Roofing Rebates 2024 Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates In the case of property placed in service after December 31 2022 and before January 1 2024 22 Q Is a roof eligible for the residential energy efficient property tax credit A In general traditional roofing materials and structural components do not qualify for the credit However some solar roofing tiles and solar roofing shingles

Roofing Rebates 2024

Roofing Rebates 2024

https://excelmetalroofing.com/wp-content/uploads/2021/08/Excel_Metal_Roofing_Rebates_For_Metal_Roofs.jpg

CE Center Utilizing Utility Rebates To Drive Energy Efficient Roofing

https://mcgrawimages.buildingmedia.com/CE/CE_images/2018/June/Infrared-Photo-1.jpg

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

The CEC expects rebates will become available in 2024 Expand All Request for Information Home Efficiency Rebates HOMES Program Home Electrification and Appliance Rebates HEEHRA Training for Residential Energy Contractors TREC Expected Timeline for California IRA Residential Energy Rebates Legislation Upcoming Events Home energy audits 150 Exterior doors 250 per door up to 500 per year Exterior windows and skylights central A C units electric panels and related equipment natural gas propane and oil water heaters furnaces or hot water boilers 600 In addition to the 1 200 credit limit above a separate aggregate yearly credit limit of 2 000

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 Save Up to 1 200 on Energy Efficiency Home Improvements Claim 30 up to 1 200 for these qualifying energy property costs and certain energy efficient home improvements Windows Skylights Water Heaters Natural Gas Oil Propane Central Air Conditioners Doors Furnaces Electric Panel Upgrade Insulation Boilers Home Energy Audit

Download Roofing Rebates 2024

More picture related to Roofing Rebates 2024

Helping Homeowners Find The Right Roofing Rebates In 2021 Modernize

https://modernize.com/wp-content/themes/modernize/dist/images/bg/pros/roof-hero-desktop.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

NDP Says It Would Fund Roofing Rebates For Calgary Hailstorm Damage Calgary Herald

https://smartcdn.gprod.postmedia.digital/calgaryherald/wp-content/uploads/2022/04/0421-ndp-presser.jpg

U S Military Troops Get a 250 rebate when you install a GAF roofing system on your home and purchase an Enhanced Warranty between January 1 2024 and December 31 2024 Terms Conditions After purchase mail in rebate Claim Your Roofs for Troops Rebate Click here to learn which GAF products are part of a GAF Lifetime Roofing System Tax Credits for Homeowners Information updated 12 30 2022 Under the Inflation Reduction Act of 2022 federal income tax credits for energy efficiency home improvements will be available through 2032 A broad selection of ENERGY STAR certified equipment is eligible for the tax credits Independently certified to save energy ENERGY STAR

Office of State and Community Energy Programs Home Energy Rebate Programs Requirements and Application Instructions Home Energy Rebate Programs Requirements and Application Instructions Updated October 13 2023 Washington DC 20585 202 586 5000 Sign Up for Email Updates Rebate valid for installations between January 1 2024 through December 31st 2024 dated invoice must be provided Rebate registrations must be received by December 31 2024 Repairs additions and partial replacements do not qualify Only complete home roofs with a minimum 20 SQs of DECRA material installed are eligible

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

https://www.hhshootingsports.com/wp-content/uploads/2022/11/SmithWessonRebates-HalfPage-scaled.jpg

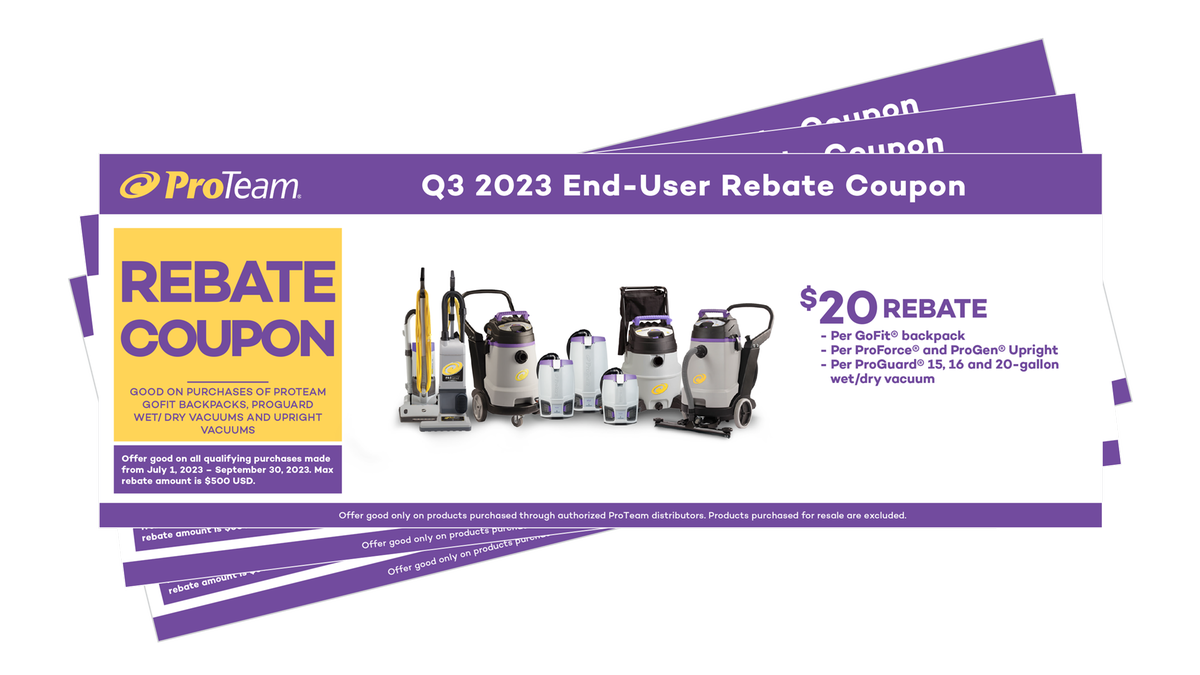

Manufacturer Rebates CleanFreak

https://cdn.shopify.com/s/files/1/0624/3270/6740/files/rebates-q3-full-line.png?v=1686831920

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

Beginning Jan 1 2023 the credit equals 30 of certain qualified expenses including Qualified energy efficiency improvements installed during the year Residential energy property expenses Home energy audits There are limits on the allowable annual credit and on the amount of credit for certain types of qualified expenses

https://www.energy.gov/scep/home-energy-rebates-programs

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

NWC Tryouts 2023 2024 NWC Alliance

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

How Do Home Rebates Work DC MD VA Home Rebates

Milwaukee Tool Rebates Printable Rebate Form

Primary Rebate South Africa Printable Rebate Form

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Can I Combine Solar Rebates With Other Incentives In South Australia

Roofing Tax Credits Energy Rebates Incentives Affordable Roofing

CEU Utilizing Utility Rebates To Drive Energy Efficient Roofing 2018 06 01 Building Enclosure

Roofing Rebates 2024 - ENERGY STAR Rebate Finder Find rebates and special offers near you on ENERGY STAR certified products Products that earn the ENERGY STAR label meet strict energy efficiency specifications set by the U S EPA helping you save energy and money while protecting the environment