Rrsp Contribution Limit Tax Return The maximum amount that an individual can contribute to registered retirement savings plans RRSP without tax implications and how much can be deducted

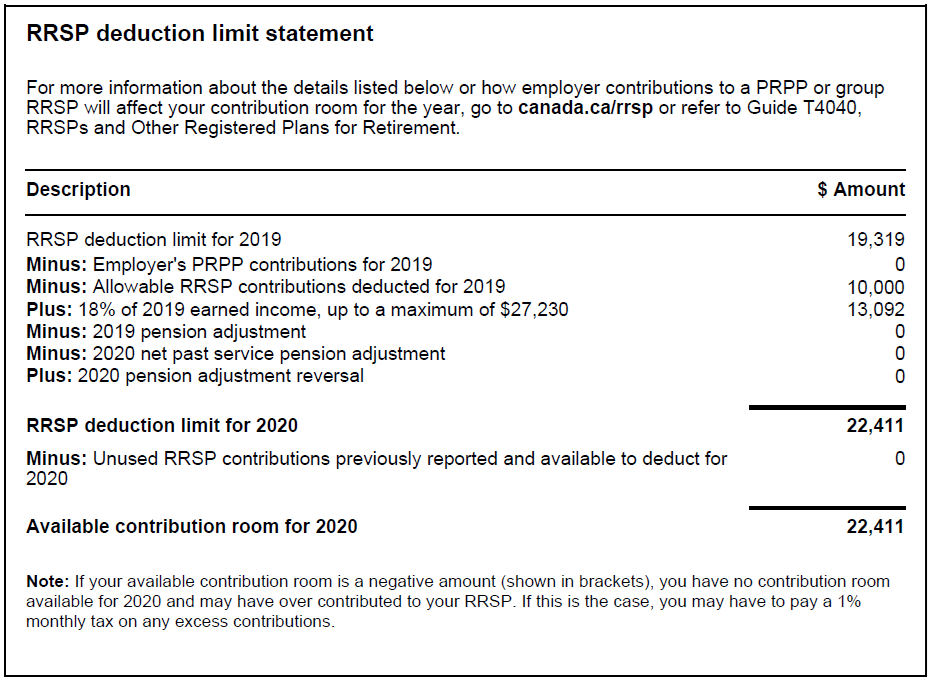

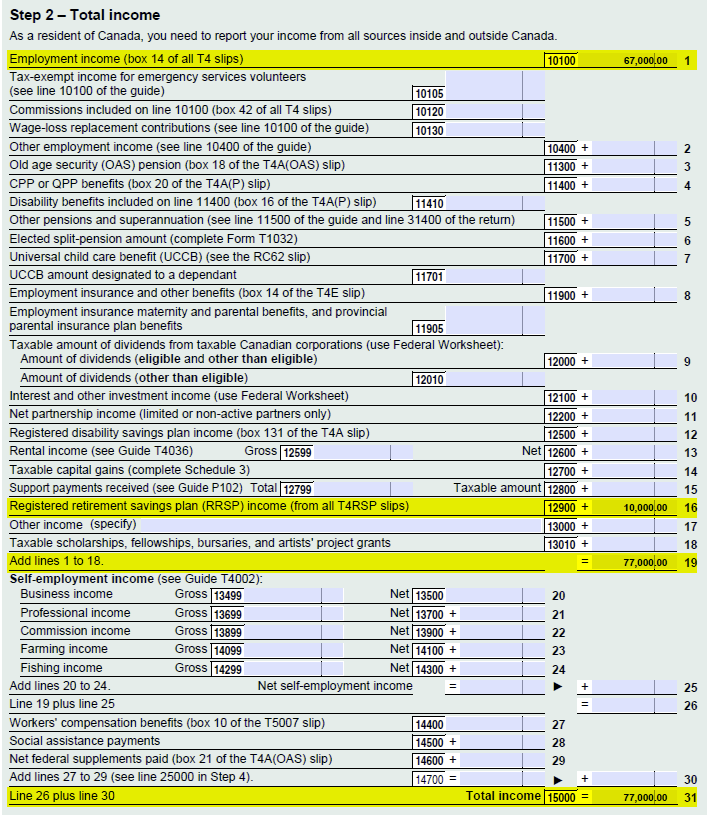

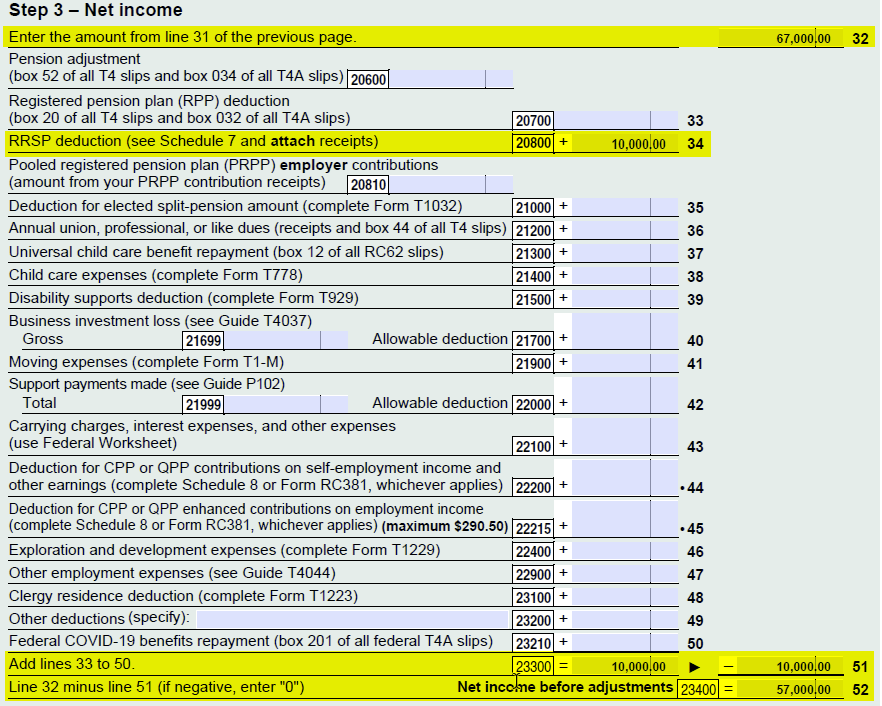

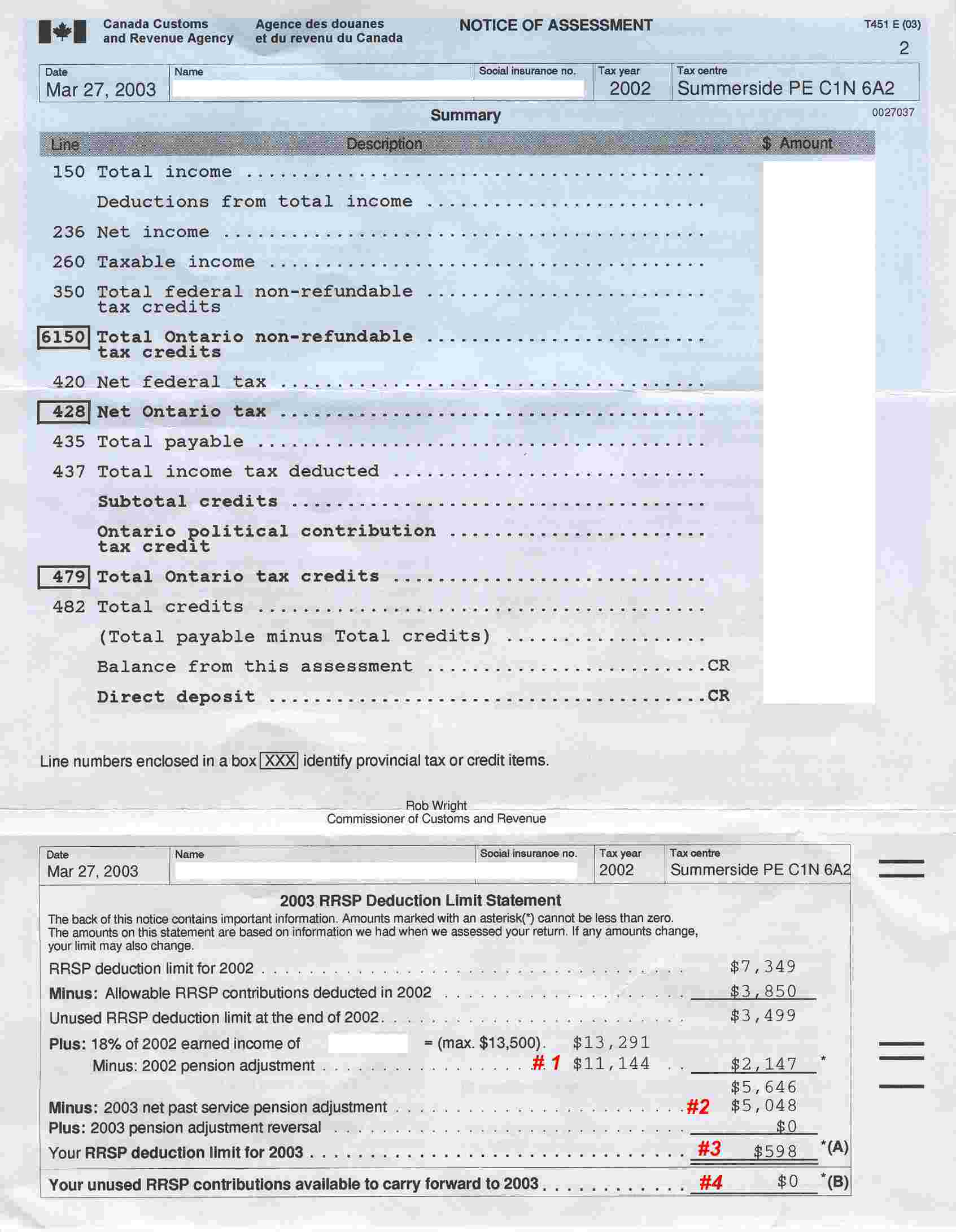

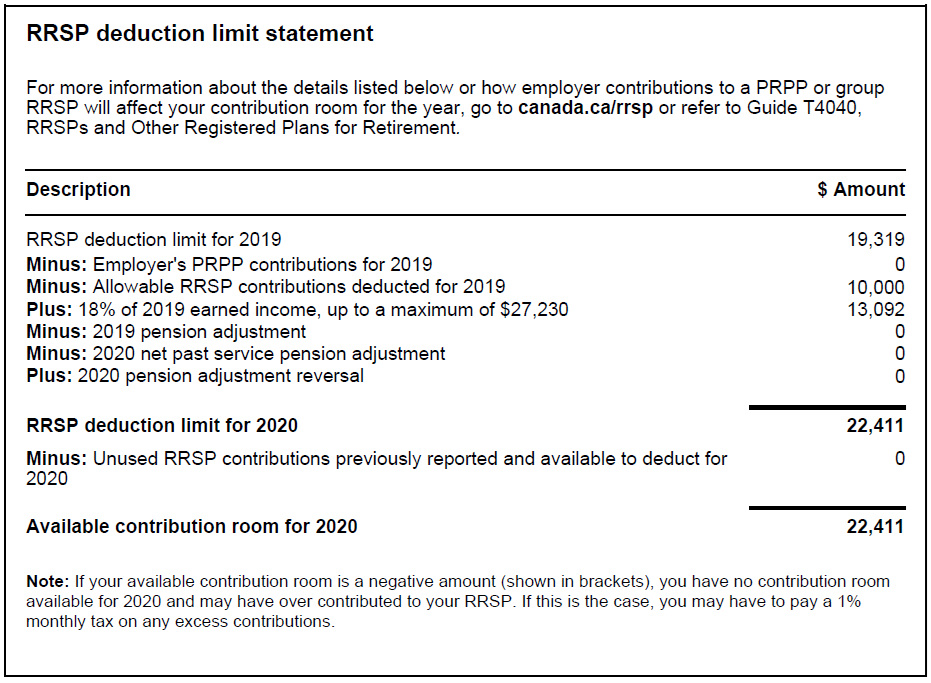

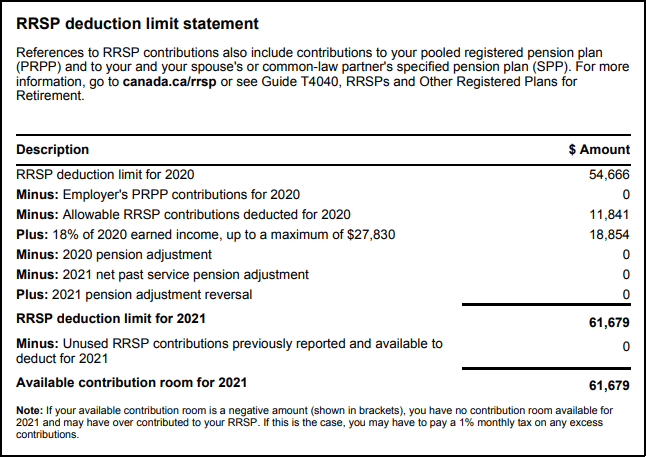

You can file your tax return for 2022 and 2023 and we will update your RRSP deduction limit You can leave the funds in your RRSP and deduct part or all of it on your 2023 return or a future return up to your deduction limit You may set up and contribute to an RRSP as long as you have employment income RRSP deduction limit and file a tax return What is an RRSP Deduction Limit Your RRSP deduction limit also known as your RRSP contribution limit is the maximum amount you can contribute to your personal or a spousal RRSP in a given year

Rrsp Contribution Limit Tax Return

Rrsp Contribution Limit Tax Return

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

RRSP Contribution Limits How Much Can You Deposit RGB Accounting

https://rgbaccounting.com/wp-content/uploads/2021/02/rrsp-how-much-you-can-contribute-1080-980x565.jpg

RRSP Withdrawal On Tax Return Example PlanEasy PlanEasy

https://www.planeasy.ca/wp-content/uploads/2022/04/RRSP-Withdrawal-on-Tax-Return-Example-PlanEasy.png

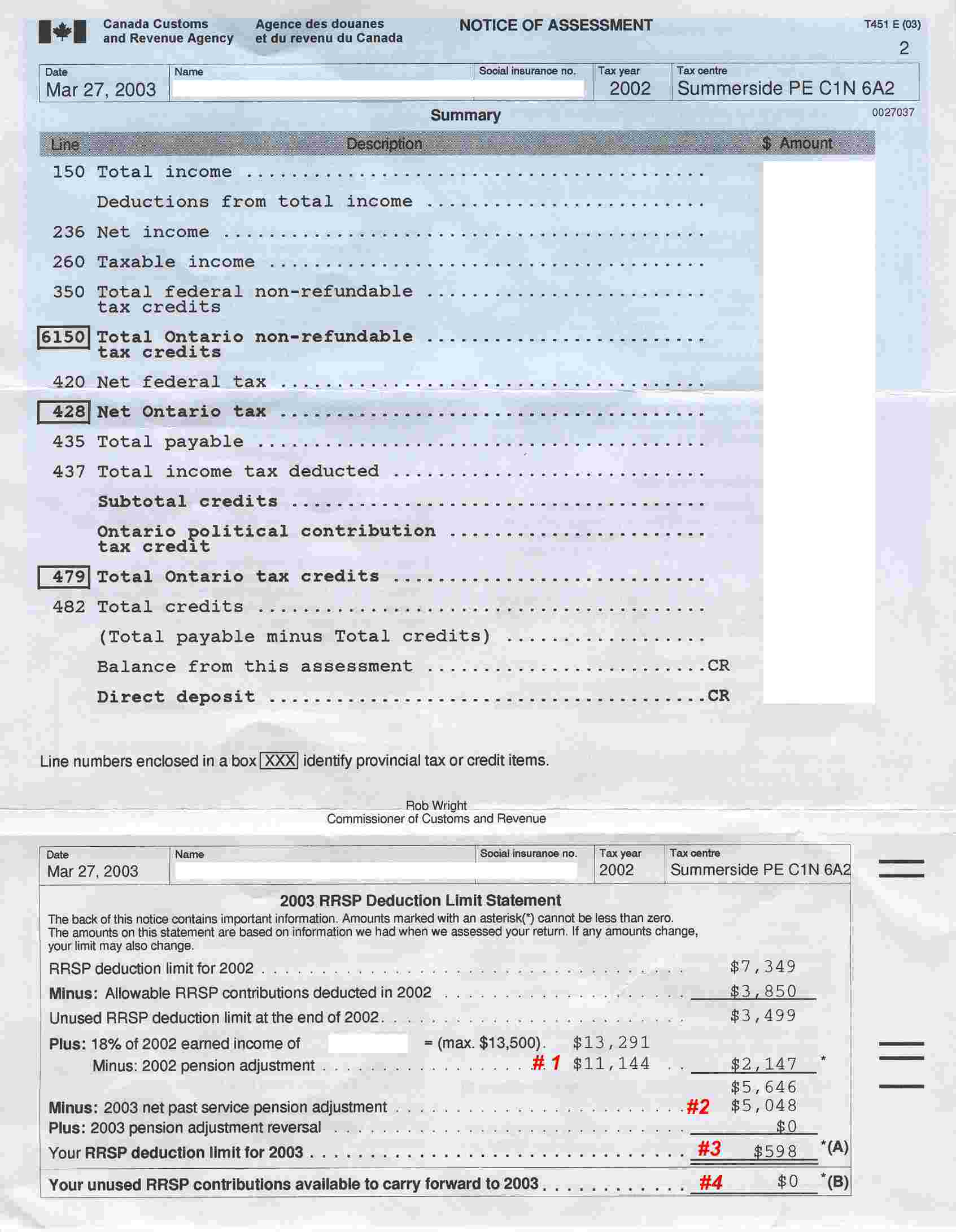

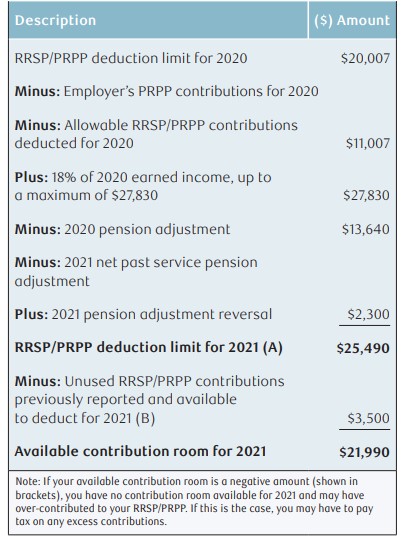

RRSP contribution room also referred to as contribution limit is the maximum amount of money you can put into your RRSP accounts in any given year You can claim allowable RRSP contributions as a deduction on your annual tax return to lower the amount of taxes you have to pay The annual limits for RRSPs money purchase defined contribution RPPs deferred profit sharing plans DPSPs and defined benefit RPPs are The DPSP limit is 1 2 of the MP limit each year The MP limit and DPSP limits for pension adjustment PA purposes are also restricted to 18 of compensation

For 2024 the RRSP contribution limit is 31 560 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency CRA sets an annual limit on the contribution amount each eligible taxpayer can make to RRSPs to avoid excess contributions Eligibility criteria for RRSPs Anyone living in Canada who has earned income and has filed a tax return can contribute to an RRSP There is no minimum age to open an RRSP For instance a child actor or a teenager working part time could file a tax return and start contributing to RRSPs

Download Rrsp Contribution Limit Tax Return

More picture related to Rrsp Contribution Limit Tax Return

2023 RRSP Season Is Here CAPCORP

https://www.capcorp.ca/wp-content/uploads/2022/02/RRSP-IMAGE.jpg

Should We Take Advantage Of Our Unused RRSP Contribution Limits Jack

https://jacklumsden.com/wp-content/uploads/2021/04/RRSPinvesting.jpg

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

https://www.planeasy.ca/wp-content/uploads/2022/04/RRSP-Contribution-Deduction-on-Tax-Return-Example-PlanEasy.png

RRSP contributions are tax deductible up to your personal deduction limit the year you make them and your investments grow on a tax deferred basis Taxes are paid when you withdraw from your RRSP An RRSP deduction limit is the maximum amount of money you can contribute to your RRSP and claim as a tax deduction when completing your income tax return You can find your RRSP deduction limit on your Notice of Assessment or in your My CRA Account online

Your RRSP contribution limit for 2024 is 18 of earned income you reported on your tax return in the previous year up to a maximum of 31 560 For 2023 the dollar limit was 30 780 For 2025 the dollar limit will be 32 490 How to claim your RRSP PRPP or SPP contributions on your income tax and benefit return Registered retirement savings plan RRSP issuers pooled registered pension plan PRPP or specified pension plan SPP administrators will give you a receipt for the amounts you contributed

RRSP Explanation

https://www.execulink.com/~osstf11/images/assessntc.jpg

RRSP Contributions How To Avoid Paying Taxes Qopia Financial

https://qopiafinancial.ca/wp-content/uploads/2022/02/RRSP-spelled-out-1080x675.jpg

https://www.canada.ca/en/revenue-agency/services/...

The maximum amount that an individual can contribute to registered retirement savings plans RRSP without tax implications and how much can be deducted

https://www.canada.ca/en/revenue-agency/services/...

You can file your tax return for 2022 and 2023 and we will update your RRSP deduction limit You can leave the funds in your RRSP and deduct part or all of it on your 2023 return or a future return up to your deduction limit

TFSA Contribution Limit In Canada By Year To 2021

RRSP Explanation

RRSP Contribution Limit What You Need To Know 2023 Update Gold RRSP

RRSP Contribution Limit For 2023 Another Loonie

What Is A Group RRSP And How Does It Work Blog Avalon Accounting

RRSP Contribution Limit Tax Deduction Full Guide Simplified

RRSP Contribution Limit Tax Deduction Full Guide Simplified

Tax Changes In Canada For 2023 RRSP TFSA FHSA And More Blog

2023 Tax Season RRSP Deadline Info AADCPA

The So Wealth Management Group RRSP Contribution VS Deduction Limit

Rrsp Contribution Limit Tax Return - Eligibility criteria for RRSPs Anyone living in Canada who has earned income and has filed a tax return can contribute to an RRSP There is no minimum age to open an RRSP For instance a child actor or a teenager working part time could file a tax return and start contributing to RRSPs