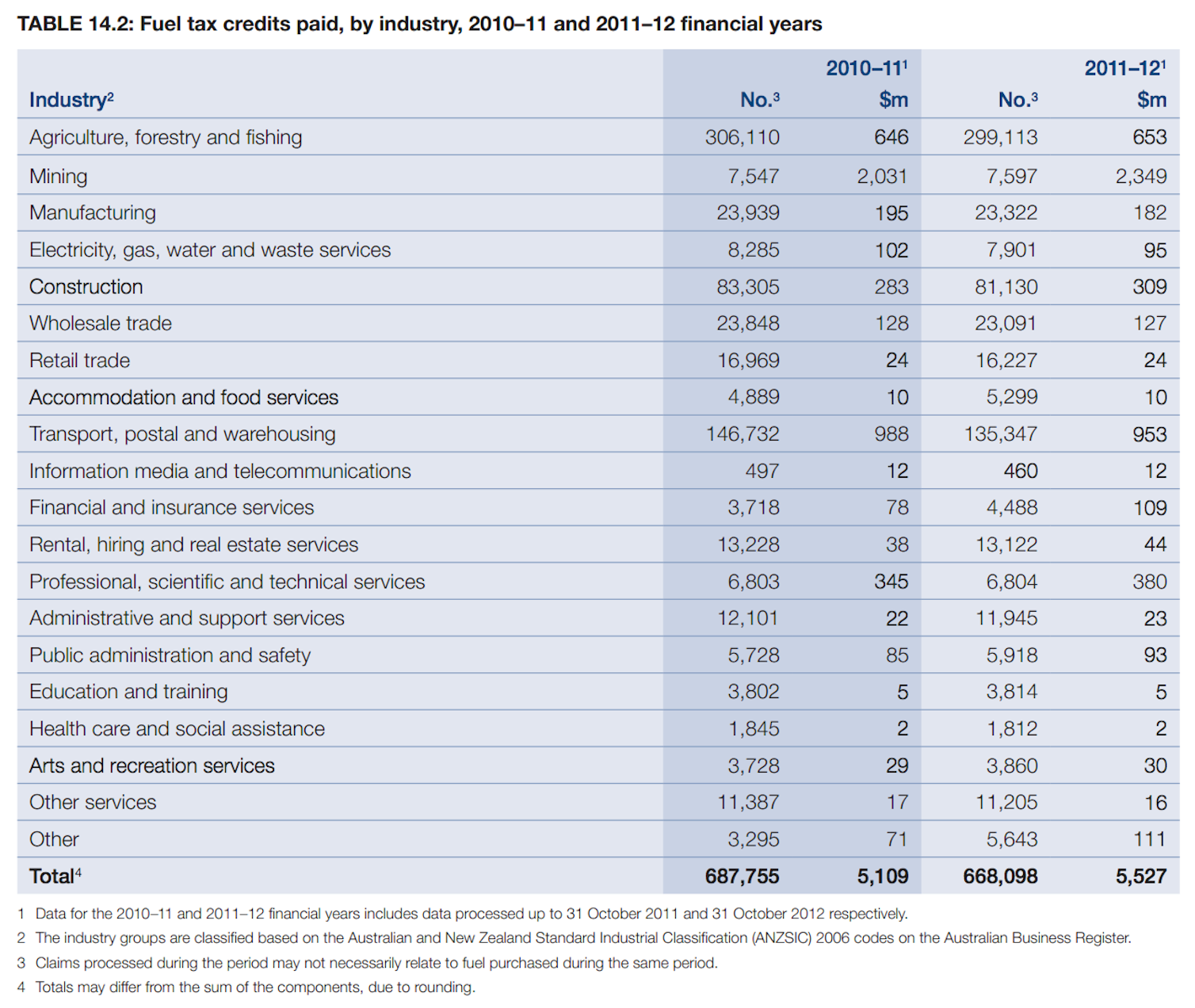

Fuel Tax Rebate Rates Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

Web Calculator The fuel tax credit calculator helps you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax credits from a Web 7 mars 2023 nbsp 0183 32 Taxation Claim fuel tax credits Last Updated 7 March 2023 If your business uses fuel you may be able to claim credits for the fuel tax included in the price

Fuel Tax Rebate Rates

Fuel Tax Rebate Rates

https://www.howellcountynews.com/sites/default/files/field/image/afront-gas rebate.jpg

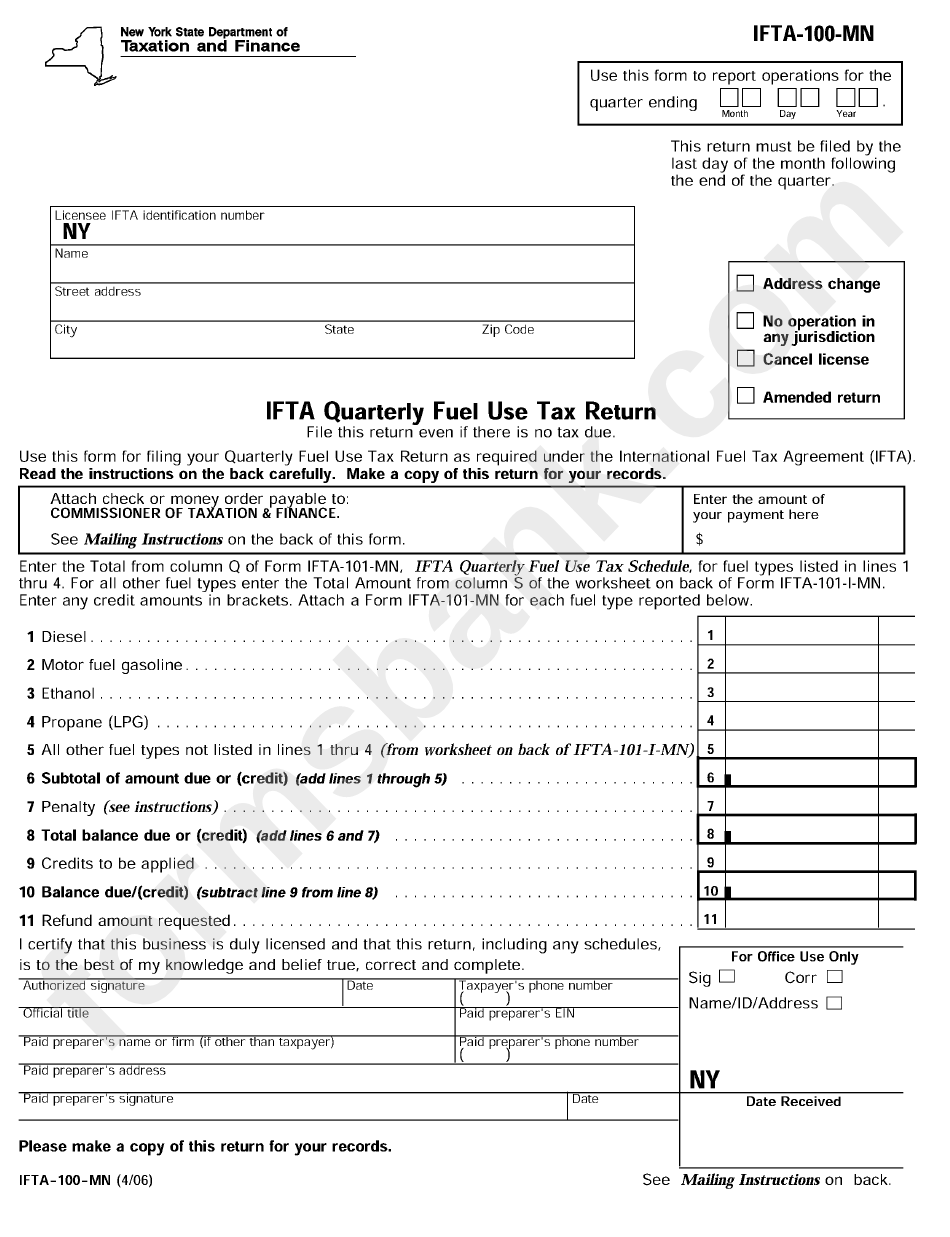

IFTA 400 Q3 3rd Quarter 2015 Fuel Tax Rates MCRT IFTA Free Download

https://www.formsbirds.com/formhtml/a48b0ecbc6a9c3da67eb/2d445076a7779c89a5cdfda44f/bg1.png

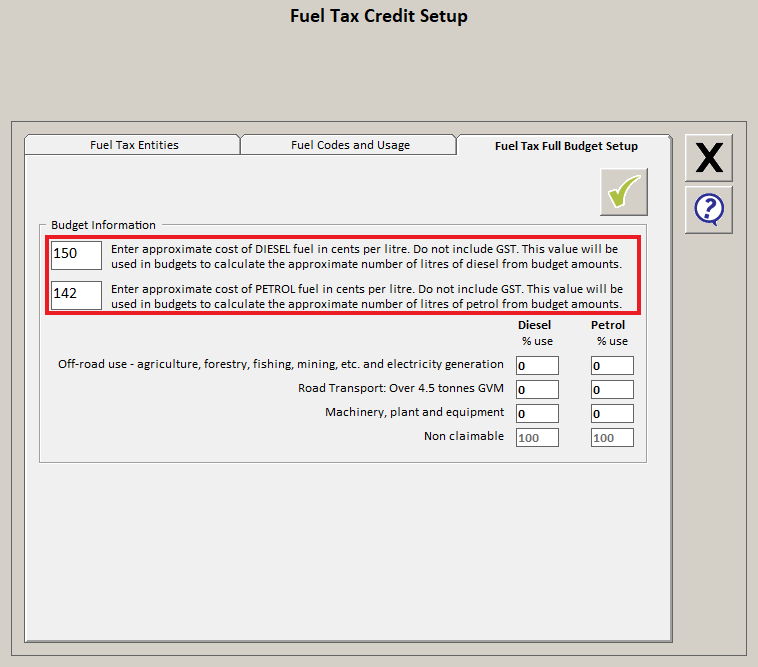

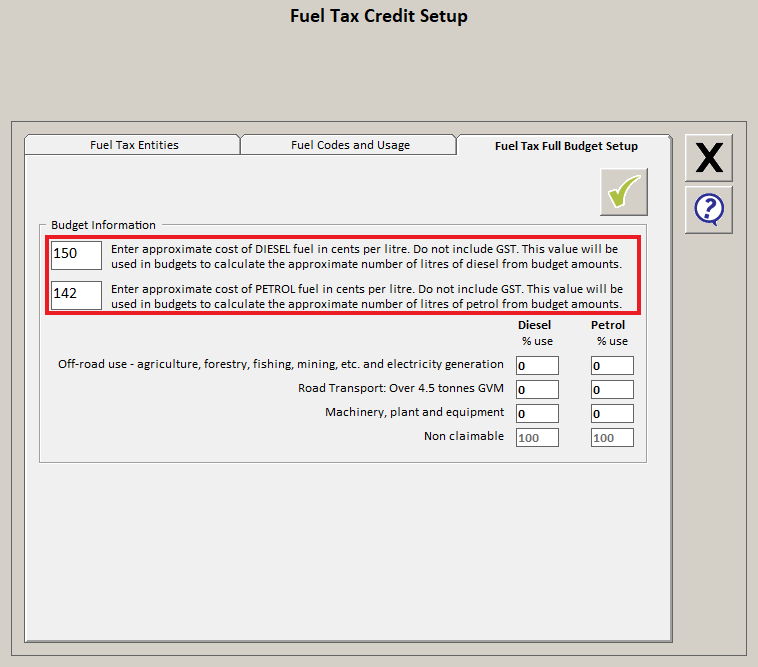

Reporting Fuel Tax Rebate Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002878975/fuelrebatereport.PNG

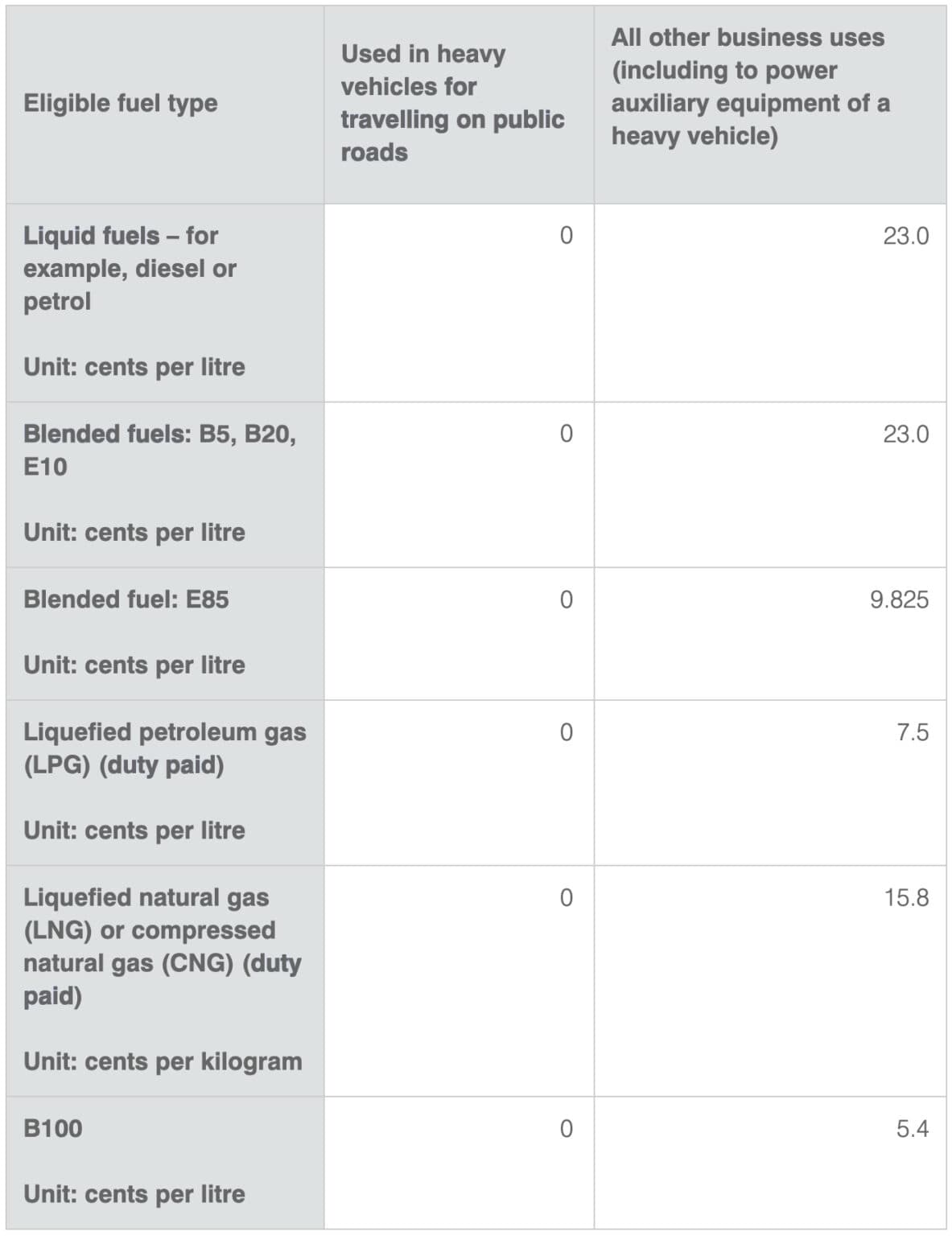

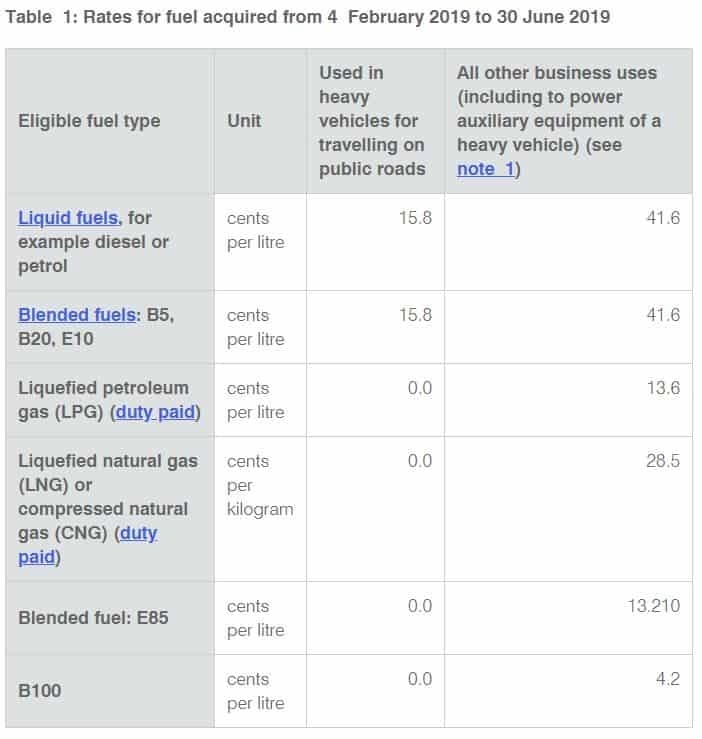

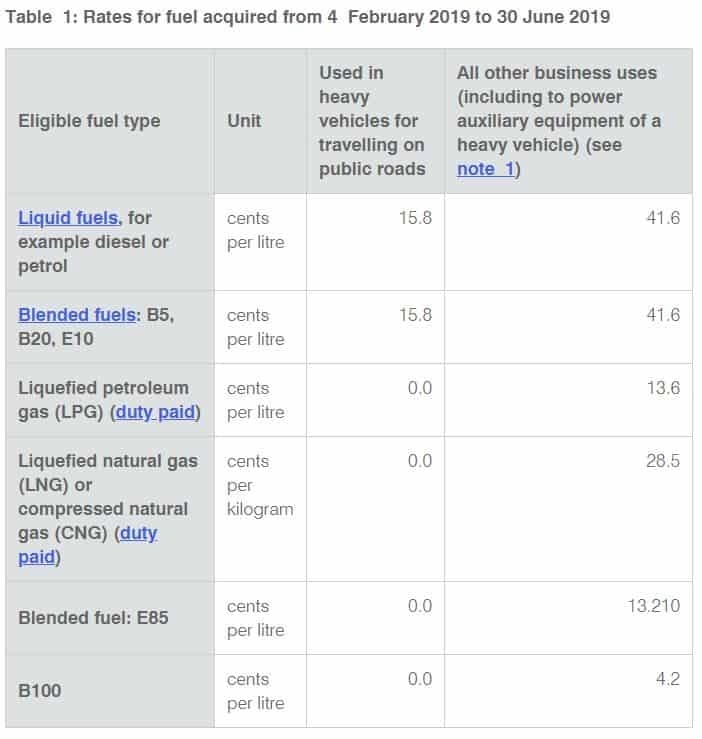

Web The updated February 2023 Fuel Tax Credit rates are as follows per the ATO website Fuel Acquired 1 February 2023 30 June 2023 What records are required to claim Fuel Tax Credits Businesses must keep a Web 6 avr 2022 nbsp 0183 32 6 April 2022 Much attention has been given to the 2022 Budget measure of temporarily halving of the fuel excise for petrol and diesel from 44 2 cents litre to 22 1

Web Both taxes are levied by the federal government In Australia the GST currently 10 is applied on top of the fuel excise tax In some cases businesses may be entitled to Web 21 juin 2022 nbsp 0183 32 Current and historical rates are as follows 30 Mar 2022 30 Jun 2022 There has been a temporary reduction in fuel tax From 30 March 2022 until 28 September 2022 businesses using fuel in heavy

Download Fuel Tax Rebate Rates

More picture related to Fuel Tax Rebate Rates

Fuel Tax Credit Rates Fuel Tax Assist

https://cdn.fueltaxassist.com.au/wp-content/uploads/2022/08/FT-Rates-1-8-2022-1183x1536.jpg

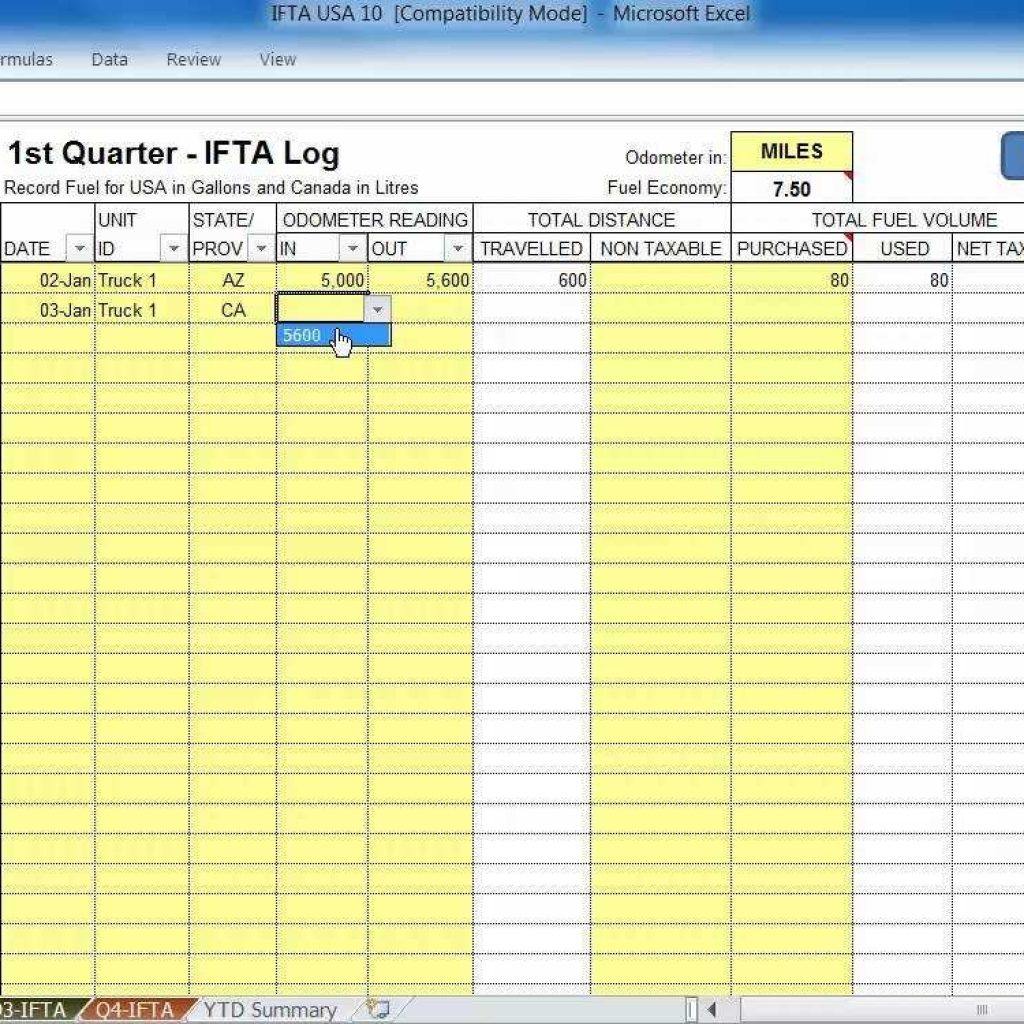

Ifta Fuel Tax Spreadsheet Db excel

https://db-excel.com/wp-content/uploads/2019/01/ifta-fuel-tax-spreadsheet-throughout-ifta-spreadsheet-fuel-tasoftware-ndash-usa-truckers-for-up-to-10.jpg

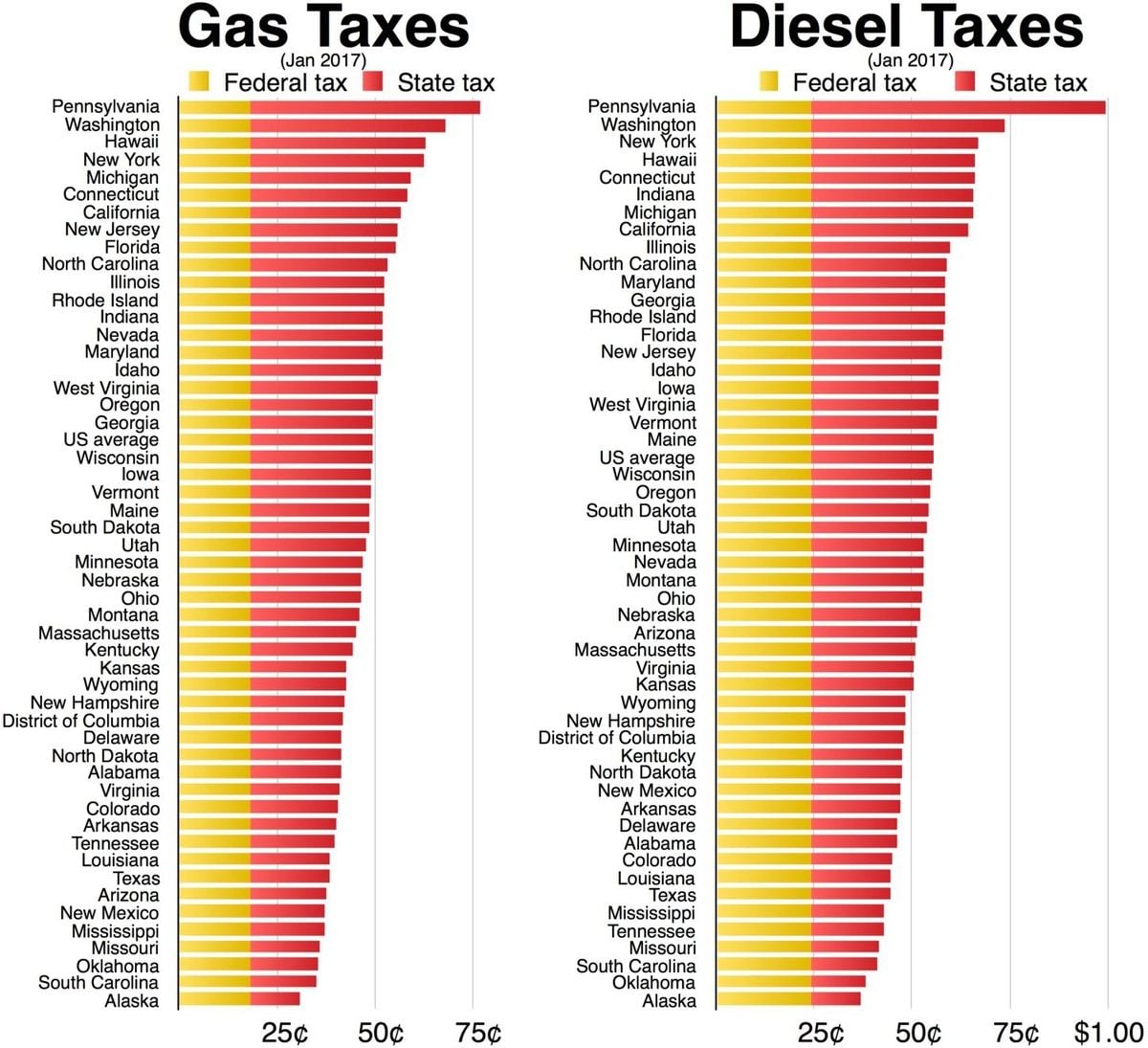

Explain Why Diesel Fuel Is So Much More Now Page 2 Ford Truck

https://cimg1.ibsrv.net/gimg/www.ford-trucks.com-vbulletin/1200x1095/gas_and_diesel_taxes_a22362d2393eeee1c161e48a15f56c27dd5d7d3f.jpg

Web Diesel Fuel Rebate Rates 2022 You can claim tax credits when you use fuel for business activities The diesel fuel rebate rates depend on the use of the fuel You need to use the correct rates in your fuel rebate Web 21 juin 2022 nbsp 0183 32 1 Manual Process The simplest approach is to do everything manually Collect your heavy vehicle fuel receipts and assume all on road usage Then use the low

Web 11 nov 2021 nbsp 0183 32 In simple terms fuel tax credits provide businesses with a rebate for the fuel tax paid at the bowser or pump in order to run heavy vehicles light vehicles machinery Web 14 juin 2022 nbsp 0183 32 Effective July 1 Maryland s motor fuel tax rates will increase with the exception of the tax on aviation fuel which will remain taxed at 0 07 per gallon The

Setting Up Fuel Tax Rebate Single Entity Agrimaster

https://support.agrimaster.com.au/hc/article_attachments/360002822615/fueltaxmulti15.png

Viewpoints Should Fuel Tax Credits Be Cut In The Budget

https://images.theconversation.com/files/47595/original/3cfp2vcz-1398993376.jpg?ixlib=rb-1.1.0&q=30&auto=format&w=754&h=636&fit=crop&dpr=2

https://www.ato.gov.au/.../GST-and-excise/Changes-to-fuel-tax-credit-rates

Web All fuel tax credit claimants need to apply the new rates for fuel acquired from 1 August To make it easier if your business claims less than 10 000 in the year you can use the rate

https://www.ato.gov.au/Calculators-and-tools/Fuel-tax-credit-tools

Web Calculator The fuel tax credit calculator helps you work out the fuel tax credit amount to report on your business activity statement BAS adjustments for fuel tax credits from a

State Motor Fuels Tax Rates Tax Policy Center

Setting Up Fuel Tax Rebate Single Entity Agrimaster

Form Ifta 100 Mn Ifta Quarterly Fuel Use Tax Return Printable Pdf

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

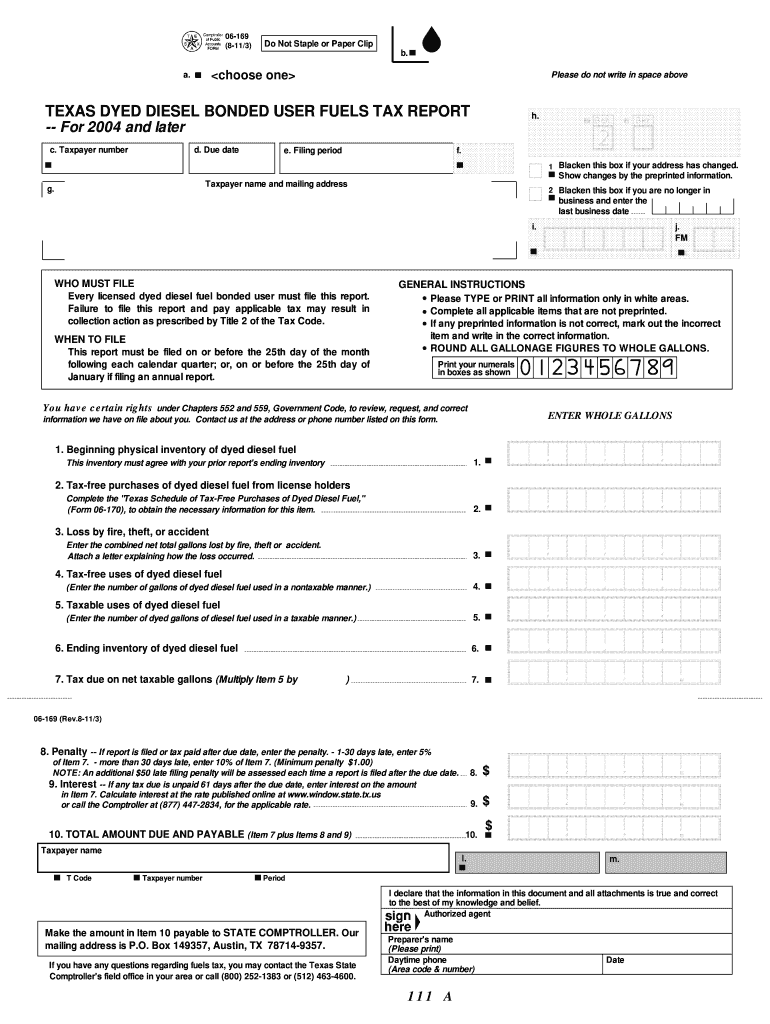

06 169 Fill Out Sign Online DocHub

Fuel Tax Credit Atotaxrates info

Fuel Tax Credit Atotaxrates info

State Gas Tax Rates State Gas Tax Rankings July 2021 Tax

How IFTA Works Learn To Truck

Iowa Fuel Tax Rate Change Effective July 1 2022

Fuel Tax Rebate Rates - Web Both taxes are levied by the federal government In Australia the GST currently 10 is applied on top of the fuel excise tax In some cases businesses may be entitled to