Rrsp Contribution Tax Deduction With an RRSP your contributions may be tax deductible meaning that you can possibly claim a tax deduction for the amount you contribute and potentially reduce taxable

TurboTax s free RRSP tax calculator Estimate your 2023 income tax savings your RRSP contribution generates in each Canadian province and territory You can make contributions and receive the tax deduction more on that below There are some specific rules around withdrawals from spousal RRSPs that you should know in

Rrsp Contribution Tax Deduction

Rrsp Contribution Tax Deduction

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

Calculate RRSP Contribution And Deduction Limit HomeEquity Bank

https://www.chip.ca/wp-content/uploads/africanamerican-senior-couple-doing-finances-rrsp.jpg

Advisorsavvy RRSP Tax Deduction

https://advisorsavvy.com/wp-content/uploads/2022/08/RRSP-Tax-Deduction-In-Post-768x1152.jpg

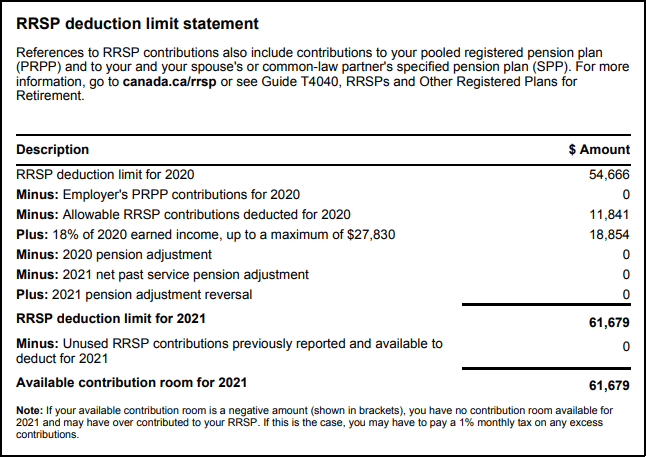

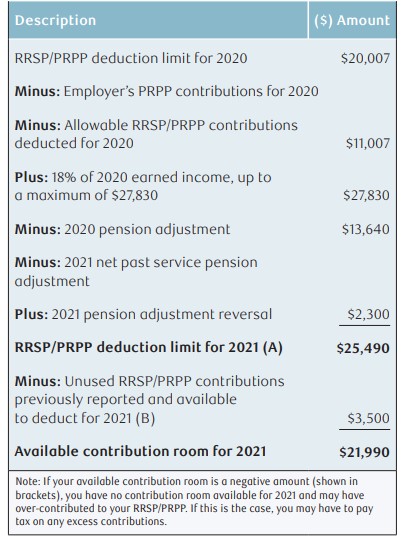

Key Takeaways An RRSP is a special savings plan that helps Canadians save for retirement Every dollar you sock away into an RRSP savings or investing account cuts You can contribute only a certain amount to your RRSP every year 18 of your total income earned in the previous year up to a maximum limit set by the government this

When you contribute to an RRSP any growth such as through interest and dividends is tax exempt for as long as you keep it in the plan However another big advantage is that You may get anywhere from 20 per cent to 50 per cent of your RRSP contributions back as an income tax refund based on your marginal tax rate Use the RRSP Tax Refund

Download Rrsp Contribution Tax Deduction

More picture related to Rrsp Contribution Tax Deduction

How To Calculate Rrsp Contribution For Tax Refund Dollar Keg

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-rrsp-contribution-for-tax-refund-768x527.jpg

Five Biggest RRSP Mistakes SADOVNICK MORGAN LLP

https://www.smllp.ca/sites/default/files/field/image/iStock-514154526.jpg

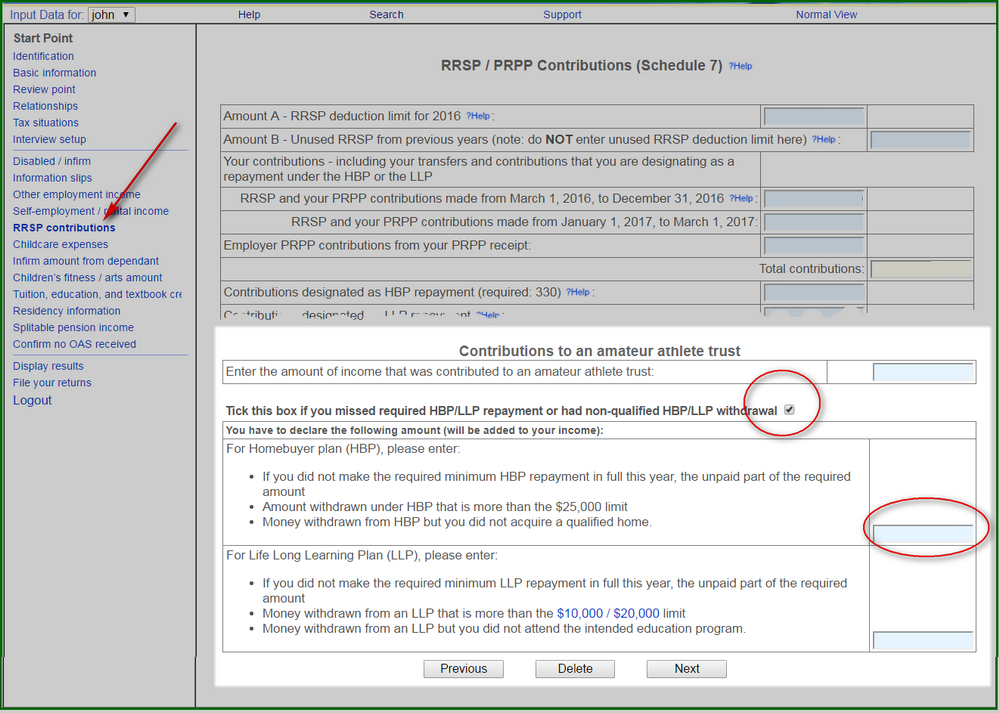

RRSP Minimum Repayment

https://www.taxchopper.ca/t1help/Q_deduction/rrspRepay.png

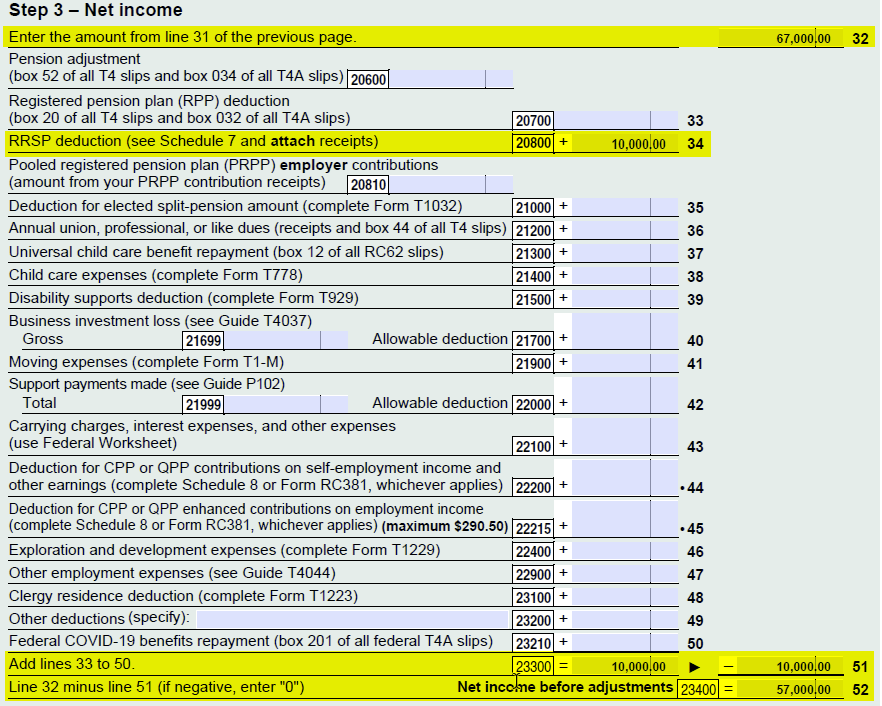

RRSP contributions are deductible and can reduce your taxes Deduct them on line 20800 of your tax return There is a maximum annual limit on how much you can contribute to When you deposit money to your RRSP your taxable income is reduced by the same amount up to your contribution limit Here s a basic explanation If your taxable income is

Reflects known rates as of December 1 2022 Taxable Income RRSP Contribution Calculate Tax Calculators 2022 RRSP Savings You re allowed to deduct RRSP contributions made from January to March 2023 on your 2023 tax return as long as you didn t deduct them on your To claim these contributions

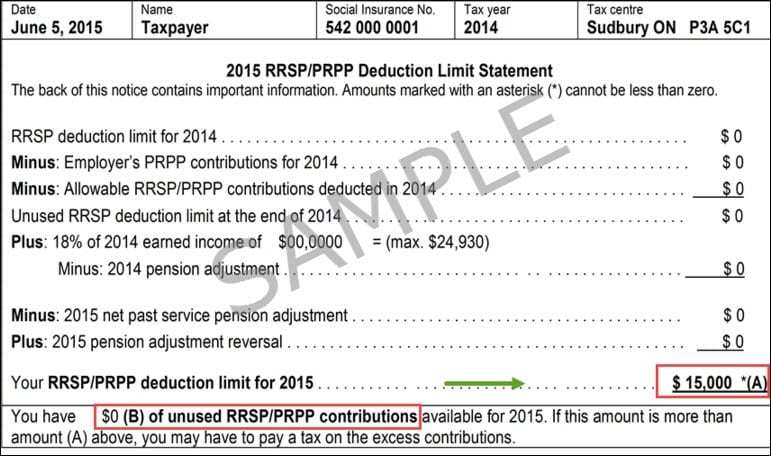

RRSP Contribution Limit For 2023 Another Loonie

https://www.anotherloonie.ca/wp-content/uploads/2021/11/RRSP-deduction-limit-statement.png

Don t Miss The RRSP And TFSA 2020 Deadline W B White Insurance Ltd

https://www.wbwhite.com/wp-content/uploads/2020/01/tax-refund.png

https://www.td.com/.../rrsp-contribution-limit-rules

With an RRSP your contributions may be tax deductible meaning that you can possibly claim a tax deduction for the amount you contribute and potentially reduce taxable

https://turbotax.intuit.ca/tax-resources/canada-rrsp-calculator.jsp

TurboTax s free RRSP tax calculator Estimate your 2023 income tax savings your RRSP contribution generates in each Canadian province and territory

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

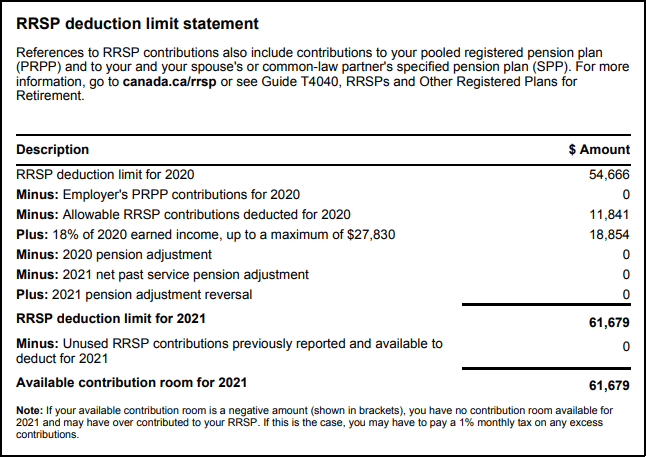

RRSP Contribution Limit For 2023 Another Loonie

The So Wealth Management Group RRSP Contribution VS Deduction Limit

RRSP Contribution Limit Tax Deduction Full Guide Simplified

Tax Changes In Canada For 2023 RRSP TFSA FHSA And More Blog

RRSP Season 2022 Deadline Is March 1 Get Your Contributions In Now VFS

RRSP Season 2022 Deadline Is March 1 Get Your Contributions In Now VFS

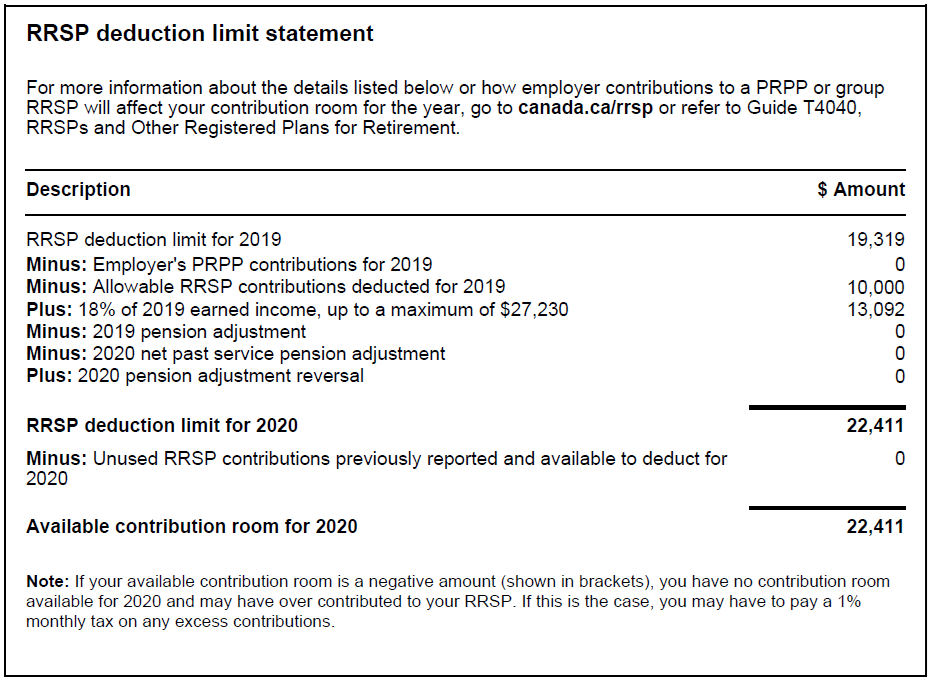

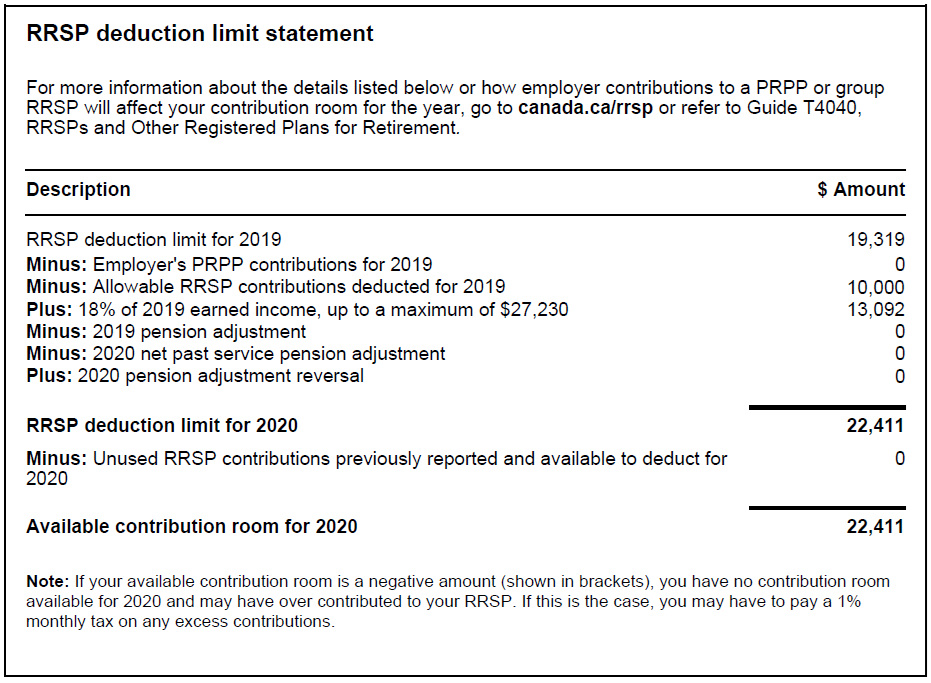

What Is My RRSP Contribution Limit In Canada For 2019 2020

How Much Can I Contribute To My RRSP Common Wealth

RRSP Deadline Contribution Limit And Tax Deduction Money We Have

Rrsp Contribution Tax Deduction - Key Takeaways An RRSP is a special savings plan that helps Canadians save for retirement Every dollar you sock away into an RRSP savings or investing account cuts