impressive gains As funding propels rapid advancements in energy efficiency states will move forward in planning and implementing these initiatives while utilities partners and

Roof Rebates 2024

Roof Rebates 2024

https://myrainplan.com/wp-content/uploads/2022/06/AdobeStock_69914372-scaled.jpeg

Reflective Roof Rebates Database Now Available

https://facilityexecutive.com/wp-content/uploads/2016/03/rcma_roof-1068x561.jpg

Rebates And Tax Credits Can Help Fund Your Metal Roof Expenses Excel Metal Roofing

https://excelmetalroofing.com/wp-content/uploads/2021/08/Excel_Metal_Roofing_Rebates_For_Metal_Roofs.jpg

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 Office of State and Community Energy Programs Home Energy Rebate Programs Requirements and Application Instructions Home Energy Rebate Programs Requirements and Application Instructions Updated October 13 2023 Washington DC 20585 202 586 5000 Sign Up for Email Updates

Home Growing the Economy Energy Federal Funding for Buildings Home Energy Rebates The federal Inflation Reduction Act and the Washington State Legislature will provide funds to support home improvements like energy efficiency and home electrification measures Inflation Reduction Act Home Energy Rebates IR 2023 97 May 4 2023 The Internal Revenue Service reminds taxpayers that making certain energy efficient updates to their homes could qualify them for home energy tax credits

Download Roof Rebates 2024

More picture related to Roof Rebates 2024

Buy Flat Roof Drain DN 100 IncludingLeaf Trap Bitumen PVC Flange Roof Gully Inlet Roof

https://m.media-amazon.com/images/I/61KqQCZfUCL.jpg

Leading Metal Roof Company Announces 5000 Manufacturer s Authorized Roofing Rebate

http://ww1.prweb.com/prfiles/2013/04/03/10598087/Rebate2.jpg

Buy 2024 Wall 2024 Jan 2024 Dec 2024 12 X 24 Open 12 Month Wall 2024 With Unruled

https://m.media-amazon.com/images/I/81J20wwDaLL.jpg

Save Up to 1 200 on Energy Efficiency Home Improvements Claim 30 up to 1 200 for these qualifying energy property costs and certain energy efficient home improvements Windows Skylights Water Heaters Natural Gas Oil Propane Central Air Conditioners Doors Furnaces Electric Panel Upgrade Insulation Boilers Home Energy Audit Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits Independently certified to save energy ENERGY STAR

The goals of HOMES and HEEHRA which comprise the IRA s Home Energy Rebate Programs are to help households save money on energy bills improve energy efficiency reduce greenhouse gas GHG emissions and improve indoor air quality Updated Aug 7 2023 10 52am We earn a commission from partner links on Forbes Home Commissions do not affect our editors opinions or evaluations Getty Images Table of Contents New York Solar

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Roof Rebates For Veterans All Craft Exteriors Joins GAF In It s Roofs For Troops Program

https://i.ytimg.com/vi/ty7viglqwtA/maxresdefault.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Business use of home If you use a property solely for business purposes you can t claim the credit If you use your home partly for business the credit for eligible clean energy expenses is as follows Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use

https://www.energy.gov/scep/home-energy-rebates-programs

SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News

Illinois Solar Incentives Tax Credits Rebates 2024 Today s Homeowner

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

Helping Homeowners Find The Right Roofing Rebates In 2021 Modernize

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Rebates For Seniors Mark Coure MP

Tolminator 2024

Tolminator 2024

Orbit Blackhawk Climbable Roof Masts Orbit

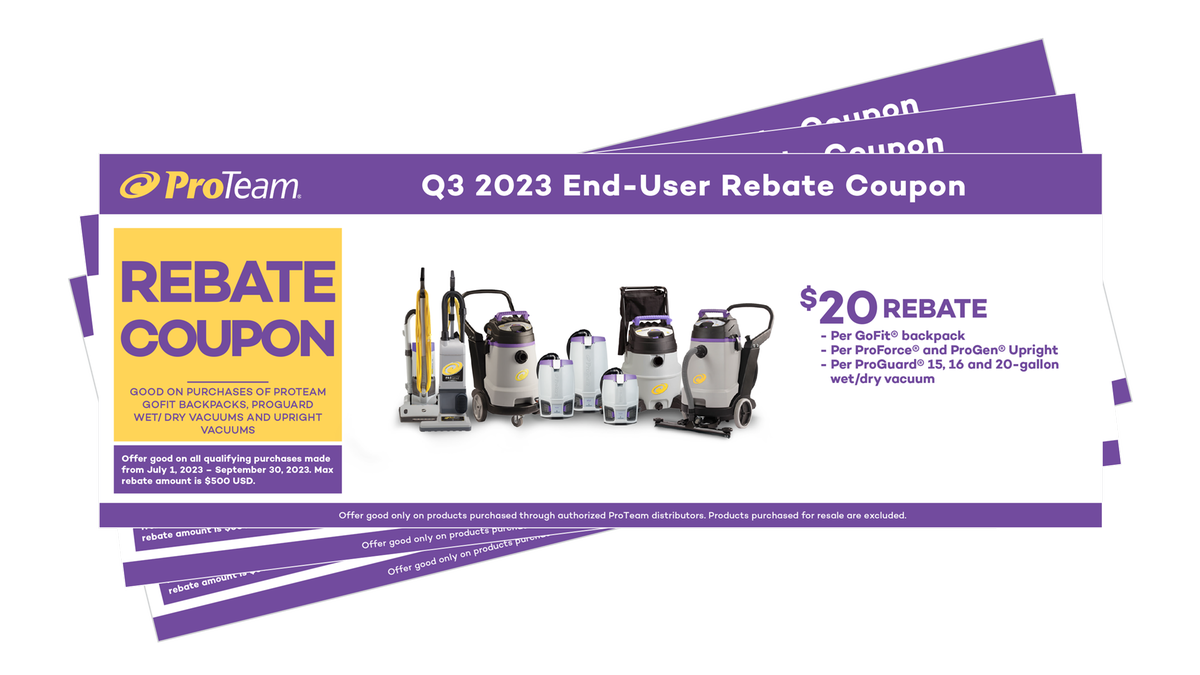

Manufacturer Rebates CleanFreak

CAT Rebates W L Inc

Roof Rebates 2024 - 50 1 SunPower